Tag Archive: Retail sales

Dollar Recovers After Losses Extended in Asia

Overview: On the back of lower interest rates, the greenback's

slide was extended in early Asia Pacific turnover, but it has recovered. As

North American trading begins, the dollar is firmer against all the G10

currencies but the New Zealand dollar, which has been aided by the hawkish hold

of the central bank, and an immaterial gain in the Swiss franc. Emerging market

currencies are mixed. Central European currencies and the Mexican peso are...

Read More »

Read More »

Weekly Market Pulse: There Is No Certainty In Investing

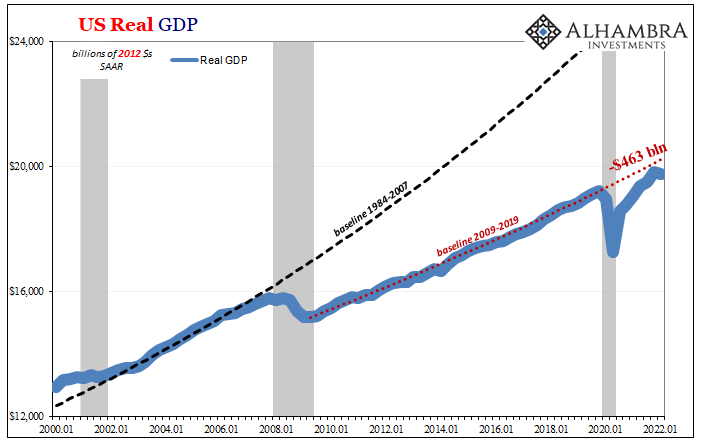

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record.

Read More »

Read More »

Market Pulse: Mid-Year Update

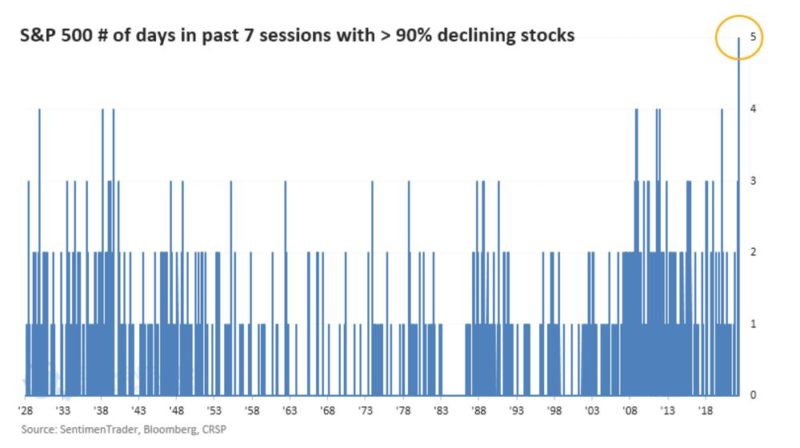

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

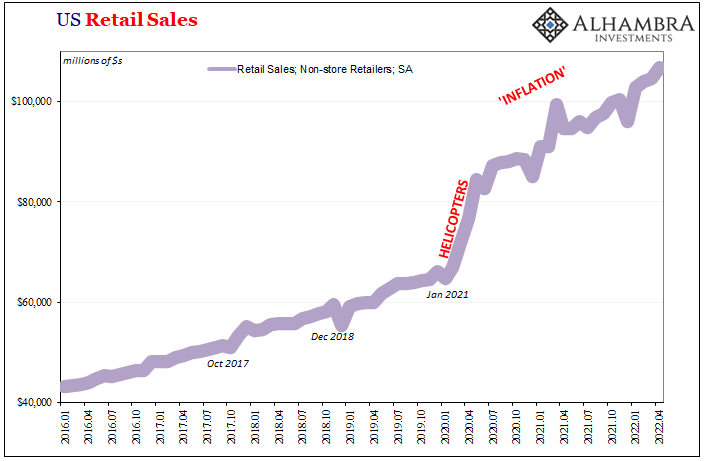

“Inflation” Not Inflation, Through The Eyes of Inventory

It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices.Who cares, most people wonder. After all, what does it really matter why prices are going up so far?

