Tag Archive: NASDAQ

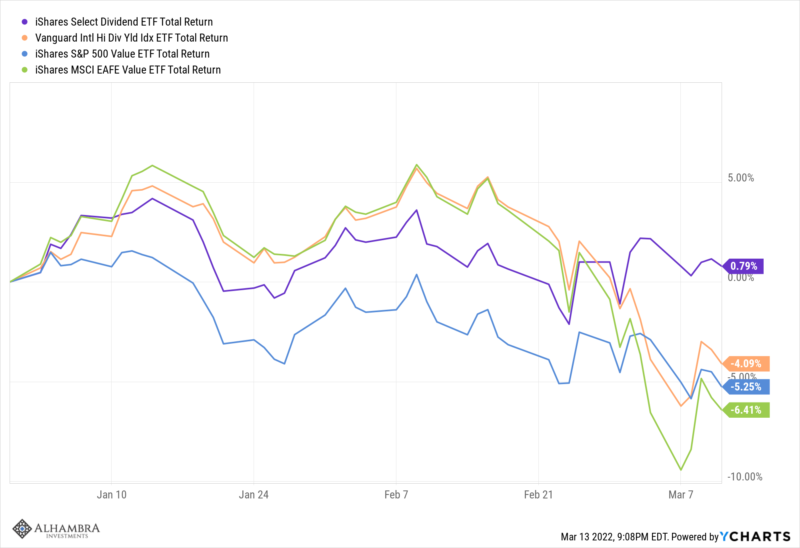

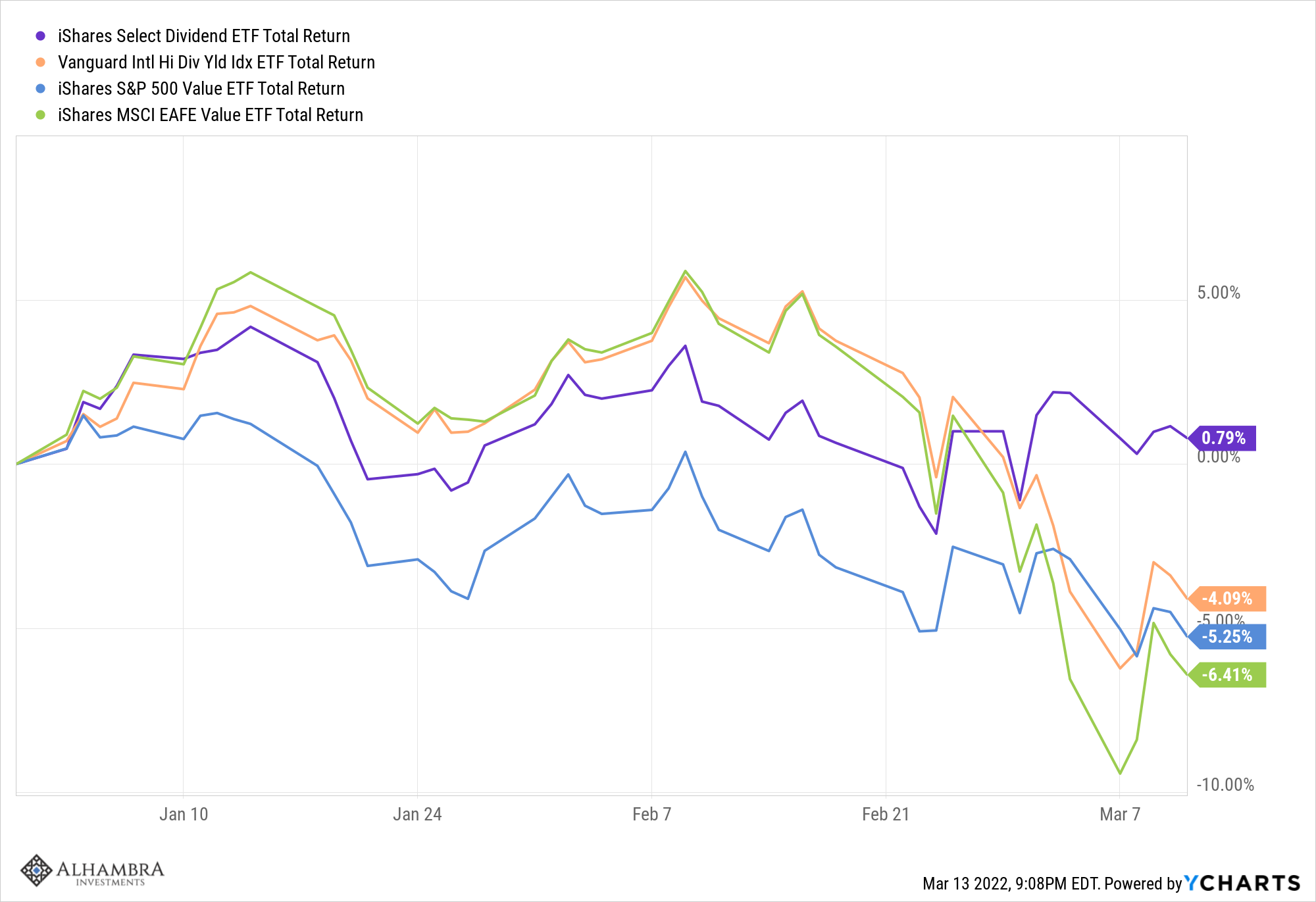

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

