Tag Archive: QT

Weekly Market Pulse: First, Kill All The Speculators

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome.

Read More »

Read More »

Peak Policy Error

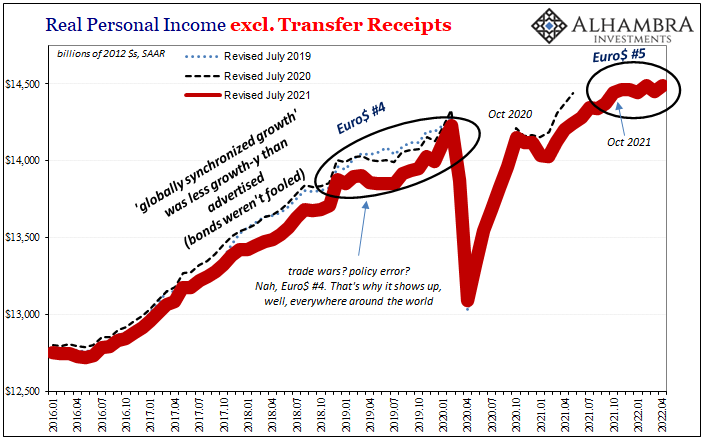

Another economic discussion lost to the eventual coronavirus pandemic mania was the 2019 globally synchronized downturn. Not just downturn, outright recession in key parts from around the world, maybe including the US.

Read More »

Read More »

Collateral Shortage…From *A* Fed Perspective

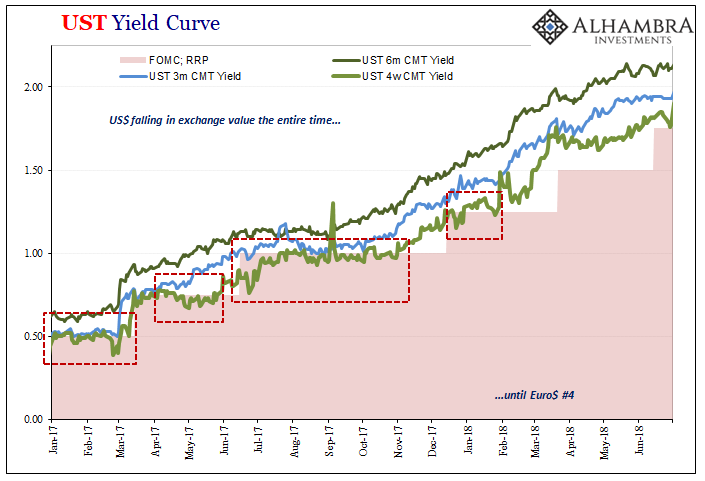

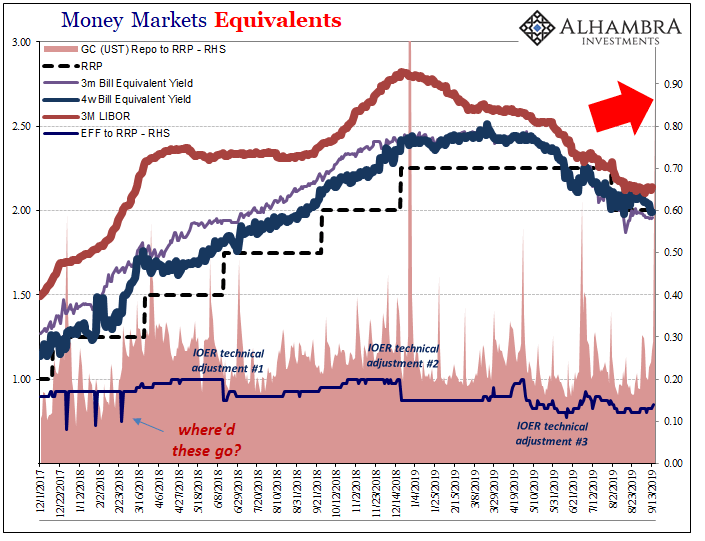

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods....

Read More »

Read More »

I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape.

Read More »

Read More »

2019: The Year of Repo

The year 2019 should be remembered as the year of repo. In finance, what happened in September was the most memorable occurrence of the last few years. Rate cuts were a strong contender, the first in over a decade, as was overseas turmoil. Both of those, however, stemmed from the same thing behind repo, a reminder that September’s repo rumble simply punctuated.

Read More »

Read More »

Head Faking In The Empty Zoo: Powell Expands The Balance Sheet (Again)

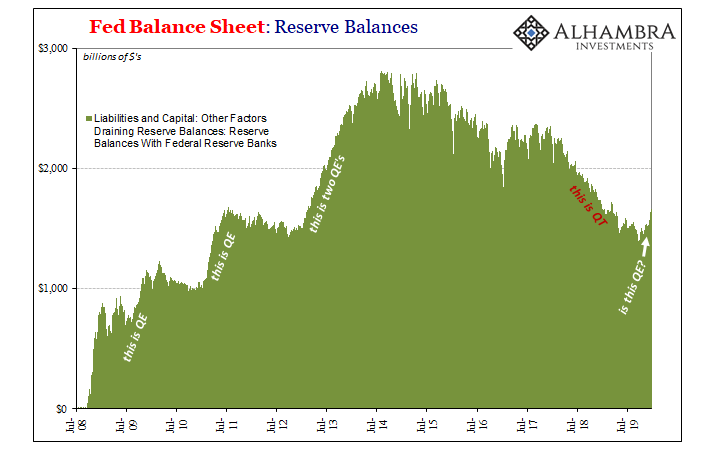

They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing.

Read More »

Read More »

Stuck at A: Repo Chaos Isn’t Something New, It’s The Same Baseline

Finally, finally the global bond market stopped going in a straight line. I write often how nothing ever does, but for almost three-quarters of a year the guts of the financial system seemed highly motivated to prove me wrong. Yields plummeted and eurodollar futures prices soared. It is only over the past few weeks that rates have backed up in what has been the first real selloff since last year.

Read More »

Read More »

FX Daily, February 13: QT is not the Opposite of QE

The Federal Reserve has long been clear on the sequence of events as it innovated the playbook during the Great Financial Crisis. There would be a considerable period between when the Fed would finish its credit easing operations that involved purchasing Treasuries and mortgage-backed securities (MBS) and its first-rate hike.

Read More »

Read More »