Tag Archive: Inventory

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

It’s Inventory PLUS Demand

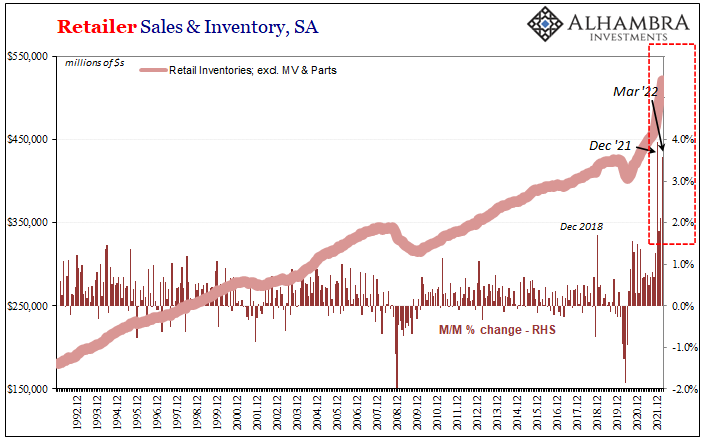

It’s not just the flood of never-ending inventory. That’s a huge and growing problem, sure, as the chickens of last year’s short-termism overordering finally come home to their retailer roost. Being stuck with too many goods isn’t necessarily fatal to the global and domestic manufacturing sectors.

Read More »

Read More »

Prices As Curative Punishment

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022.

Read More »

Read More »

Simple Economics and Money Math

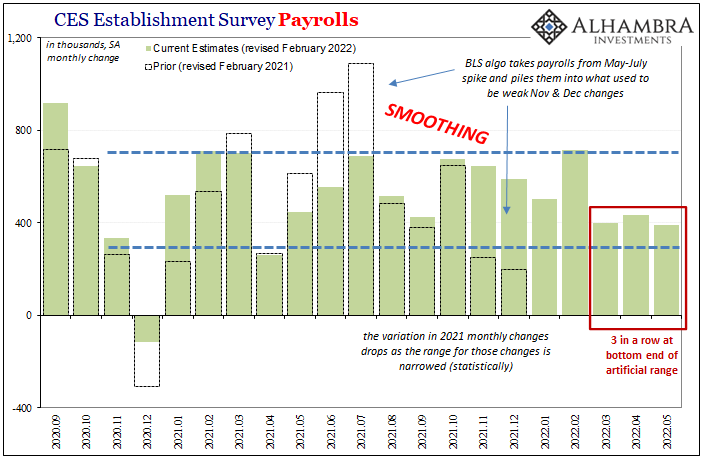

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips).

Read More »

Read More »

“Inflation” Not Inflation, Through The Eyes of Inventory

It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices.Who cares, most people wonder. After all, what does it really matter why prices are going up so far?

Read More »

Read More »

Inventory Flood Continues Just As Consumers Tap Out

If it continues to play out the same way, it would be all the worst scenarios lumped together all at the same time. A real unfortunate convergence, yet one that has been entirely predictable. Consumers reaching their absolute spending limits.

Read More »

Read More »

Is It Being Demanded?

Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing.

Read More »

Read More »

Is It Recession?

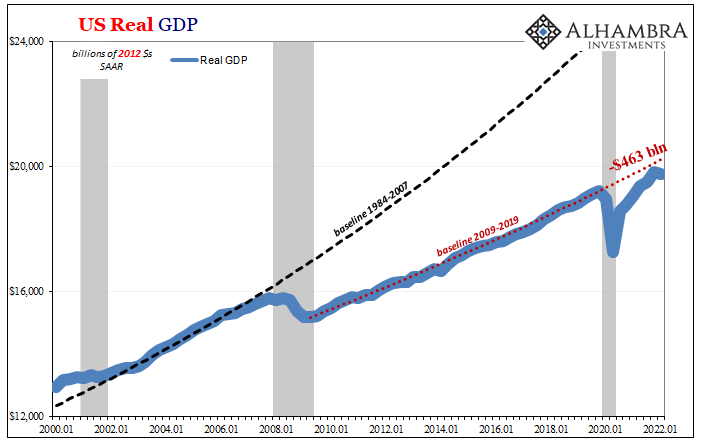

According to today’s advance estimate for first quarter 2022 US real GDP, the third highest (inflation-adjusted) inventory build on record subtracted nearly a point off the quarter-over-quarter annual rate. Yes, you read that right; deducted from growth, as in lowered it. This might seem counterintuitive since by GDP accounting inventory adds to output.

