Tag Archive: ZIRP

2024 outlook: Gold Shines Bright in the Gathering Storm

The year 2024 is poised to be a critical period for the global economy and it already appears to be fraught with economic and geopolitical challenges, casting a dark shadow over the global landscape. Signs of a looming economic downturn are becoming increasingly evident and the many challenges we faced over the past year will certainly remain with us for many months to come.

Economic and monetary landscape

Central bankers in most advanced...

Read More »

Read More »

Debt cancellation: the new panacea?

There is clearly a common denominator in the kind of “solutions” that the State comes up with to deal with the problems that it caused (and that’s most problems). Not only are these remedies worse than the disease, but they are always extremely simplistic, reductionist and they never, ever, take into account anything else apart from the political “optics” and the populistic value of each new measure or piece of legislation. There is no...

Read More »

Read More »

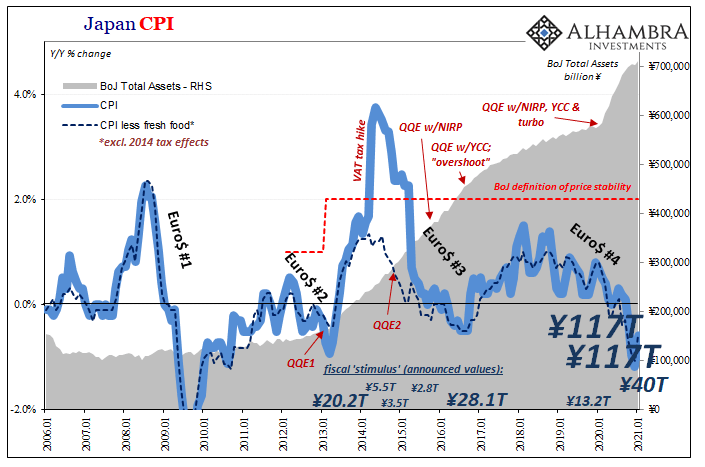

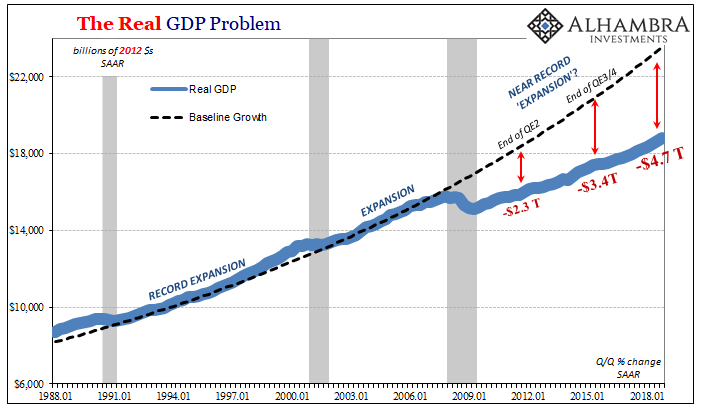

Nine Percent of GDP Fiscal, Ha! Try Forty

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt.

Read More »

Read More »

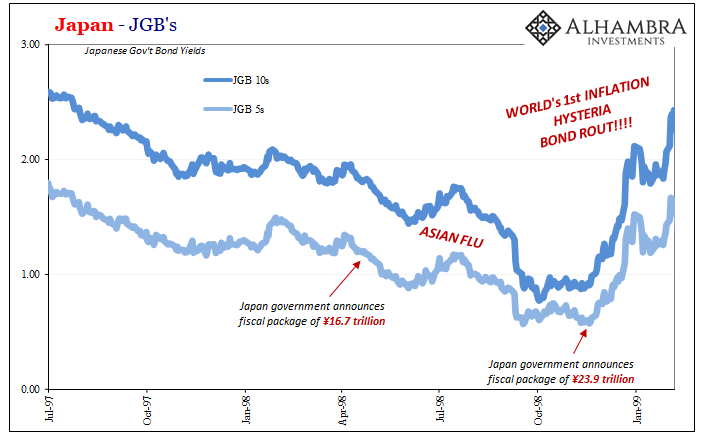

They’ve Gone Too Far (or have they?)

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

This Has To Be A Joke, Because If It’s Not…

After thinking about it all day, I’m still not quite sure this isn’t a joke; a high-brow commitment of utterly brilliant performance art, the kind of Four-D masterpiece of hilarious deception that Andy Kaufman would’ve gone nuts over. I mean, it has to be, right?I’m talking, of course, about Jackson Hole and Jay Powell’s reportedly genius masterstroke.

