Tag Archive: RMB

Location Transformation or HIBORMania

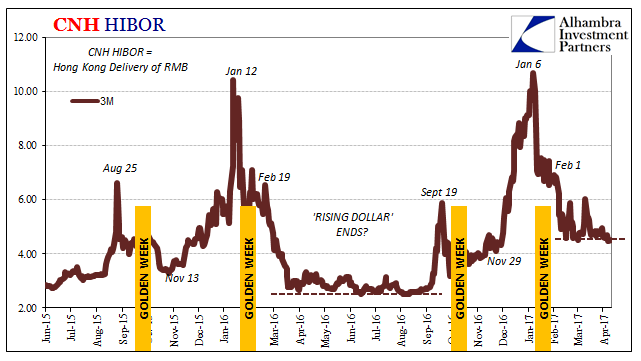

The Communist Chinese established their independence on September 21, 1949. The grand ceremony commemorating the political change was held in Tiananmen Square on October 1 that year. The following day, October 2, the Resolution on the National Day of the People’s Republic of China was passed making October 1to be China’s National holiday. It typically kicks off the second of China’s Golden Week holidays. The first relates to the Chinese New Year...

Read More »

Read More »

It Was Collateral, Not That We Needed Any More Proof

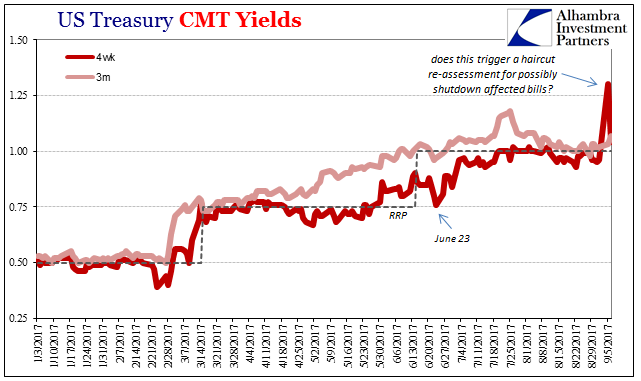

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

Little Behind CNY

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely.

Read More »

Read More »

PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

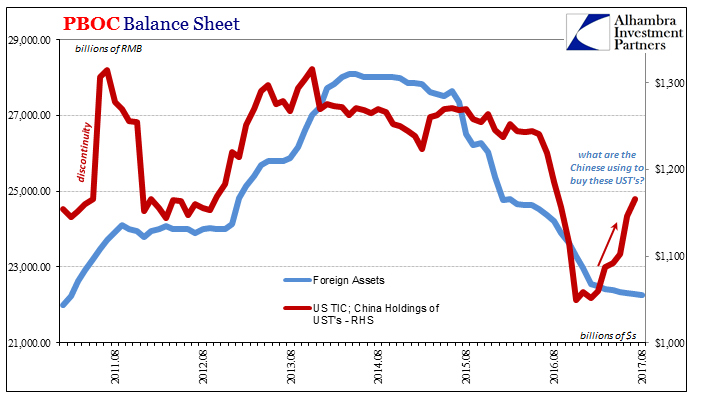

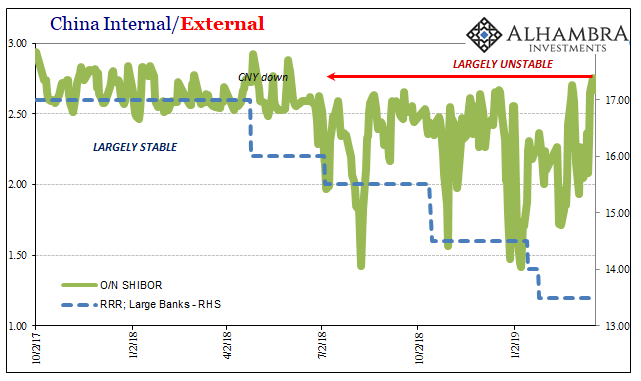

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.

