Tag Archive: IHS Markit

As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

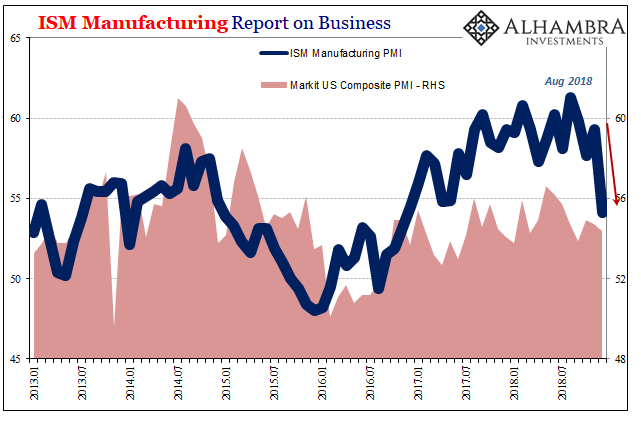

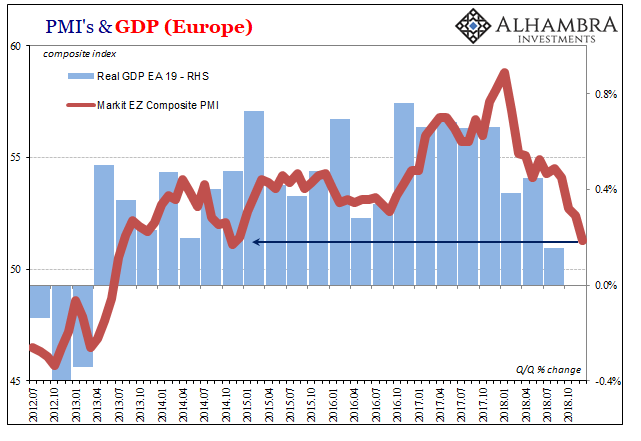

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

Read More »

Read More »

Weekly Market Pulse: Inflation Scare!

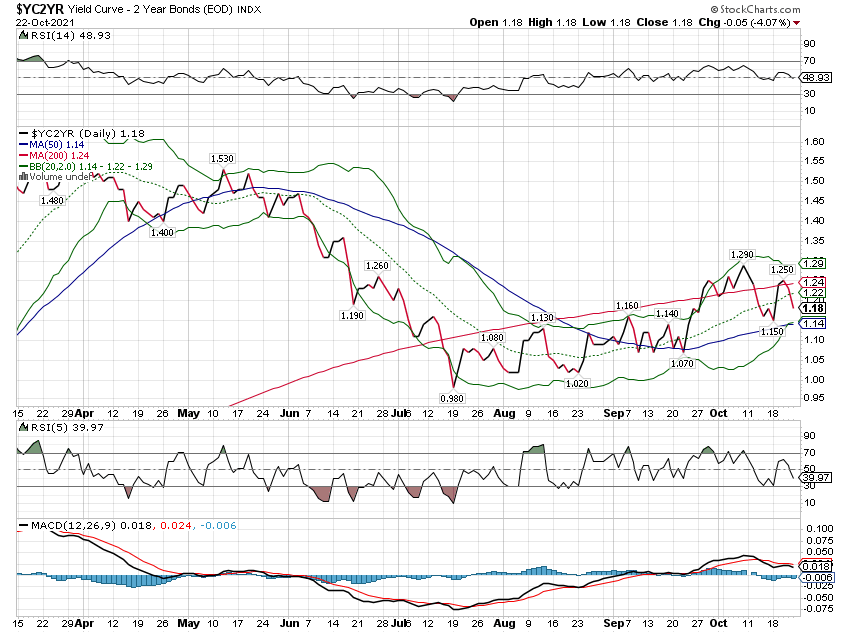

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »

All Eyes On Inventory

You’ve heard of the virtuous circle in the economy. Risk taking leads to spending/investment/hiring, which then leads to more spending/investment/hiring. Recovery, in other words. In the old days of the 20th century, quite a lot of the circle was rounded out by the inventory cycle. Both recession and recovery would depend upon how much additional product floated up and down the supply chain.

