Tag Archive: Labor Market

Simple Economics and Money Math

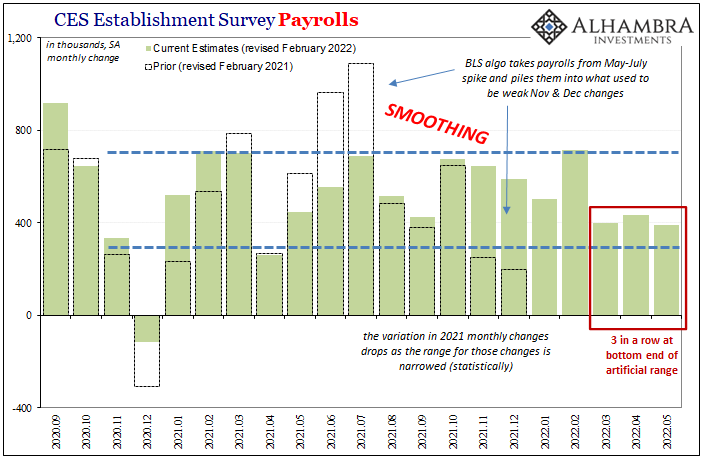

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips).

Read More »

Read More »

May Payrolls (and more) Confirm Slowdown (and more)

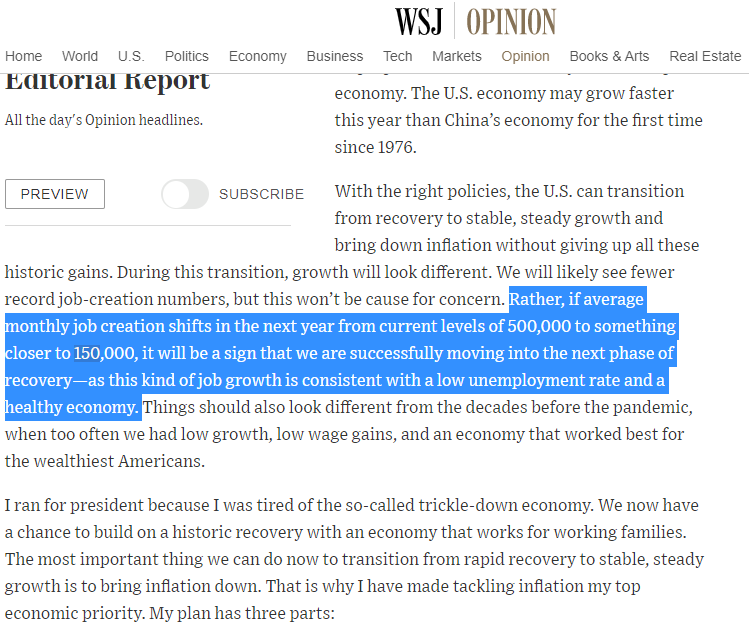

May 2022’s payroll estimates weren’t quite the level of downshift President Phillips had warned about, though that’s increasingly likely just a matter of time. In fact, despite the headline Establishment Survey monthly change being slightly better than expected, it and even more so the other employment data all still show an unmistakable slowdown in the labor market.

Read More »

Read More »

ADP Front-Runs BLS and President Phillips

It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part.

Read More »

Read More »

For The Fed, None Of These Details Will Matter

Most people have the impression that these various payroll and employment reports just go into the raw data and count up the number of payrolls and how many Americans are employed. Perhaps the BLS taps the IRS database as fellow feds, or ADP as a private company in the same data business of employment just tallies how many payrolls it processes as the largest provider of back-office labor services.That’s just not how it works, though. In fact,...

Read More »

Read More »

Taper Discretion Means Not Loving Payrolls Anymore

When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money.The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97.

Read More »

Read More »

How Many More Americans Might Have Quit Their Jobs Than The Huge Number Already Estimated, And What Might This Mean For FOMC Taper

There were a few surprises included in the BLS JOLTS data just released today for the month of November (note: the government has changed its release schedule so that JOLTS, already one month further in arrears than the payroll report, CES & CPS, will now come out earlier so that its numbers are publicly available for the same monthly payrolls before the next CES & CPS get released).

Read More »

Read More »

As The Fed Tapers: What If More Rapid (published) Wage Increases Are Actually Evidence of *Deflationary* Conditions?

