The key word in the whole thing is “bias.” For a very long time, people working in and around the finance industry have sought to gain tremendous advantages. No explanation for the motive is required. Charts, waves, technical (sounding) analysis and so on.

Read More »

Tag Archive: profits

Consistent Trade War Inconsistency Hides The Consistent Trend

You can see the pattern, a weathervane of sorts in its own right. Not for how the economy is actually going, mind you, more along the lines of how it is being perceived from the high-level perspective. The green light for “trade wars” in the first place was what Janet Yellen and Jay Powell had said about the economy.

Read More »

Read More »

Now Capex?

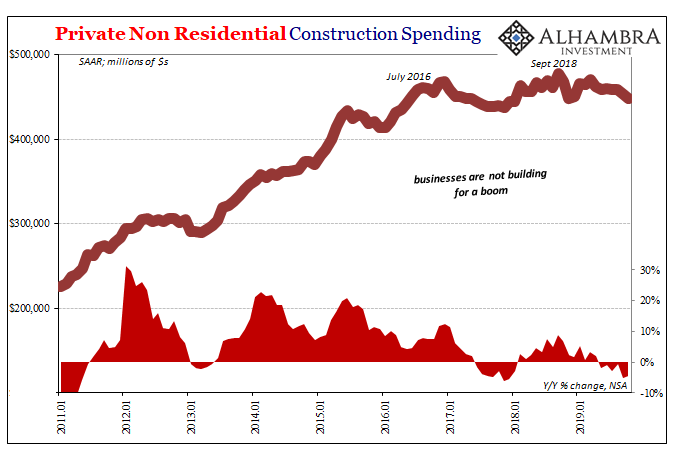

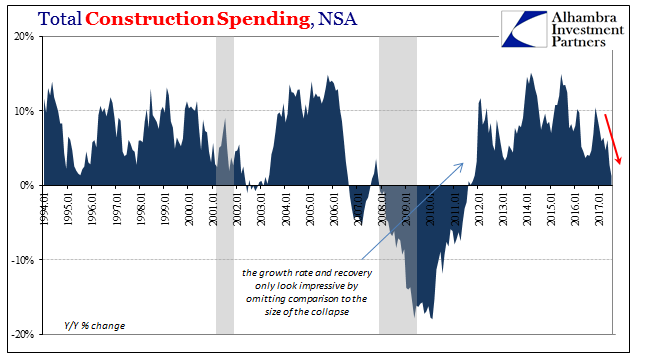

Of all the high frequency data the Personal Savings Rate is probably the least reliable. It is subject to both regular and benchmark revisions that can change the estimates drastically one way or the other. One step up from that statistic is the figures for Construction Spending. The initial monthly estimates don’t survive very long, and lately they have been quite weak in the first run only to be revised sharply higher over subsequent months.

Read More »

Read More »

Some Thoughts on Q3 US GDP

US Q3 was revised higher mostly due to consumption. Business investment was a drag. Profits rose to snap a five-quarter slide.

Read More »

Read More »

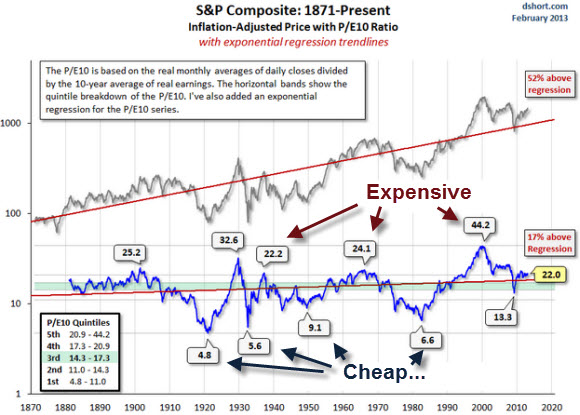

Rising Profits as Reason for the Stock Market Rally?

A list of relevant graphs for long-term price earnings ratios and the rising company profits in the last years.

Read More »

Read More »

Performance of global stock markets compared

A list of relevant graphs for the long-term price earnings rations and different stock market returns over the last 2 years. Moreover we show the return of the S&P 500 for each of the year.

Read More »

Read More »