Tag Archive: Real Estate

Weekly Market Pulse: Buy The Rumor, Sell The News

There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report.

Read More »

Read More »

Monthly Macro Monitor – September (VIDEO)

Alhambra CEO Joe Calhoun and Alhambra's Bob Williams look at data from the past month and discuss what it means for the economy.

Read More »

Read More »

Monthly Market Monitor – August 2020

Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again.

Read More »

Read More »

Monthly Macro Monitor – August 2020

One of the advantages we enjoy here at Alhambra is the opportunity to interact with a lot of investors. We talk to hundreds of individual investors on a monthly basis, giving us a front-row seat to everyone’s fear and greed. Economic data tells us about the past, which isn’t particularly useful for investors focused on the future.

Read More »

Read More »

Monthly Market Monitor – July 2020

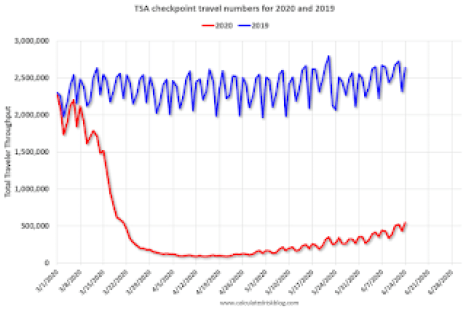

Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime.

Read More »

Read More »

Monthly Macro Monitor – June 2020

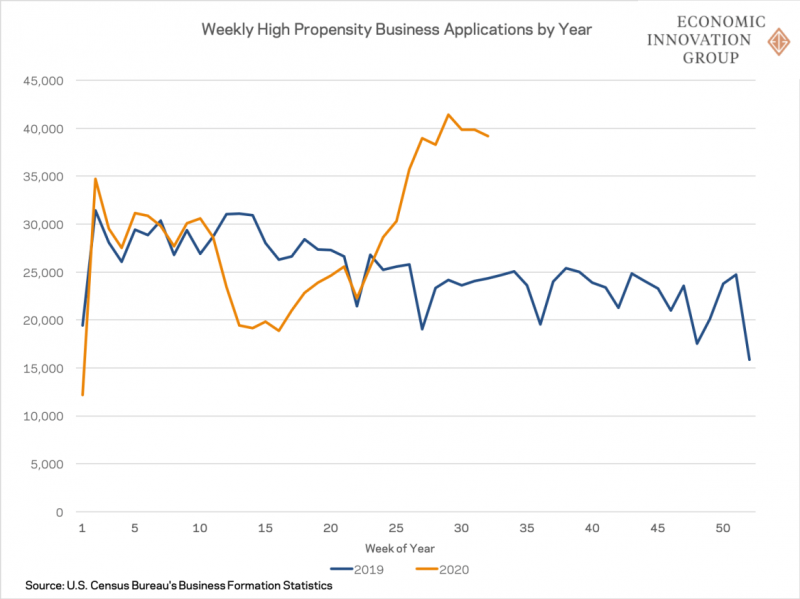

The stock market has recovered most of its losses from the March COVID-19 induced sell-off and the enthusiasm with which stocks are being bought – and sold but mostly bought – could lead one to believe that the crisis is over, that the economy has completely or nearly completely recovered. Unfortunately, other markets do not support that notion nor does the available economic data.

Read More »

Read More »

We Have Reached The Silly Phase of the Bull Market

Have we entered a new bull market? Was the 35% pullback in the S&P 500 in March the fastest bear market in history? Or is this just a continuation of the bull market that started in 2009, interrupted by a rather large correction? Bull markets and bear markets are about behavior, about the human emotions of fear and greed. While we got a brief bout of fear in March, greed has since overwhelmed all sense, common and otherwise.

Read More »

Read More »

Regime Change

Stocks took another beating last week as the scope of the coronavirus shutdown started to sink in. The S&P 500 was down 15% last week with most of that coming on Monday after the Fed’s emergency rate cuts. Our accounts performed much better than that, but were still down on the week as corporate and municipal bonds continued to get marked down.

Read More »

Read More »

Is this the Beginning of a Recession?

