Tag Archive: Liquidity

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground.And so it was also in...

Read More »

Read More »

Powell Would Ask For His Money Back, If The Fed Did Money

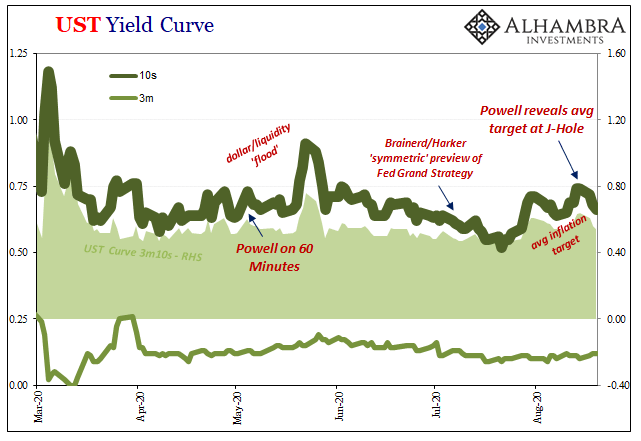

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!!

Read More »

Read More »

Wait A Minute, What’s This Inversion?

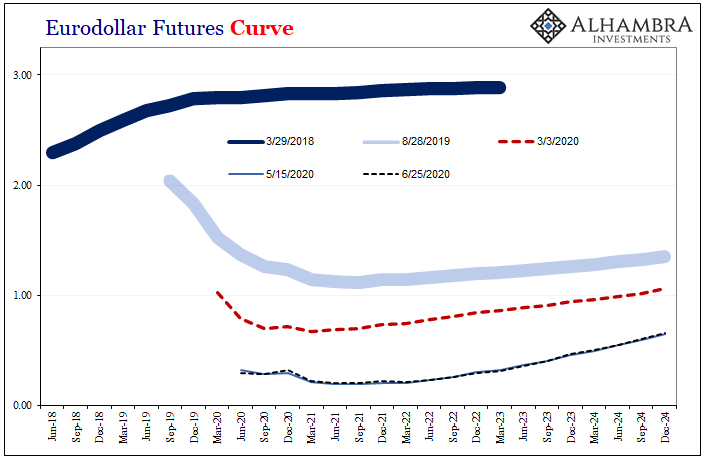

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board.And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute.

Read More »

Read More »

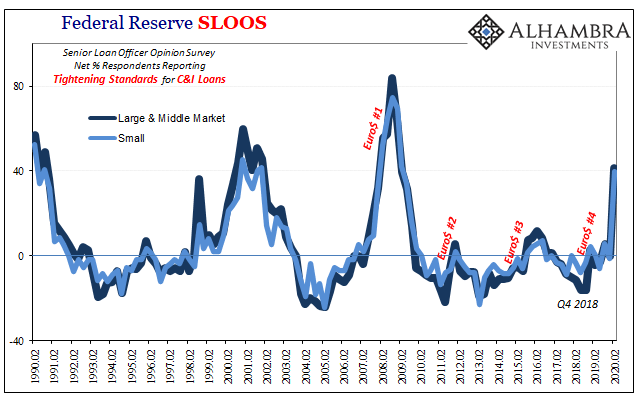

Not COVID-19, Watch For The Second Wave of GFC2

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own.

Read More »

Read More »

Fed Balance Sheet: Swap Me Update

Just a quick update to add a little more data and color to my last Friday’s swap line criticism so hopefully you can better see how there is intentional activity behind them. Since a few people have asked, I’ll break them out with a little more detail. While the volume of swaps outstanding at the Fed has, in total, remained relatively constant (suspiciously, if you ask me), the underlying tenor of them has not.Meaning, there is purpose.

Read More »

Read More »

Cool Video: A Quick Review of the the FOMC and a Look to Next Week

Sometimes the news drives the price action, but sometimes the price action drives the news. If the initial rally in US stocks after the FOMC meeting had been sustained and if the dollar had continued to decline, observers would drawing a different conclusion.

Read More »

Read More »

Cool Video: The Liquidity Hypothesis

Jackie Pang from Meigu TV called and wanted to talk about the seeming disconnect between Wall Street and Main Street. In this nearly 4.5 minute clip that she posted here, she gave me plenty of time to explain what I make of it.