Read More »

Read More »

US Stall? Only Half The Imagined “V” May Indicate One, Too

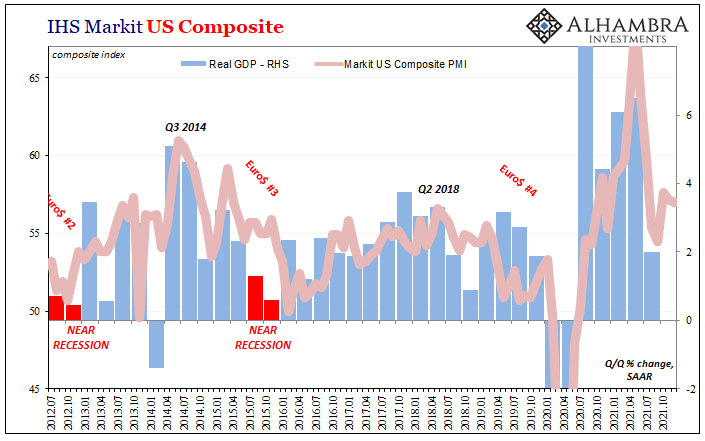

These are not numbers that are consistent with a robust rebound. In fact, they don’t indicate very much of one at all. IHS Markit’s flash PMI’s for July 2020 instead look way too much like the sentiment indicators in Germany and Japan. Though they are now back near 50, both services and manufacturing, that doesn’t actually indicate what everyone seems to think it does.

Read More »

Read More »

Manufacturing Clears Up Bond Yields

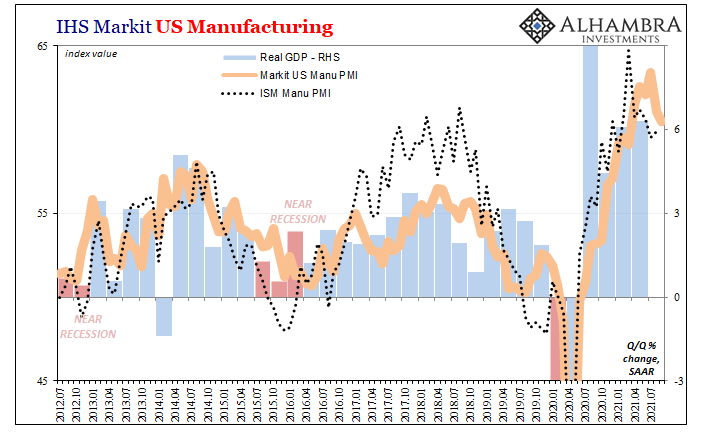

Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month.

Read More »

Read More »

Latest European Sentiment Echoes Draghi’s Last Take On Global Economic Risks

While sentiment has been at best mixed about the direction of the US economy the past few months, the European economy cannot even manage that much. Its most vocal proponent couldn’t come up with much good to say about it – while he was on his way out the door. At his final press conference as ECB President on October 24, Mario Draghi had to acknowledge (sort of) how he is leaving quite the mess for Christine Lagarde.

Read More »

Read More »