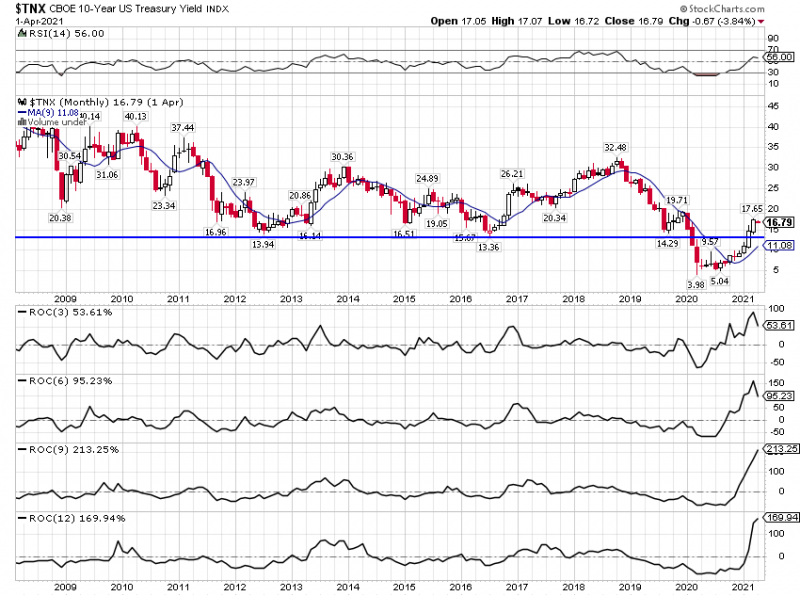

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn.

Read More »

Read More »

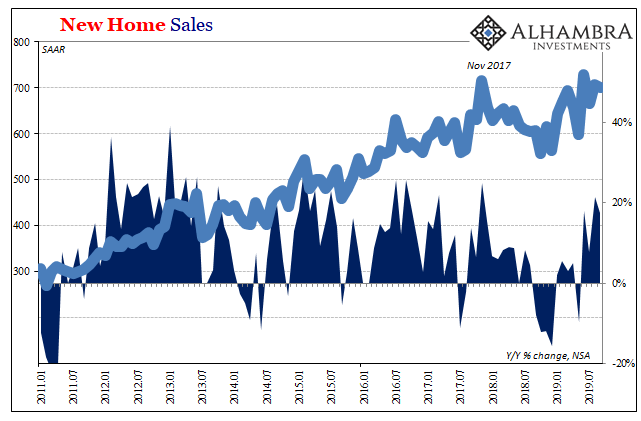

Downward Home Prices In The Downturn, Too

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that...

Read More »

Read More »

Macro Housing: Bargains and Discounts Appear

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space.

Read More »

Read More »

Real Estate Perfectly Sums Up The Rate Cuts

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening.

Read More »

Read More »

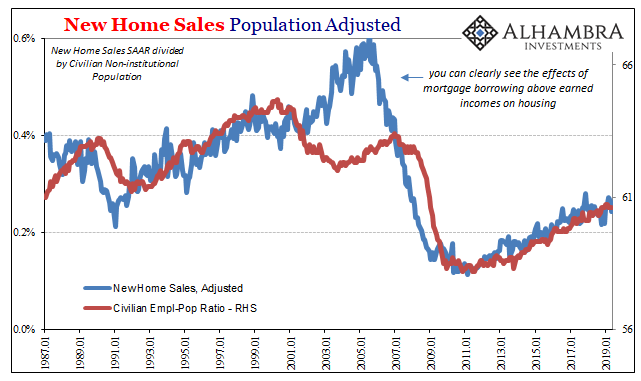

What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it.

Read More »

Read More »

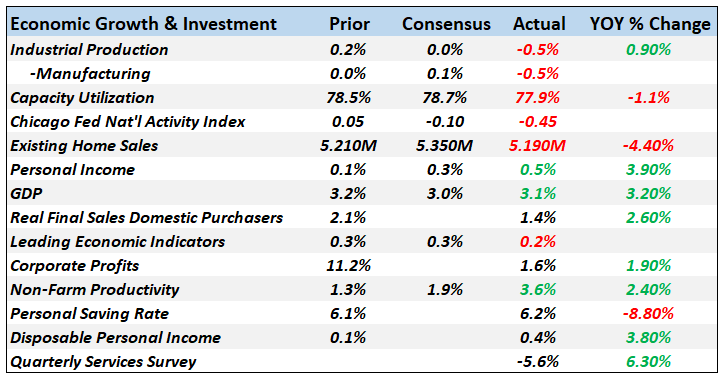

Monthly Macro Monitor: Economic Reports

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction.

