Tag Archive: Reflation

Inching Closer To Another Warning, This One From Japan

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart.

Read More »

Read More »

Anyone Remember That Whole SLR Cliff?

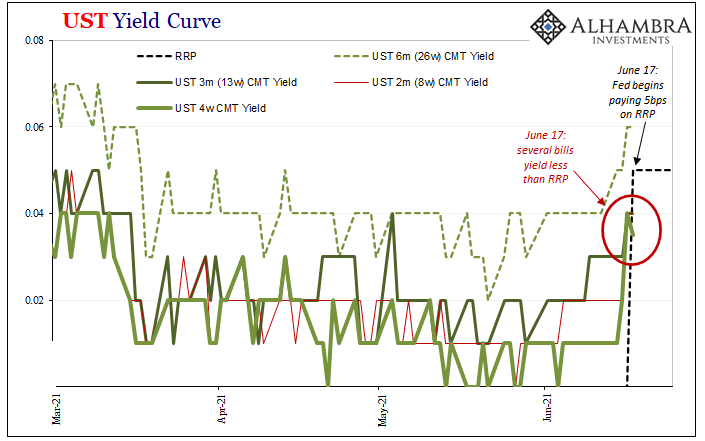

Does anyone remember the SLR “cliff?” Of course you don’t, because in the end it didn’t seem to make any difference. For a few weeks, it was kind of ubiquitous if only in the sense that it was another one of those deep plumbing issues no one seems able to understand (forcing all the “experts” to run to Investopedia in order write something up about it).

Read More »

Read More »

The FOMC Accidentally Exposes Itself (Reverse Repo-style)

Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely.

Read More »

Read More »

Rechecking On Bill And His Newfound Followers

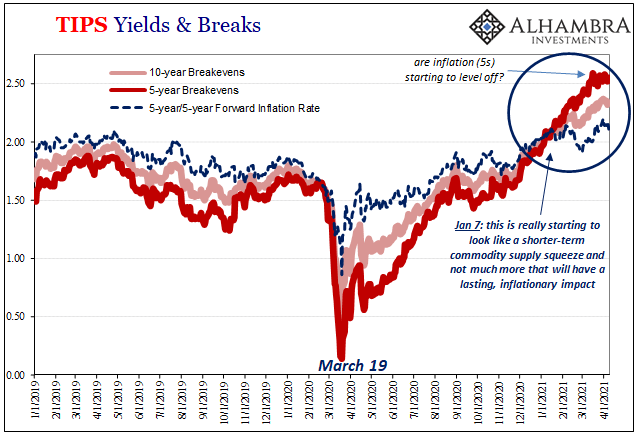

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard).

Read More »

Read More »

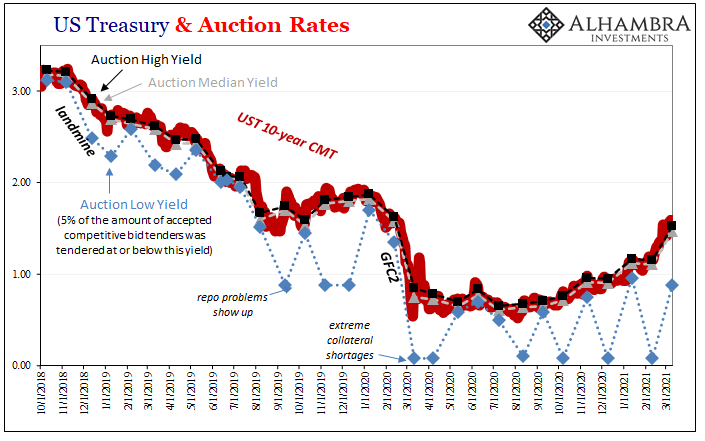

What Gold Says About UST Auctions

The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first.

Read More »

Read More »

What Might Be In *Another* Market-based Yield Curve Twist?

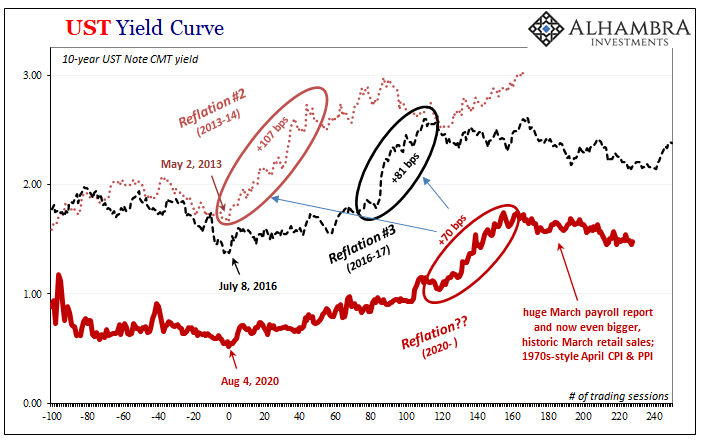

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago.