Read More »

Read More »

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

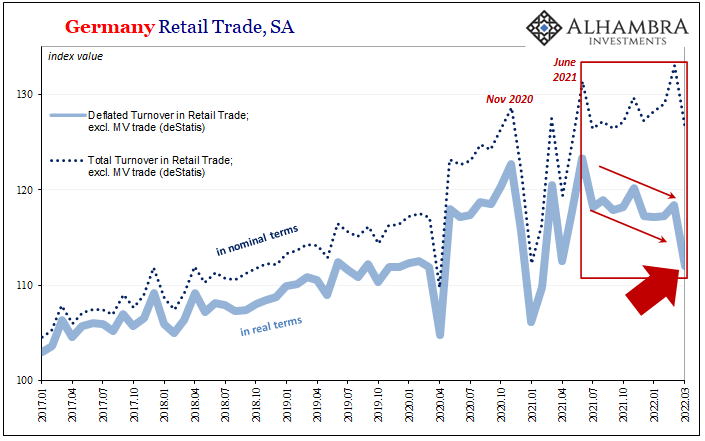

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

Can’t Blame COVID For This One

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal.

Read More »

Read More »

Shipping Around Retail ‘Inflation’

This whole “inflation” scenario isn’t really that difficult to piece together, effect from cause. Sure, Jay Powell’s trying to nuke it by hiking the federal funds rate, but no one really uses fed funds and the problem isn’t the unsecured cost of borrowing bank reserves (not money) that are literally overflowing.

Read More »

Read More »

T-bills Targeted Target

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like...

Read More »

Read More »

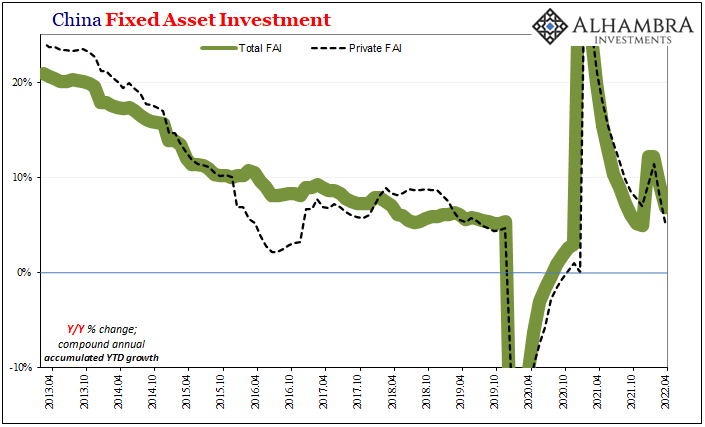

Synchronized Not Coronavirus

There is an understandable tendency to just write off this weekend’s disastrous Chinese data as nothing more than pandemic politics. After all, it has been Emperor Xi’s harsh lockdowns spreading like wildfire across China rather than any disease (why it has been this way, that’s another Mao-tter).

Read More »

Read More »

