Tag Archive: Goldman Sachs

Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic.

Read More »

Read More »

U.S. Consumer Price Index, Oil Prices: Why It Will Continue, Again Continued

Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing what is just one quarter shy of...

Read More »

Read More »

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank's interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the "the BoJ comes in big, the...

Read More »

Read More »

Blocher and the People That Ruined the EU

Last weekend, European leaders gathered in Rome for the 60th anniversary of the Treaty of Rome. They discussed, not for the first time, how to get the EU back on track. And they told each other they are still committed to the Union and believe in its future. (We’ve heard that one before, too.)

Read More »

Read More »

Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum.

Read More »

Read More »

Davos: In Defense Of Populism

DAVOS MAN: “A soulless man, technocratic, nationless and cultureless, severed from reality. The modern economics that undergirded Davos capitalism is equally soulless, a managerial capitalism that reduces economics to mathematics and separates it from human action and human creativity.” – From the post: “For the Sake of Capitalism, Pepper Spray Davos”

Read More »

Read More »

Daniel Hannan – The Right Approach To Brexit

Daniel Hannan, a British member of the European Parliament (MEP), made an eloquent, impassioned speech this weekend on what should take place in Brexit talks. After listening to Hannan on Brexit, regulation and trade, I am certain he would make a far better US president than anyone in the entire field from 18 months ago.

Read More »

Read More »

NIRP Has Failed: European Savings Rate Hits 5 Year High

One year ago, when it was still widely accepted conventional wisdom that NIRP would "work" to draw out money from savers who are loathe to collect nothing (or in some cases negative interest) from keeping their deposits at the bank, and would proceed to spend their savings, either boosting the stock market or the economy, we showed research from Bank of America demonstrating that far from promoting dis-saving, those European nations which had...

Read More »

Read More »

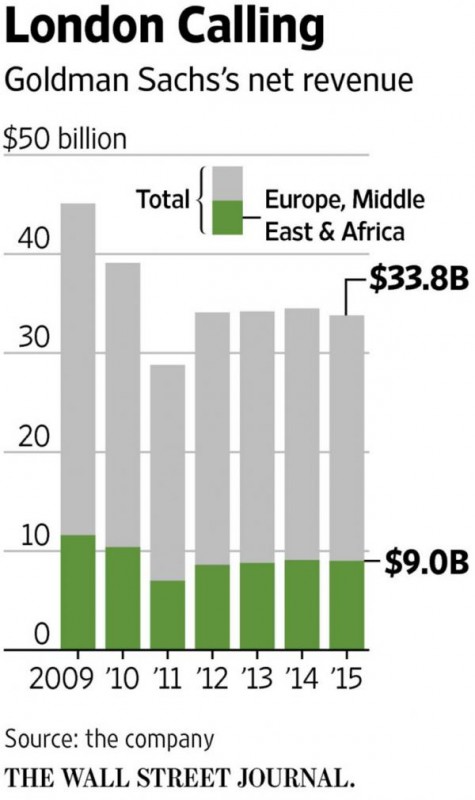

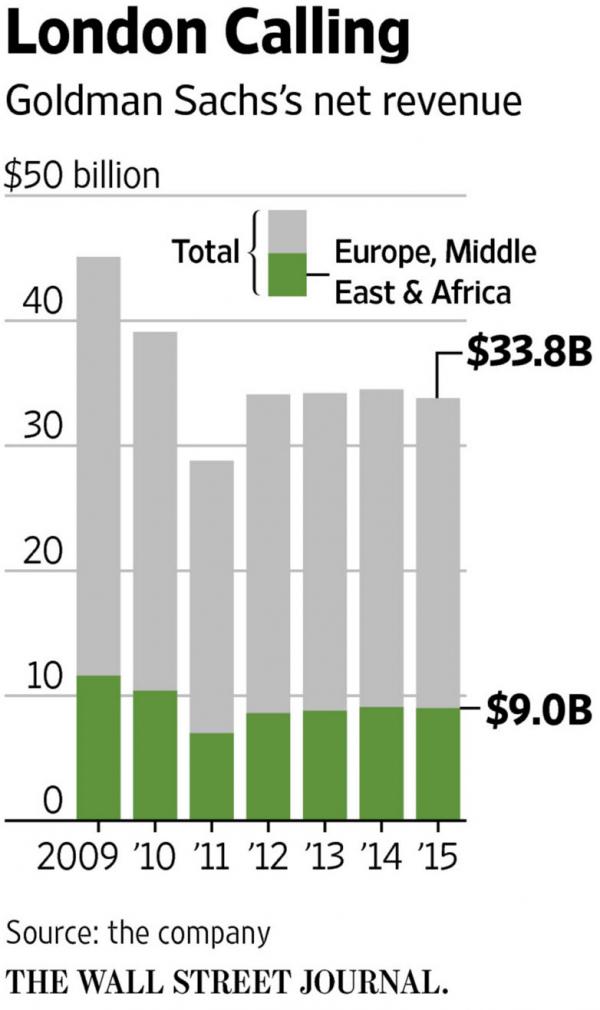

Guess Which Major Bank Loses The Most From Brexit?

Banks have been lobbying intensively against Brexit. Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU... and now we know why (hint - it's not concern fo...

Read More »

Read More »

Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into...

Read More »

Read More »