Tag Archive: UBS

UBS Issues Hong Kong’s First Investment-Grade Tokenised Warrant on Ethereum

UBS has launched Hong Kong’s first investment-grade tokenised warrant, leveraging the Ethereum public blockchain. This product is part of the bank’s UBS Tokenise initiative, aimed at advancing its in-house tokenisation services.

Read More »

Read More »

Swiss National Bank Launches Wholesale Central Bank Digital Currency Project

On 1 December 2023, the Swiss National Bank – together with five Swiss and one German commercial bank – started a pilot project with central bank digital currency for financial institutions (wholesale central bank digital currency) on the regulated platform of SIX Digital Exchange (SDX).

With this pilot, called Helvetia Phase III, the SNB will for the first time issue real wholesale CBDC in Swiss francs on a financial market infrastructure based on...

Read More »

Read More »

Swiss National Bank Launches Pilot Project With CBDC for Financial Institutions

On 1 December 2023, the Swiss National Bank – together with six commercial banks – will start a pilot project with central bank digital currency for financial institutions (wholesale CBDC) on the regulated platform of SIX Digital Exchange (SDX).

With this pilot, called Helvetia Phase III, the SNB will for the first time issue real wholesale CBDC in Swiss francs on a financial market infrastructure based on distributed ledger technology (DLT). The...

Read More »

Read More »

UBS Asset Management Launches First Blockchain-Native Tokenized VCC Fund Pilot in Singapore

UBS Asset Management has launched its first live pilot of a tokenized Variable Capital Company (VCC) fund. The fund is part of a wider VCC umbrella designed to bring various “real world assets” on-chain as part of Project Guardian, a collaborative industry initiative led by the Monetary Authority of Singapore (MAS).

Thomas Kaegi

Thomas Kaegi, Head UBS Asset Management, Singapore & Southeast Asia, said:

“This is a key milestone in understanding...

Read More »

Read More »

Bank of China and UBS Issue First Fully Digital Tokenized Structured Notes in Hong Kong

BOCI (Bank of China) has successfully issued CNH 200 million fully digital structured notes, making it the first Chinese financial institution to issue a tokenized security in Hong Kong. The product was originated by UBS and placed to its clients in Asia Pacific, marking a long-term collaboration between BOCI and UBS in the space of digital structured notes.

UBS had issued a USD 50 million tokenized fixed rate note in December 2022 under English...

Read More »

Read More »

Credit Suisse and the War Against Swiss Culture

I hope you will enjoy my latest interview with Maneco64.

[embedded content]

Claudio Grass, Hünenberg See, Switzerland

This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here

Read More »

Read More »

UBS Completes Cross-Border Intraday Trade On Broadridge’s Blockchain-Powered Platform

Global financial technology company Broadridge Financial Solutions announced that UBS and a global Asian bank have successfully executed a cross-border intraday repo transaction on its blockchain-enabled platform.

This intraday trade marks the launch of the next phase in the rollout of Broadridge’s Distributed Ledger Repo (DLR) platform.

This platform provides a utility where market participants can agree, execute, and settle repo transactions,...

Read More »

Read More »

UBS Launches the World’s First Dual-Blockchain Listed Digital Bond

UBS has launched the world’s first digital bond — a CHF 375 million three-year bond with 2.33% coupon — that is publicly traded and settled on both blockchain-based and traditional exchanges.

Read More »

Read More »

China No Longer Needs US Parts In Its Phones

China was once very dependent on US chips for its phones. The latest Chinese phones have no US parts. The Wall Street Journal reports Huawei Manages to Make Smartphones Without American Chips. American tech companies are getting the go-ahead to resume business with Chinese smartphone giant Huawei Technologies Co., but it may be too late: It is now building smartphones without U.S. chips.

Read More »

Read More »

Swiss firms give over CHF5 million a year to parties and candidates

Switzerland’s biggest firms – mainly banks, pharmaceutical firms and insurance companies - donate at least CHF5 million ($5 million) a year to political parties and candidates, a survey has revealed. The poll of 140 companies by Swiss public radio RTS, published on Tuesday, found that one in five firms donate regularly to political parties or politicians, to the tune of CHF5 million annually.

