Tag Archive: QE2

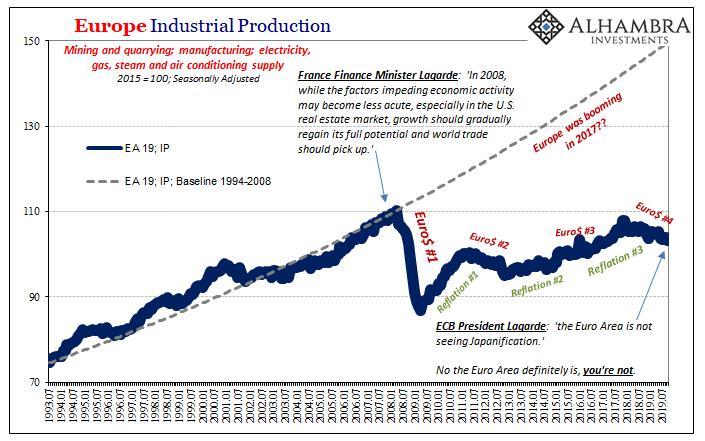

Lagarde Channels Past Self As To Japan Going Global

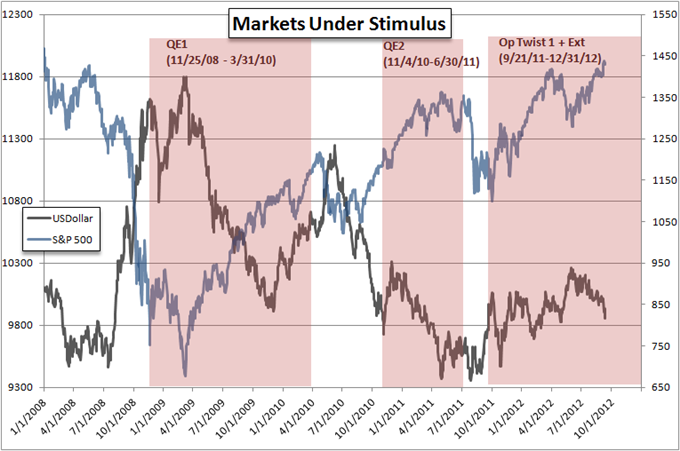

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

Quantitative Easing, its Indicators and the Swiss Franc

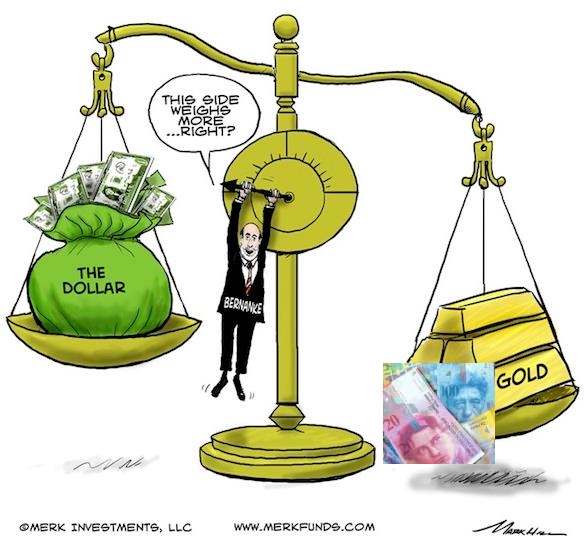

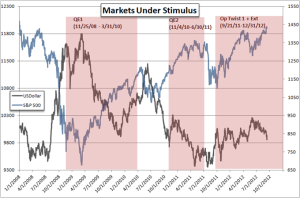

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

Balance of Payments Crisis: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

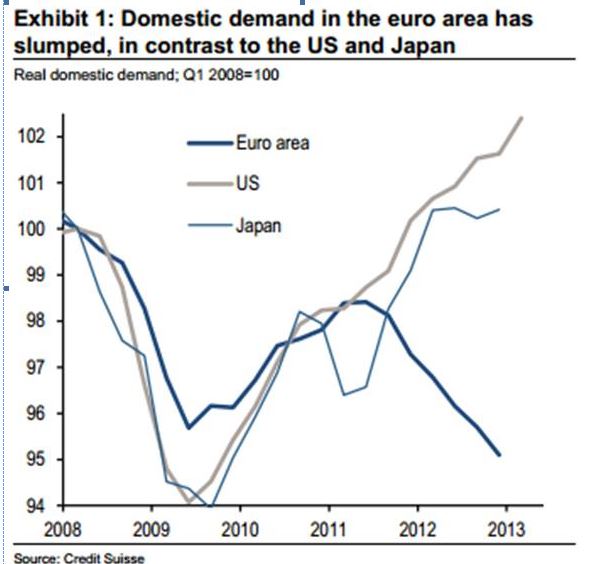

The Fed's excessive monetary easing QE2 caused an inflationary period, that created a balance of payments crisis during which the Eurozone members were obliged to introduce excessive austerity measures.

Read More »

Read More »

Helicopter Money against Animal Spirits and our Critique

The newest paper by McCulley and Poszar "Helicopter Money: or how I stopped worrying and love fiscal-monetary cooperation" presents fiscal policy and monetary policy along these two criteria

Read More »

Read More »

Quantitative Easing, Gold and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and safe-havens like the CHF, gold or the Japanese Yen up. … Continue reading »

Read More »

Read More »

How the SNB Destroyed Ashraf Laidi’s EUR/USD 1.35 Party

Trend Follower Ashraf Laidi Loses Against the Contrarian Investor SNB The currency strategist Ashraf Laidi recently evoked a EUR/USD exchange rate of 1.35 thanks to the risk appetite after the easing operations of the Fed and the ECB. We show that he and the masses of his Forex rooters actually traded against a big central …

Read More »

Read More »

It’s not simply QE3

Submitted by Mark Chandler, from marctomarkets.com The outcome of the FOMC meeting is not just a new round of quantitative easing, some might call it QE3. What the Fed announced represents a new chapter in its policy response. The first distinguishing aspect of its decision is the open-ended nature of it. While it has not indicated … Continue reading...