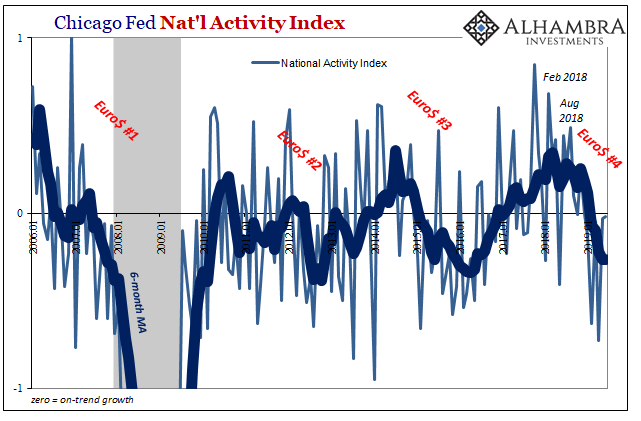

QE’s and Rate Cuts: Two Very Different Sets of Sentiment Drawn From Them

The stock market’s dichotomy grows ever wider. On the one side, record high prices which are being set by the expectations of a trade deal plus renewed worldwide “stimulus.” Sure, officials everywhere were late to see the downturn coming, but they’ve since woken up and went to work.

Read More »

Read More »

Somehow Still Decent European Descent

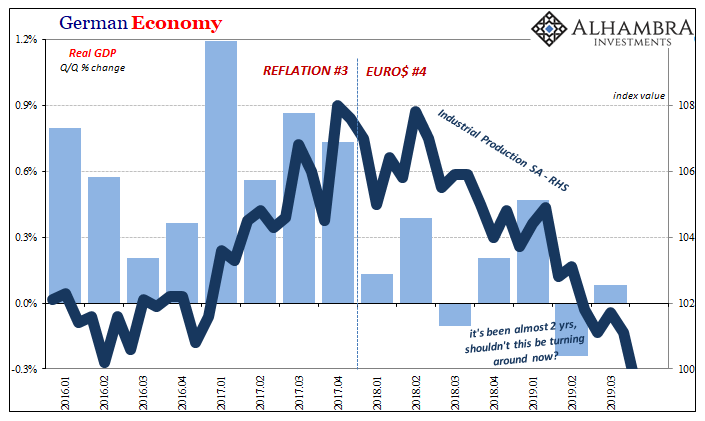

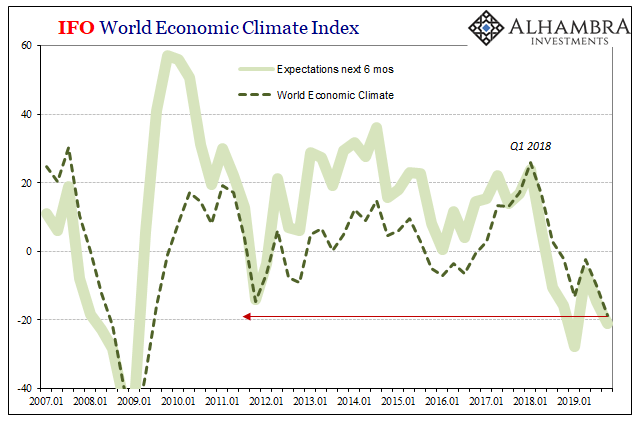

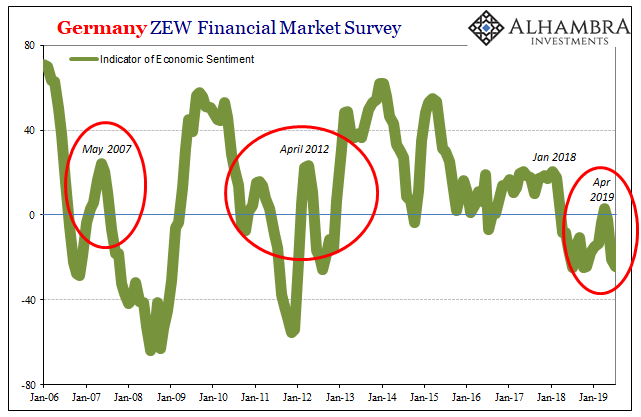

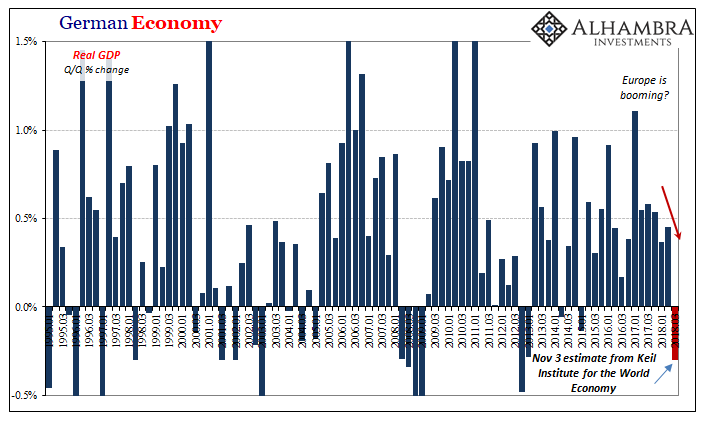

How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year.

Read More »

Read More »

More Down In The Downturn

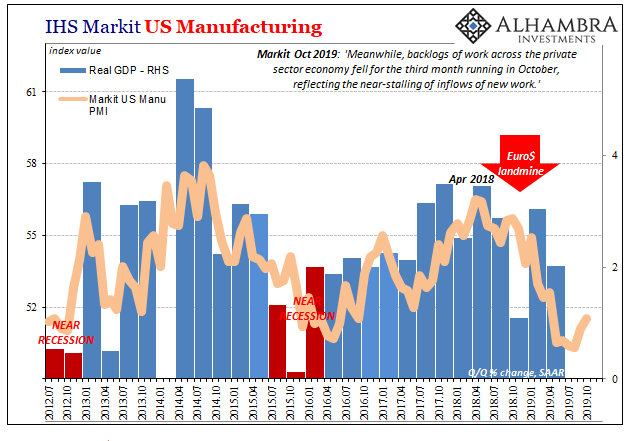

