Tag Archive: TIPS

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year.

Read More »

Read More »

Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

Weekly Market Pulse: Expand Your Horizons

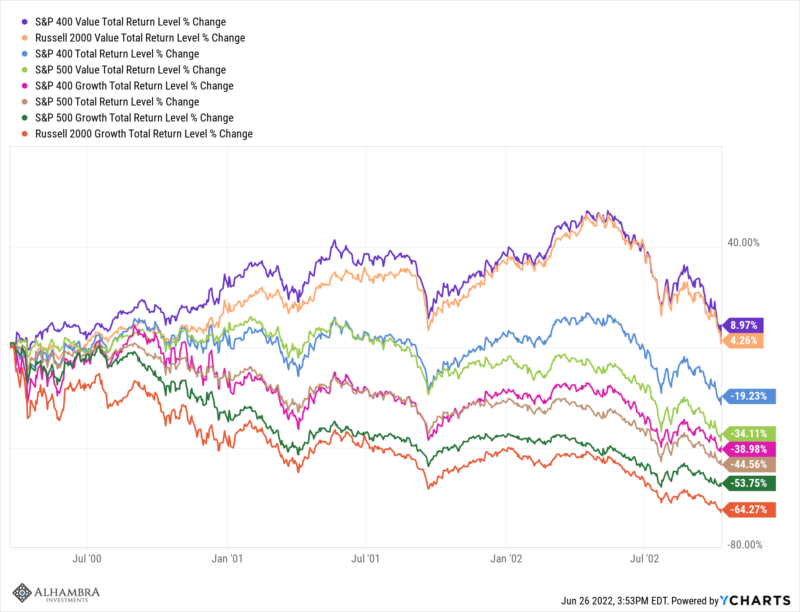

Late last year I wrote a weekly update that focused on the speculative nature of the markets. In that article, I focused on the S&P 500 because I wanted to make a point, namely that owning the S&P 500 did not absolve investment advisers of their fiduciary duty.

Read More »

Read More »