Read More »

Read More »

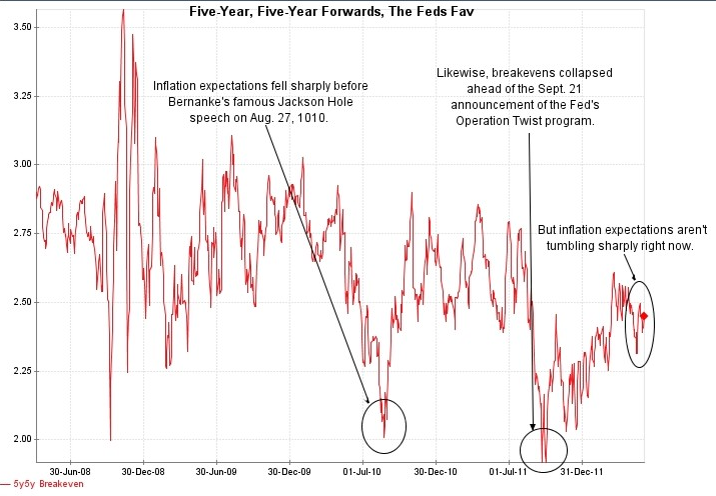

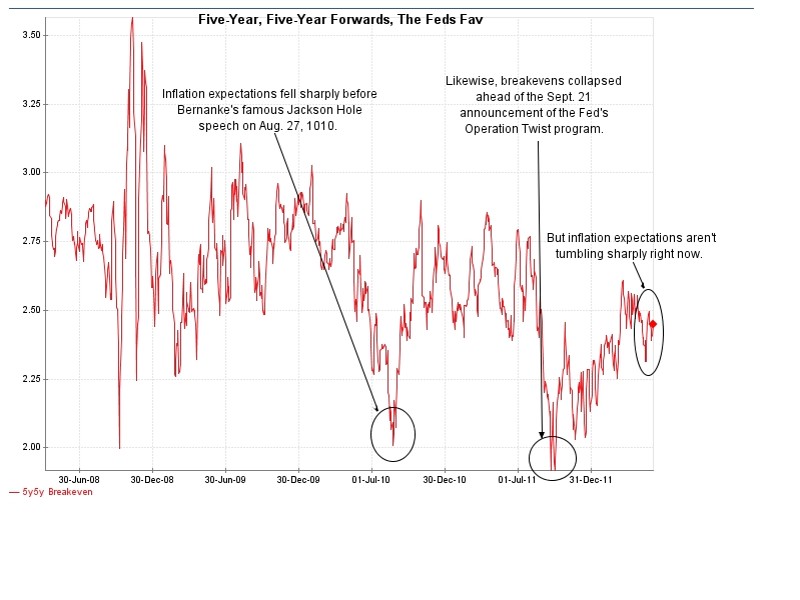

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

Quantitative Easing Indicators, June 2012

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This will push down the dollar and safe-havens like the CHF, gold or the … Continue reading »

Read More »

Read More »

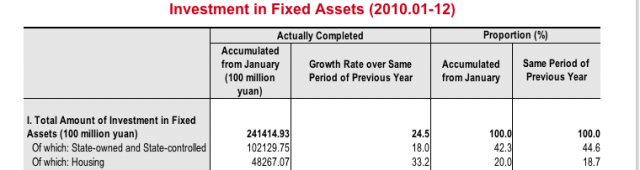

The Chinese Government, a bubble creator or when finally does China consume ?

The years 2009 to 2011 have seen four institutions that created bubbles in commodity, stock and real estate markets. 2008 and 2009 saw the massive Keynesian interventions by the US state and the Chinese government. In 2009 the first Quantitative Easing measures enabled a first flood of hot money into Emerging Markets. Summer 2010 witnessed …

Read More »

Read More »

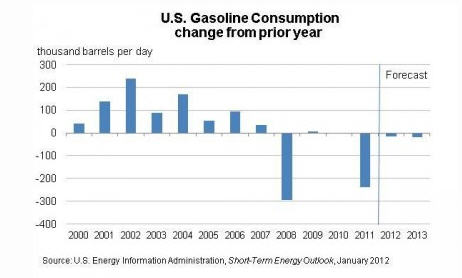

Keynesians vs. Anti-Keynesians: How price deflation has kick started the US growth

In recent posts Keynesians were criticized that hikes in the monetary base like Quantitative Easing (QE2) failed to lift the US economy, but it was the debt ceiling that helped to restore confidence in the US and that austerity can lead to GDP growth. Paul Krugman angrily replied that “even a huge rise in the …

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): May 2011

May 2011 ForexLive Asian Market Open: Analysis With Fries Just brilliant Jamie Australian GDP this morning and the market is now gearing itself for a poor number after yesterday’s data and weekend comments from the Treasurer. China is selling rallies in AUD/USD and Middle East Sovereigns are buying big dips; sounds like a recipe for medium … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): November 2010

EUR/CHF Continues Lower Presently down at 1.3055 from early 1.3090, having been as low as 1.3037 so far. Earlier I was reading comments made by UBS economist Huenerwadel, who said “At least from a fundamental point of view and aware of the increased long CHF positioning, very little speaks in favour of a materially higher EUR/CHF … Continue reading...

Read More »

Read More »