Tag Archive: jolts

How Many More Americans Might Have Quit Their Jobs Than The Huge Number Already Estimated, And What Might This Mean For FOMC Taper

There were a few surprises included in the BLS JOLTS data just released today for the month of November (note: the government has changed its release schedule so that JOLTS, already one month further in arrears than the payroll report, CES & CPS, will now come out earlier so that its numbers are publicly available for the same monthly payrolls before the next CES & CPS get released).

Read More »

Read More »

A Global JOLT(s) In July

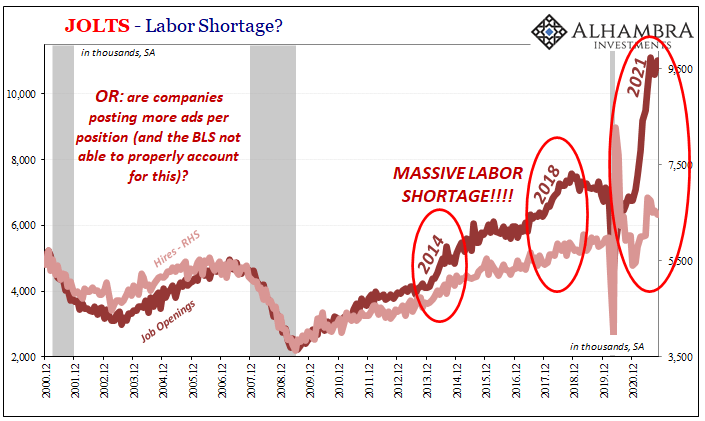

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million.

Read More »

Read More »

Weekly Market Pulse: Happy Anniversary!

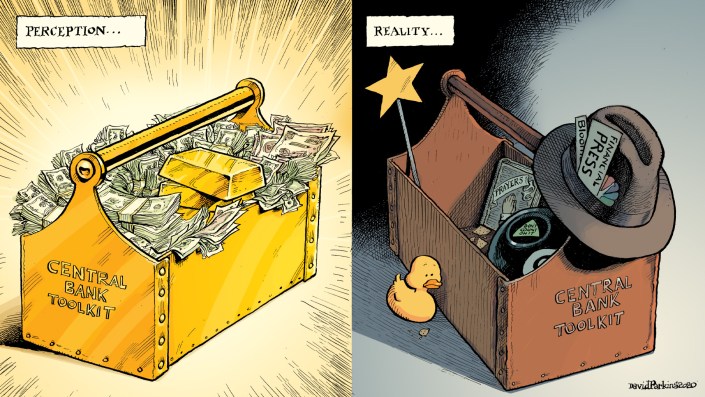

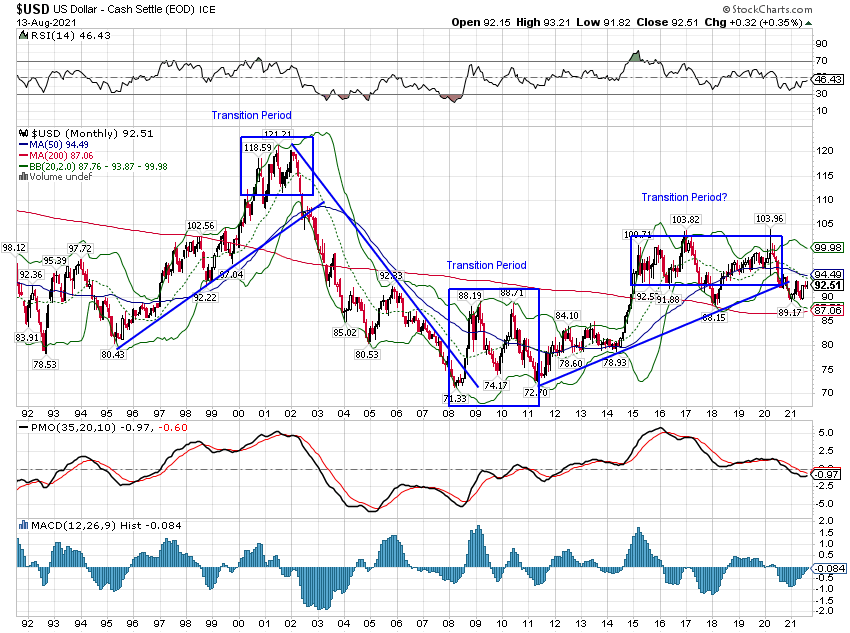

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar.