Flash PMI’s from IHS Markit for the US economy were split in October. According to the various sentiment indicators, there’s a little bit of a rebound on the manufacturing side as contrary to the ISM’s estimates for the same sector. Markit reports a sharp uptick in current manufacturing business volumes during this month.

Read More »

Read More »

No Longer Hanging In, Europe May Have (Been) Broken Down

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their...

Read More »

Read More »

US Economic Crosscurrents Reach the 50 Mark

In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat.

Read More »

Read More »

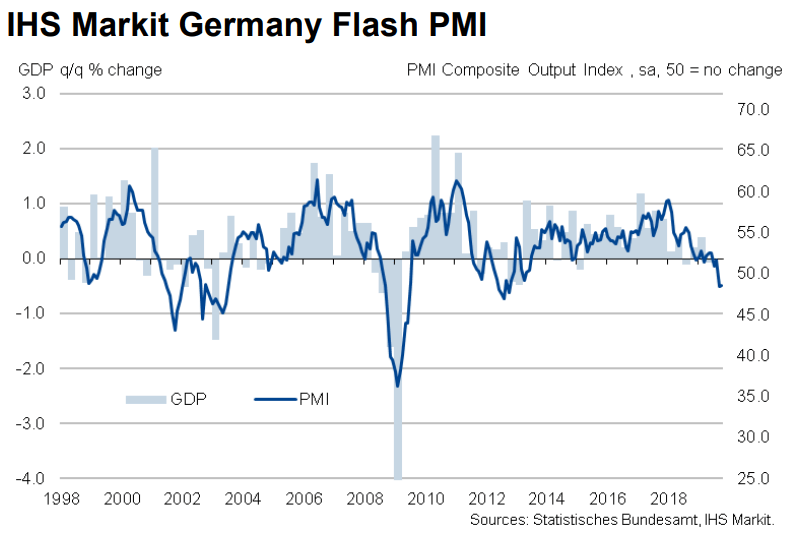

Germany Struggles On

The popular image of the German industrial machine politics is one which has Germany’s massive factories efficiently churning out goods for trade with the South of Europe (Club Med). Because of the common currency, numerous disparities starting with productivity differences had left the South highly indebted to the North just as the Global Financial Crisis would strike.