Read More »

Read More »

Seizing The Dirt Shirt Title

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

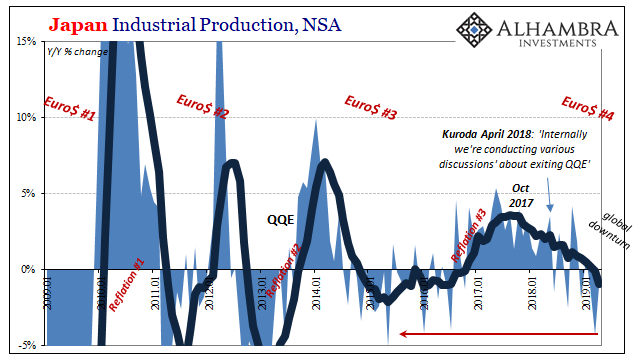

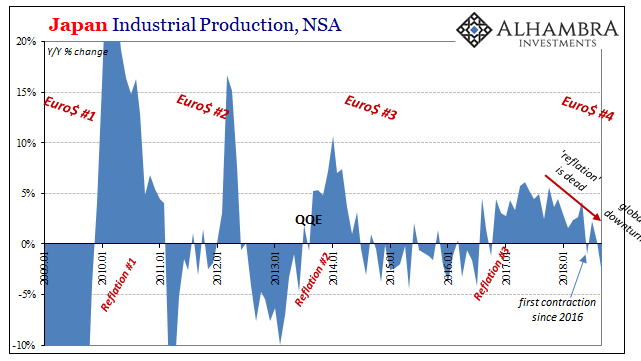

Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best.

Read More »

Read More »

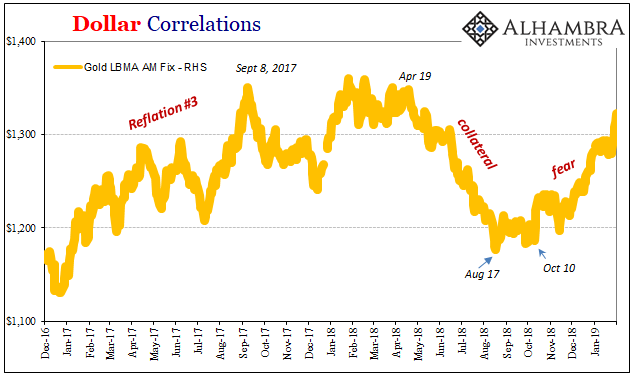

Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way.

Read More »

Read More »

Insight Japan

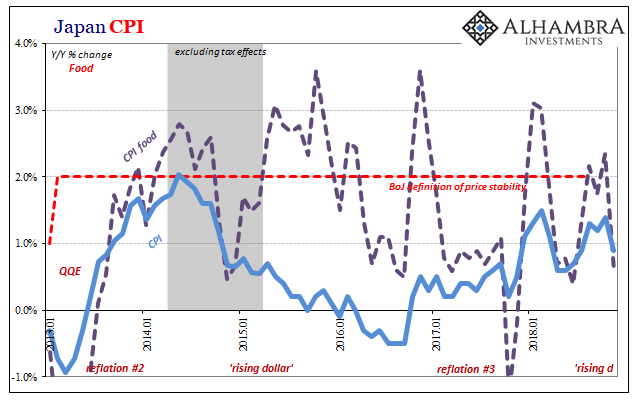

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost.

Read More »

Read More »

