Tag Archive: Labor Market

The Endangered Inflationary Species: Gazelles

Nevada is, by all accounts and accountants, in rough shape. Very rough shape. An economy overly dependent upon a single industry, tourism, in this case, is a disaster waiting to happen should anything happen to that industry. Pandemic restrictions, for instance.

Read More »

Read More »

Inflation Hysteria #2 (WTI)

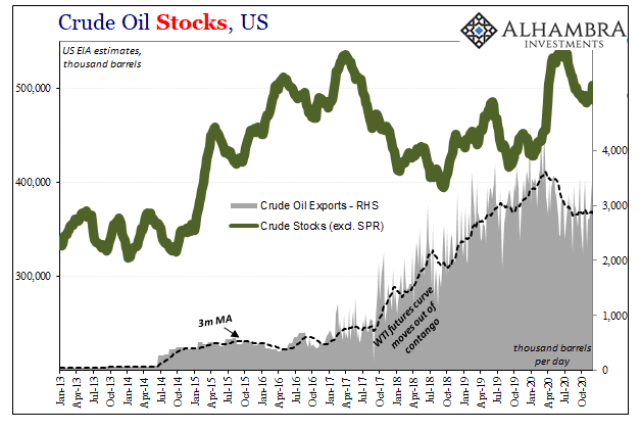

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously.

Read More »

Read More »

Polar Opposite Sides of Consumer Credit End Up in the Same Place: Jobs

If anything is going to be charged off, it might be student loans. All the rage nowadays, the government, approximately half of it, is busily working out how it “should” be done and by just how much. A matter of economic stimulus, loan cancellation proponents are correct that students have burdened themselves with unprofitable college “education” investments.

Read More »

Read More »

Don’t Really Need ‘Em, Few More Nails Anyway

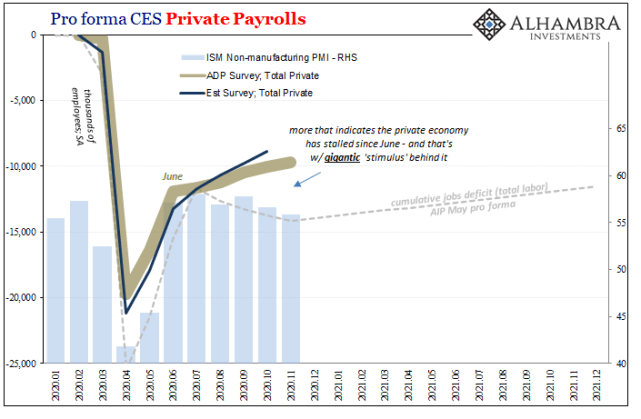

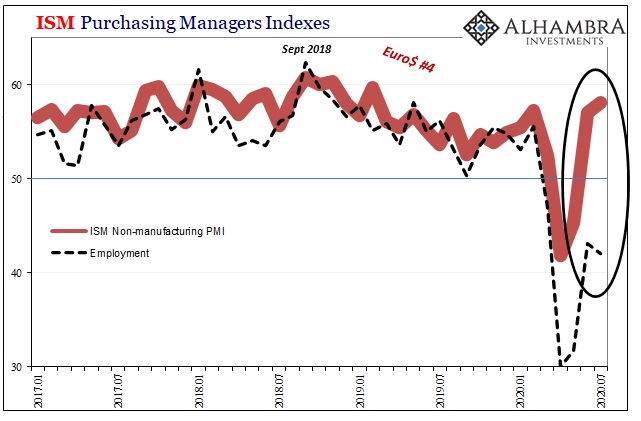

The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.”

Read More »

Read More »

There Have Actually Been Some Jobs Saved, Only In Place of Recovery

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5.

Read More »

Read More »

Good Payrolls Still Say Slowdown

The payroll report for the month of October 2020 was a very good one. This shouldn’t be surprising, perfect BLS publications appear with regularity even during the most challenging of circumstances. Headlines and underneath, everything looked fine last month.

Read More »

Read More »

Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too.