Read More »

Read More »

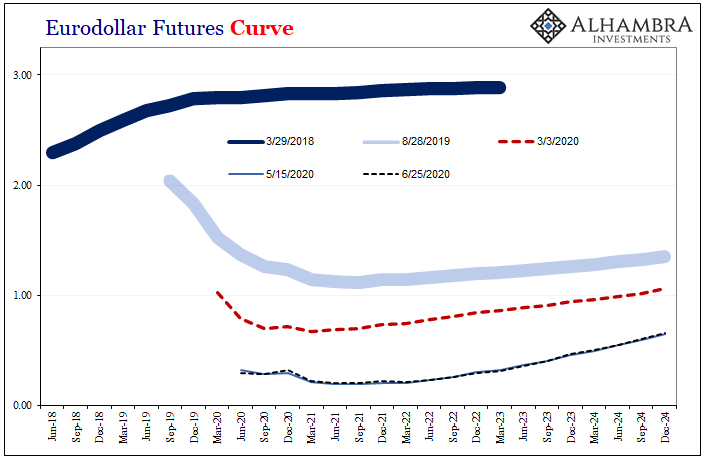

Wait A Minute, What’s This Inversion?

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board.And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute.

Read More »

Read More »

QE by any other name

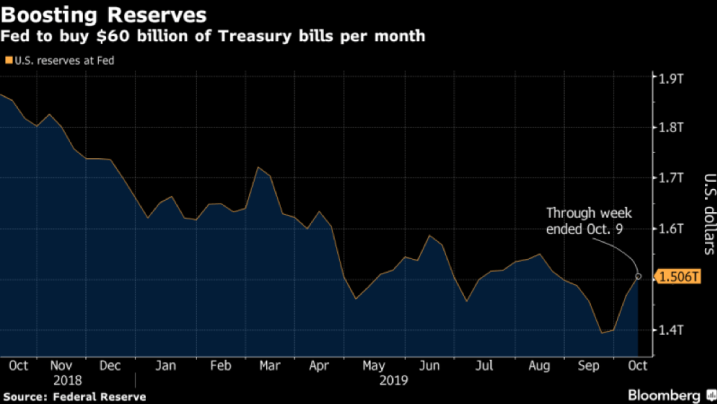

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since.

Read More »

Read More »

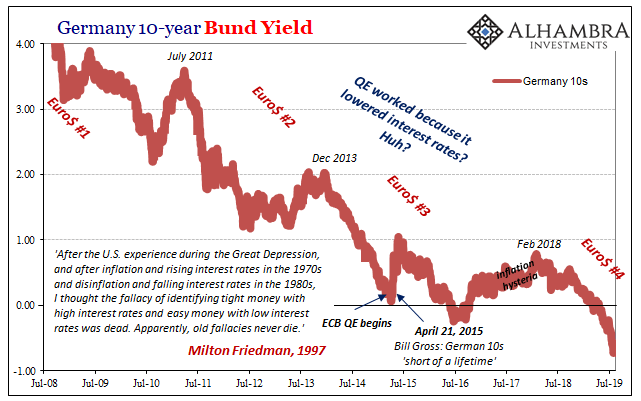

The Obligatory Europe QE Review

If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived.

Read More »

Read More »

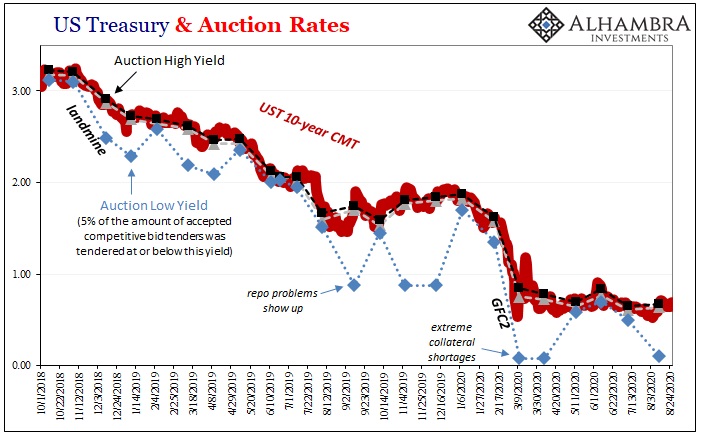

What Kind Of Risks/Mess Are We Looking At?

