Tag Archive: JGB

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

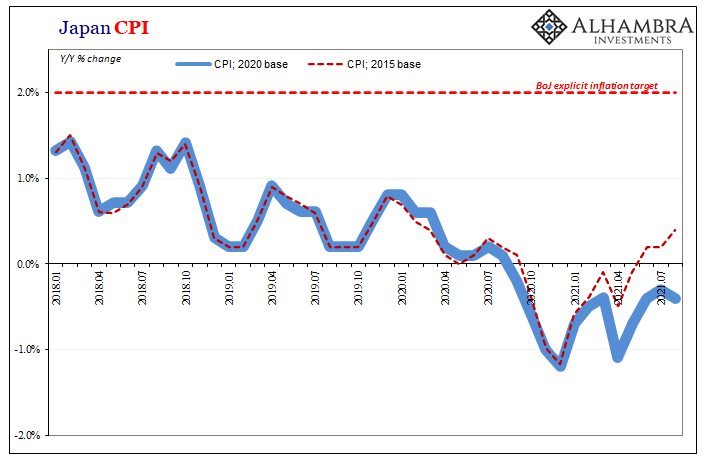

August Avoids Zero In JGB’s

Central banks and their staffs have long been accused of trying to hide inflation. This allegation had been a staple of their critics, those charging reckless monetary policies for creating “too much” money that had allegedly been causing price imbalances all over the financial map.

Read More »

Read More »

Inching Closer To Another Warning, This One From Japan

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart.

Read More »

Read More »

Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change.

Read More »

Read More »

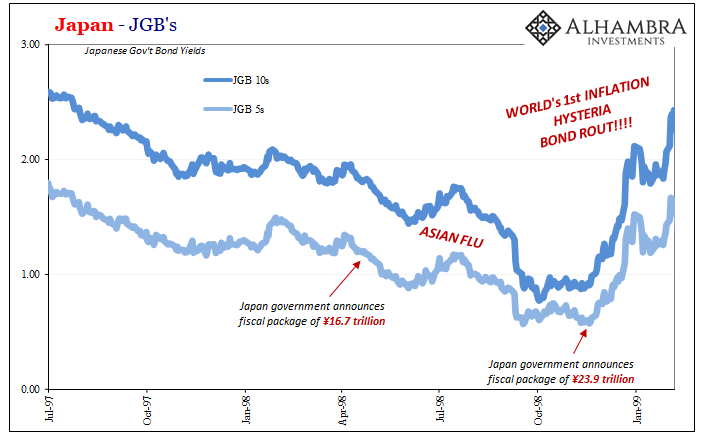

They’ve Gone Too Far (or have they?)

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates?Not for nothing, every couple years when we do those (record low yields) that’s what “they”...

Read More »

Read More »

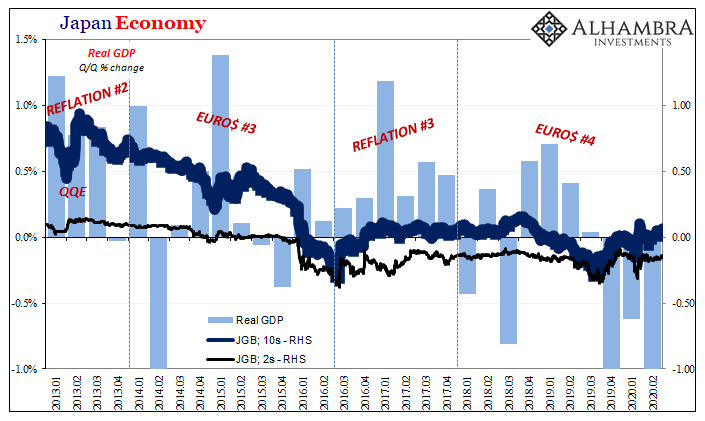

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

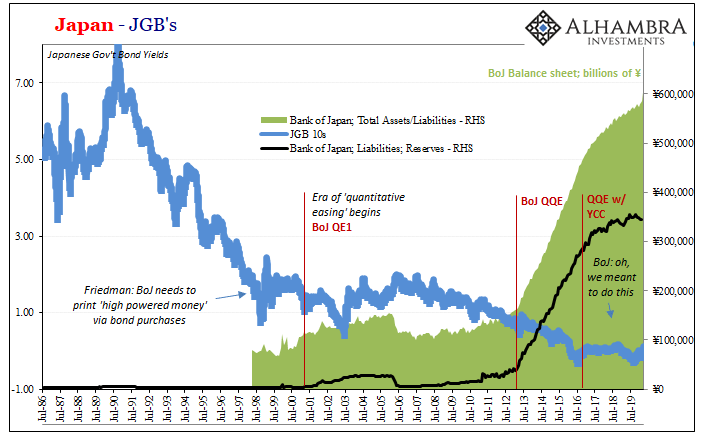

There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates.No, stupid, declared Milton Friedman.

