Tag Archive: money

Here are three things you can learn from the Fed

Anyone who has decided to buy gold, or follows the gold price will be aware of how powerful the US Federal Reserve is. This year the Federal Reserve will turn 110 years old, only in recent years is dollar hegemony appearing to falter. Below we look at the central bank’s origins and three lessons we can learn from the history of the world’s most powerful bank, in order to help our investment decisions in 2023.

Read More »

Read More »

Your Wealth Will Save Central Banks!

Today we ask, what is wealth? As we start a new year many will be looking at their portfolios and wondering what 2023 will have in store for them. Similar to 2022, we suspect there will be a lot of unknowns.

As with anything unforeseen, it’s a good idea to have some insurance. This is why there were record levels of gold buying last year, and we expect the same in the coming months; because people want to protect their wealth with the...

Read More »

Read More »

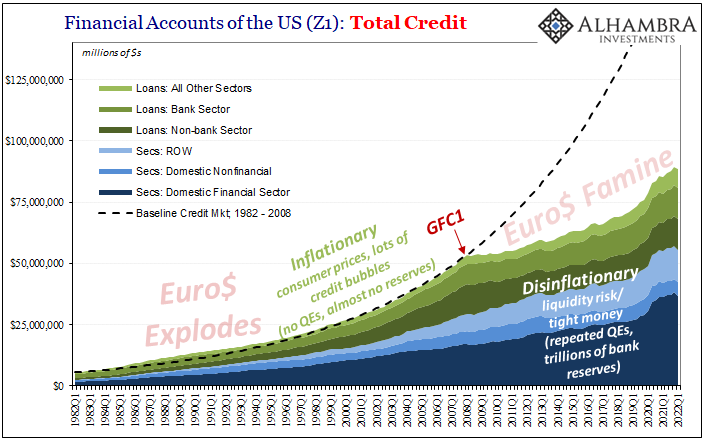

The Everything Data’s (Z1) Verdict: Not Inflation, Only More Of The Same

The only thing that changed was the CPI. What distinguishes 2021-22 from the prior post-crisis period 2007-20 is merely the performance of whatever consumer price index. This latter has been called inflation, yet the data conclusively support the market verdict pricing how it never was.What data?

Read More »

Read More »

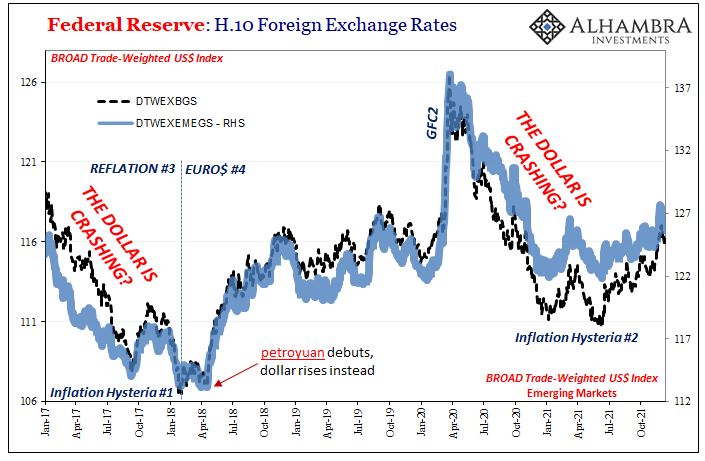

China’s Petroyuan, Uncle Sam’s Checkbook, The Fed’s Bank Reserves: Who Really Sits On King Dollar’s Throne? (trick question)

A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike.

Read More »

Read More »

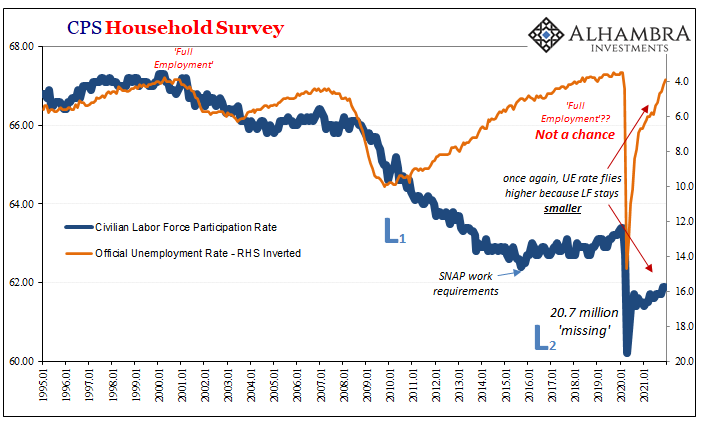

Taper Discretion Means Not Loving Payrolls Anymore

When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money.The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97.

Read More »

Read More »

The Two Big Anniversaries of August: The Lost Decade (plus) Of The ‘Fiat’ Half Century

As my esteemed podcast co-host Emil Kalinowski has already mentioned (recurrently), we have, this year, two major anniversaries during these dog days of summer circled on our calendar. Today is, obviously, August 9 and for anyone the slightest familiar with the eurodollar story, that date is seared into their consciousness for as long as it will take to rebuild from the ashes created by the monetary fire lit that day. It has been, sadly, fourteen...

