Tag Archive: Trade Wars

Peak Policy Error

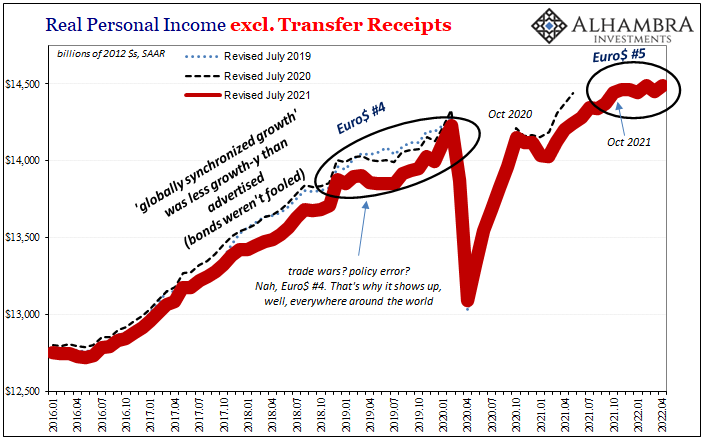

Another economic discussion lost to the eventual coronavirus pandemic mania was the 2019 globally synchronized downturn. Not just downturn, outright recession in key parts from around the world, maybe including the US.

Read More »

Read More »

The Real Trade Dilemma

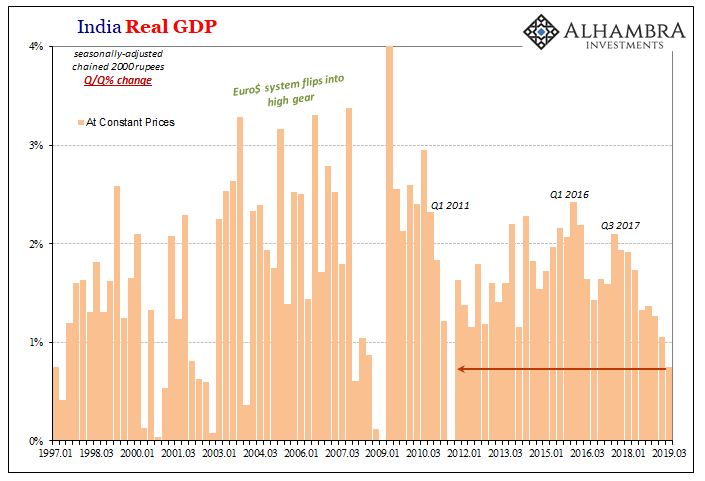

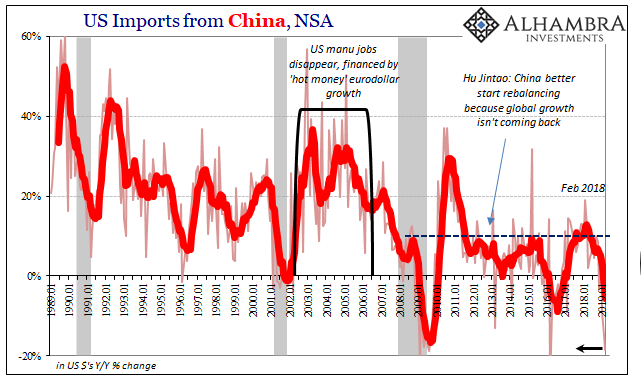

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are.

Read More »

Read More »

More Signals Of The Downturn, Globally Synchronized

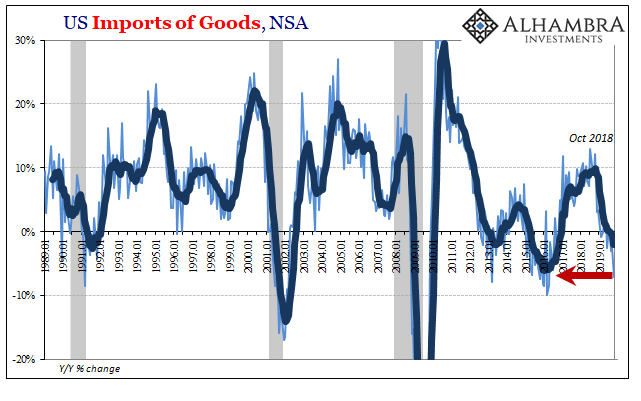

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October.