Market Pulse: Mid-Year Update

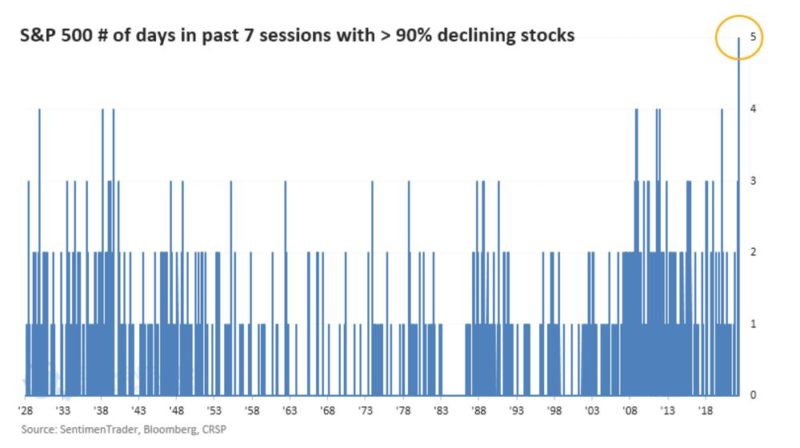

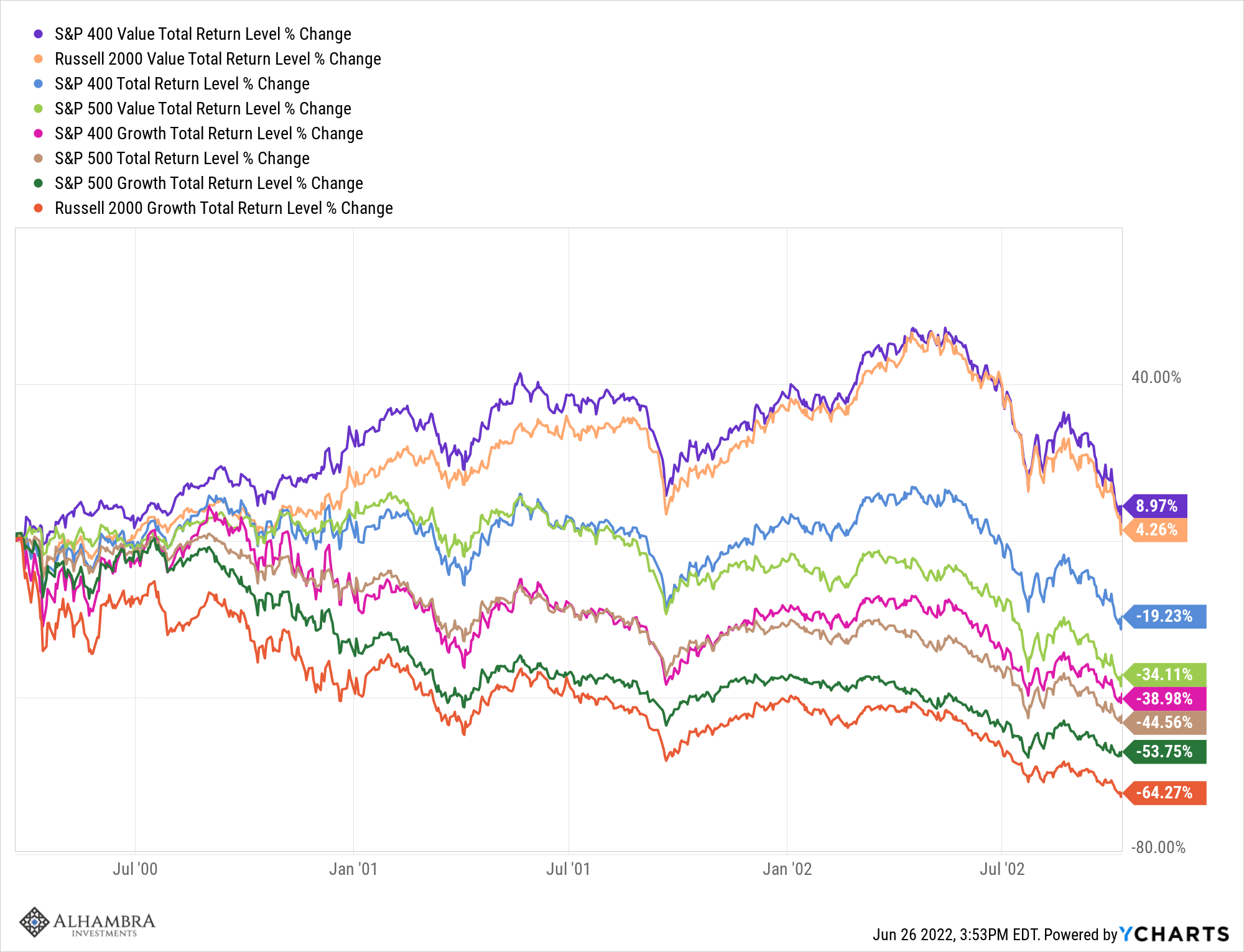

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

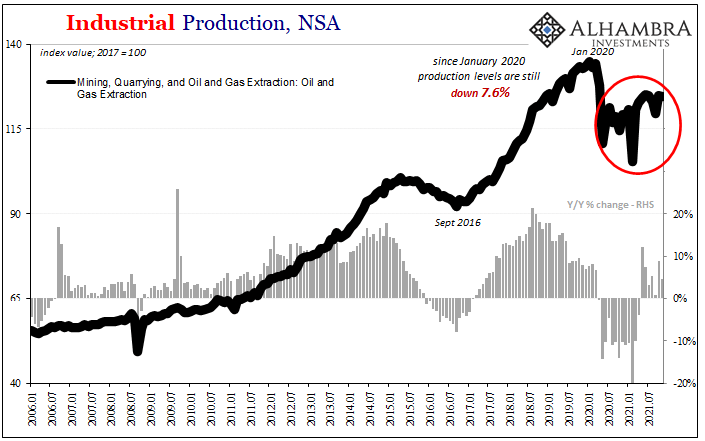

One Shock Case For ‘Irrational Exuberance’ Reaching A Quarter-Century

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts.