Read More »

Read More »

Why The Japanese Are Suddenly Messing With YCC

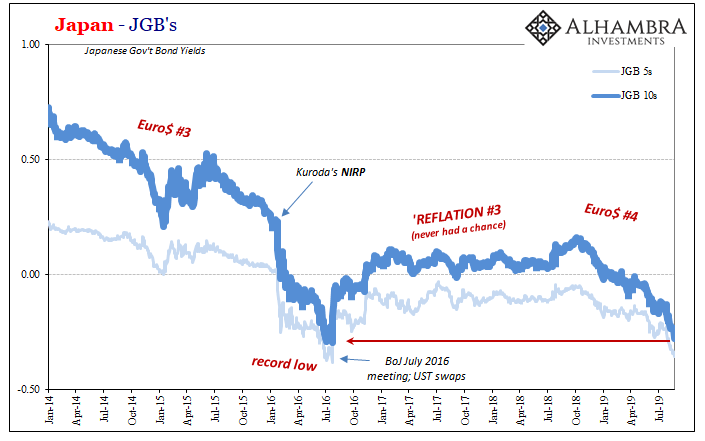

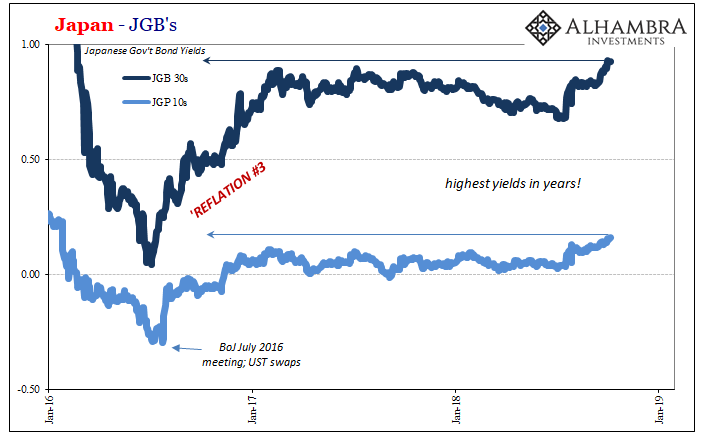

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more.

Read More »

Read More »

ISM Spoils The Bond Rout!!!

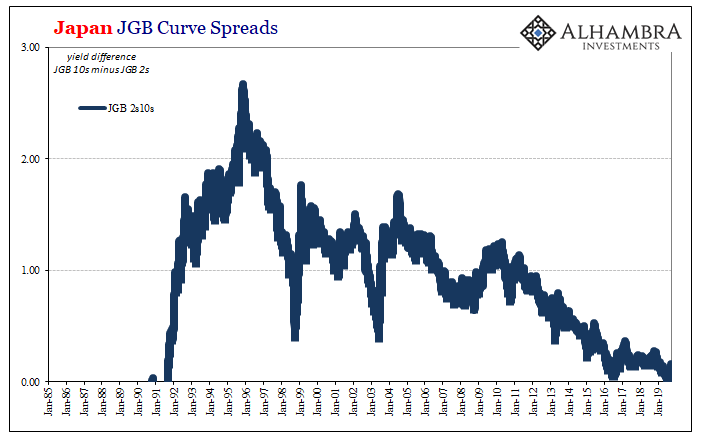

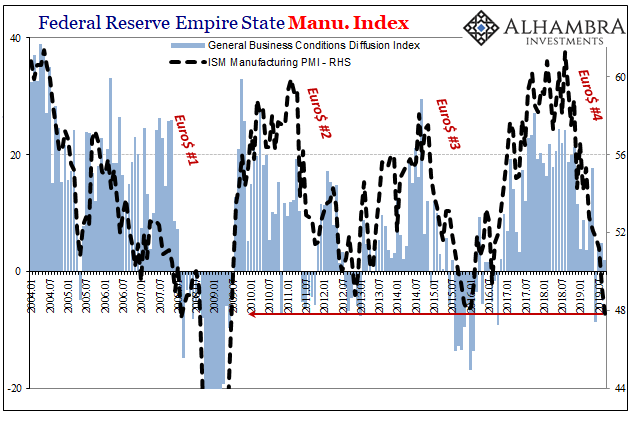

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out.