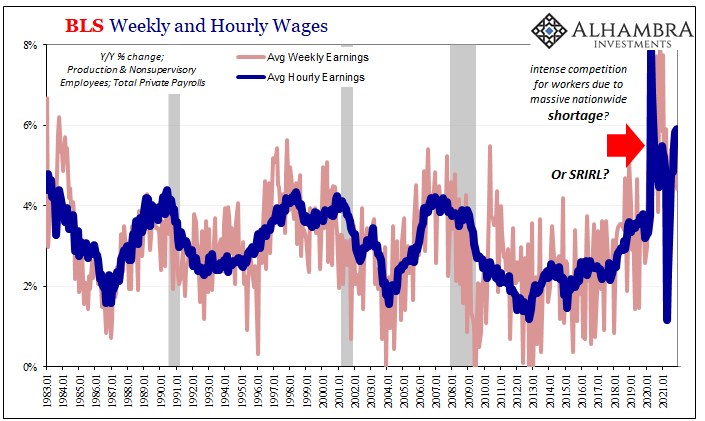

Since the Federal Reserve is not in the money business, their recent hawkish shift toward an increasingly anti-inflationary stance is a twisted and convoluted case of subjective interpretation.

Read More »

Read More »

A Global JOLT(s) In July

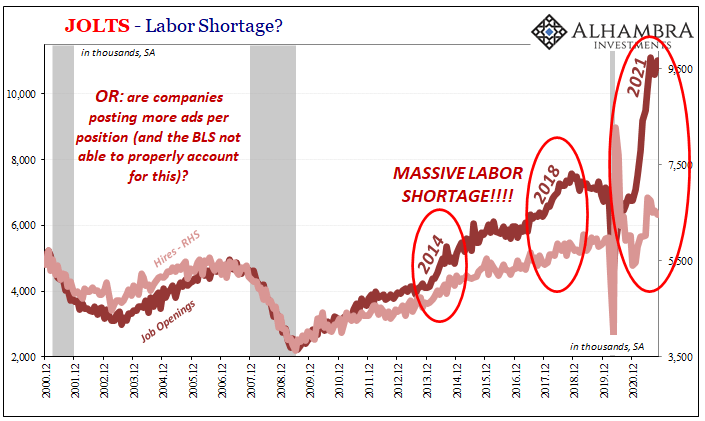

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million.

Read More »

Read More »

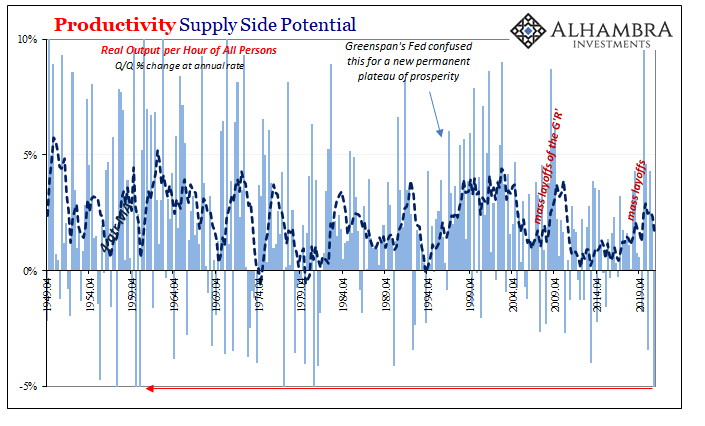

The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market.

Read More »

Read More »

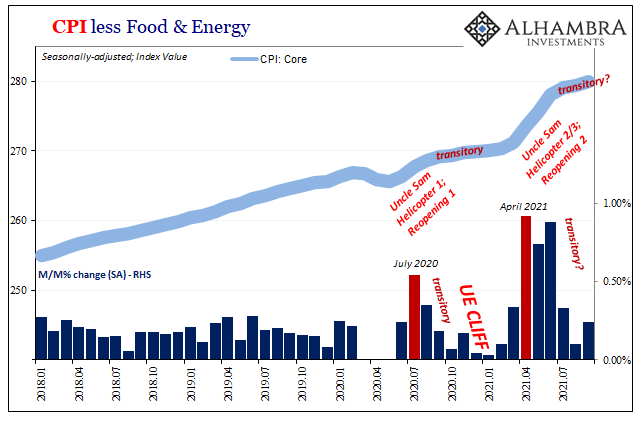

The Wile E. Powell Inflation: Are We Really Just Going To Ignore The Cliff?

Last year did not end on a sound note. The initial rebound after 2020’s recession was supposed to be a straight line, lifting upward for the other side of the infamous “V” shape. Such hopes had been dashed, though, and as the disappointing year wound toward its own end yet another big problem loomed.

Read More »

Read More »

Isn’t the Labor Shortage Transitory?

Overview: The major central banks have successfully pushed back against the aggressive tightening the market had discounted. The Bank of England's decision not to raise rates after key officials seemed to suggest one was imminent. On the heels of what we argued was a dovish tapering announcement by the Fed, it spurred a dramatic decline in short and long-term interest rates. The drop in UK rates--21 bp in the 2-year and nearly 14 bp in the...