Read More »

Read More »

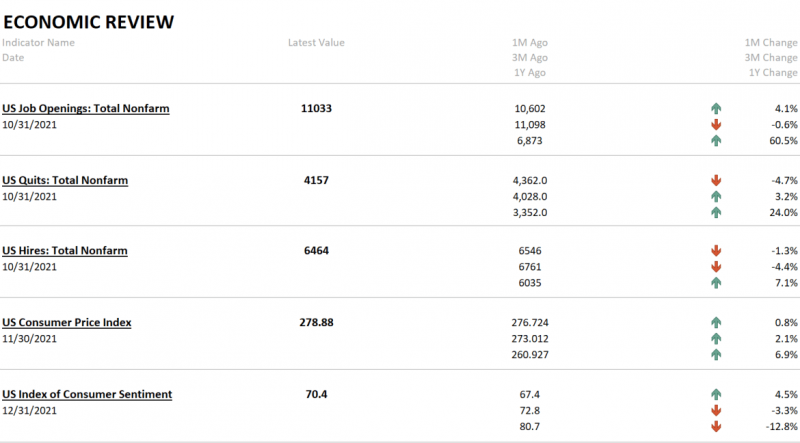

Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years. Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More. Inflation is Soaring..

Read More »

Read More »

Weekly Market Pulse: Discounting The Future

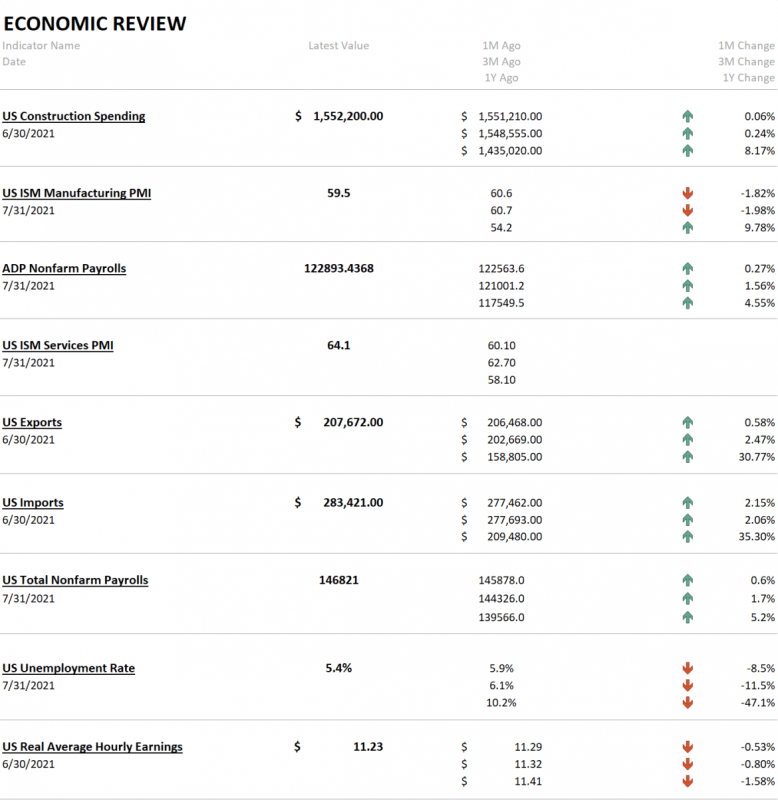

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs.

Read More »

Read More »

Weekly Market Pulse: Growth Scare?