Read More »

Read More »

Weekly Market Pulse: Is It Time To Panic Yet?

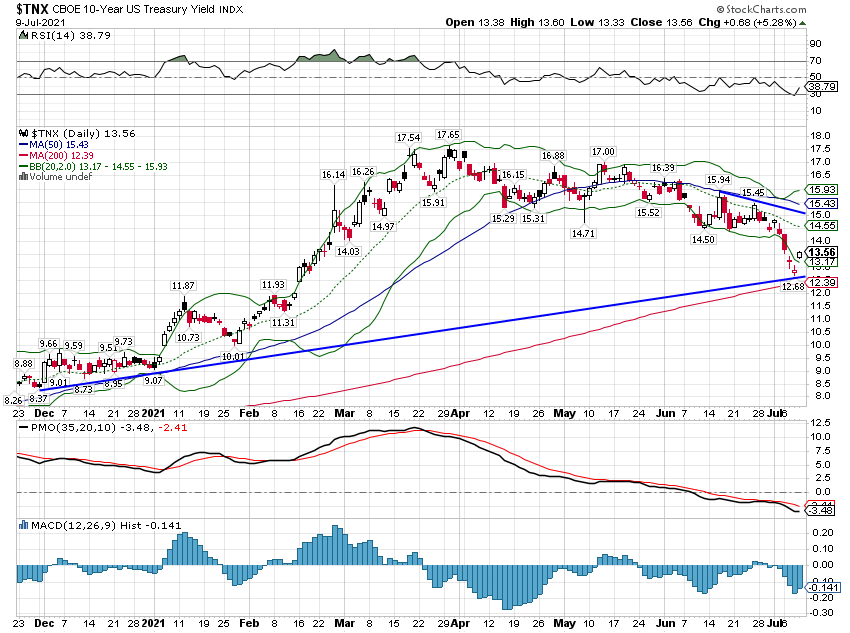

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »

JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again.

Read More »

Read More »

Inflation Hysteria #2 (WTI)

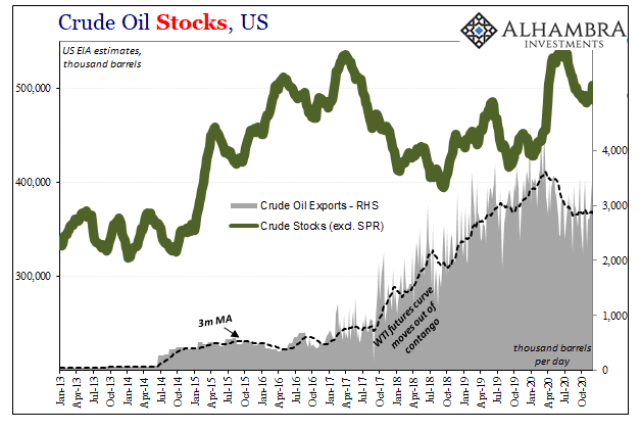

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously.

Read More »

Read More »

A Second JOLTS

What happens when we are stunned and dazed? We filter out the noise to focus on the bare basics by getting back to our instincts, acting reflexively based upon our deeply held beliefs and especially training. When faced with a crisis and there’s no time to really think, shorthand will have to suffice.

Read More »

Read More »

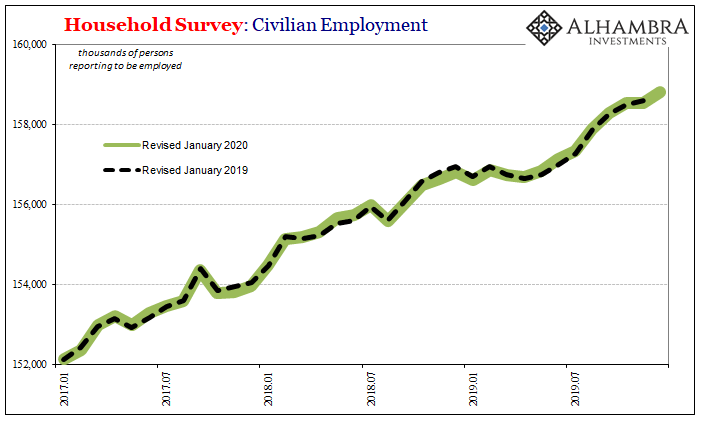

Very Rough Shape, And That’s With The Payroll Data We Have Now

The Bureau of Labor Statistics (BLS) has begun the process of updating its annual benchmarks. Actually, the process began last year and what’s happening now is that the government is releasing its findings to the public. Up first is the Household Survey, the less-watched, more volatile measure which comes at employment from the other direction. As the name implies, the BLS asks households who in them is working whereas the more closely scrutinized...