Read More »

Read More »

Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large.

Read More »

Read More »

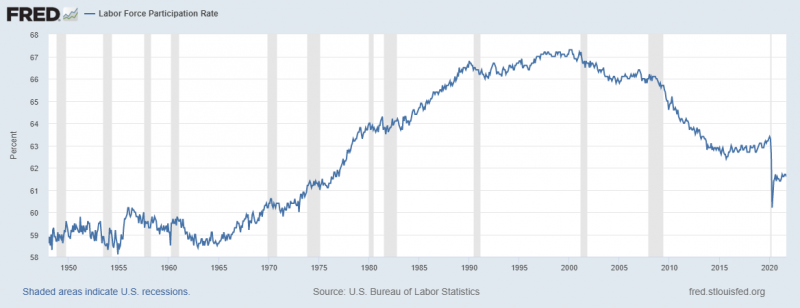

For The Love Of Unemployment Rates

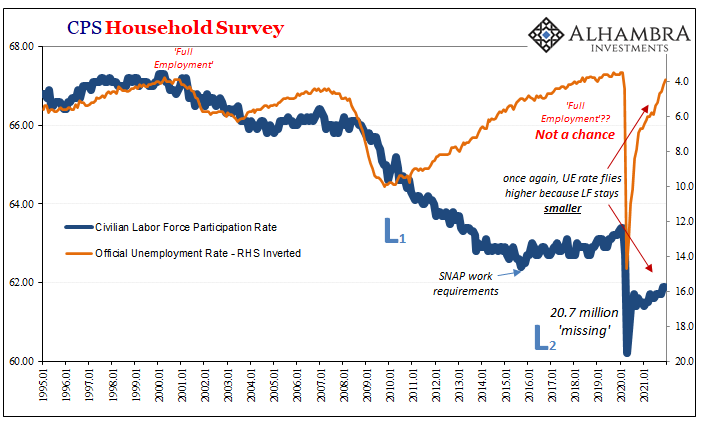

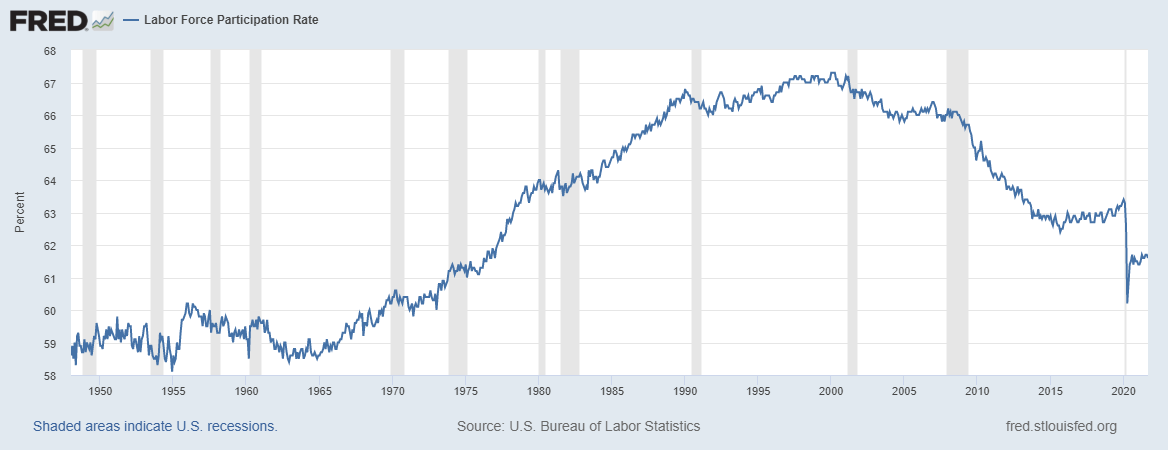

Here we are again. The labor force. The numbers from the BLS are simply staggering. During September 2021, the government believes it shrank for another month, down by 183,000 when compared to August. This means that the Labor Force Participation rate declined slightly to 61.6%, practically the same level in this key metric going back to June.

Read More »

Read More »

Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion.

