Tag Archive: U.S. Treasuries

Weekly Market Pulse: A Fatal Conceit

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

UST 2s & Euro$ Futures *Whites* Both Ask, Landmine At Last?

The 2-year Treasury right now is the key point, the spot on the yield curve which is influenced mostly by potential alternative rates including those offered by the Federal Reserve. Because of this, the market for the 2s is looking forward at what those alternate rates are likely to be, then pricing yields accordingly.

Read More »

Read More »

Looking Back At Chaotic March Through TIC

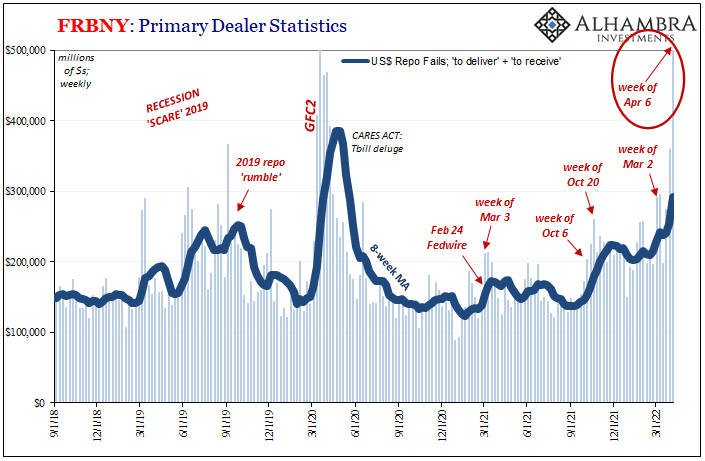

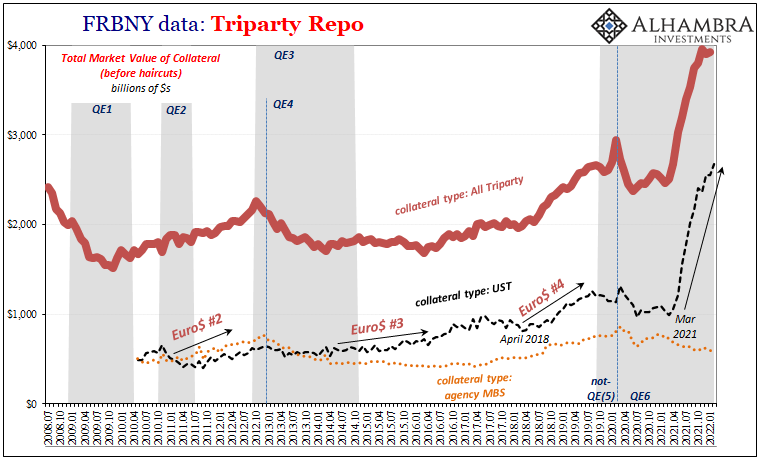

March ended up being a pretty wild ride. Lost amidst the furor over Russia’s invasion of Ukraine, the month began with a couple clear “collateral days. T-bill rates along with repo fails echoed that same shortfall before the yield curve then joined the eurodollar futures curve being inverted.

Read More »

Read More »

Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him?

Read More »

Read More »

China, Japan, And The Relative Pre-March Euro$ Calm In February

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion.Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable.

Read More »

Read More »

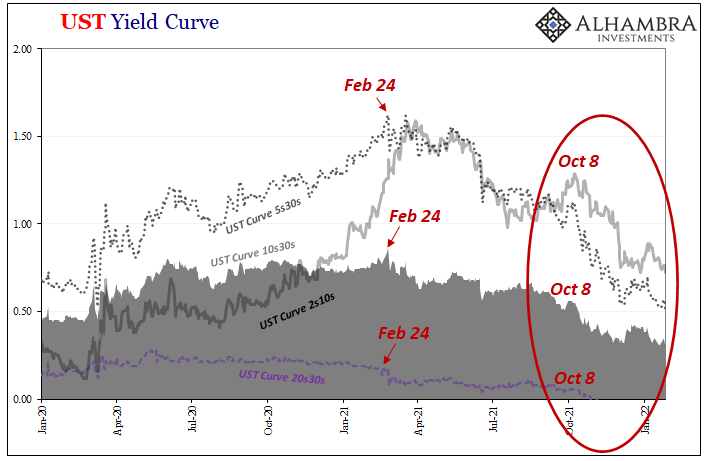

Yield Curve Inversion Was/Is Absolutely All About Collateral

If there was a compelling collateral case for bending the Treasury yield curve toward inversion beginning last October, what follows is the update for the twist itself. As collateral scarcity became shortage then a pretty substantial run, that was the very moment yield curve flattening became inverted.Just like October, you can actually see it all unfold.