Read More »

Read More »

Consistent Trade War Inconsistency Hides The Consistent Trend

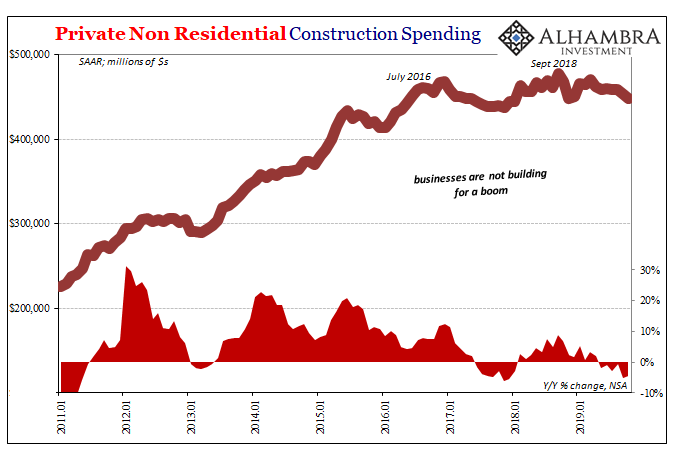

You can see the pattern, a weathervane of sorts in its own right. Not for how the economy is actually going, mind you, more along the lines of how it is being perceived from the high-level perspective. The green light for “trade wars” in the first place was what Janet Yellen and Jay Powell had said about the economy.

Read More »

Read More »

From Friends to Nemeses: JO and Jay

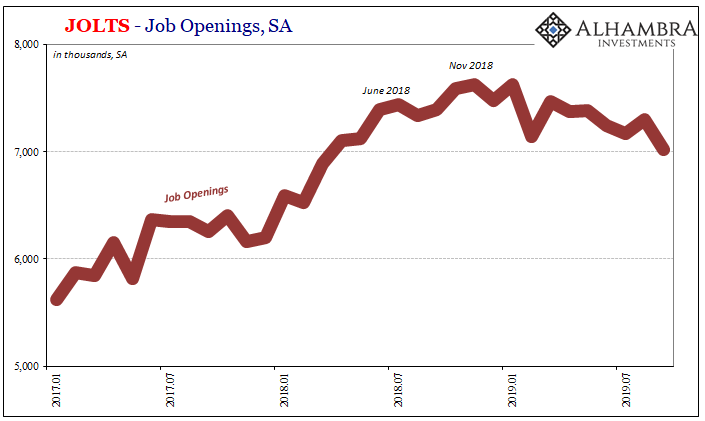

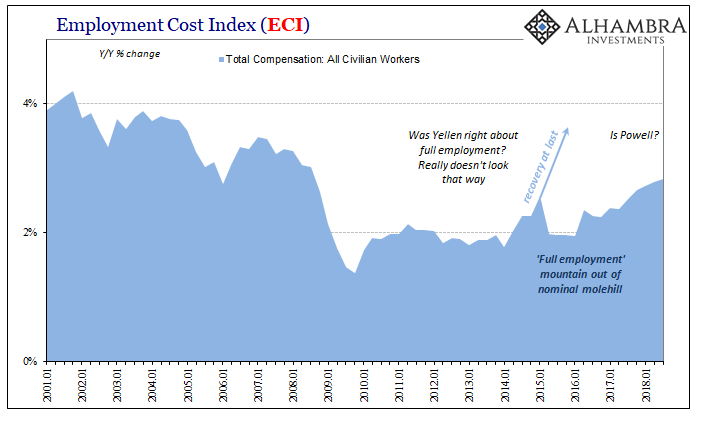

It was one of the first major speeches of his tenure. Speaking to the Economic Club of Chicago in April 2018, newly crowned Federal Reserve Chairman Jerome Powell was full of optimism. At that time, however, optimism was being framed as some sort of bad thing. This was the height of inflation hysteria, where any sort of official upgrade to the economic condition was taken as further “hawkishness.”