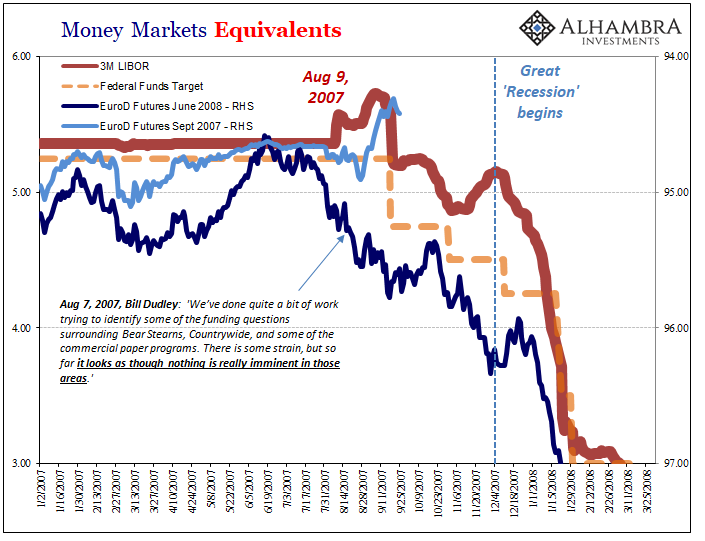

The fact that the mainstream isn’t taking this all very seriously isn’t anything new. But how serious are things really? That’s pretty much the only question anyone should be asking. What are the curves telling us about what’s now just over the horizon?

Read More »

Read More »

Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture:

Read More »

Read More »

All In The Curves

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December.

Read More »

Read More »

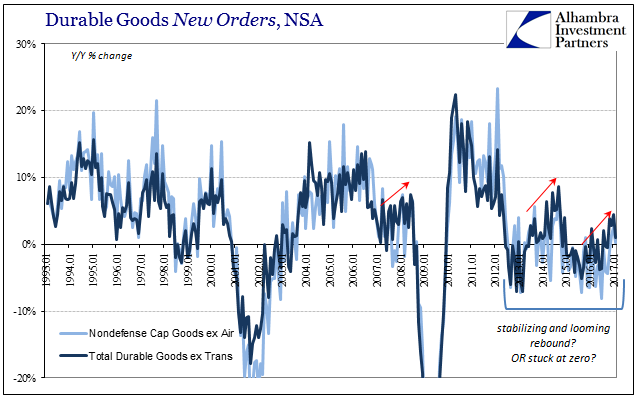

Durable Goods After Leap Year

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version.

Read More »

Read More »

Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them.

Read More »

Read More »

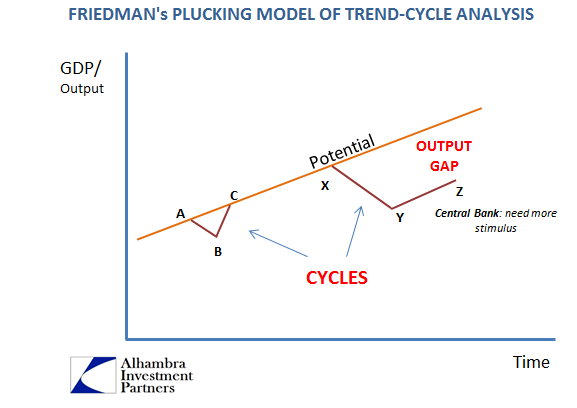

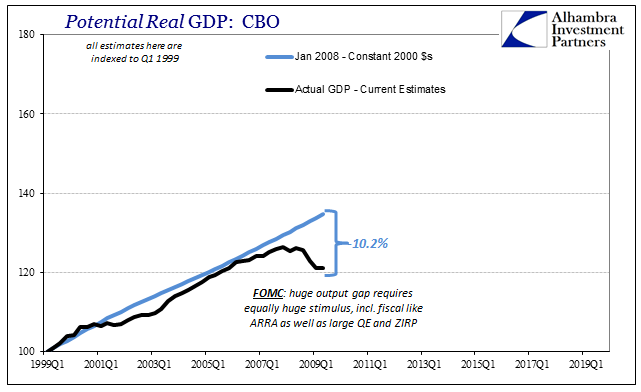

Their Gap Is Closed, Ours Still Needs To Be

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great “Recession” at around 10% of the CBO’s...

Read More »

Read More »