Tag Archive: PMI

Risk On, Dollar Sold

Overview: The

post-close rally in US tech stocks after Nvidia's earnings has fueled risk-on

activity today. The Nikkei closed at record highs with a 2.2% rally. China's

CSI rose for the eighth consecutive session as official discourage sales at the

open and close, and short sales in general. Europe's Stoxx 600 is up more than

0.5% to recoup the small losses seen in the last two sessions. US indices are

poised to gap higher at the open. Benchmark...

Read More »

Read More »

The US Dollar and Rates Rise Further

Overview: The US dollar and interest rates have continued to

rise after the strong employment report before the weekend helped drive home the

Fed's message at last week's FOMC meeting. The greenback has been bid to new

highs for the year against the G10 currencies but the Canadian dollar. The

dollar also rose to a marginal new high for the year against the Chinese yuan. Interest

rates are jumping, and the market has downgraded the chances of a May...

Read More »

Read More »

BOJ Stands Pat, Exit Draws Closer, while HK Liquidity is Squeezed Easing Pressure on the Yuan

Overview: The dollar remains largely confined

to its recent ranges as the consolidative phase extends. The Bank of Japan

stood pat and revised its forecasts as it is seen drawing closer another

adjustment in policy, with the market still favoring an April timeframe. A

squeeze in the Hong Kong money market and talk of a large package to support

the equity market helped lift the Chinese yuan for the third consecutive

session and lifted Chinese...

Read More »

Read More »

Softer Tokyo CPI Buys BOJ Time while Moody’s Cuts the Outlook for China’s Debt following Fiscal Stimulus and the Continued Property Slump

Overview: Outside of the Australian dollar, which

has fallen by around 0.6% following the RBA meeting and the softer final PMI,

which may have dragged the New Zealand dollar a lower by around 0.25%, the

other G10 currencies trading little changed ahead of the start of the North

American session. The eurozone and UK final PMIs were revised higher. Central

European currencies lead the emerging market currencies. China reported better

than expected...

Read More »

Read More »

Corrective Forces Help the Dollar Stabilize

Overview: Corrective

forces helped the dollar stabilize yesterday and it enjoys a firmer today. The

euro has slipped below $1.09, and the dollar has resurfaced above JPY149.00. The

FOMC minutes seem dated by the more than 30 bp decline in the US 10-year yield,

the 7% rally in the S&P 500 and roughly 3% drop in the Dollar Index. The

implied year-end 2024 Fed funds rate has fallen by 10 bp to 4.51% (5.33%

currently). The Japanese government...

Read More »

Read More »

Poor Flash PMI from Japan and Eurozone

Overview: Bonds

and stocks are higher today, and the dollar is mixed. A weak PMI reading seemed

to weigh on the euro, but the market shrugged the weak Australian PMI off and

the Australian dollar is the G10 currencies while the euro is among the weakest.

Yesterday, the North American session showed an appetite for foreign currencies

and with some of their intraday momentum stretched to the downside, the stage

is set for a possible repeat today. The...

Read More »

Read More »

Yen Drops After BOJ Does Nothing and Says Little

Overview: The BOJ's failure to do anything or

further ideas that an exit of the negative target rate, despite the firm CPI

report helped the dollar recover the ground lost yesterday against the yen. The

focus has returned to "intervention watch" and the market continues

to press for the official pain threshold. Sterling is the weakest of the G10

currencies, off another 0.5% today following the BOE's decision not to hike

yesterday. The...

Read More »

Read More »

US Dollar Punches Higher

Overview: Disappointing

data in Asia and Europe has sent the greenback broadly higher. The strong gains

posted before the weekend were mostly consolidated yesterday when the US and

Canadian markets were on holiday. The rally resumed today. The Antipodeans and

Scandis have been hit the hardest (-0.7% to -1.25%) but all the G10 currencies

are down. The Swiss franc and yen are off the least (-0.35%-0.45%), and the

euro and sterling have taken out...

Read More »

Read More »

China’s Measures Begin to Find Traction, US Employment Report on Tap

Overview: Beijing's seemingly steady stream of

measures to support the economy and steady the yuan are beginning to produce

the desired effect. The yuan is snapping a four-week decline and the CSI 300

halted a three-week drop. Some economists estimate that the bevy of measures

may be worth as much as 1% for GDP. The dollar is narrowly mixed ahead of the

US employment data, which is expected to see the pace of job growth slow to

around 170k. Of...

Read More »

Read More »

Euro and Sterling Slump on Poor PMI

Overview: Poor European flash PMI pushed on open

door, giving the market a new reason to do what it was doing and that buying the

dollar. The euro has approached important support around $1.08 and sterling is

approaching the lower end of its two-cent trading range (~$1.26-$1.28). The

greenback is consolidating against the yen and holding above JPY145. The

Chinese yuan is little changed while the Mexican peso is extending yesterday's

gains. Despite...