Read More »

Read More »

Basic China Money Math Still Doesn’t Add Up To A Solution

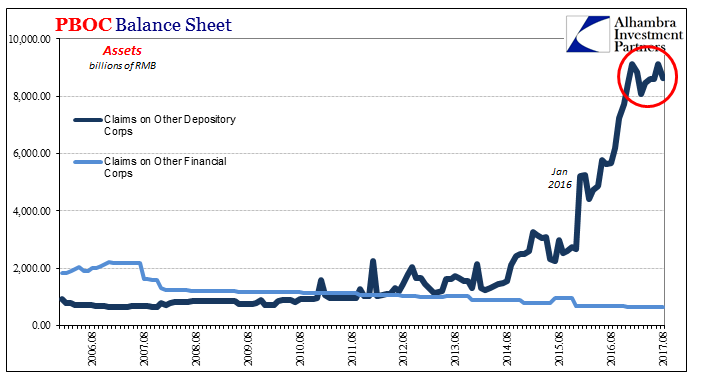

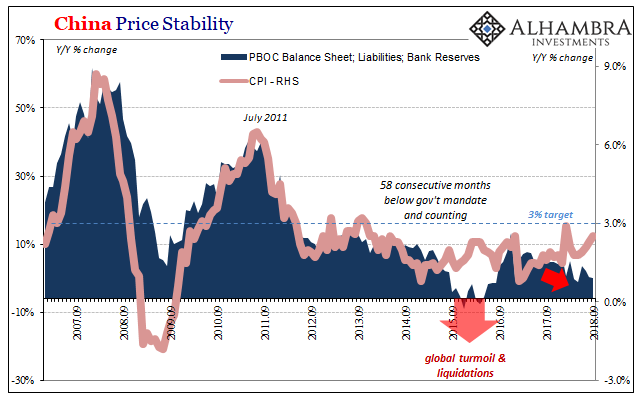

There are four basic categories to the PBOC’s balance sheet, two each on the asset and liability sides of the ledger. The latter is the money side, composed mainly of actual, physical currency and the ledger balances of bank reserves. Opposing them is forex assets in possession of the central bank and everything else denominated in RMB.

Read More »

Read More »

Now China’s Curve

Suddenly central banks are mesmerized by yield curves. One of the jokes around this place is that economists just don’t get the bond market. If it was only a joke. Alan Greenspan’s “conundrum” more than a decade ago wasn’t the end of the matter but merely the beginning. After spending almost the entire time in between then and now on monetary “stimulus” of the traditional variety, only now are authorities paying close attention.

Read More »

Read More »

The ‘Dollar’ Devil Shows Itself Again In China

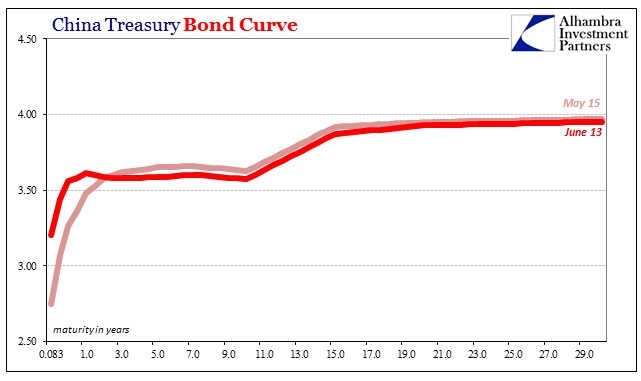

Some economic and financial conditions leave a yield curve as a more complex affair.Then there are others that are incredibly simple.The UST yield curve is the former, while right now the Chinese Treasury curve is the latter.

Read More »

Read More »

Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean.

Read More »

Read More »

Non-Randomly Surveying RMB

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been – neutral.

Read More »

Read More »

Great Graphic: The Yuan’s Weakness

Don't be fooled, the yuan has fallen more against its basket that against the dollar this year. It is not clear what China means by stable. Market forces appear to be moving in the same direction as officials wish.

Read More »

Read More »