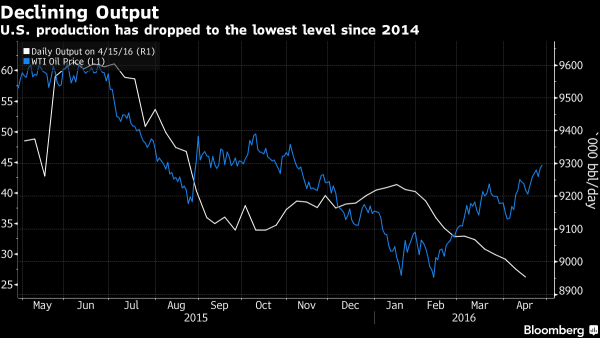

Weekly Market Pulse: Oil Shock

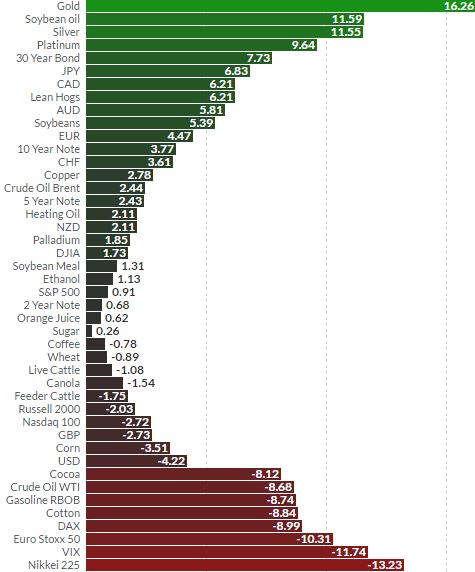

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week.

Read More »

Read More »