Read More »

Read More »

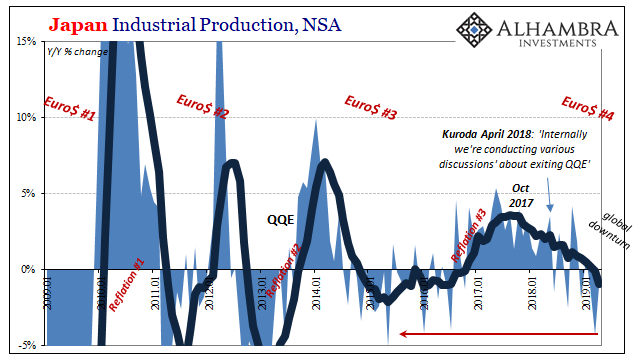

Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best.

Read More »

Read More »

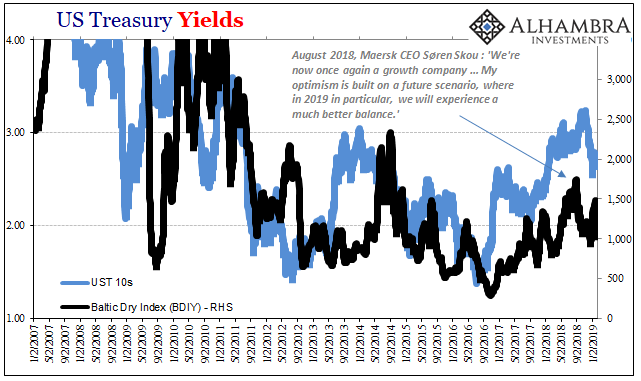

Sinking Shippers Signal Global Goods Troubles

It infects every boardroom across the world. Big business requires decent forecasting, yet time and again it seems they are deprived of what they desperately need. Instead, even after this last decade, the world’s largest companies continue to be surprised by weakness that is far more prevalent than strength.

Read More »

Read More »

If You’ve Lost The ISM…

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow.

Read More »

Read More »

Just In Time For The Circus

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up the more “they” say it’s nothing just transitory roughness.

Read More »

Read More »

The Direction Is (Globally) Clear

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception.

Read More »

Read More »

Harmful Modern Myths And Legends

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death.

Read More »

Read More »

Global PMI’s Hang In There And That’s The Bad News

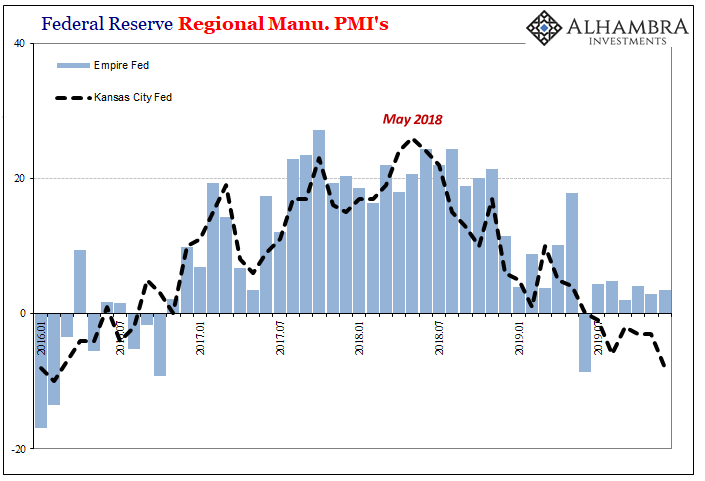

At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more.

Read More »

Read More »

The Currency of PMI’s

Markit Economics released the flash results from several of its key surveys. Included is manufacturing in Japan (lower), as well as composites (manufacturing plus services) for the United States and Europe. Within the EU, Markit offers details for France and Germany.

Read More »

Read More »