Read More »

Read More »

Consistent Trade War Inconsistency Hides The Consistent Trend

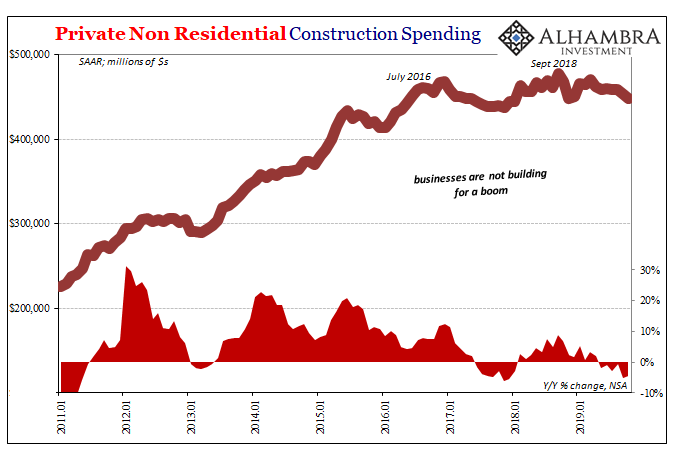

You can see the pattern, a weathervane of sorts in its own right. Not for how the economy is actually going, mind you, more along the lines of how it is being perceived from the high-level perspective. The green light for “trade wars” in the first place was what Janet Yellen and Jay Powell had said about the economy.

Read More »

Read More »

The Risen (euro)Dollar

Back in April, while she was quietly jockeying to make sure her name was placed at the top of the list to succeed Mario Draghi at the ECB, Christine Lagarde detoured into the topic of central bank independence. At a joint press conference held with the Governor of the Reserve Bank of South Africa, Lesetja Kganyago, as the Managing Director of the IMF Lagarde was asked specifically about President Trump’s habit of tweeting disdain in the direction...

Read More »

Read More »

The Sudden Need For A Trade Deal

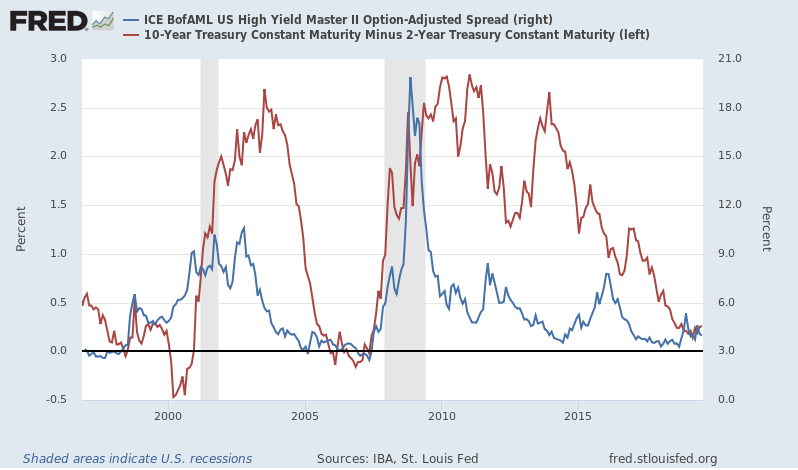

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018?

Read More »

Read More »

The Big Picture Doesn’t Include ‘Trade Wars’

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors.

Read More »

Read More »

ISM Spoils The Bond Rout!!!

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out.