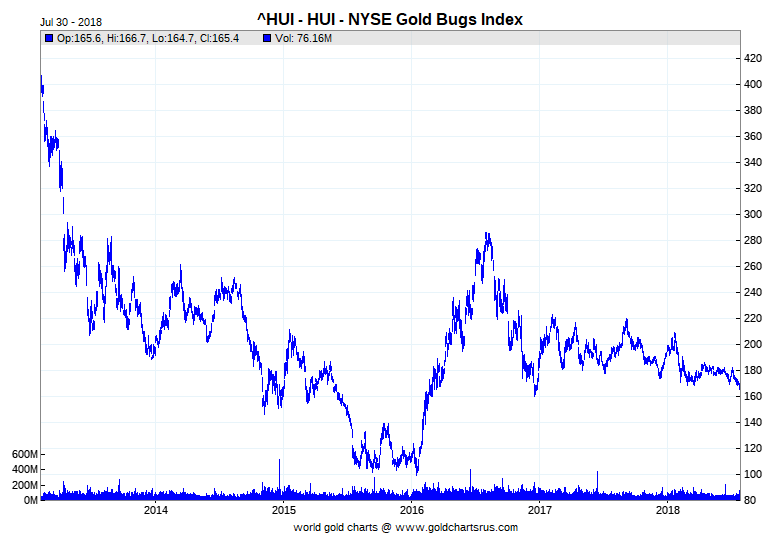

Spotlight on the HUI and XAU Gold Stock Indexes

Probably the two best known gold mining stock indexes in the world’s financial markets are the HUI and the XAU. HUI is the ticker symbol for the NYSE Arca Gold BUGS Index. XAU is the ticker symbol for the Philadelphia Gold and Silver Index. Both of these monikers make an appearance on many gold related websites and many general financial market websites as well, so its worth knowing briefly what these indexes are and what they represent.

Read More »

Read More »

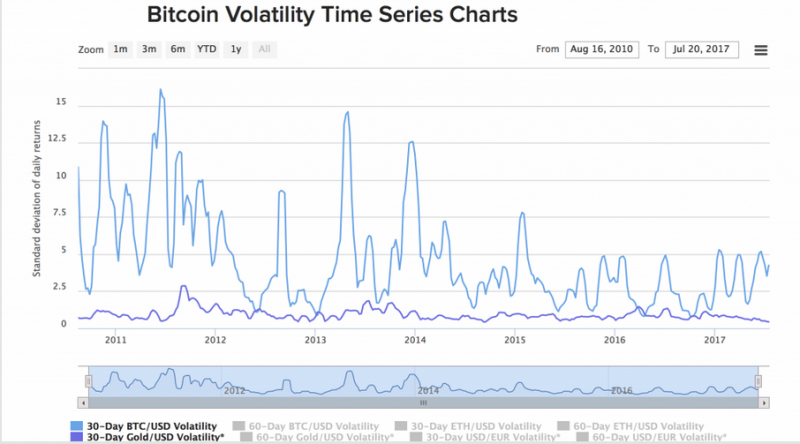

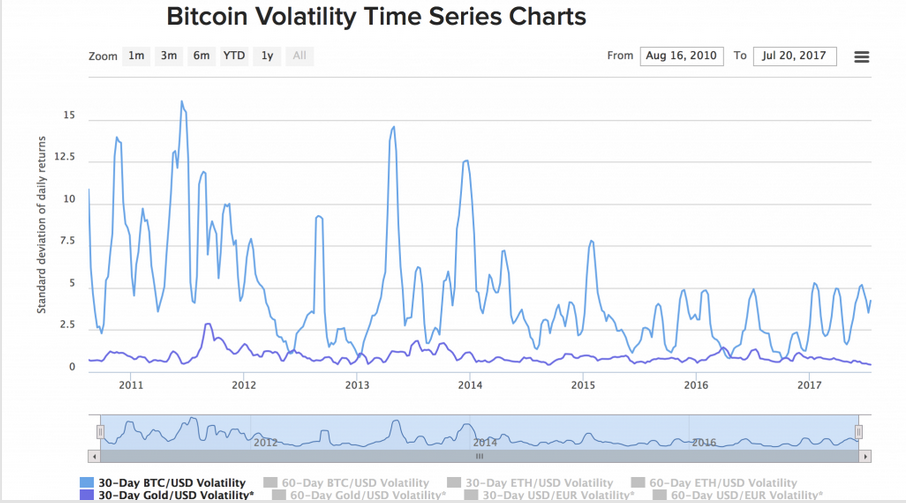

If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange.