Read More »

Read More »

Quantitative Easing: A Boon or Curse?

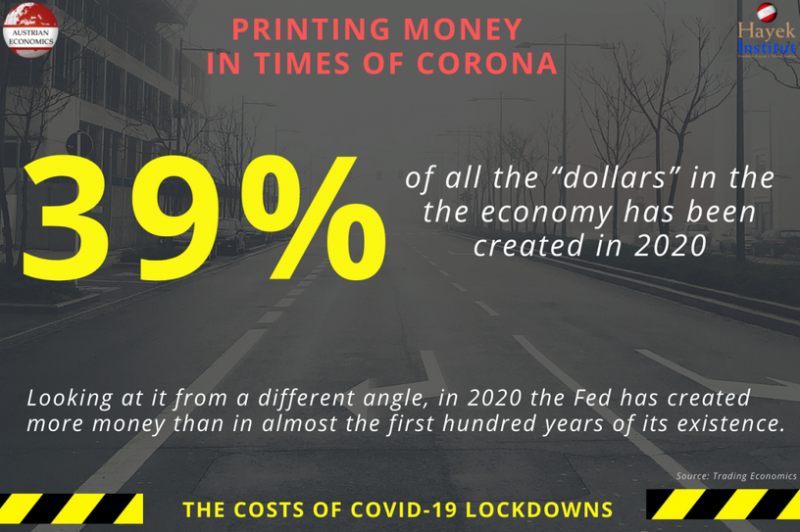

Central banks’ massive Quantitative Easing (QE) programs have come under scrutiny many times since the central banks fired up the printing press and began quantitative easing programs en masse after the 2008-09 Great Financial Crisis.

However, the increase in central bank assets due to quantitative easing programs during the crisis pale in comparison to the QE programs during the Covid pandemic.

As economies recovered after the...

Read More »

Read More »

A Clear Balance of Global Inflation Factors

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years.

Read More »

Read More »

Printing Money in Times of Corona

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it.

Read More »

Read More »

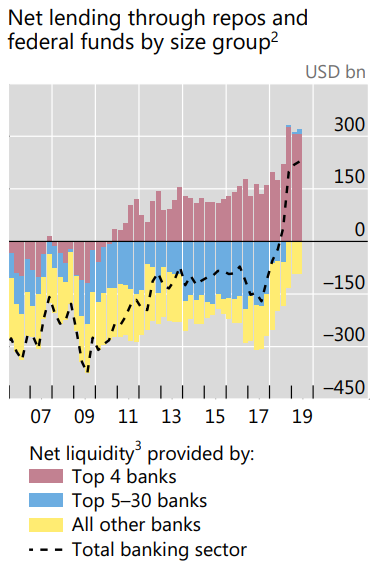

The BIS Misses An Opportunity To Get Consistent With The Facts

Much has been made about the repo market since mid-September. Much continues to be made about it. The question is why. It is now near the middle of December and repo looks dicey despite repo operations and a not-QE small-scale asset purchase intended to increase the level of bank reserves. Always the focus on “funds” which may be available. It was John Adams who took on the task of defending several British soldiers on trial for the Boston...

Read More »

Read More »

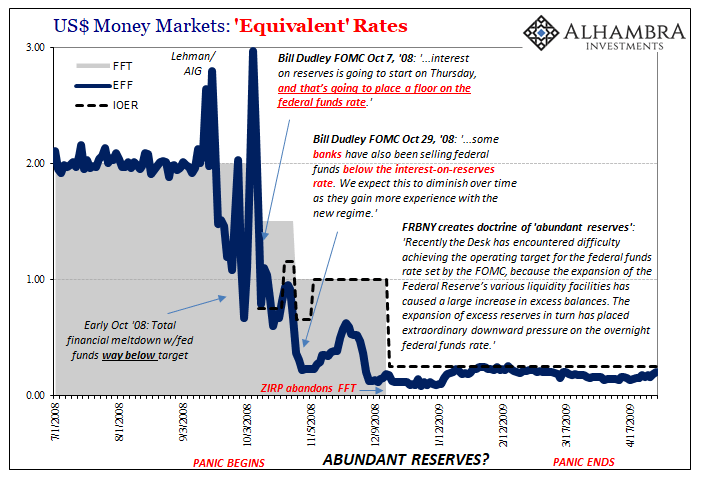

More Than A Decade Too Late: FRBNY Now Wants To Know, Where Were The Dealers?

I’ve said it all along; focusing in on bank reserves would leave you dazed and confused. It’s just not how the system works. After all, as I pointed out again not long ago, “our” glorious central bank had the audacity to claim that there were “abundant” reserves during the worst financial panic in four generations. “Somehow” despite that, it was a Global Financial Crisis that lived up to its name – global.

Read More »

Read More »

Gold Hits New All Time Highs

2023-11-02

by Dave Russell

2023-11-02

Read More »