Read More »

Read More »

So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal.That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected.

Read More »

Read More »

COT Black: No Love For Super-Secret Models

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust.

Read More »

Read More »

Three Short Run Factors Don’t Make A Long Run Difference

There are three things the markets have going for them right now, and none of them have anything to do with the Federal Reserve. More and more conditions resemble the early thirties in that respect, meaning no respect for monetary powers. This isn’t to say we are repeating the Great Depression, only that the paths available to the system to use in order to climb out of this mess have similarly narrowed.

Read More »

Read More »

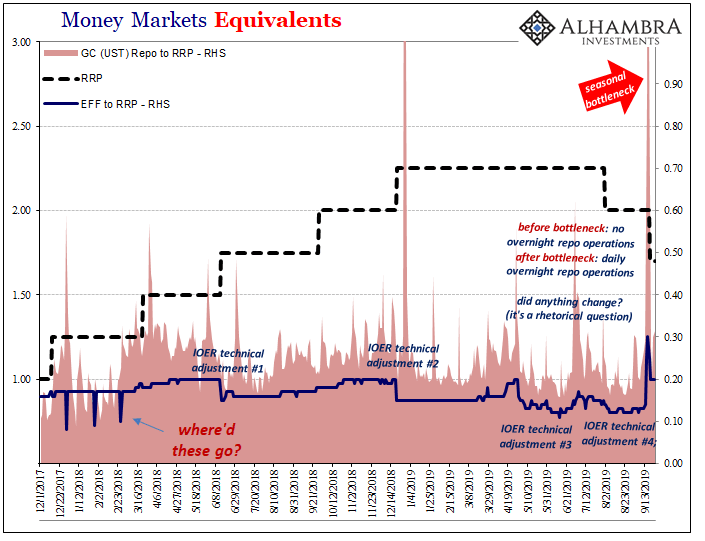

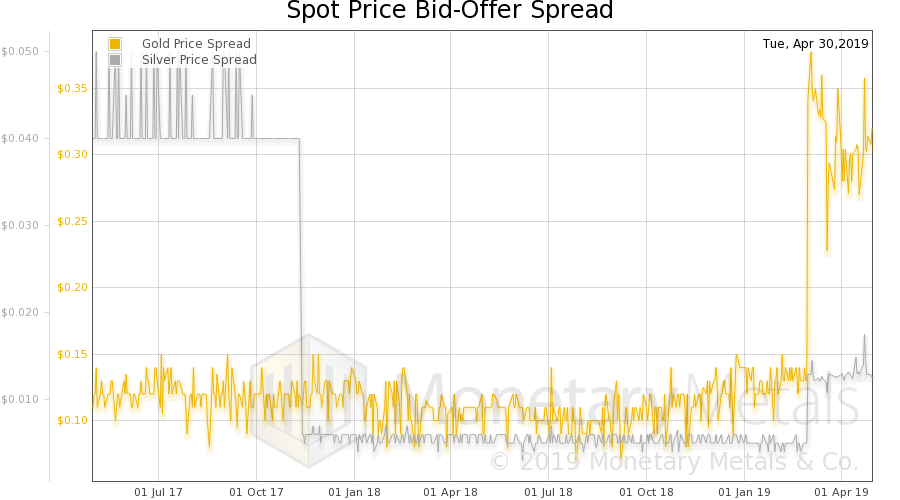

2019: The Year of Repo

The year 2019 should be remembered as the year of repo. In finance, what happened in September was the most memorable occurrence of the last few years. Rate cuts were a strong contender, the first in over a decade, as was overseas turmoil. Both of those, however, stemmed from the same thing behind repo, a reminder that September’s repo rumble simply punctuated.

Read More »

Read More »

Tidbits Of Further Warnings: Houston, We (Still) Have A (Repo) Problem

Despite the name, the Fed doesn’t actually intervene in the US$ repo market. I know they called them overnight repo operations, but that’s only because they mimic repo transactions not because the central bank is conducting them in that specific place. What really happened was FRBNY allotting bank reserves (in exchange for UST, MBS, and agency collateral) only to the 24 primary dealers.