Read More »

Read More »

Dollar Eases, Stocks and Bonds Advance

Overview: For the first time in more than a week,

North American dealers will take to their posts with the dollar softer against

all the G10 and most of the emerging market currencies. Despite stepped up

efforts by Chinese officials and a firmer yen, the yuan remains on the

defensive and is one of the handful of emerging market currencies softer on the

day. Stocks and bonds are mostly higher too. The yuan might not be benefitting

from a softer...

Read More »

Read More »

RBA Holds Fire, Greenback Rebounds

Overview: The dollar has

come back bid. It is rising against all the major currencies today. The Reserve

Bank of Australia left rates steady and the poor Chinese Caixin PMI is weighing

on the Australian dollar, which is off about 1.25% today. Sterling is the best

G10 performer, off about 0.1%. Perhaps, the BOE's meeting on Thursday is

helping to deflect some of the selling pressure. Emerging market currencies are

also nearly all lower, led by the...

Read More »

Read More »

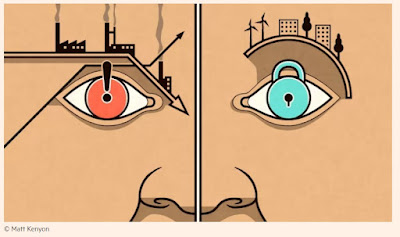

Greenback Jumps on Weak Flash PMIs

Overview: As the market reluctantly edges toward the

Fed's guidance, the disappointing PMIs from Europe (but also Japan and

Australia) helped boost the greenback. The Dollar Index is trading at seven-day

highs above 103 after briefly dipping below 102 to set a new low since mid-May

yesterday. The unwinding of cross positions is helping the yen hold its own

today as it consolidates near its worst level of the year. The surging dollar

and risk-off...

Read More »

Read More »

Dollar Gains Extended, Oil Steadies at Higher Levels after Saudi’s Cut, US Bill Deluge Begins Today

Overview: The US dollar has extended its post-employment

gains today, helped by firmer rates and several countries seeing downward

revisions from the preliminary May PMI. The greenback is trading with a firmer

bias against all the G10 currencies and most of the emerging market currencies,

including Turkey, India, and China. July WTI gapped higher after the Saudi

Arabia announced a voluntary and unilateral cut of one million barrels a day in

output...

Read More »

Read More »

US Debt Ceiling Drama Ends with a Whimper, Focus on US Jobs and Fed

Overview: Another bizarre US debt-ceiling episode is over. President

Biden will sign the bill that was approved by the Senate late yesterday. It is

a bit anticlimactic for the market, for which the US jobs data is the key focus

now. Outside of the fiscal drama, the Federal Reserve leadership has

effectively push against market expectations for a hike later this month. The

odds were around 70% earlier this week, and ahead of the jobs report, is...

Read More »

Read More »

Yen Recovers from New 2023 Low, while Sterling Sets a New Low for the Month

Overview: The dollar is bid. Only the Japanese yen

is holding its own against the greenback but only after it fell to new lows for

the year. The Scandis and Antipodeans are the heaviest among the G10

currencies, while sterling has fallen to a new low for the month. The prospect

of a rate hike tomorrow has not protected the New Zealand dollar much and it is

off nearly 0.5%. Emerging market currencies are more mixed. Outside of the

Russian rouble,...

Read More »

Read More »

OPEC+ Surprises while Manufacturing Remains Challenged

Overview: News of OPEC+ unexpected output cuts saw May WTI gap

sharply higher and helped lift bond yields. May WTI settled near three-week

highs before the weekend near $75.65 and opened today near $80. It reached

almost $81.70 before stabilizing and is straddling the $80 area before the

North American session. The high for the year was set in the second half of

January around $83. Benchmark 10-year yields are up 2-5 bp points. The 10-year

US...

Read More »

Read More »

Tumbling Tokyo Prices Gives Ueda Breathing Space

Overview: Talk from two Fed officials yesterday,

which seemed to validate market expectations eased the upward pressure on the

dollar and helped equities launch a dramatic recovery. The market is pricing in a terminal rate near 5.50%, a little higher than the median dot in December. The S&P 500 posted a

dramatic recover and posted a potential bullish key reversal. Its 0.75% closing

gain was the largest advance in nearly three weeks. A large...

Read More »

Read More »

The Dollar Pares Yesterday’s Gains but Near-term Change in Sentiment may be at Hand

Overview: The dollar remained firm yesterday, even

after the ECB's hawkish stance, reaffirming its intention to hike rates by

another 50 bp next month. We had expected the greenback to have been sold in

North America yesterday. That this did not materialize warns that despite its

pullback in Asia and especially Europe today, that near-term sentiment may be

changing with the Fed and ECB meetings over and die cast for next month, where

the Fed is...

Read More »

Read More »

Will What the Fed Says be More Important than What it Does?

Overview: The focus is squarely on the Federal Reserve today. There is nearly universal agreement that it will lift the target by 25 bp. The market is inclined to see the shift as a sign that the Fed is nearing the end of its tightening cycle, and sees, at most, one more quarter-point hike. Despite the Fed's warnings, including in the December FOMC minutes, about the premature easing of financial conditions, the market has done precisely that.

Read More »

Read More »