Read More »

Read More »

Federal Court to give verdict on UBS tax evasion case

The Swiss Federal Court is to decide on Friday whether Swiss bank UBS should handover data on its French clients to Paris tax authorities as part of a crackdown on suspected tax evasion. The decision has been described as key for Swiss banking circles.

Read More »

Read More »

Scandals hurt Swiss Business Reputation in 2018

Switzerland’s reputation as a place to do business took a serious hit last year following various scandals, from corporate bank fraud to illegal subsidies. The Swiss Economy Reputation Index 2018external link, published on Tuesday by Basel-based consultancy Commslab and the fög research institute at the University of Zurich, dropped for the fifth consecutive quarter, reaching its lowest level since July 2014.

Read More »

Read More »

UBS tax fraud trial opens in Paris

A sweeping investigation into UBS bank, accused of tax fraud and money laundering, comes to trial in Paris today. The bank risks a fine of up to €5 billion (CHF5.7 billion). The trial is set to begin on Monday after years of investigations into the Swiss bank’s French activities, as well as aborted negotiations in which authorities made a settlement offer of €1.1 billion.

Read More »

Read More »

Swiss CEOs still the best-off in Europe

A report on the salaries of CEOs across Europe has found that Switzerland once again tops the table, ahead of Great Britain and Germany. The report also discovers that salaries have risen over the past year.

Read More »

Read More »

Swiss cantons forced to fish for multinationals with non-tax lures

Proposed changes to Switzerland’s tax rules could have a dramatic effect on which cantons remain attractive locations for multinational companies in future. As a result, factors such as the cost of premises or concentration of high tech facilities, will play a greater role, according to UBS bank.

Read More »

Read More »

Credit Suisse freezes $5 billion in US-Russia sanctions move

The Swiss Credit Suisse bank froze some CHF5 billion ($5 billion) of assets linked to Russia earlier this year in an effort to toe the line with US sanctions levied against Moscow. The bank froze the funds in the second quarter of 2018, according to Reuters, in response to sanctions introduced by Washington in April.

Read More »

Read More »

Swiss court blocks French request for UBS banking data

Switzerland’s Federal Administrative Court has ordered the Federal Tax Administration (FTA) not to provide France with details about 40,000 UBS bank clients with French addresses. In May 2016, the French tax authorities requested administrative assistance from the FTA. They wanted details about UBS clients who lived or had lived in France.

Read More »

Read More »

UBS Boss Bemoans Geopolitical Jitters

UBS may have seen quarterly profits rise year-on-year, but chief executive Sergio Ermotti says the threat of trade wars and political unrest has dampened investor enthusiasm and continues to hold back financial markets.

Read More »

Read More »

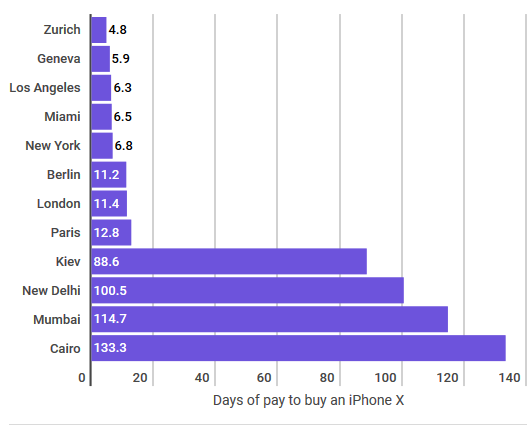

Pay in Zurich and Geneva highest in the world

A survey of the cost of living in 77 cities, by UBS, ranks Zurich (1st) and Geneva (2nd) as the most expensive. But while these cities are the most expensive, their workers are also the highest paid. In Zurich, less than five days pay affords an iPhone X. In Geneva, the same device requires less than six days of labour.

Read More »

Read More »