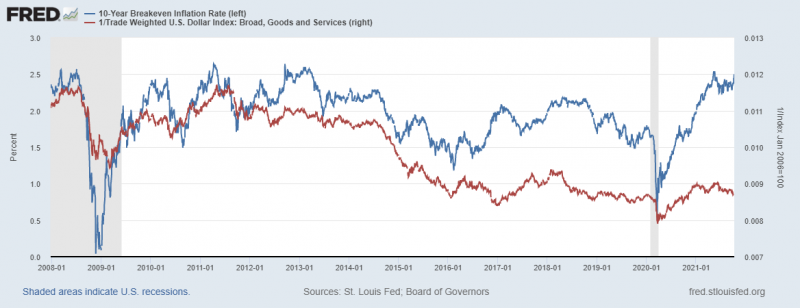

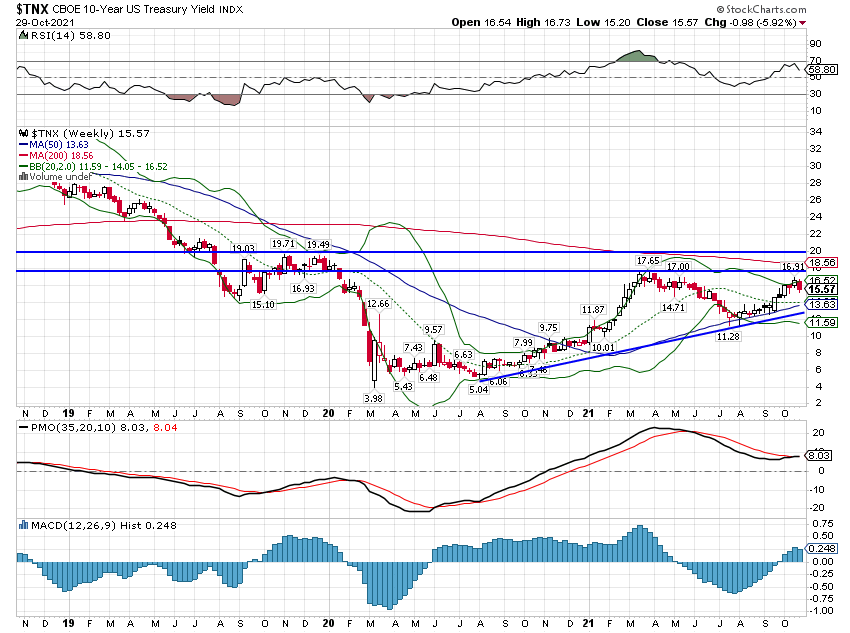

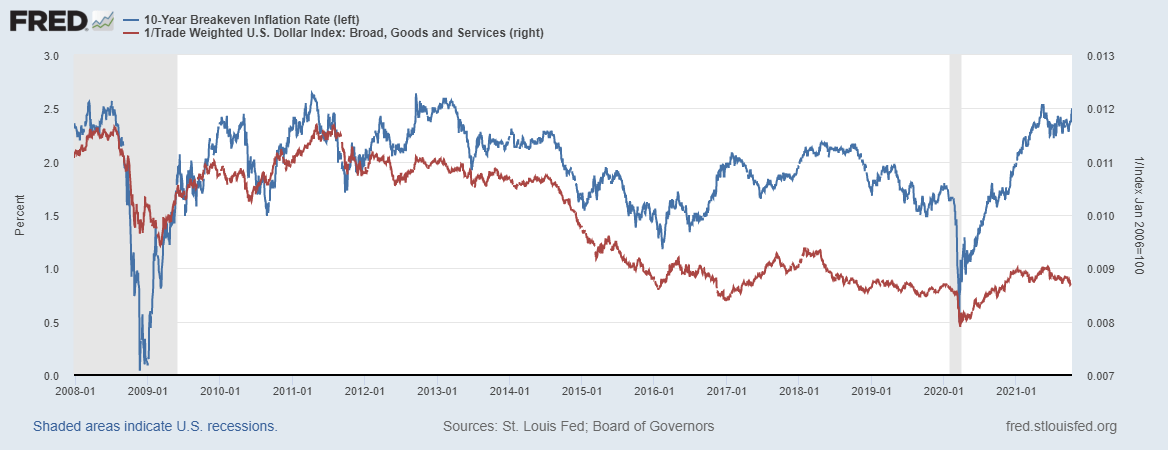

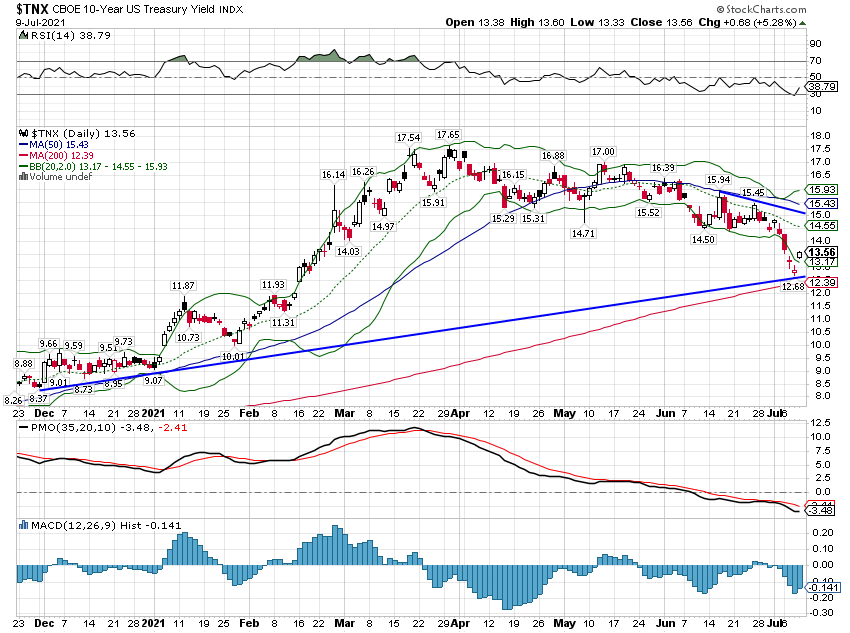

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved.

Read More »

Read More »

Short Run TIPS, LT Flat, Basically Awful Real(ity)

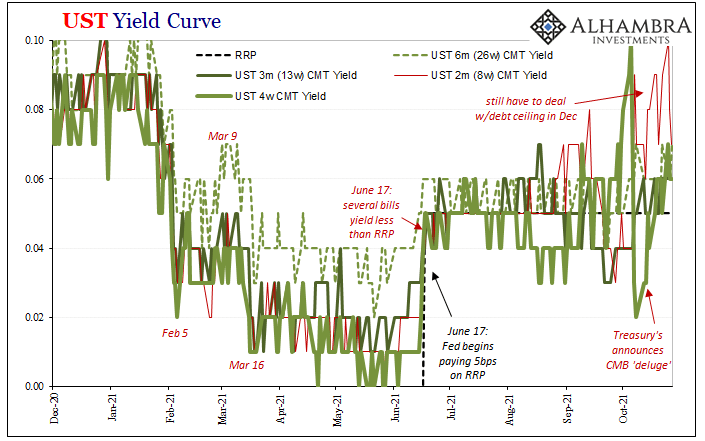

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »

Weekly Market Pulse: Inflation Scare?

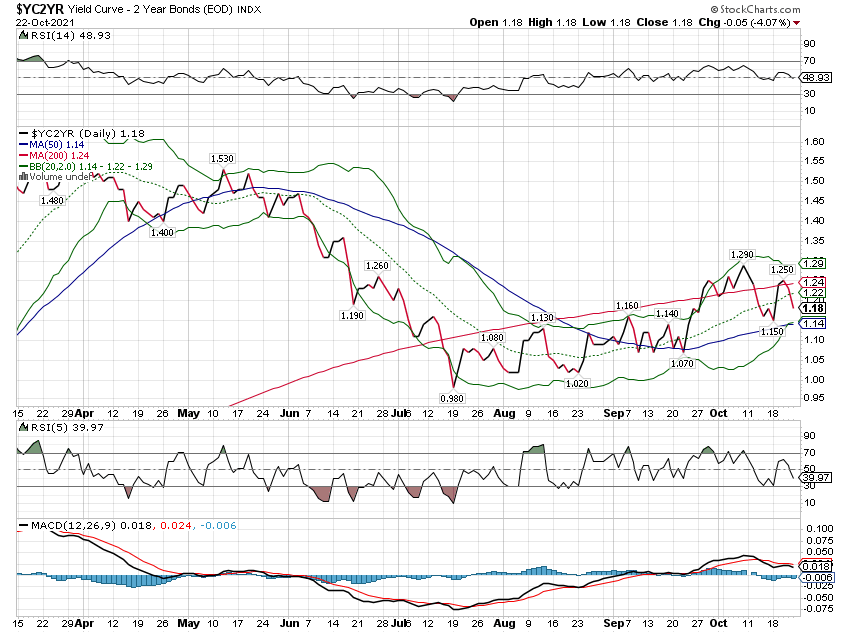

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it.

Read More »

Read More »

Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion.

Read More »

Read More »

Weekly Market Pulse: What Is Today’s New Normal?

Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be:

“a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the...