Read More »

Read More »

An Economy Dividing By Inventory And Labor

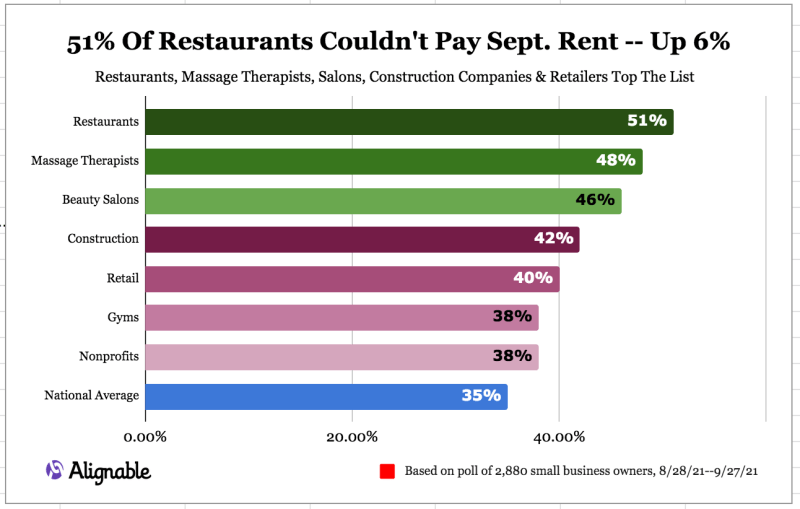

Is it delta COVID? Or the widely reported labor shortage? Something has created a soft patch in the presumed indestructible US economy still hopped up on Uncle Sam’s deposits made earlier in the year. And yet, there’s a nagging feeling over how this time, like all previous times, just might be too good to be true, too.

Read More »

Read More »

Do Rising ‘Global’ Growth Concerns Include An Already *Slowing* US Economy?

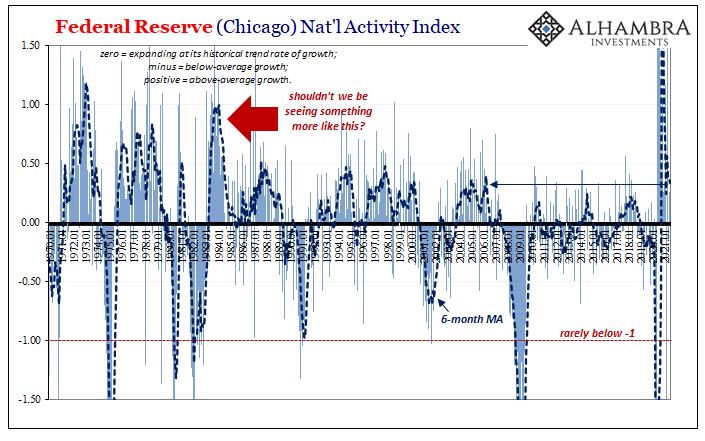

Global factors, meaning that the wave of significantly higher deflationary potential (therefore, diminishing inflationary chances which were never good to begin with) in global bond yields the past five months have seemingly focused on troubles brewing outside the US. Overseas turmoil, it was called back in 2015, leaving by default a picture of relative American strength and harmony.

Read More »

Read More »

JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again.

Read More »

Read More »

