Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

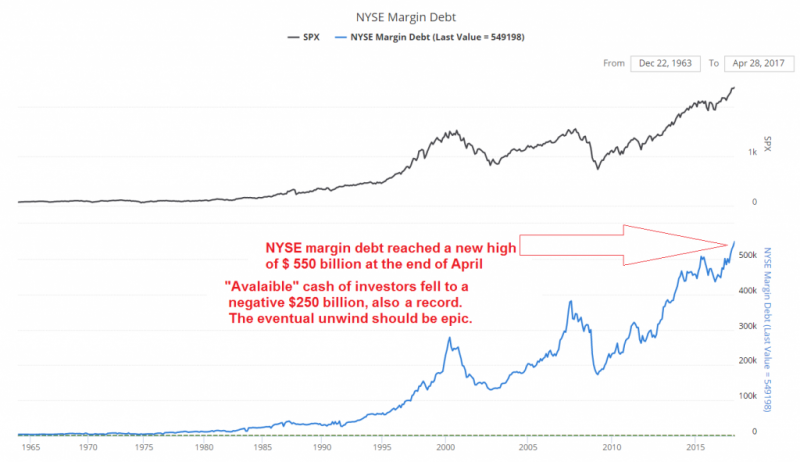

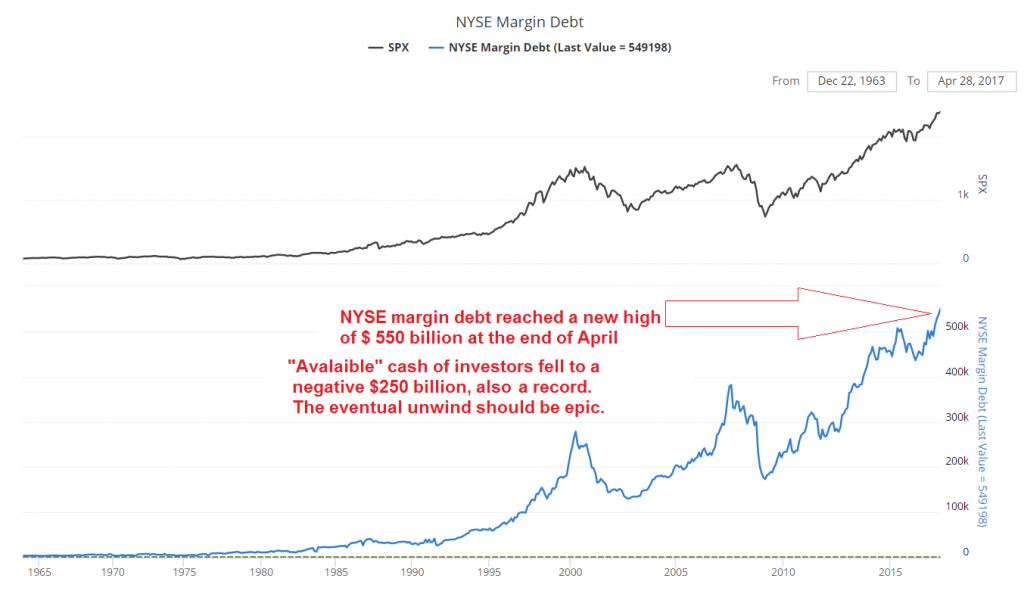

Tag Archive: Margin Debt

What Happens When Rampant Asset Inflation Ends?

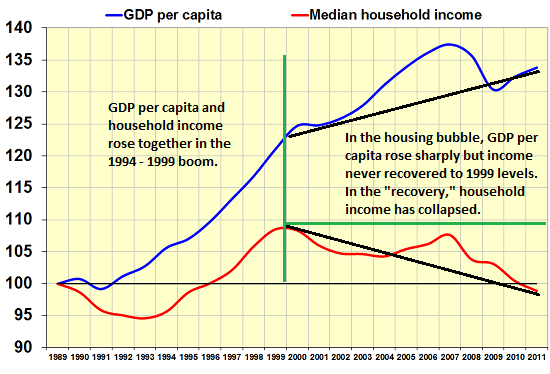

Yesterday I explained why Revealing the Real Rate of Inflation Would Crash the System. If asset inflation ceases, the net result would be the same: systemic collapse. Why is this so? In effect, central banks and states have masked the devastating stagnation of real income by encouraging households to take on debt to augment declining income and by inflating assets via quantitative easing and lowering interest rates and bond yields to near-zero (or...

Read More »

Read More »

Where Will All the Money Go When All Three Market Bubbles Pop?

Since the stock, bond and real estate markets are all correlated, it's a question with no easy answer. Everyone who's not paid to be in denial knows stocks, bonds and real estate are in bubbles of one sort or another. Real estate is either an echo bubble or a bubble that exceeds the previous bubble, depending on how attractive the market is to hot-money investors.

Read More »

Read More »

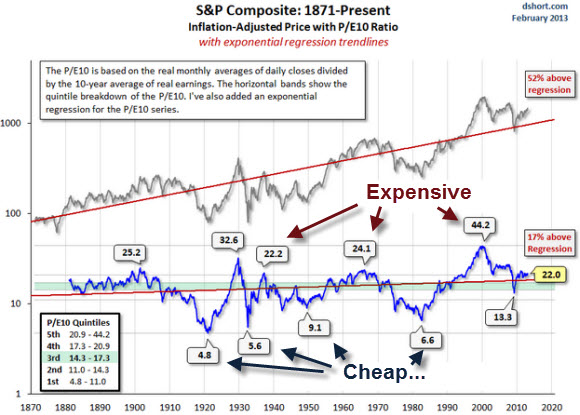

Rising Profits as Reason for the Stock Market Rally?

A list of relevant graphs for long-term price earnings ratios and the rising company profits in the last years.

Read More »

Read More »

Performance of global stock markets compared

A list of relevant graphs for the long-term price earnings rations and different stock market returns over the last 2 years. Moreover we show the return of the S&P 500 for each of the year.

Read More »

Read More »