Read More »

Read More »

Japan: Fall Like Germany, Or Give Hope To The Rest of the World?

After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned.

Read More »

Read More »

Lost In Translation

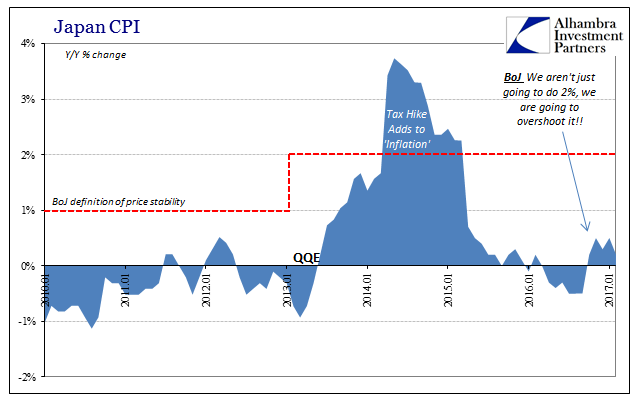

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish.

Read More »

Read More »

The Global Burden

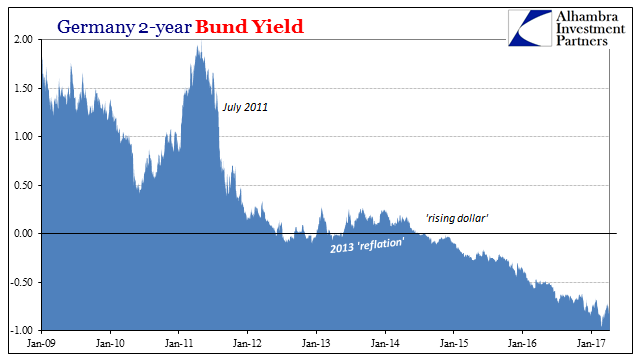

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it.

Read More »

Read More »

Systemic Depression Is A Clear Choice

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group.

Read More »

Read More »