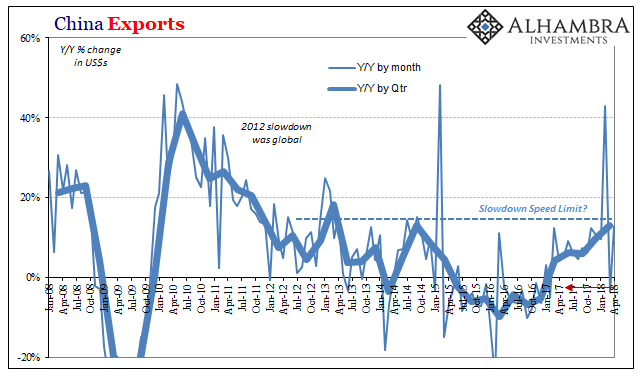

China Now Japan; China and Japan

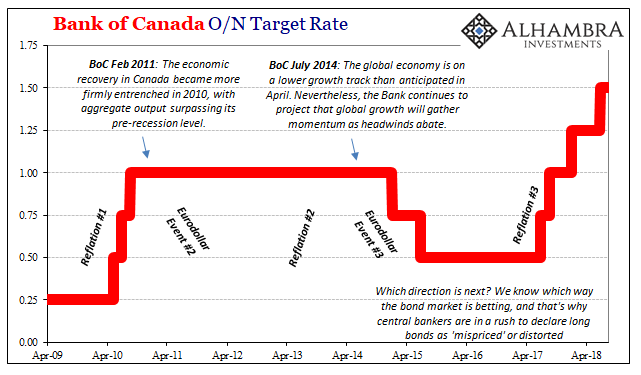

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc.

Read More »

Read More »

‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are.

Read More »

Read More »

What China’s Trade Conditions Say About The Right Side Of ‘L’

Chinese exports rose 12.9% year-over-year in April 2018. Imports were up 20.9%. As always, both numbers sound impressive but they are far short of rates consistent with a growing global economy. China’s participation in global growth, synchronized or not, is a must. The lack of acceleration on the export side tells us a lot about what to expect on the import side.

Read More »

Read More »

The Best ‘Reflation’ Indicator May Be Japanese

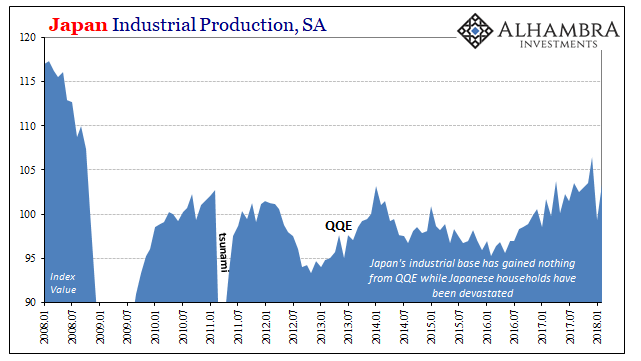

Japanese industrial production dropped sharply in January 2018, Japan’s Ministry of Economy, Trade, and Industry reported last month. Seasonally-adjusted, the IP index fell 6.8% month-over-month from December 2017. Since the country has very little mining sector to speak of, and Japan’s IP doesn’t include utility output, this was entirely manufacturing in nature (99.79% of the IP index is derived from the manufacturing sector).

Read More »

Read More »

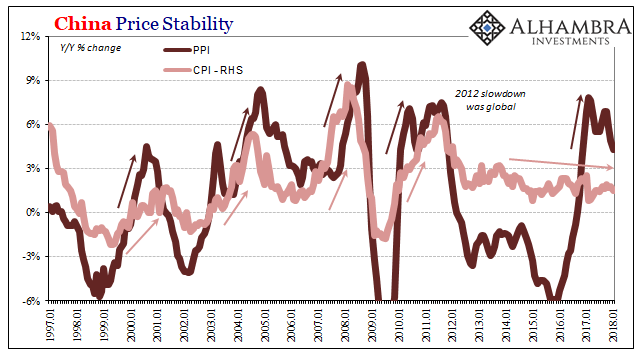

China: Inflation? Not Even Reflation

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference.

Read More »

Read More »

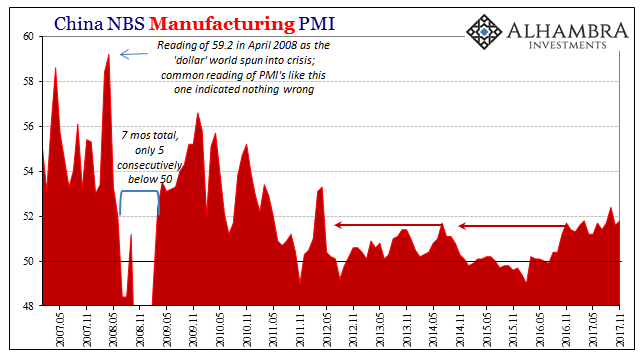

Three Years Ago QE, Last Year It Was China, Now It’s Taxes

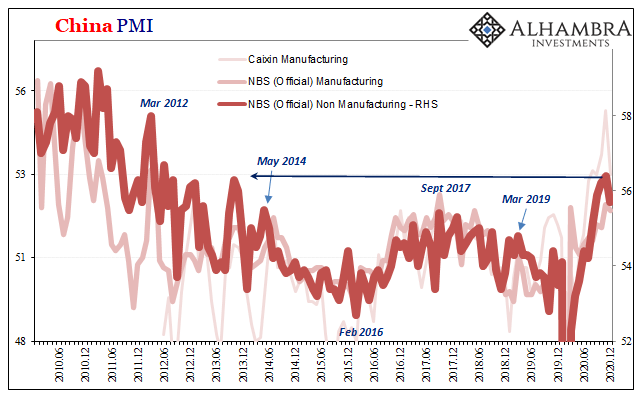

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month.