Read More »

Read More »

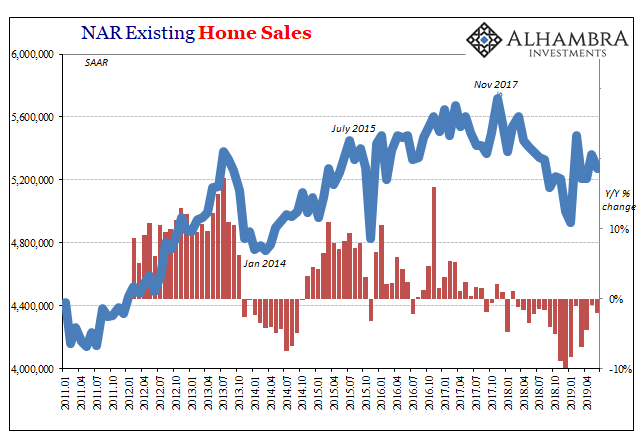

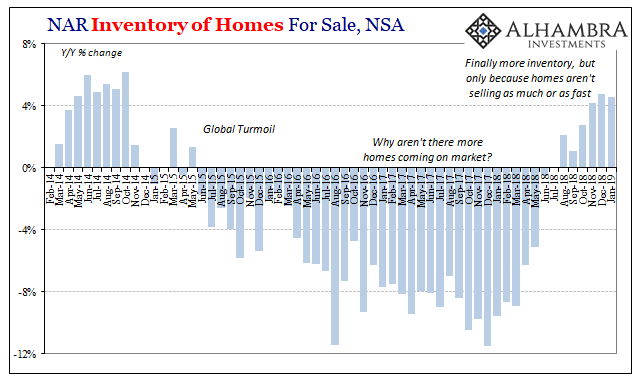

The Fate of Real Estate

For years, realtors have been waiting for more housing inventory. It had become an article of faith, what was restraining a full-blown recovery was the lack of units available. The level of resales like construction was up, but still way, way less than it was now fourteen years past the prior peak despite sufficient population growth to have absorbed the previous bubble’s overbuilding.

Read More »

Read More »

2019 Outlook

A discussion of the outlook for 2019 in the markets and the economy by Alhambra CEO Joe Calhoun and the Head of Alhambra Global Investment Research Jeff Snider.

Read More »

Read More »

Living In The Present

It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable health care or Miami Dolphin playoff games? Will China’s economy succumb to the pressure of US tariffs and make a deal?

Read More »

Read More »

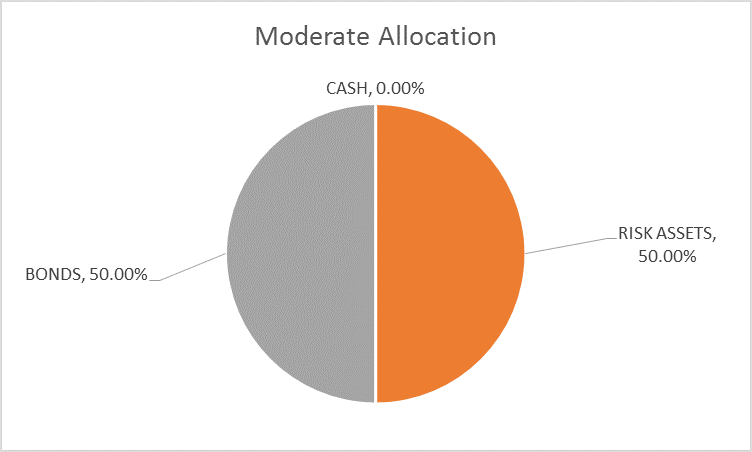

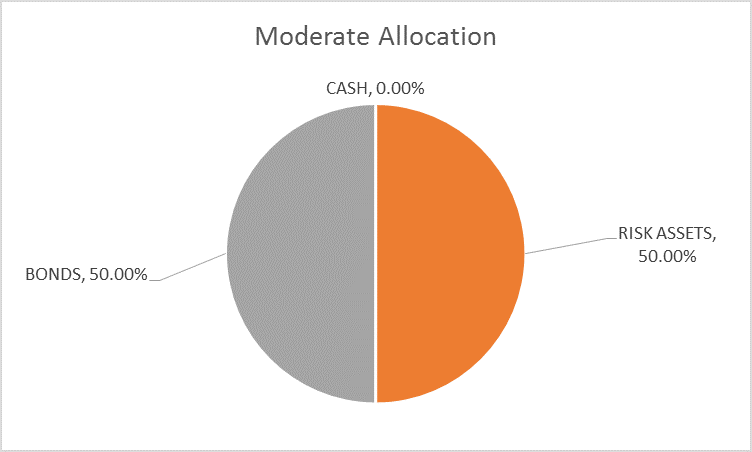

Global Asset Allocation Update

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY.

Read More »

Read More »

Global Asset Allocation Update

The risk budget changes this month as I add back the 5% cash raised in late October. For the moderate risk investor, the allocation to bonds is still 50% while the risk side now rises to 50% as well. I raised the cash back in late October due to the extreme overbought nature of the stock market and frankly it was a mistake. Stocks went from overbought to more overbought and I missed the rally to all time highs in January.

Read More »

Read More »