Tag Archive: Iran

In Uncoordinated Steps, Japan and China Help Slow Greenback’s Rally

Overview: The Bank of Japan Governor Ueda hinted the

world's third-largest economy may exit negative interest rates before the end

of the year. This sparked the strongest gain in the yen in a couple of months

and lifted the 10-year yield to nearly 0.70%. In an uncoordinated fashion,

Chinese officials stepped their rhetoric and indicated that corporate orders to

sell $50 mln or more will need authorization. This helped arrest the yuan's

slide. The...

Read More »

Read More »

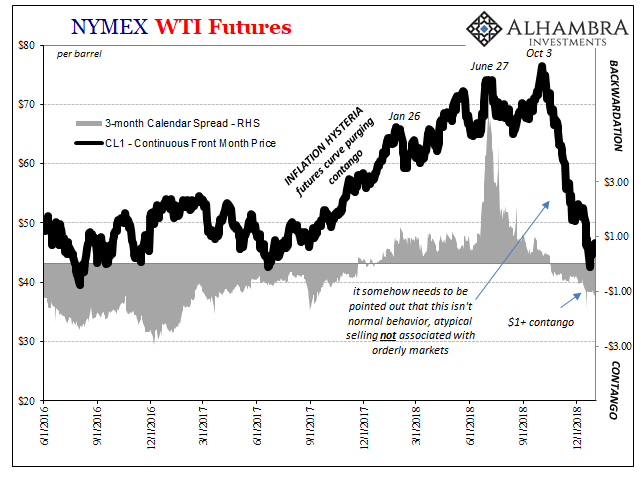

OPEC+ Surprises while Manufacturing Remains Challenged

Overview: News of OPEC+ unexpected output cuts saw May WTI gap

sharply higher and helped lift bond yields. May WTI settled near three-week

highs before the weekend near $75.65 and opened today near $80. It reached

almost $81.70 before stabilizing and is straddling the $80 area before the

North American session. The high for the year was set in the second half of

January around $83. Benchmark 10-year yields are up 2-5 bp points. The 10-year

US...

Read More »

Read More »

US Banking Crisis Swamps Other Considerations

Overview: The US banking crisis has overwhelmed other

market drivers. The strong measures announced as Asia Pacific trading got under

way was embraced by the market even though moral hazard issues and gaps in the

Dodd-Frank regulatory framework were exposed. The dollar is trading heavily. The

prospect of a 50 bp Fed hike next week has evaporated and some are doubting

that a 25 bp increase will be delivered. Rate hike expectations for the ECB

this...

Read More »

Read More »

Crypto-Mining-Farmen im Iran beschlagnahmt

Im Iran wurde in den letzten Tagen Equipment der Mining-Farmen beschlagnahmt. Offiziell heißt es, dass die iranische Regierung damit Blackouts verhindern wolle, die durch Strommangel verursacht werden.

Read More »

Read More »

China and Hong Kong Stocks Plummet, Yields Soar

Overview: While the World Health Organization debates about downgrading Covid from a pandemic, the rise China and Hong Kong cases is striking. A lockdown in Shenzhen and restrictions in Shanghai, coupled with a record fine by PBOC officials on Tencent drove local stocks sharply lower. China's CSI 300 fell 3% and a measure of Chinese stocks that trade in HK plunged more than 7%.

Read More »

Read More »

Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia,...

Read More »

Read More »

FX Daily, May 20: Market Stabilize after Yesterday’s Tumultuous Session

US equity indices finished lower, but the real story was their recovery. Asia Pacific equities were mixed, with Australia's 1.5% rally leading the recovery in some markets, including Tokyo and Singapore. Europe's Dow Jones Stoxx 600 is up a little more than 0.5% near mid-session, led by information technology and industrials, while energy and financials lagged with small gains.

Read More »

Read More »

FX Daily, February 16: Greenback Remains Heavy

The equity rally appears undeterred by the rise in interest rates or the surge in oil prices. Led by Tokyo and Hong Kong, Asia Pacific equities advanced. China, Taiwan, and Vietnam markets remain closed. After gapping higher yesterday and extended the gains in early turnover today, the Dow Jones Stoxx 600 is consolidating.

Read More »

Read More »

FX Daily, January 8: Hopes of De-Escalation Help Markets Stabilize

The Iranian retaliatory missile strike on Iraqi-bases housing US forces initially sparked a dramatic risk-off response throughout the capital markets. The muted response by the US coupled with signals from Tehran that it had "concluded" its proportionate measures saw the markets retrace the initial reaction. It was too late for equities in the Asia Pacific region, and several markets (Japan, China, Korea, Malaysia, and Thailand) fell more than 1%.