Read More »

Read More »

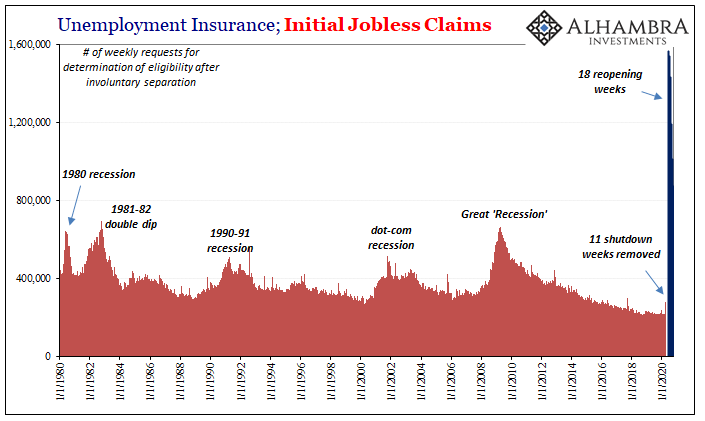

It Just Isn’t Enough

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state.

Read More »

Read More »

Who’s Negative? The Marginal American Worker

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments.

Read More »

Read More »

This Has To Be A Joke, Because If It’s Not…

After thinking about it all day, I’m still not quite sure this isn’t a joke; a high-brow commitment of utterly brilliant performance art, the kind of Four-D masterpiece of hilarious deception that Andy Kaufman would’ve gone nuts over. I mean, it has to be, right?I’m talking, of course, about Jackson Hole and Jay Powell’s reportedly genius masterstroke.

Read More »

Read More »

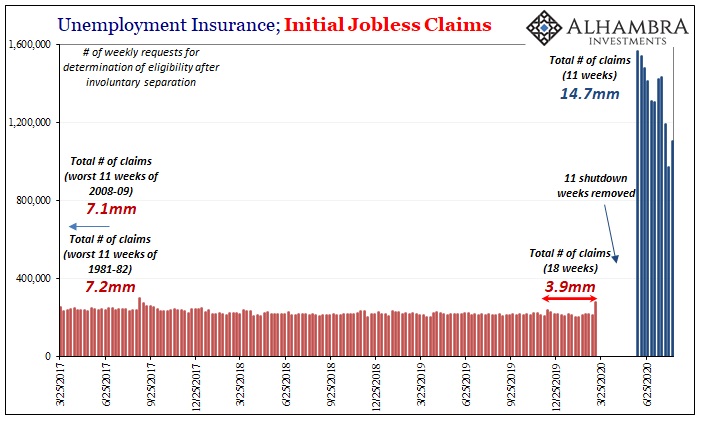

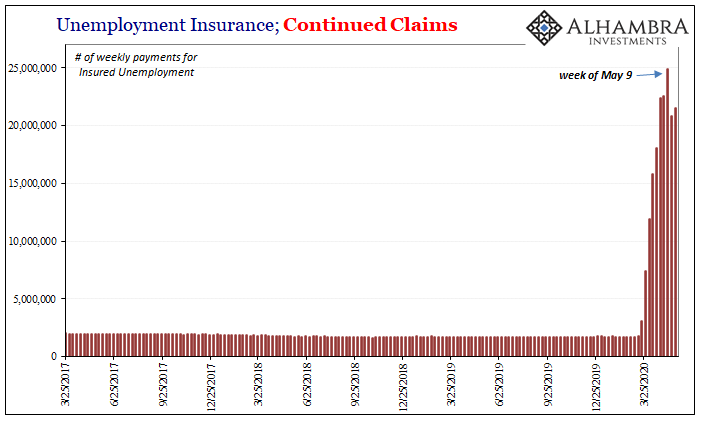

*These* Are The Real Huge Jobs Numbers, And They Will Make Your Blood Run Cold

There is simply no way to spin these figures as anything good. Not just the usual ones were talking about here, but more so some new data that you probably haven’t seen before. Beginning with the regular, it doesn’t matter that the level of initial jobless claims has declined substantially over the past few weeks

Read More »

Read More »

A Second JOLTS

What happens when we are stunned and dazed? We filter out the noise to focus on the bare basics by getting back to our instincts, acting reflexively based upon our deeply held beliefs and especially training. When faced with a crisis and there’s no time to really think, shorthand will have to suffice.