Read More »

Read More »

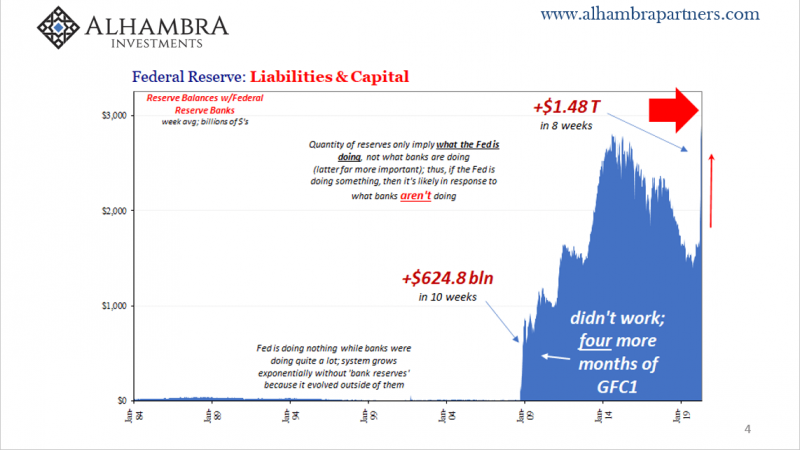

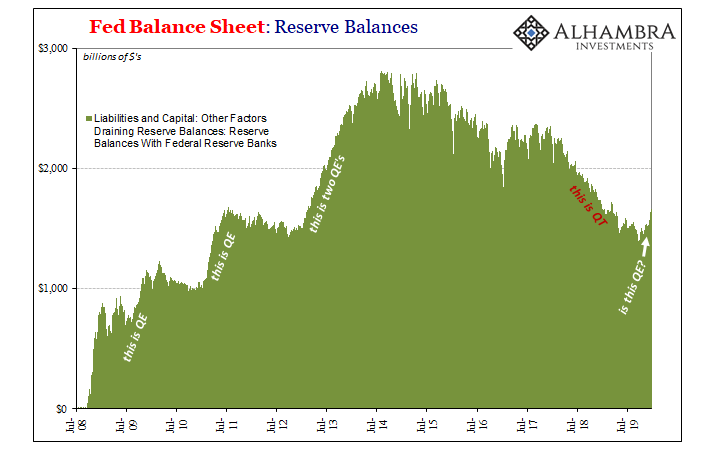

Head Faking In The Empty Zoo: Powell Expands The Balance Sheet (Again)

They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing.

Read More »

Read More »

Money Markets: Sizing Up the Cavalry

There’s been an unusual level of honesty coming out of Liberty Street of late. Not total honesty but certainly more than the usual nothing denials and dismissals. If you don’t immediately recognize the reference, that’s the street in NYC where FRBNY and its Open Market Desk resides. What is supposed to be the moneyed centered of the universe. After all, as Ben Bernanke famously threatened in November 2002, that’s the printing press.

Read More »

Read More »

COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge.

Read More »

Read More »

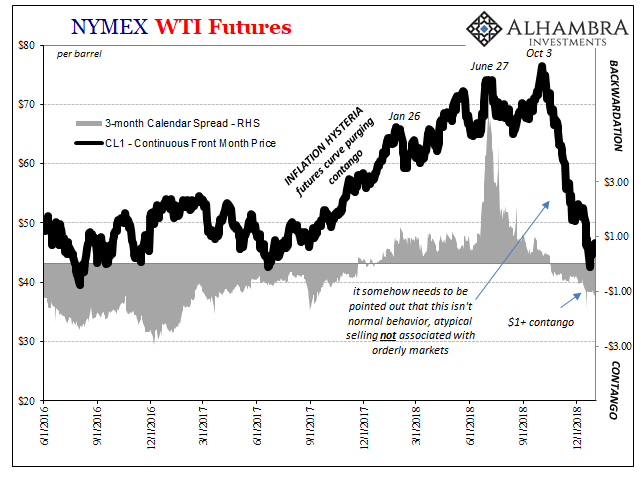

Nothing To See Here, It’s Just Everything

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal.

Read More »

Read More »