Read More »

Read More »

Waiting on the Calvary

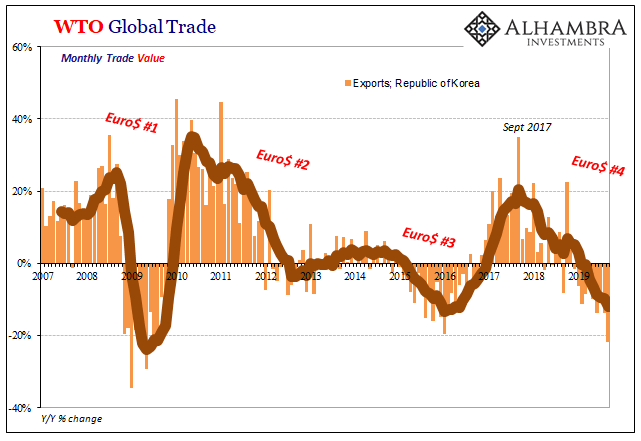

Engaged in one of those protectionist trade spats people have been talking about, the flow of goods between South Korea and Japan has been choked off. The specific national reasons for the dispute are immaterial. As trade falls off everywhere, countries are increasingly looking to protect their own. Nothing new, this is a feature of when prolonged stagnation turns to outright contraction.

Read More »

Read More »

Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances.

Read More »

Read More »

United States: The ISM Conundrum

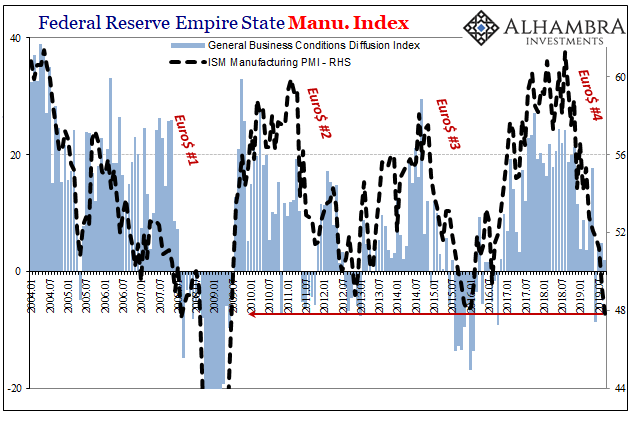

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding.

Read More »

Read More »

Monthly Macro Monitor: We’re Not There Yet

I first wrote about the current economic slowdown a year ago and Jeff Snider actually started seeing signs of slowdown in the Eurodollar market as early as May 2018. So, the slowdown we’re in now certainly isn’t a surprise here at Alhambra. I think though that we often forget how long these things take to develop.

Read More »

Read More »