Read More »

Read More »

Historic Inventory Continued In March, But Is It All Price Illusion, Too?

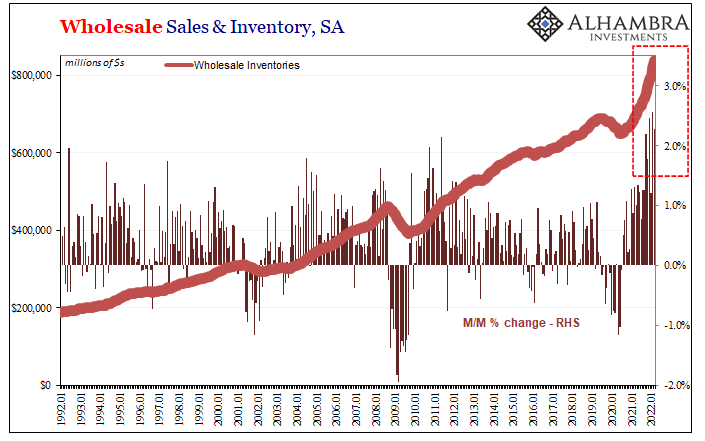

The Census Bureau today released its advanced estimates for March trade. These include, among other accounts like imports and exports, preliminary results reported by retailers and wholesalers. That means, for our purposes, inventories. Oh my, was there ever more inventory. It was, apparently, widely expected that following an avalanche of goods building up over the previous five months the situation might calm down a touch.

Read More »

Read More »

Houston, We Have An Oil (and inventory) Problem

If only, like in the aftermath of the Apollo 13 explosion, we could just radio Houston to get started in figuring out just the way out of our fix. Mission Control would certainly buzz all the right people with the right stuff, summoning the best engineers and scientists from their quiet divans to the frenzied and dangerous work ahead.

Read More »

Read More »

Briefing Even More Inventory

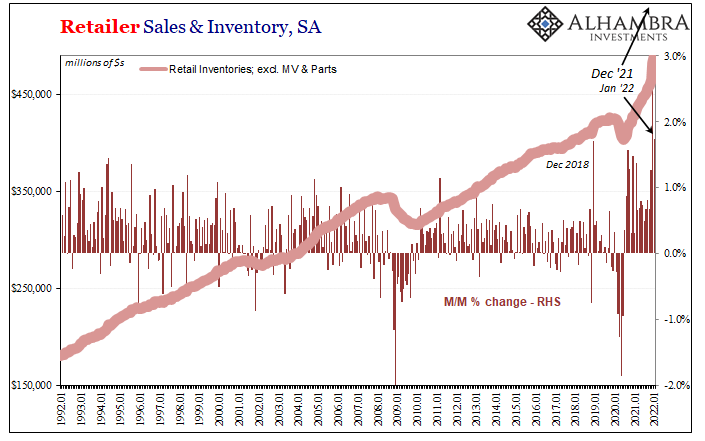

Retail sales stumbled in December, contributing some to the explosion in inventory across the US supply chain – but not all. Inventories were going to spike even if sales had been better. In fact, retail inventories rose at such a record pace beyond anything seen before, had sales been far improved the monthly increase in inventories still would’ve unlike anything in the data series.

Read More »

Read More »

FOMC Goes With Unemployment Rate While This Huge Number Happens To Far More Relevant Economic Data

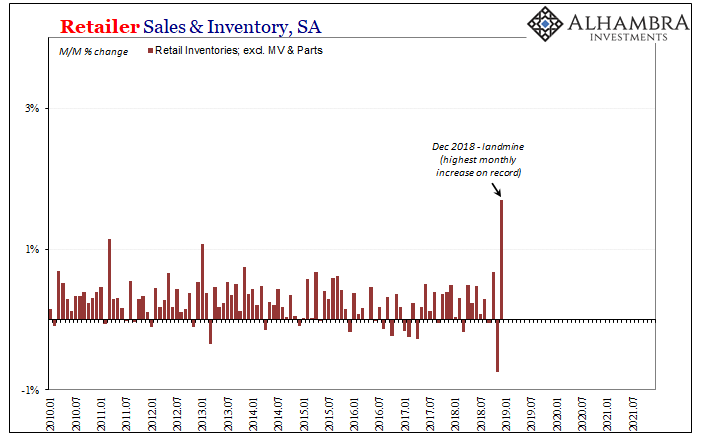

The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters.

