Tag Archive: labor shortage

Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large.

Read More »

Read More »

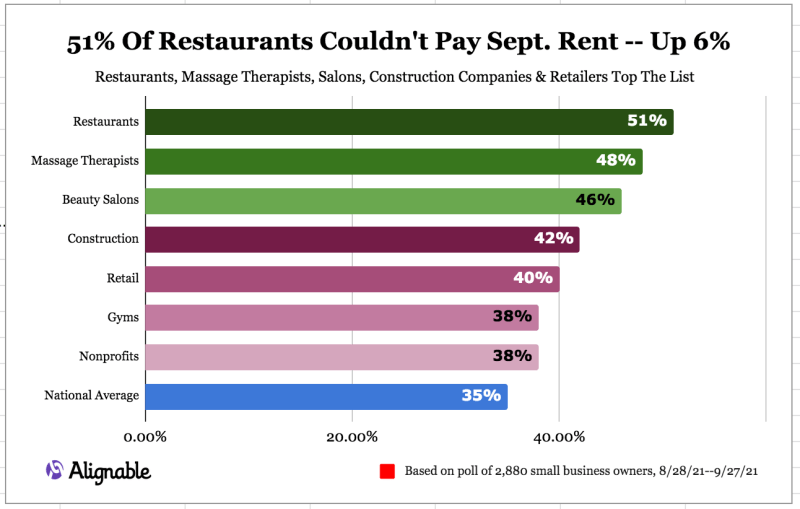

An Economy Dividing By Inventory And Labor

Is it delta COVID? Or the widely reported labor shortage? Something has created a soft patch in the presumed indestructible US economy still hopped up on Uncle Sam’s deposits made earlier in the year. And yet, there’s a nagging feeling over how this time, like all previous times, just might be too good to be true, too.

Read More »

Read More »

Inflation Hysteria #2 (Slack-edotes)