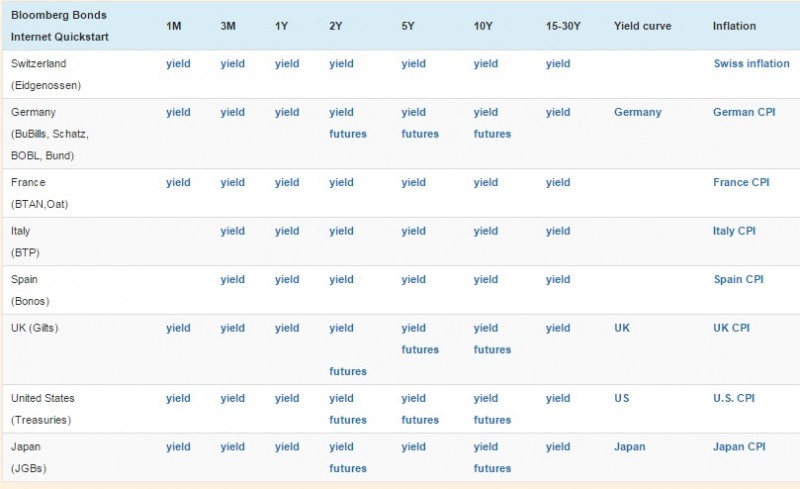

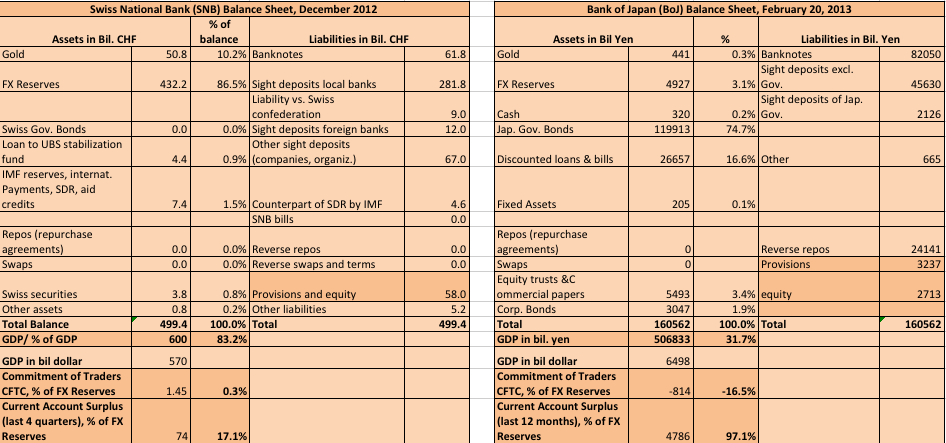

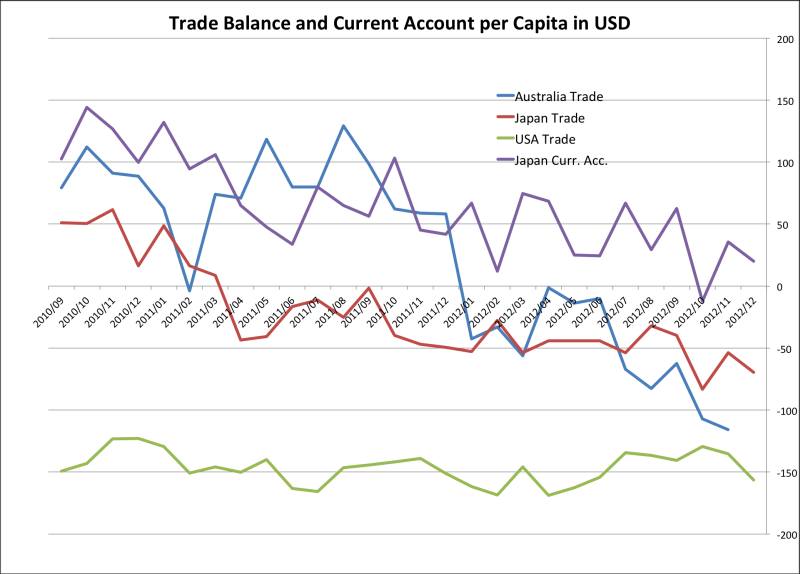

Japanese Currency Debasement, Part 1: Current Account and Japanese Bond Bears

In our first part on Japans currency debasement, we look on three aspects, government bond yields, current account balances and potential hyper-inflation which causes yields to rise strongly.

Read More »

Read More »

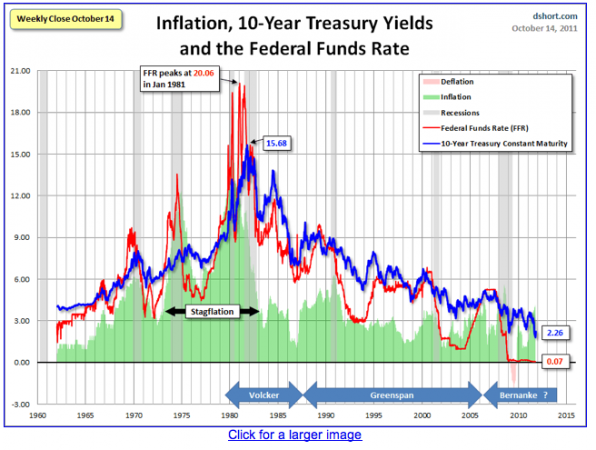

The Biggest Bubble of the Century is Ending: Government Bond Yields

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Update August 16, 2013: So, 10-year Treasury yields have ended the day closer to 3 per cent. But not as close as they … Continue reading »

Read More »

Read More »

May Japan face a weak yen and high bond yields?

Like often in global economic downturns, the demand for Japanese cars and electronics has fallen in Q3, especially due to European purchasers. Additionally fueled by a row with China, the current account has become negative. Is Japan doomed because the yen will fall and bond yields will rise?

Read More »

Read More »