Read More »

Read More »

Purchasing Managers Indigestion

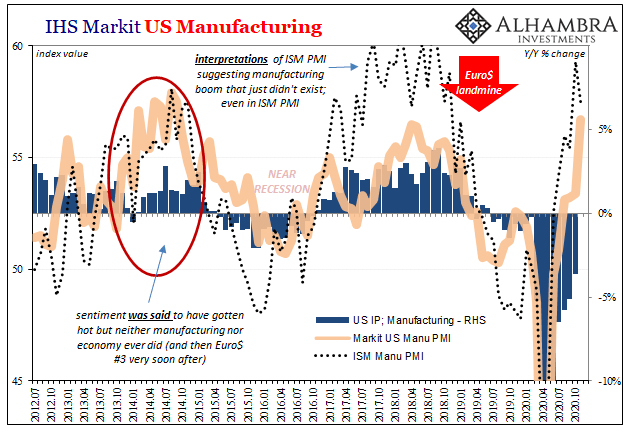

There’s already doubt given how the two major series supposedly measuring the same thing seemingly can’t agree. If the rebound was truly robust, it would show up unambiguously everywhere. But IHS Markit’s purchasing managers indices struggled to get back above 50 in July, barely getting there, suggesting the economy might be slowing or even stalling way too close to the bottom.

Read More »

Read More »

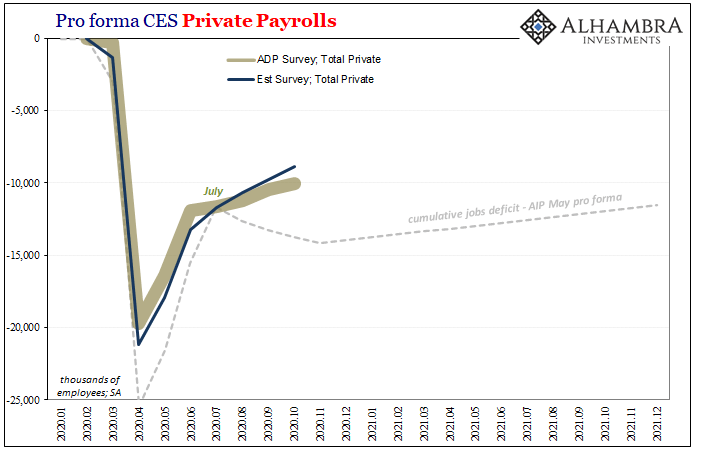

Reality Beckons: Even Bigger Payroll Gains, Much Less Fuss Over Them

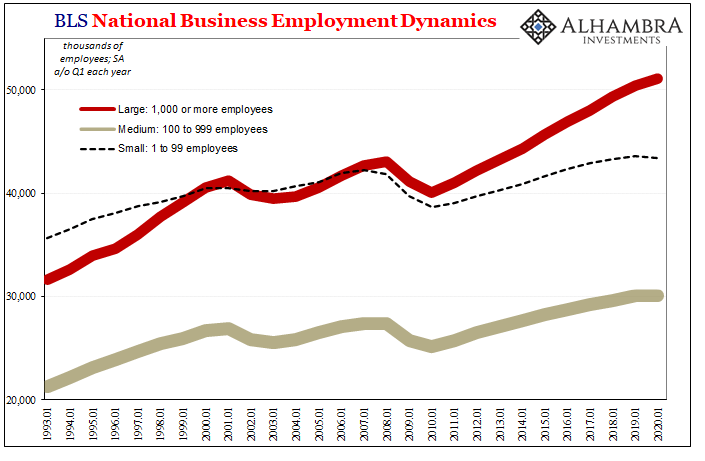

What a difference a month makes. The euphoria clearly fading even as the positive numbers grow bigger still. The era of gigantic pluses is only reaching its prime, which might seem a touch pessimistic given the context. In terms of employment and the labor market, reaction to the Current Employment Situation (CES) report seems to indicate widespread recognition of this situation. And that means how there are actually two labor markets at the moment.