Read More »

Read More »

GDP Red Flag

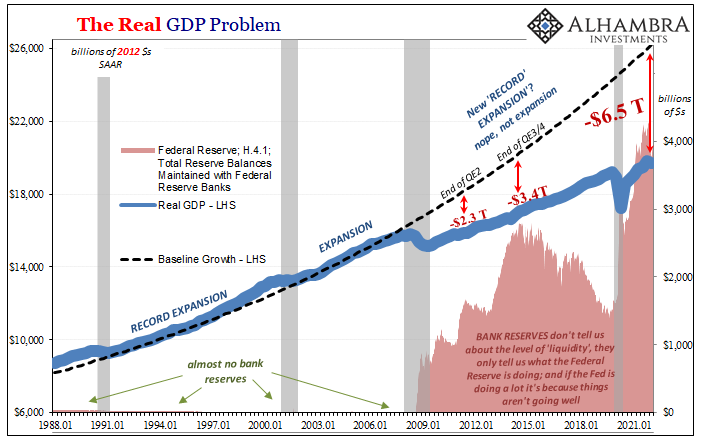

There were no surprises in today’s US GDP data. As expected, output sharply decelerated, modestly missing much-reduced expectations. The continuously compounded annual rate of change for Q3 2021 compared to Q2 was the tiniest bit less than 2% (1.99591%) given most recent expectations had been closer to 3%.

Read More »

Read More »

What *Seems* Inflation Now Is Something Else Entirely

This is yet another one of those crucial recent developments which should contribute much clarity about the economic situation, yet is exploited in other ways (political) adding only more to the general state of economic confusion. The shelves may be empty in a lot of places around the country, leaving anyone with the impression there just aren’t enough goods.

Read More »

Read More »

More About Less New Orders

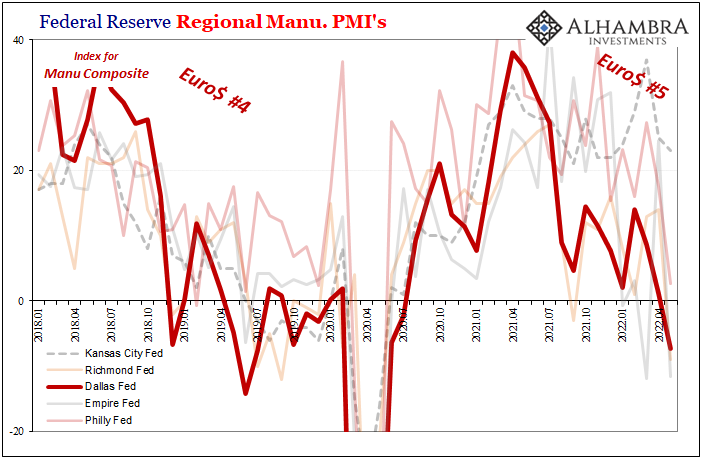

The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”).

Read More »

Read More »