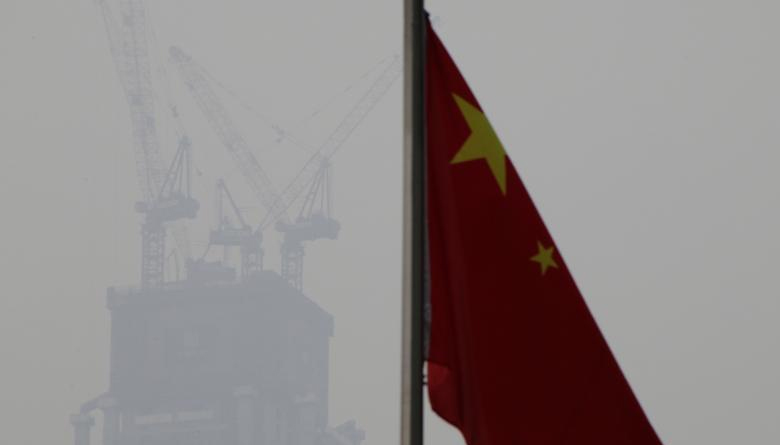

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

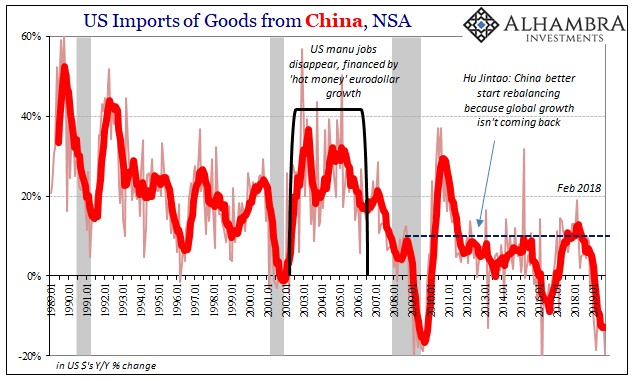

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

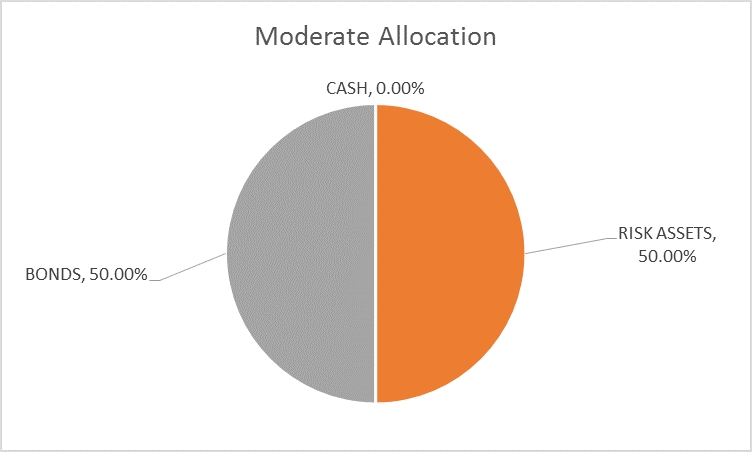

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

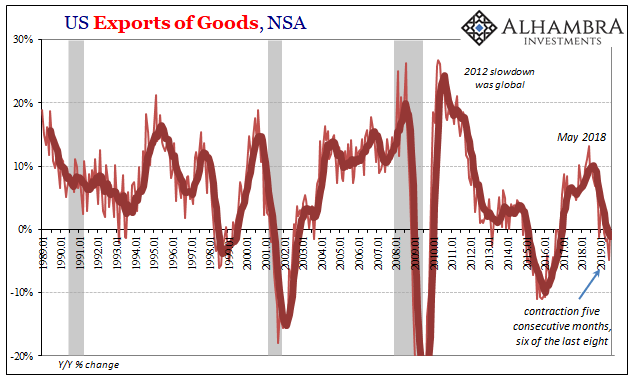

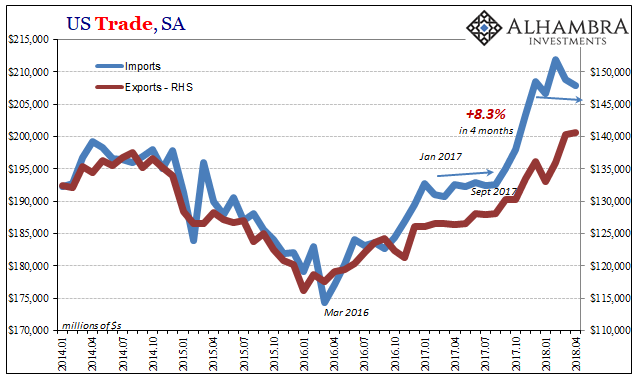

US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods.

Read More »

Read More »

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

China Says It Is Ready To Assume “World Leadership”, Slams Western Democracy As “Flawed”

Over the weekend China used the Trump inauguration to warn about the perils of democracy, touting the relative stability of the Communist system as President Xi Jinping heads toward a twice-a-decade reshuffle of senior leadership posts.

Read More »

Read More »