Read More »

Read More »

The Short, Sweet Income Case For Ugly Inversion(s), Too

A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news.

Read More »

Read More »

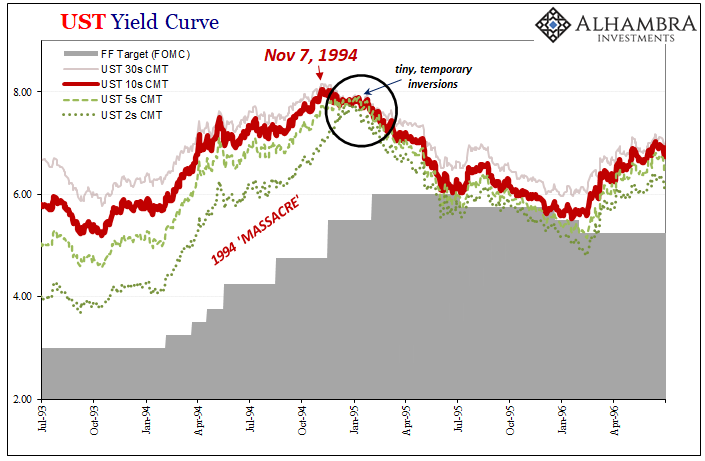

We Can Only Hope For Another (bond) Massacre

To begin with, the economy today is absolutely nothing like it had been almost thirty years ago. That fact in and of itself should end the discussion right here. However, comparisons will be made and it does no harm to review them.I’m talking about 1994, or, more specifically, the eleven months between late February 1994 and early February 1995.

Read More »

Read More »

Inversion Is The Real March Madness, Just Don’t Take It Literally

With such low levels of self-awareness, it isn’t surprising that the FOMC’s members continue to pour gasoline on the already-blazing curve fire. March Madness is supposed to be on the courts of college basketball, instead it is playing out more vividly across all financial markets.

Read More »

Read More »

The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

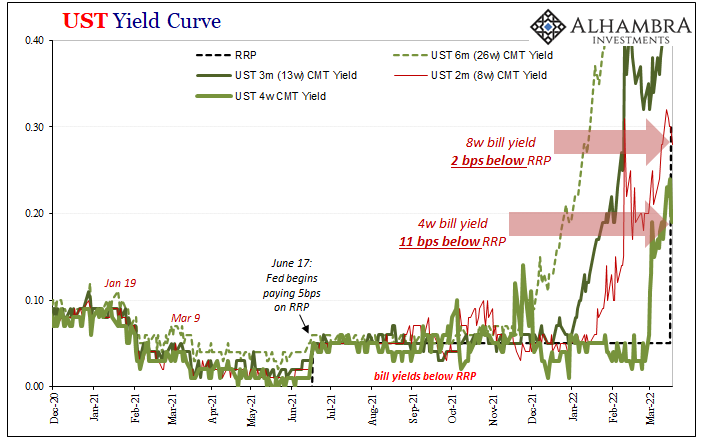

The Federal Reserve didn’t just raise the range for its federal funds target by 25 bps, upper and lower bounds, it also added the same to its twin policy tools which the “central bank” says are crucial to maintaining order in money markets thereby keeping federal funds inside the band where it is supposed to be. The FOMC voted to increase IOER from 15 bps to 40 bps, and the RRP from 5 bps to 30 bps.

Read More »

Read More »

Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end.We shouldn’t care much about the Fed.

Read More »

Read More »

There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 2]

Securities lending as standard practice is incredibly complicated, and for many the process can be counterintuitive. With numerous different players contributing various pieces across a wide array of financial possibilities, not to mention the whole expanse of global geography, collateral for collateral swaps have gone largely unnoticed by even mainstream Economics and central banking.