Read More »

Read More »

Ne conservez pas votre or dans une banque. Egon Von Greyerz

Ne détenez pas d’or dans une banque suisse ou dans n’importe quelle autre banque. Nous voyons régulièrement des exemples dans des banques suisses de taille moyenne et de grande taille qui devraient fortement inquiéter les clients. En voici quelques-uns : Un client entrepose de l’or physique dans une banque, mais lorsqu’il souhaite le transférer vers des coffres privés, l’or n’y est plus et la banque doit s’en procurer.

Read More »

Read More »

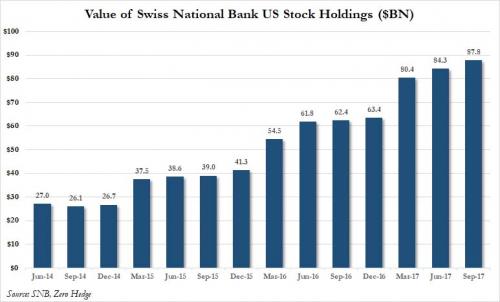

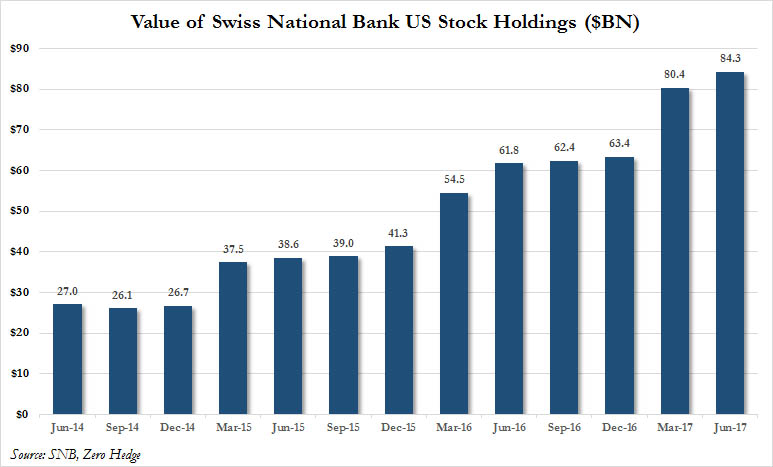

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

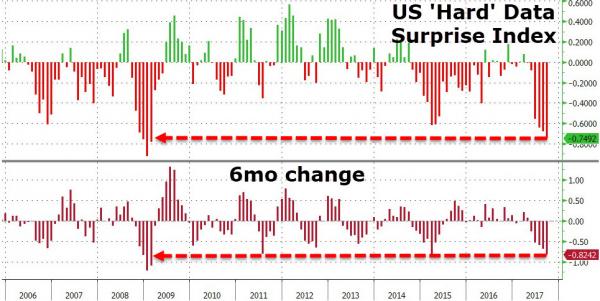

Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...BUT...US 'hard' economic data has not been this weak (and seen the biggest drop) since Feb 2009...Q3 Was a Roller-Coaster...Q3 was the 8th straight quarterly gain in a row for The Dow - the longest streak since Q3 1997.

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks.

Read More »

Read More »

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank's interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the "the BoJ comes in big, the...

Read More »

Read More »

Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly...All-time highs within reach... everything is awesome...wait what...

Quite a week:

Gold +5.25% in last 2 weeks - best run in 4 months

Silver +5.65% this week - best week since May 2015

Copper -4% this week to lowest week...

Read More »

Read More »

Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into...

Read More »

Read More »

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

– Gold prices gained 16% in Q1 – best quarterly performance since 1986– Gains due to increasing global financial, macroeconomic and monetary risk– Stocks come under pressure – Flat in U.S.; Falls ...

Read More »

Read More »

The Black Friday Stock Market Crash – Gareth Soloway

2021-11-30

by Stephen Flood

2021-11-30

Read More »