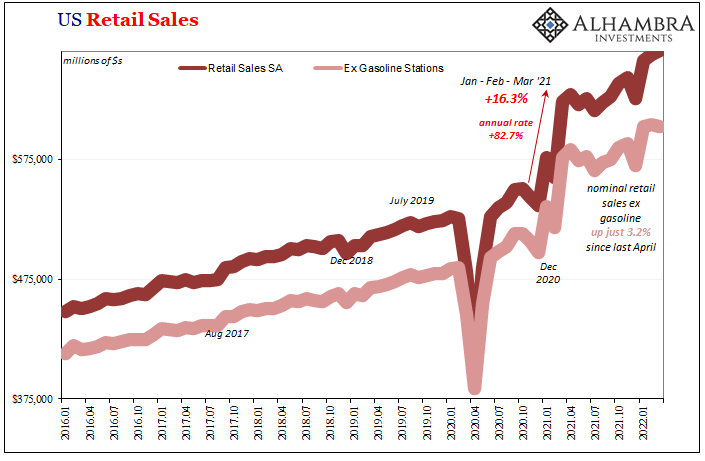

Not Good Goods

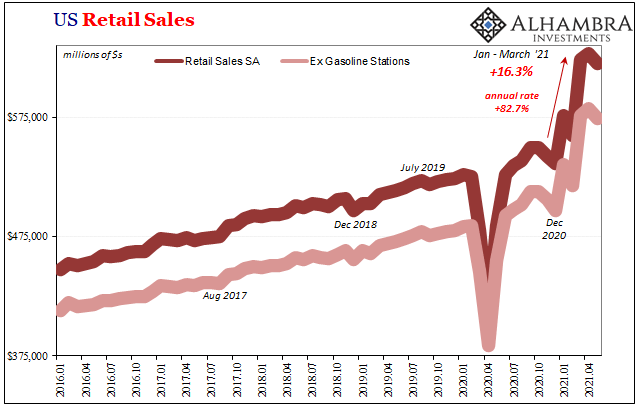

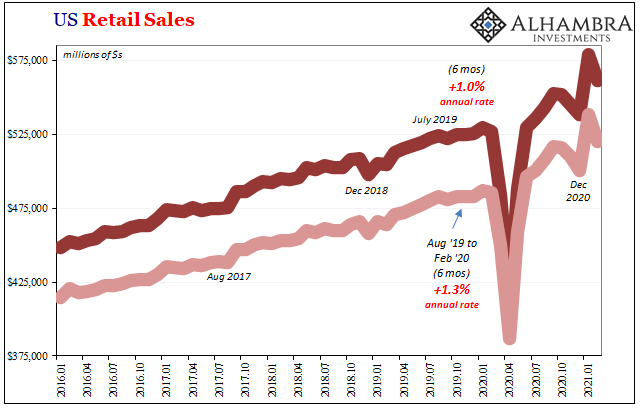

The goods economy in the United States is – maybe was – the lone economic bright spot. That in and of itself should’ve provoked more caution, instead there was the red-hot recovery to sell under the cover of supply shock pricing changes. The sheer spending on goods, and how they arrived, each unabashedly artificial from the get-go.

Read More »

Read More »

Shanghai’s Current Plight Began in 2017

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing.

Read More »

Read More »

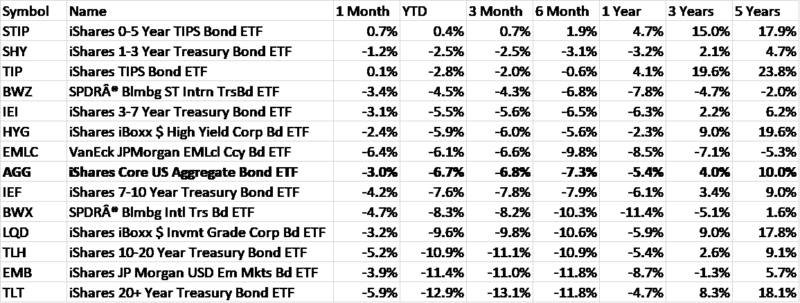

Weekly Market Pulse: The Cure For High Prices

There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells.

Read More »

Read More »

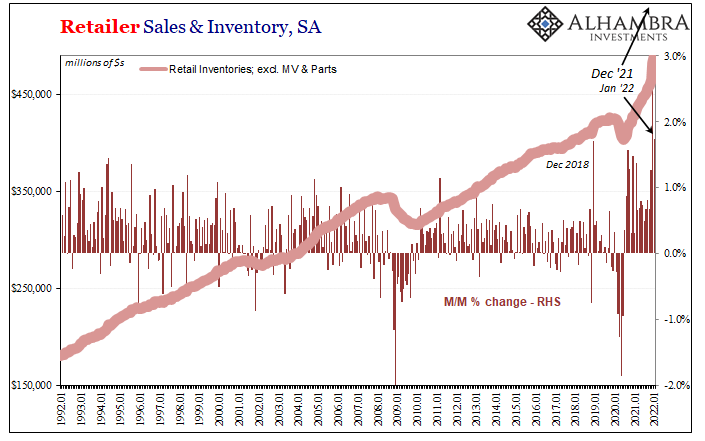

Briefing Even More Inventory

Retail sales stumbled in December, contributing some to the explosion in inventory across the US supply chain – but not all. Inventories were going to spike even if sales had been better. In fact, retail inventories rose at such a record pace beyond anything seen before, had sales been far improved the monthly increase in inventories still would’ve unlike anything in the data series.

Read More »

Read More »

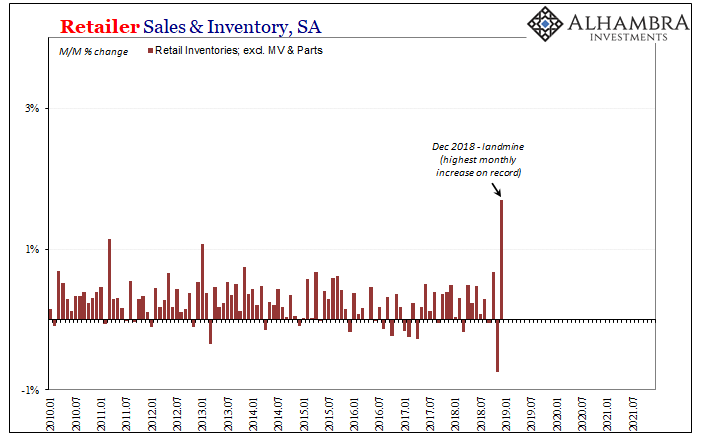

FOMC Goes With Unemployment Rate While This Huge Number Happens To Far More Relevant Economic Data

The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters.