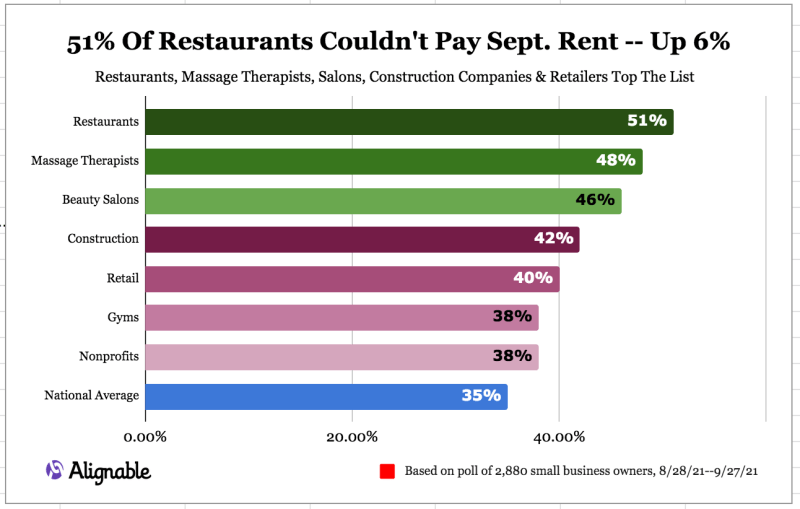

An Economy Dividing By Inventory And Labor

Is it delta COVID? Or the widely reported labor shortage? Something has created a soft patch in the presumed indestructible US economy still hopped up on Uncle Sam’s deposits made earlier in the year. And yet, there’s a nagging feeling over how this time, like all previous times, just might be too good to be true, too.

Read More »

Read More »

All Eyes On Inventory

You’ve heard of the virtuous circle in the economy. Risk taking leads to spending/investment/hiring, which then leads to more spending/investment/hiring. Recovery, in other words. In the old days of the 20th century, quite a lot of the circle was rounded out by the inventory cycle. Both recession and recovery would depend upon how much additional product floated up and down the supply chain.

Read More »

Read More »

A Real Example Of Price Imbalance

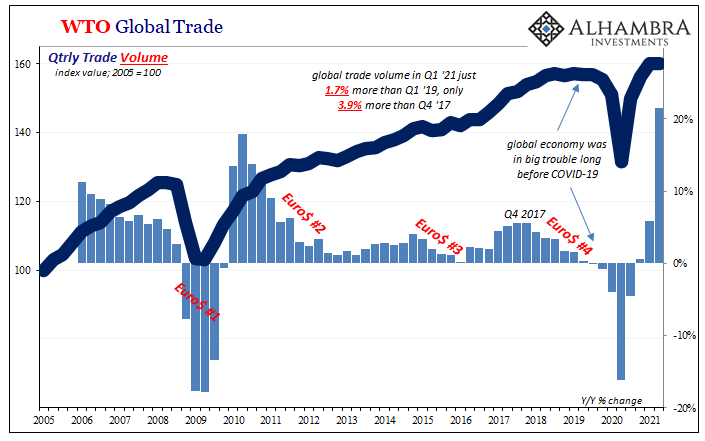

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim.

Read More »

Read More »

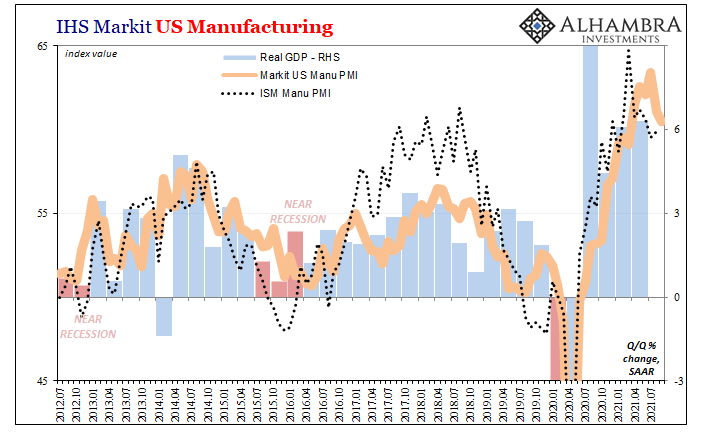

That’s Probably Why Only Half a “V”

Why only half a “V?” If the latest PMI’s are anywhere close to accurate, and they don’t have to be all that close, then the production side of the economy may have stalled out somewhere nearer the trough of this contraction. The promise of May’s big payroll report surprise has dissipated in more than just the bond market.

Read More »

Read More »

The Smallness of the Most Gigantic

These numbers do seem epic, don’t they? It’s hard to ignore when you have the greatest percentage increase in the history of a major economic account. Just writing that sentence it’s difficult to deny the power of those words. Which is precisely the point: we already know ahead of time how the biggest economic holes in history are going to produce the biggest positives coming out of them.

Read More »

Read More »