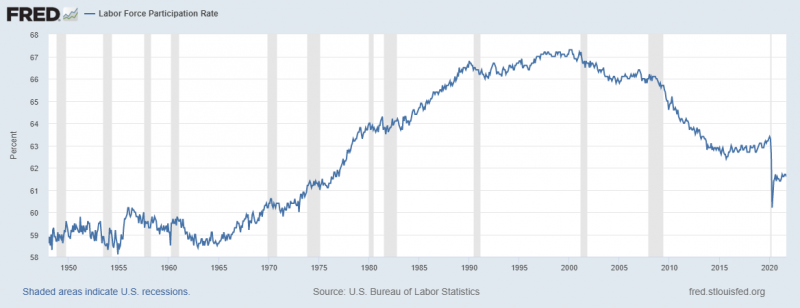

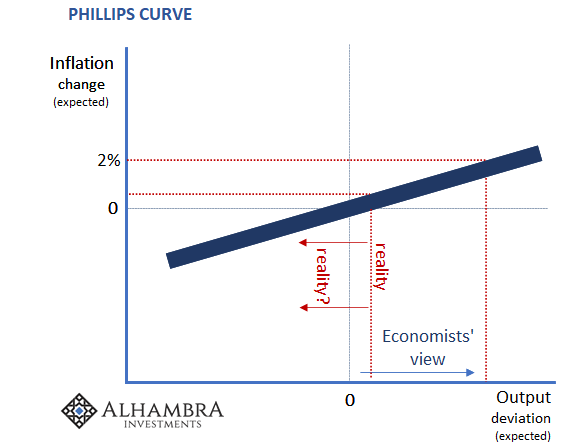

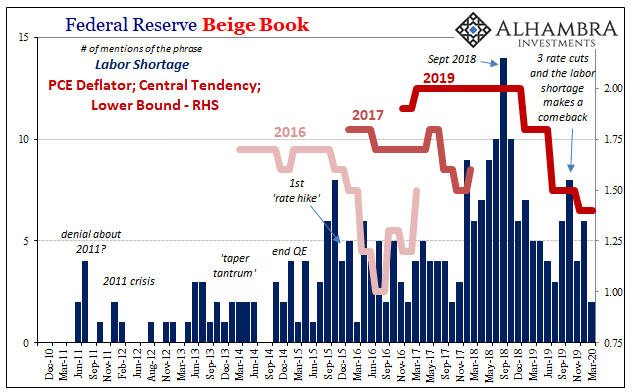

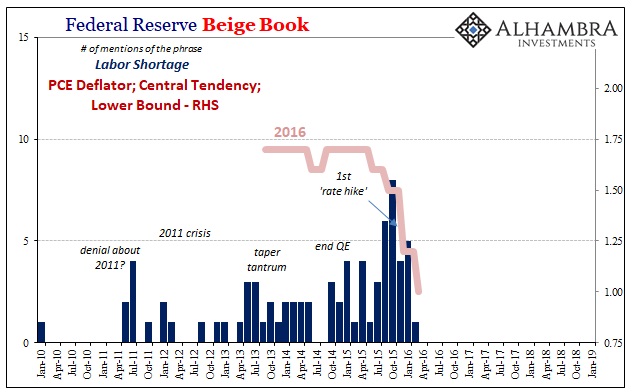

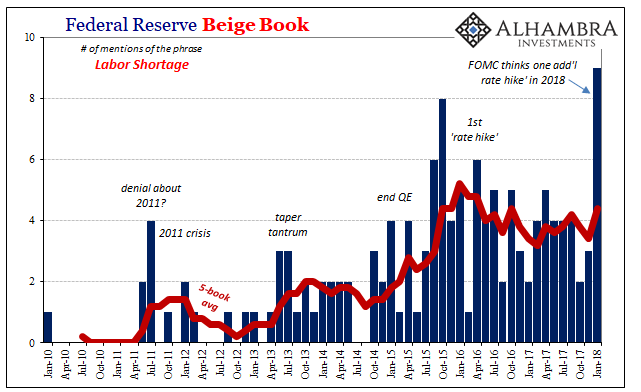

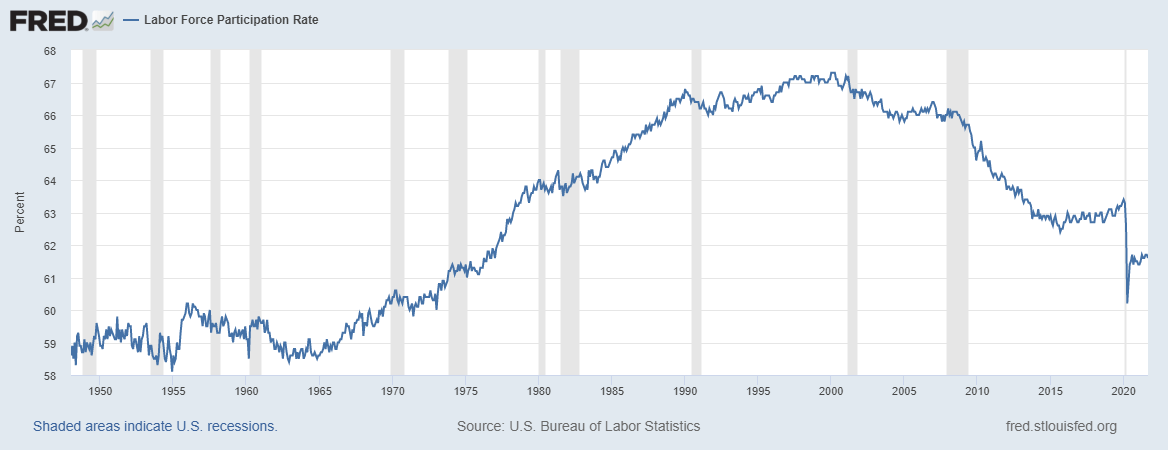

Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them.

Read More »

Read More »

Like Repo, The Labor Lie

The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors.

Read More »

Read More »

Hall of Mirrors, Where’d The Labor Shortage Go?

Today was supposed to see the release of the Census Bureau’s retail trade report, a key data set pertaining to the (alarming) state of American consumers, therefore workers by extension (income). With the federal government in partial shutdown, those numbers will be delayed until further notice. In their place we will have to manage with something like the Federal Reserves’ Beige Book.

Read More »

Read More »

Buybacks Get All The Macro Hate, But What About Dividends?

When it comes to the stock market and the corporate cash flow condition, our attention is usually drawn to stock repurchases. With good reason. These controversial uses of scarce internal funds are traditionally argued along the lines of management teams identifying and correcting undervalued shares. History shows, conclusively, that hasn’t really been true.

Read More »

Read More »

All The World’s A (Imagined) Labor Shortage

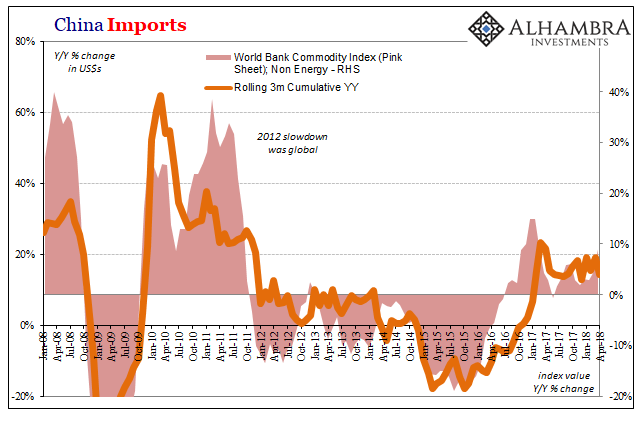

Last year’s infatuation with globally synchronized growth was at least understandable. From a certain, narrow point of view, Europe’s economy had accelerated. So, too, it seemed later in the year for the US economy. The Bank of Japan was actually talking about ending QQE with inflation in sight, and the PBOC was purportedly tightening as China’s economy appeared to many ready for its rebound.

Read More »

Read More »

The Retail Sales Shortage

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months.

Read More »

Read More »

U.S. Unemployment: The Dissonance Book

I’ve found the word “dissonance” has become more common in regular usage beyond just my own. Whether that’s a function of my limited observational capacities or something more meaningful than personal bias isn’t at all clear. Still, the word does seem to fit in economic terms more and more as we carry on uncorrected by meaningful context.

Read More »

Read More »

The JOLTS of Drugs

Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary task should it be found...

Read More »

Read More »

Reports on a Quarterly Survey Conducted: Qualifying Shortage (Labor)

There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is illegitimate), or find an excuse why...

Read More »

Read More »

Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014.

Read More »

Read More »

Simple (economic) Math

The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing funds to...

Read More »

Read More »