Read More »

Read More »

Trying To Project The Goods Trade Cycle

One quick note on yesterday’s retail sales estimates in the US for the month of November 2021. The increase for them was less than had been expected, but these were hardly awful by any rational measure.

Read More »

Read More »

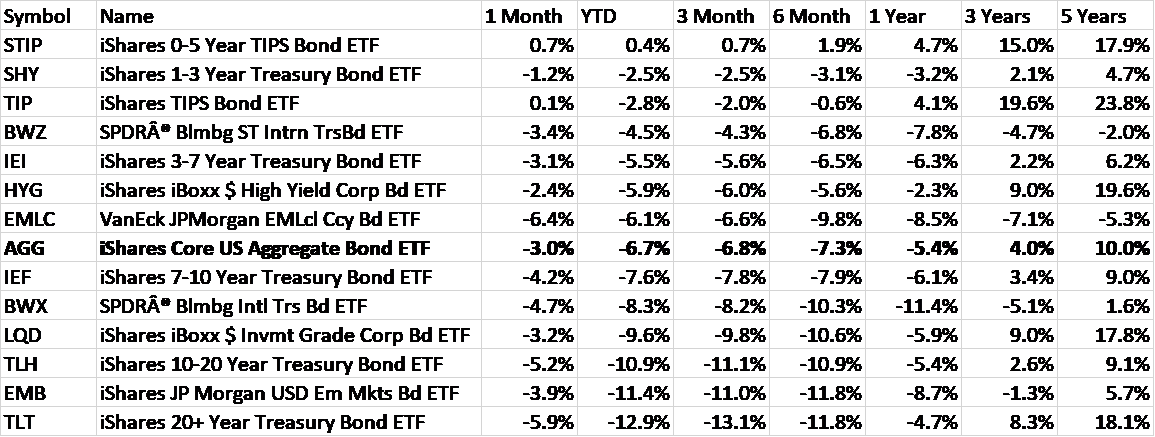

Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time.

Read More »

Read More »

August Retail Sales Surprise To The Upside, Because They Were Down?

According to the movie The Princess Bride, the worst classic blunder anyone can make is to get involved in a land war in Asia. No kidding. The second is something about Sicilians and death. There is also, I’ve come to learn, an unspoken third which cautions against chasing down and then trying to break down seasonal adjustments in economic data.Some things are best left just as they are published.

Read More »

Read More »

Weekly Market Pulse: Is It Time To Panic Yet?

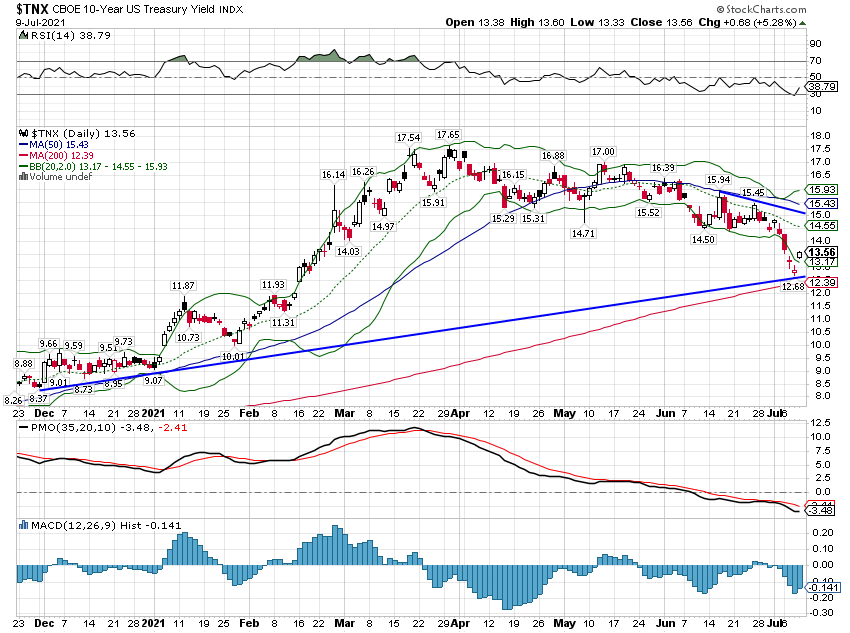

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »

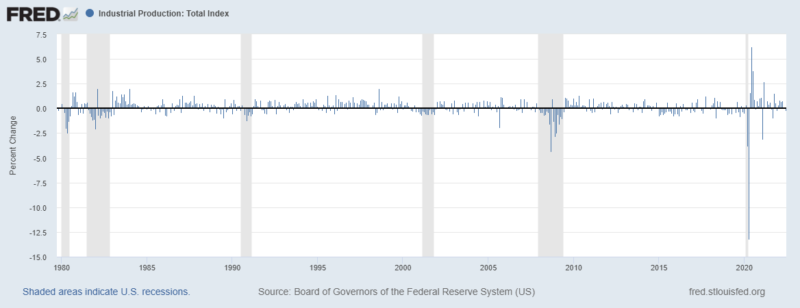

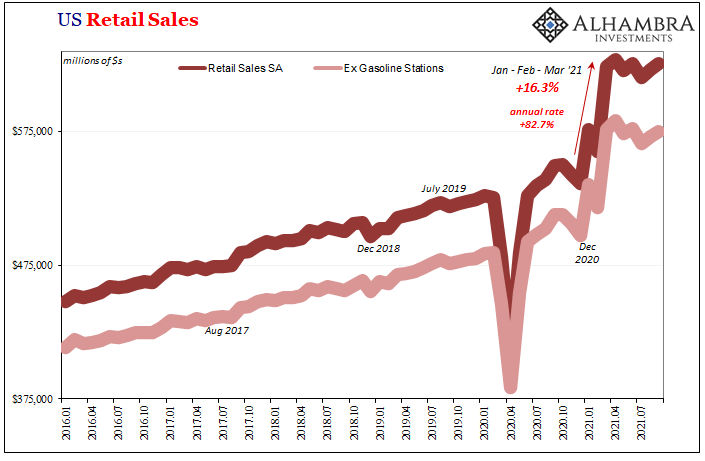

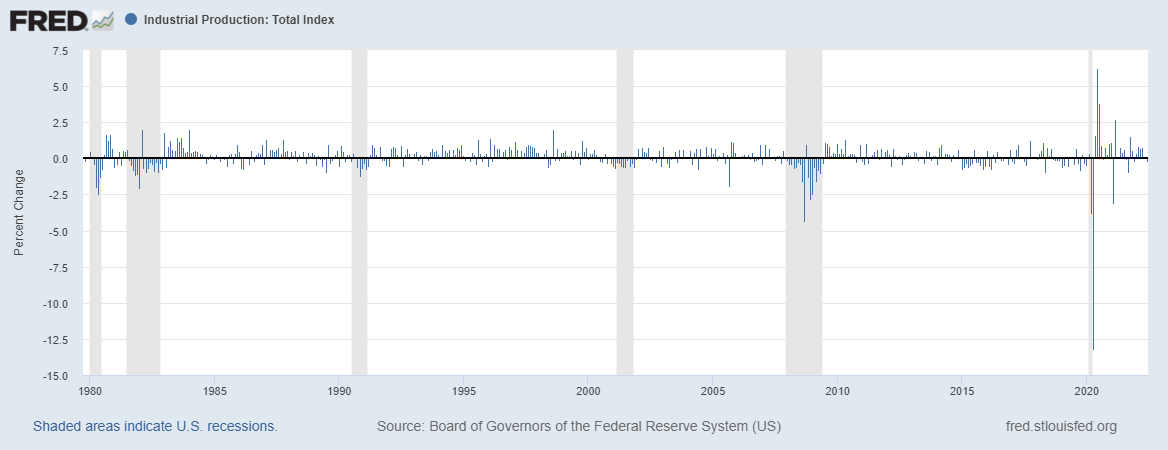

Another Round of Transitory: US Retail Sales & (revised) IP

Same stuff, different month. We can basically reprint both what was described yesterday about supply curves not keeping up with exaggerated demand as well as the past two months of commentary on Retail Sales plus Industrial Production each for the US. Quite on the nose, US demand for goods, anyway, is eroding if still artificially very high.

Read More »

Read More »

Spending Here, Production There, and What Autos Have To Do With It

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise.

Read More »

Read More »