Read More »

Read More »

FX Daily, January 03: Geopolitics Saps Risk Appetite

Iran's Ayatollah Ali Khamenei has threatened "severe retaliation" for the US attacked that killed an important head of a force within the Islamic Revolutionary Guard. At the same time, reports indicate that North Korea's Kim Jong Un is no longer pledging to halt its nuclear weapons testing and has threatened to unveil a new weapon. Meanwhile, Turkish forces have reportedly entered Libya.

Read More »

Read More »

FX Daily, June 25: Heightened Political Risks Weigh on Sentiment

Overview: It is far from clear that the US sanctions against nine Iranian officials, with the foreign minister to be added later brings negotiations any closer. At the same time, US officials trying to keep expectations low for the weekend meeting between Trump and Xi. The heightened political anxiety will have to make room for Fed Chairman Powell's talk in NY.

Read More »

Read More »

FX Daily, June 24: Slow Start to Important Week

The Trump-Xi meeting at the G20 this coming weekend and heightened tensions in the Gulf, with the US set to impose new sanctions on Iran's crippled economy are keeping investors on edge. News the opposition won the re-do of the Istanbul mayoral election has lifted the Turkish lira.

Read More »

Read More »

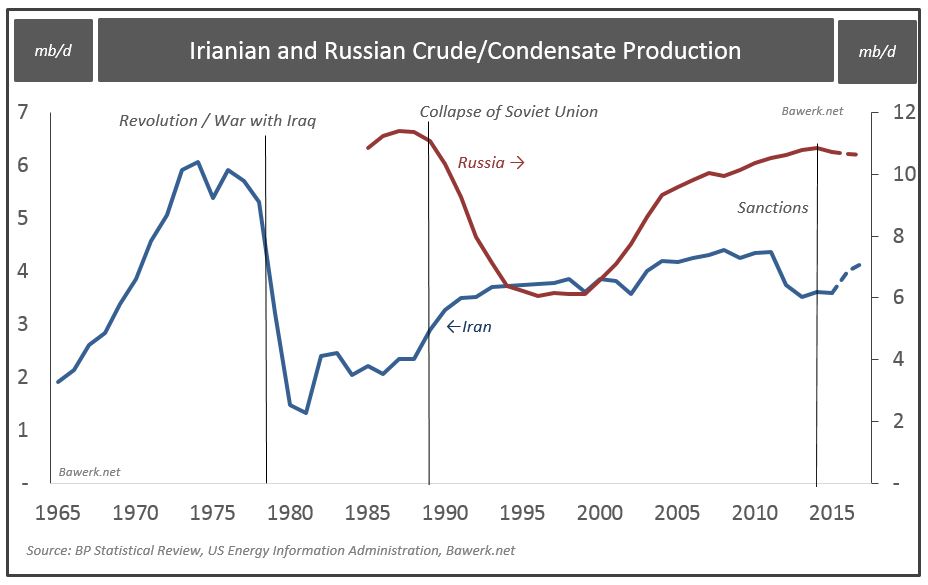

Nothing To See Here, It’s Just Everything

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal.

Read More »

Read More »