Read More »

Read More »

Monthly Macro Monitor: Doom & Gloom, Good Grief

When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time.

Read More »

Read More »

From JOLTS Series Shift To Series of Rate Cuts

I’ve said all along that they would be dragged into them kicking and screaming. After all, the Federal Reserve undertook its last rate hike in December 2018 – just as the markets were making clear he was completely mistaken in his view of the economy. What followed was the ridiculous “Fed pause” which pretty much everyone outside of the central bank and the Economics profession knew wasn’t the end of it.

Read More »

Read More »

Another ‘Highest In Ten Years’

Upon the precipice of the Great “Recession”, US workers were cushioned to some extent by what economists call sticky wages. Before the Great Depression, as well as during it, companies would attempt to deal with looming economic contraction by cutting pay rates before workers.

Read More »

Read More »

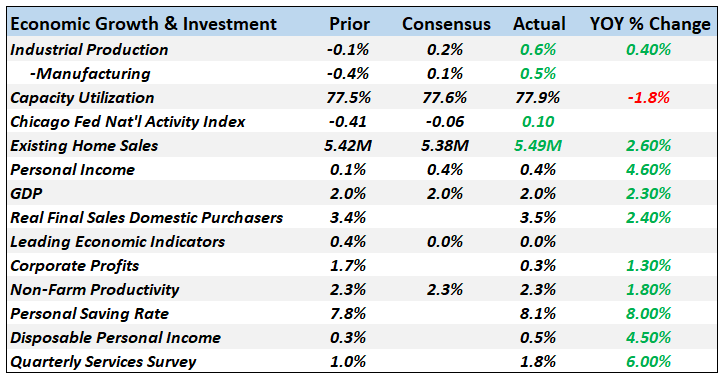

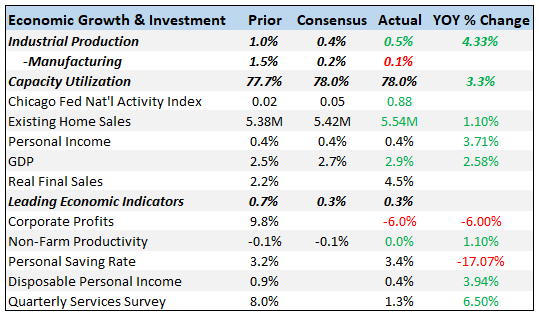

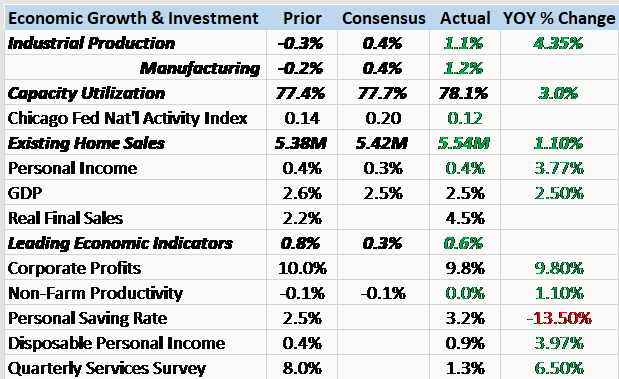