Read More »

Read More »

There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 1]

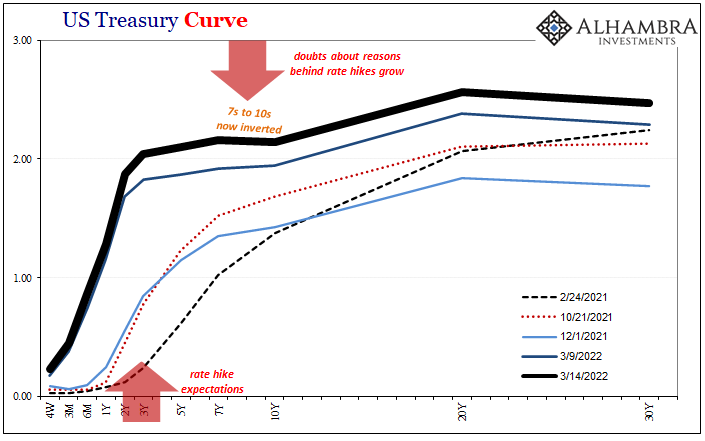

With the 7s10s already inverted, and the 5s today mere bps away, making a macro case for the distortion isn’t too difficult. Despite China’s “upside” economic data today, even the Chinese are talking more about their downside worries (shooting/hoping for “stability”) than strength. In the US or Europe, no matter the CPIs in either place there are cyclical (not just inventory) warning signs all over the place.

Read More »

Read More »

Another One Inverts, The Retching Cat Reaches Treasuries

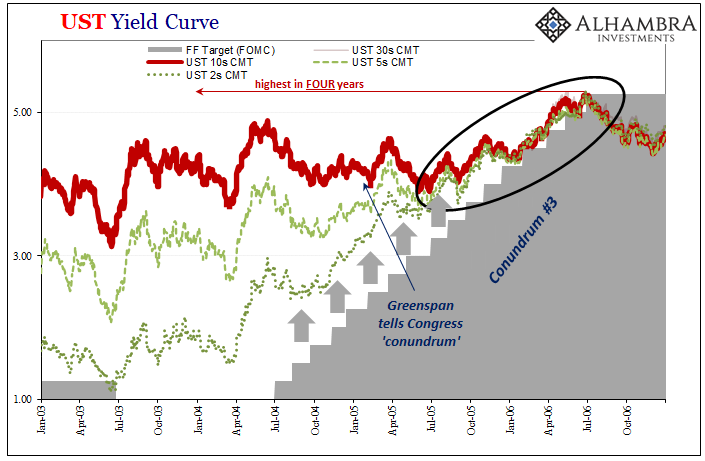

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite.

Read More »

Read More »

Consumer Prices And The Historical Pain(s)

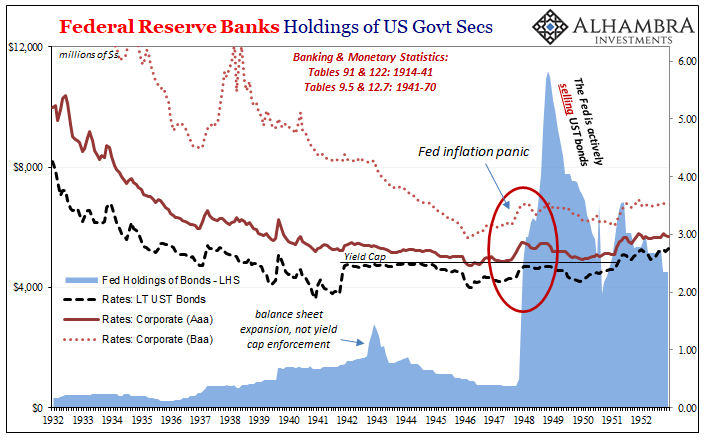

The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history.

Read More »

Read More »

So Much Fragile *Cannot* Be Random Deflationary Coincidences

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened.

Read More »

Read More »

Houston, We Have An Oil (and inventory) Problem

If only, like in the aftermath of the Apollo 13 explosion, we could just radio Houston to get started in figuring out just the way out of our fix. Mission Control would certainly buzz all the right people with the right stuff, summoning the best engineers and scientists from their quiet divans to the frenzied and dangerous work ahead.

Read More »

Read More »

After Today’s FOMC, Yield Curve Is Already As Flat As It Was In Mar ’18 **Without A Single Rate Hike Yet**

It’s not hard to reason why there continues to be this conflict of interest (rates). On the one hand, impacting the short end of the yield curve, the unemployment rate has taken a tight grip on the FOMC’s limited imagination. The rate hikes are coming and the markets like all mainstream commentary agree that as it stands there’s nothing on the horizon to stop Jay Powell’s hawkishness.

Read More »

Read More »