Read More »

Read More »

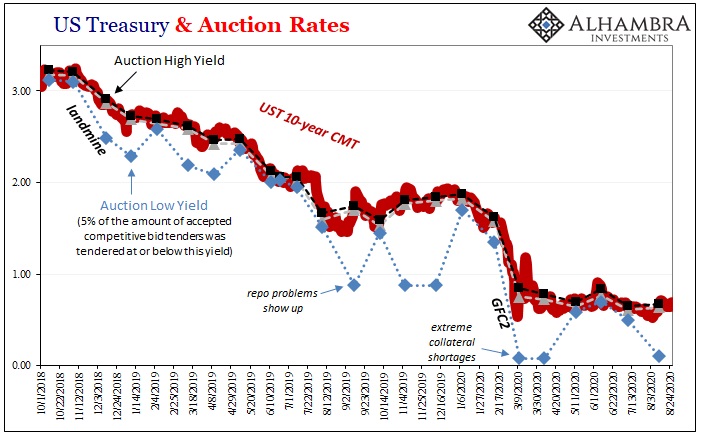

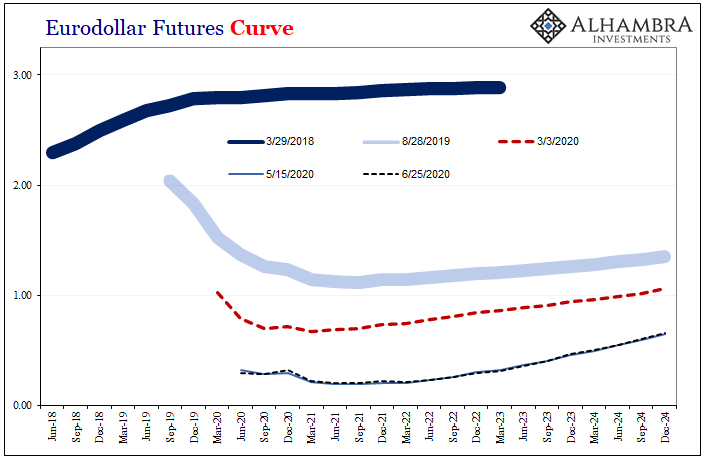

Wait A Minute, What’s This Inversion?

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board.And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute.

Read More »

Read More »

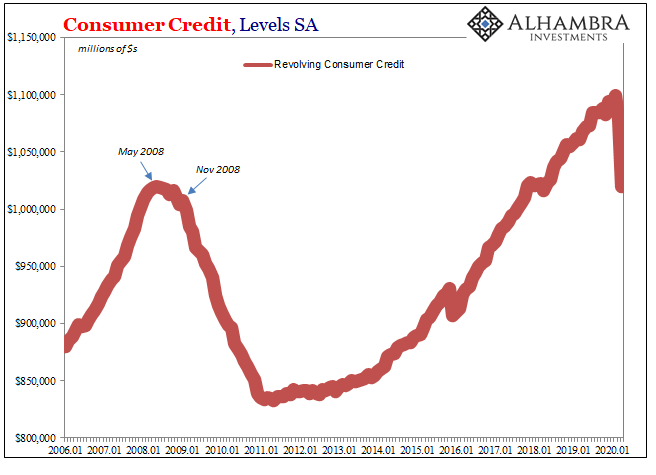

A Second Against Consumer Credit And Interest ‘Stimulus’

Credit card use entails a degree of risk appreciated at the most basic level. Americans had certainly become more comfortable with debt in all its forms over the many decades since the Great Depression, but the regular employment of revolving credit was perhaps the apex of this transformation. Does any commercial package on TV today not include one or more credit card offers? It certainly remains a staple of junk mail.

