Tag Archive: Japan

Canadian Bank Starts Charging Negative 0.75percent Rate On Most Foreign Cash Balances

Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada's most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most currencies, to match the deposit rate of Switzerland.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

Financial Repression Is Now “In Play”

A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for...

Read More »

Read More »

The Swiss Begin To Hoard Cash

While subtle, the general public loss of faith in central banking has been obvious to anyone who has simply kept their eyes open: it started in Japan where in February hardware stores were reported that consumers were hoarding cash, as confirmed by t...

Read More »

Read More »

Will The ECB Buy Stocks?

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility. We think the ECB could legally buy ETFs that fit its requirements… but it would be controversial and we question the benefits. An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme.

Read More »

Read More »

Is The US Dollar Set To Soar?

Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it's generally unwise to let that enthusiasm become the basis of one's bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or precious-metal-backed private currencies--currencies which can't be devalued by self-serving central banks or the private elites...

Read More »

Read More »

Un-Becoming American – One Man’s Painful Journey To Renouncing Citizenship

In April 2012, I returned to Switzerland – my country of birth – to commence a new phase of my adult life. Naturally, one of the first steps to undertake when establishing oneself in a new country is to open a bank account. I went down to the local Raiffeisen bank branch in the village of Aesch, Luzern, where my relatives and ancestors had lived and worked as farmers for over 10 generations.

Read More »

Read More »

Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash.

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

‘Last Economist Standing’ John Taylor Urges “Less Weird Policy” At Jackson Hole

I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it.

Read More »

Read More »

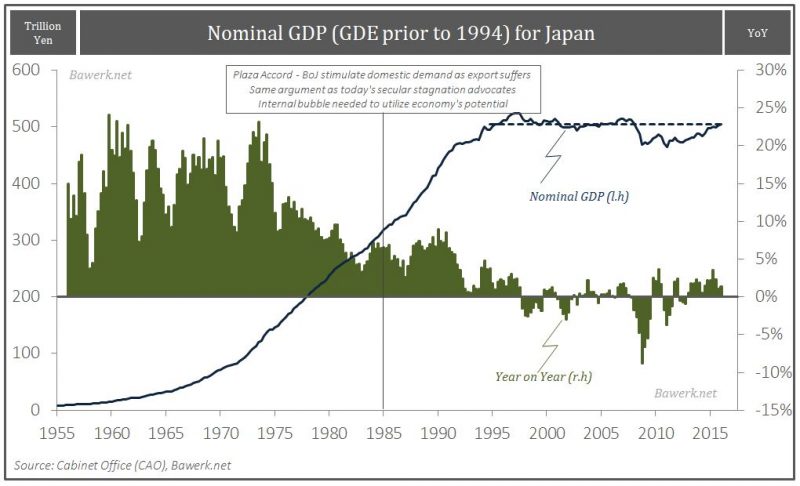

Stupid is What Stupid Does – Secular Stagnation Redux

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries.

Read More »

Read More »

Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means.

Read More »

Read More »