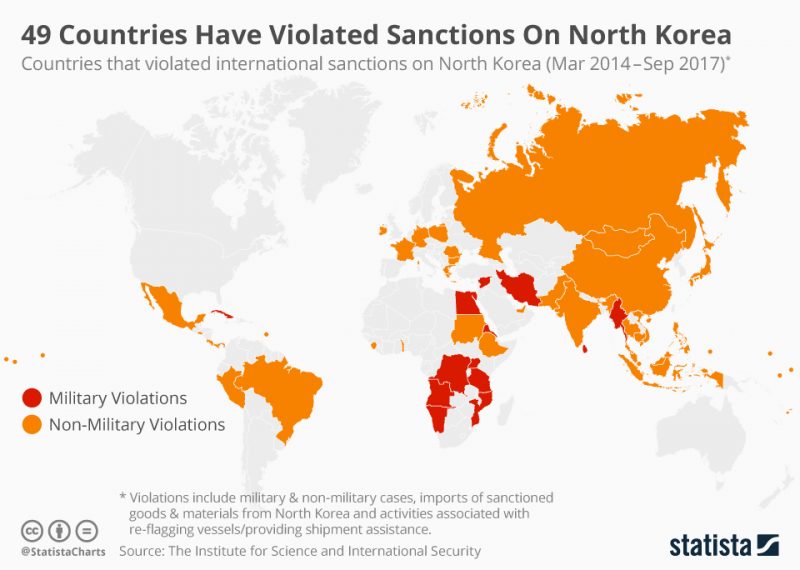

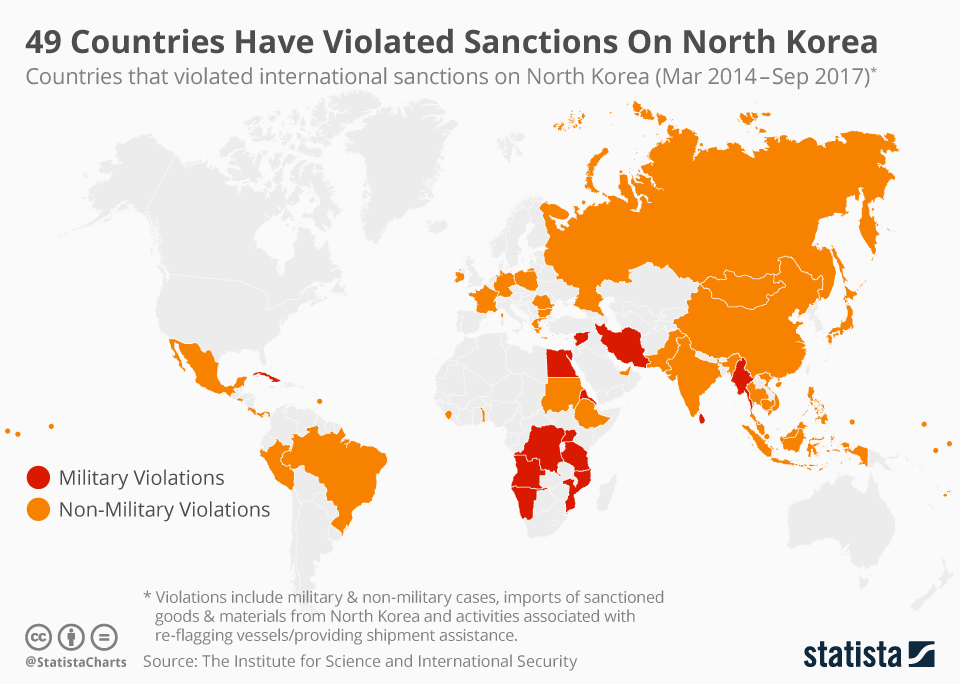

49 Countries Have Violated Sanctions On North Korea

A new report from the Institute for Science and International Security has found that 49 countries violated sanctions on North Korea to varying degrees between March 2014 and September 2017. 13 governments including Cuba, Egypt, Iran and Syria were involved in military violations, which as Statista's Martin Armstrong notes, includes either receiving military training from North Korea or being involved in the import and export of military equipment.

Read More »

Read More »

Saudi Billionaires Scramble To Move Cash Offshore, Escape Asset Freeze

Over the weekend, Saudi King Salman shocked the world by abruptly announcing the arrests of 11 senior princes and some 38 ministers, including Prince Al-Waleed bin Talal, the world’s sixty-first richest man and the largest shareholder in Citi, News Corp. and Twitter.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

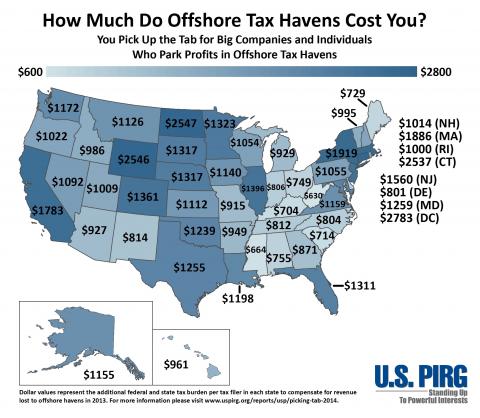

Panama Tax Haven Scandal: The Bigger Picture

The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Ass...

Read More »

Read More »

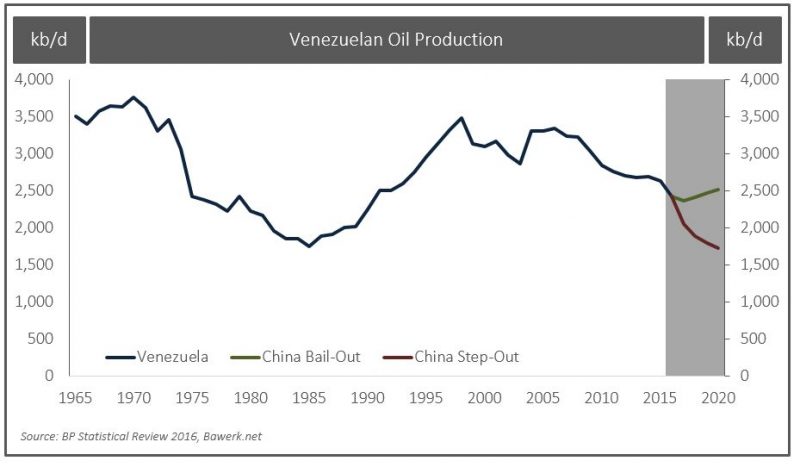

China the lender of last resort for many oil producers

Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs.

Read More »

Read More »