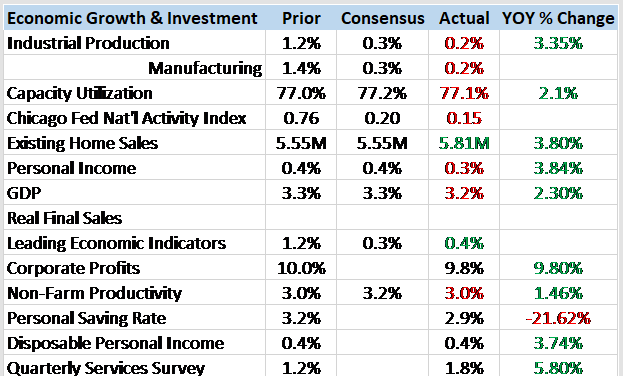

Bi-Weekly Economic Review

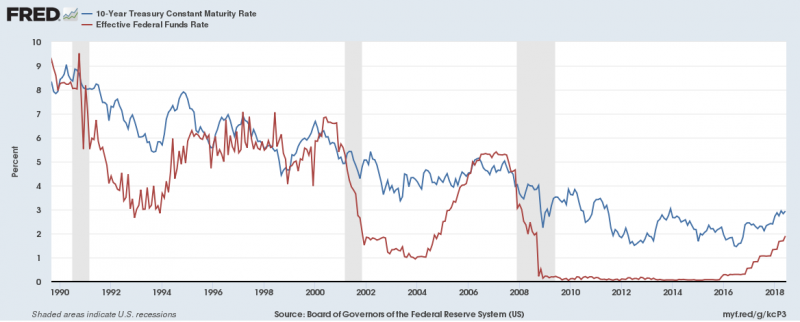

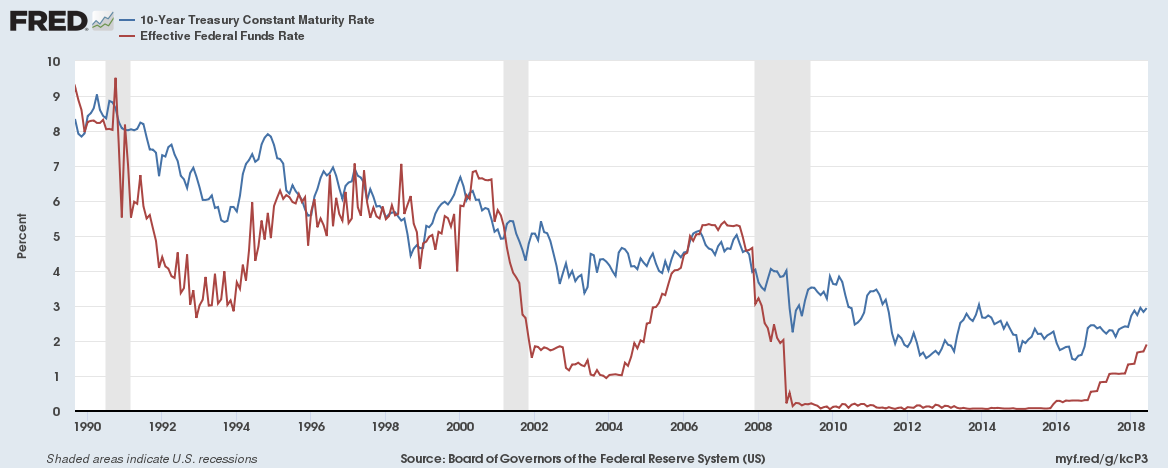

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility.

There has been for some time now a large short position held by speculators in the futures market for Treasuries.

Read More »

Read More »

Bi-Weekly Economic Review: Interest Rates Make Their Move

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears.

Read More »

Read More »

Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s going...

Read More »

Read More »

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

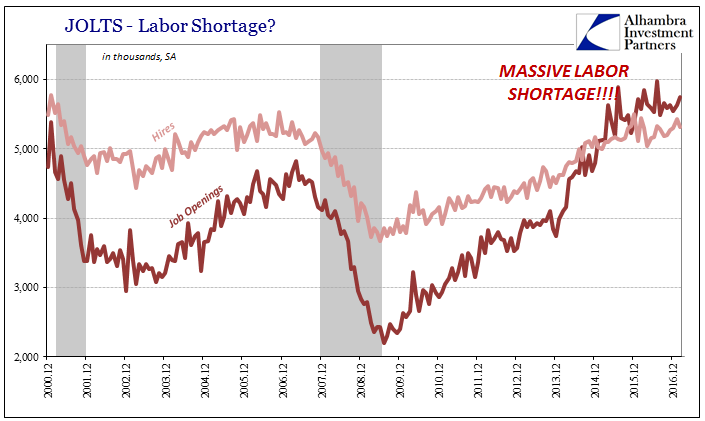

We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits.

Read More »

Read More »

The JOLTS of Drugs

Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary task should it be found...

Read More »

Read More »

Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014.

Read More »

Read More »

Defining Labor Economics

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to give those relationships some...

Read More »

Read More »