Read More »

Read More »

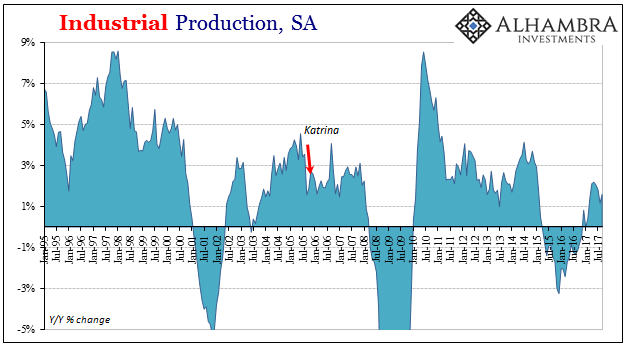

Broader Slowing in Industrial Production

Industrial Production rose 1.6% year-over-year in September 2017. That’s up from 1.2% growth in August, both months perhaps affected to some degree by hurricanes. The lack of growth and momentum, however, clearly predated the storms. The seasonally-adjusted index for IP peaked in April 2017, and has been lower ever since. This pattern, the disappointment this year is one we see replicated nearly everywhere on both sides (supply as well as demand)...

Read More »

Read More »

It Was Collateral, Not That We Needed Any More Proof

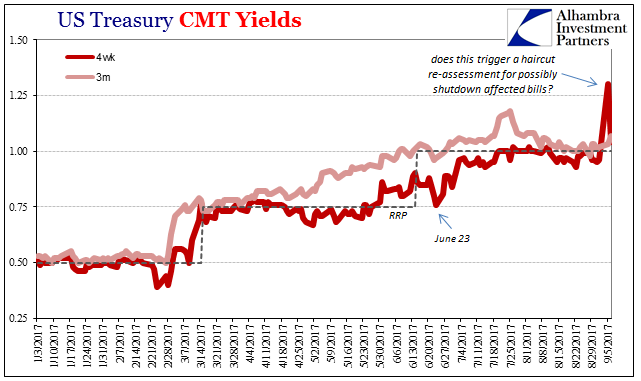

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

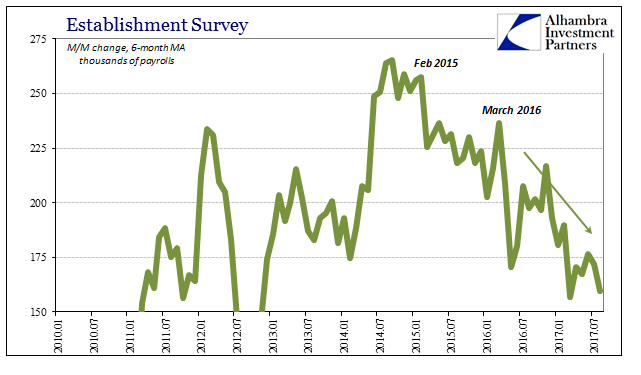

2017 Is Two-Thirds Done And Still No Payroll Pickup

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a third round of QE back in 2012.

Read More »

Read More »

Deja Vu

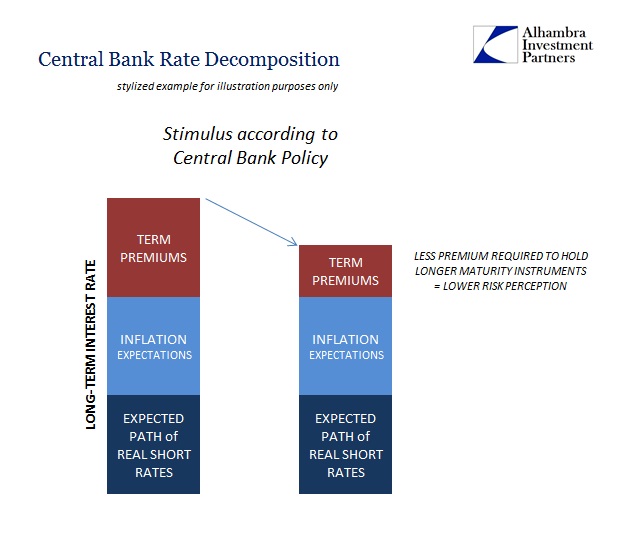

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that much longer (more return to...

Read More »

Read More »