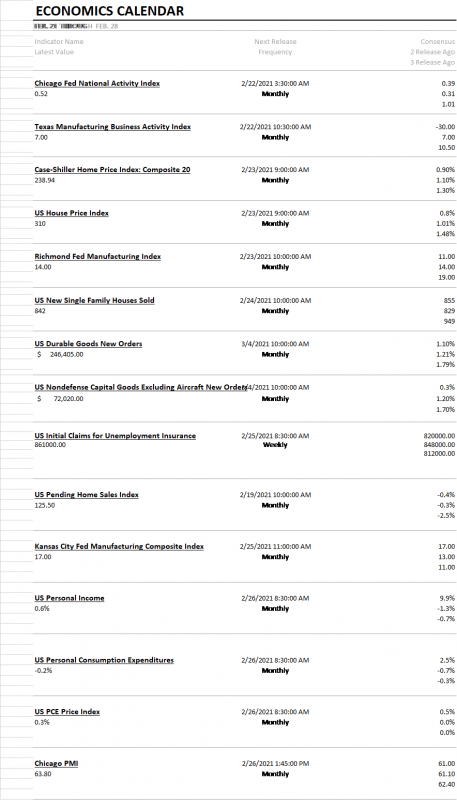

Weekly Market Pulse – Real Rates Finally Make A Move

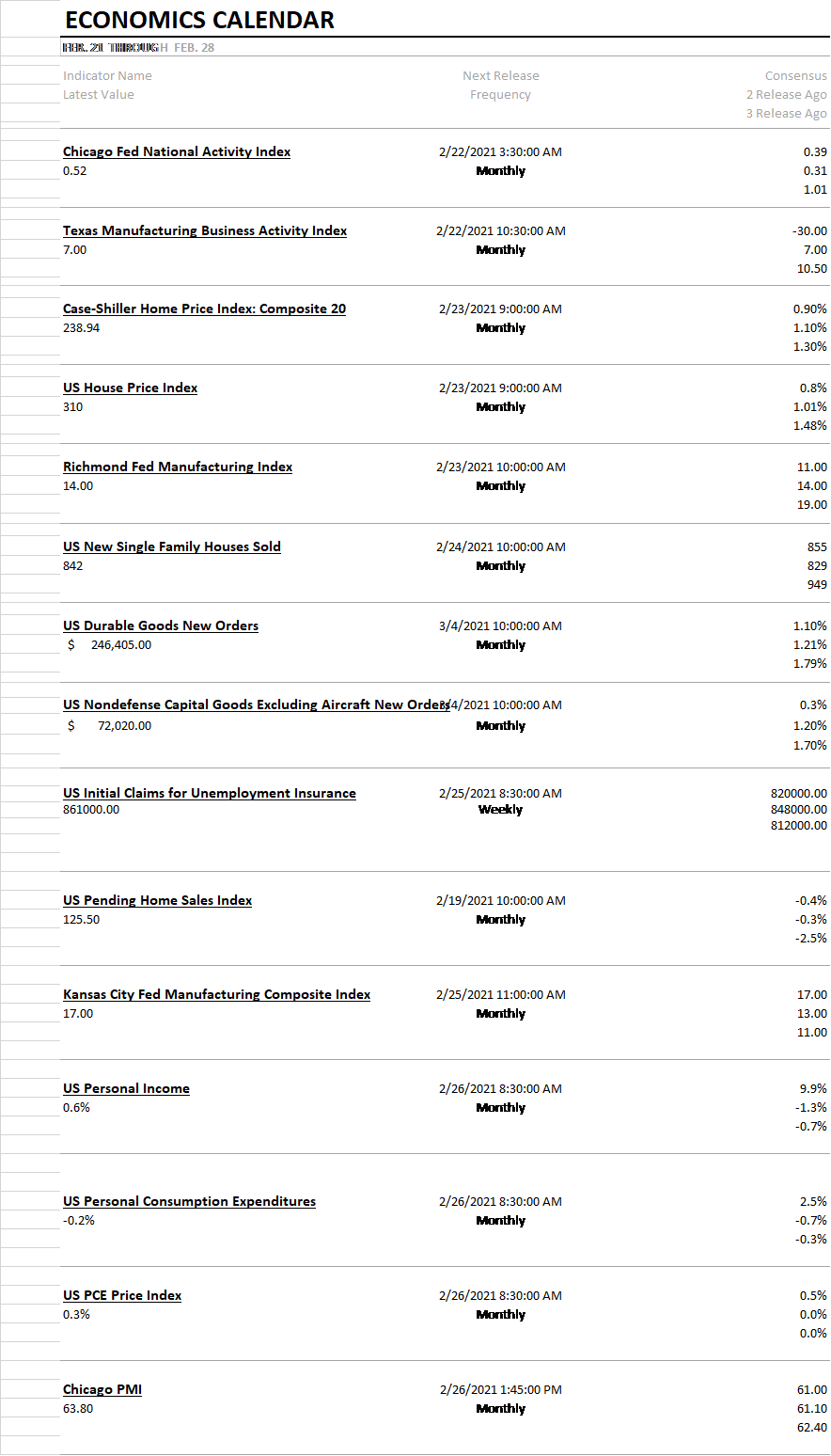

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery.

Read More »

Read More »

Two Seemingly Opposite Ends Of The Inflation Debate Come Together

It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else.

Read More »

Read More »

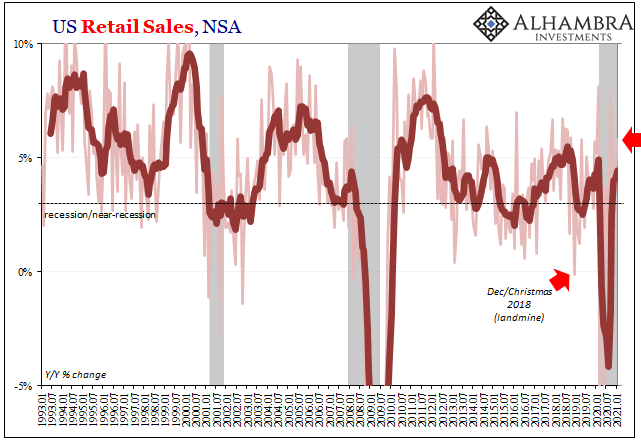

Uncle Sam Was Back Having Consumers’ Backs

American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year.

Read More »

Read More »