Read More »

Read More »

Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

Read More »

Read More »

Weekly Market Pulse: As Clear As Mud

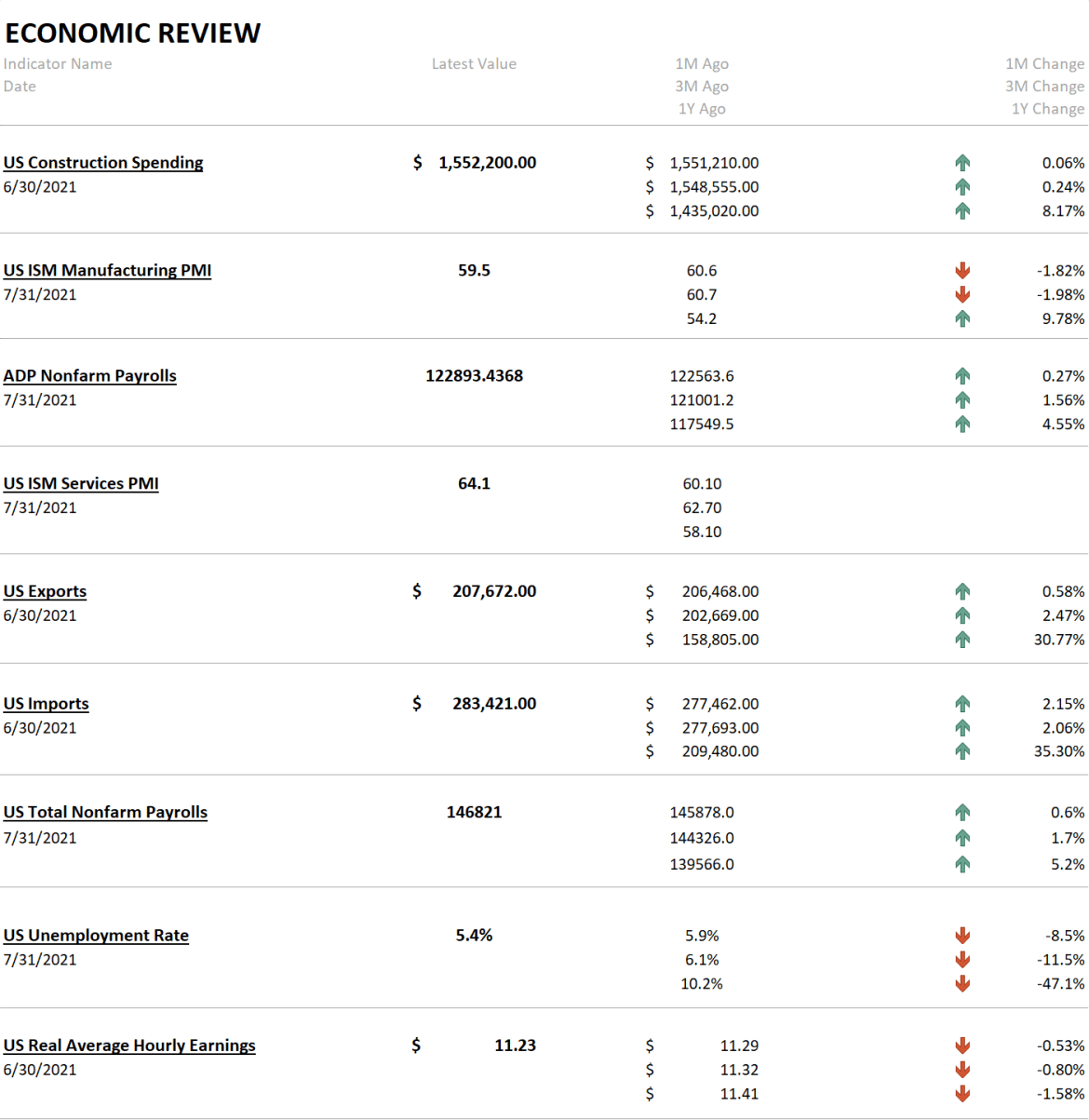

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs.

Read More »

Read More »

And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene.

Read More »

Read More »

Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »

Weekly Market Pulse: Nothing To See Here. No, Really. Nothing.

The answer to the question, “What should I do to my portfolio today (this week, this month)? is almost always nothing. Humans, and especially portfolio managers, have a hard time believing that doing nothing is the right response….to anything…or nothing. We are programmed to believe that success comes from doing things, not not doing things.

Read More »

Read More »