Read More »

Read More »

What Did Everyone Think Was Going To Happen?

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign.The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this...

Read More »

Read More »

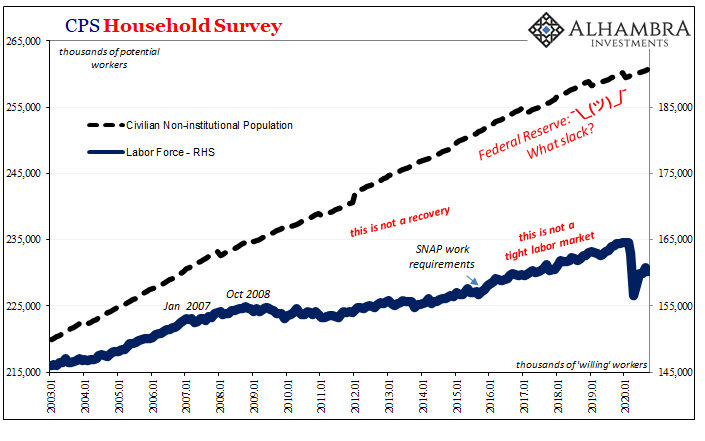

It’s Hard To See Anything But Enormous Long-term Cost

The unemployment rate wins again. In a saner era, back when what was called economic growth was actually economic growth, this primary labor ratio did a commendable job accurately indicating the relative conditions in the labor market. You didn’t go looking for corroboration because it was all around; harmony in numbers for a far more peaceful and serene period.

Read More »

Read More »

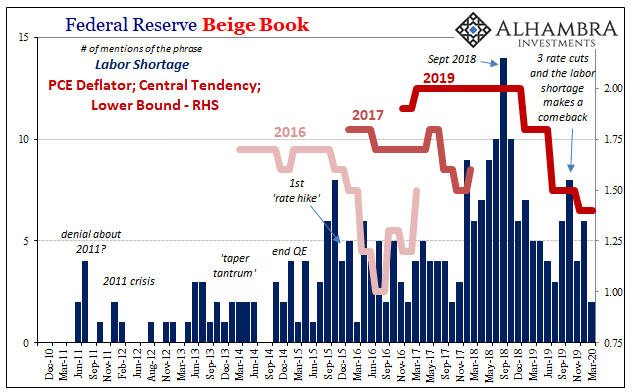

Like Repo, The Labor Lie

The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors.

Read More »

Read More »

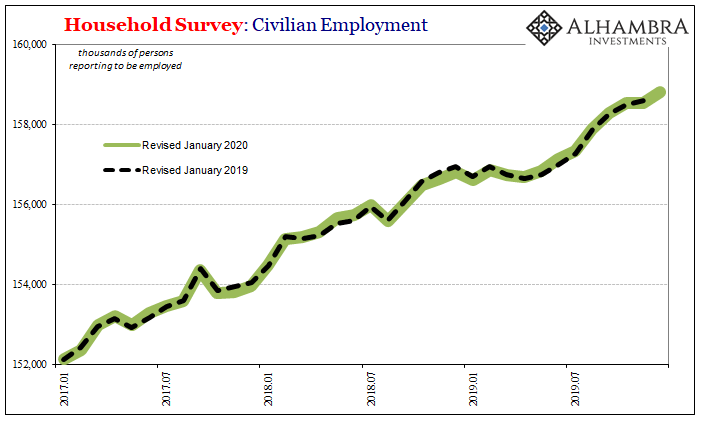

Very Rough Shape, And That’s With The Payroll Data We Have Now

The Bureau of Labor Statistics (BLS) has begun the process of updating its annual benchmarks. Actually, the process began last year and what’s happening now is that the government is releasing its findings to the public. Up first is the Household Survey, the less-watched, more volatile measure which comes at employment from the other direction. As the name implies, the BLS asks households who in them is working whereas the more closely scrutinized...

Read More »

Read More »