Tag Archive: Germany

Will the Market Push the Dollar Above JPY152 as Japanese Prime Minister Heads to the US?

Overview: The jump in US rates after the employment

report failed to ignite a sustained rally in the dollar and this shaken the

market's near-term confidence. The dollar has been mostly confined to narrow

ranges and the low yielding Swiss franc and Japanese yen are softest with the

G10 complex today. The dollar is knocking on JPY152. The Scandis and Antipodeans lead the advancers. The euro has

made little headway despite a much stronger than...

Read More »

Read More »

Sterling Buoyed by Labor Market Report Ahead of US CPI

Overview: The US dollar is enjoying a mostly firmer bias ahead

of today's CPI report. Sterling is the strongest among the G10 currencies after

a more resilient than expected labor market report. The dollar extended its

gains against the Japanese yen to a new high since last November, but the

market seems cautious as it approaches JPY150, where large options expire today.

On the other hand, emerging market currencies are mostly faring better. The...

Read More »

Read More »

The Greenback is in Narrow Ranges to Start the Week

Overview: The foreign exchange market is quiet. The

Lunar New Year holiday shut most Asian markets. That, coupled with the light

news in Europe, have served to keep the dollar in narrow ranges against the G10

currencies. The Swedish krona, Norwegian krone, and Japanese yen are posting

minor gains against the greenback. The New Zealand dollar, which was strongest

major currency last week (1.4%) is off by almost 0.5% today, making it the

weakest...

Read More »

Read More »

Greenback Consolidates Two-Day Surge

Overview: The US dollar is consolidating its the

two-day surge since the jobs data at the end of last week. The Reserve Bank of

Australia did not rule out additional rate hikes, and although the derivatives

markets do not think it is likely, the Australian dollar is the best performer

in the G10 today with a small gain. An unexpectedly strong German factory

orders report failed to help the euro much and it languished near yesterday's

low. Sterling...

Read More »

Read More »

Greenback Surges as Rates Back Up

Overview: The US dollar is bid across the board and posting its best session of the month. It is up between about 0.5% (Canadian dollar) to almost 1.0% (Australian dollar) among the G10 currencies. Among the emerging market currencies, only the Russian ruble is holding its own.

Read More »

Read More »

Consolidation Featured

Overview: After dramatic intraday price swings after

the US jobs data and service ISM figures before the weekend, the dollar is

consolidating today in mostly narrow ranges. The prospect for a March cut by

the Federal Reserve finished last Friday virtually unchanged (73% vs 70%) and

is about 66% chance today. There was interest in Dallas Fed's Logan's

suggestion that the tapering of QT be discussed, though it seems to simply

confirm what many has...

Read More »

Read More »

Consolidative Tone Emerges Ahead of Tomorrow’s US Jobs and EMU CPI

Overview: After gaining for the past couple of

sessions to open the New Year, the dollar is mostly softer today. The yen is

the main exception. The greenback was bid above the JPY144 area where

chunky options expire today. Most emerging market currencies are also firmer

though there are a few exceptions in Asia, like the South Korean won and Thai

baht. Still, the general tone is consolidative ahead of tomorrow US jobs data

and the eurozone's CPI....

Read More »

Read More »

Canadian Dollar Plays A Little Catch-Up, Rises to best Level in Nearly Seven Weeks

Overview: The US dollar is narrowly mixed against

the G10 currencies. The Canadian and Australian dollars lead the advancers,

while the Scandis are pacing the losers off 0.1%-0.2% in quiet turnover. Most

the freely accessible emerging market currencies are sporting softer profiles

today, the Chinese yuan is among them. However, most Asia Pacific currencies,

are firmer. Benchmark 10-year yields were softer in the Asia Pacific region in

mostly a...

Read More »

Read More »

Dollar Consolidates Amid Rate Volatility

Overview: The dollar is consolidating its

recent moves as interest rate swings continue. The US two-year yield has traded

in a nearly 28 bp range in the first two sessions this week, and near 4.88%

now, it is 18 bp lower since last Friday's close. The 10-year yield is slipping

below 4.50%. It reached almost 4.70% on Monday and had fallen to almost 4.40%

yesterday. Part of this reflects the shift in overnight rate expectations. The

implied yield of...

Read More »

Read More »

US CPI Front and Center, but Can Congress Avert a Government Shutdown?

Overview: The dollar is somewhat better offered

today ahead of the October CPI report. The US House of Representatives may hold

a vote today on a continuing resolution to avoid a partial government shutdown

at the end of the week. Narrow ranges have prevailed. Most emerging market currencies

are firmer, though paradoxically, the South Korean won is the weakest, despite

a strong equity market rally (~1.2%), encouraged by the first in increase in...

Read More »

Read More »

Food Prices Drive China’s CPI Lower while the Greenback is Mostly Firmer in Narrow Ranges

Overview: The dollar is mostly firmer against the

G10 currencies and has been confined to tight ranges through the European

morning. Outside of the China's deflation and Japan's monthly portfolio flow

data that showed Japanese investors bought the most amount of US Treasuries

(~$22 bln) in six months in September, the news stream is light. Most emerging

market currencies are trading with a softer bias today. The Philippine peso is

the strongest...

Read More »

Read More »

The Dollar’s Recovery has been Extended, but it may Give North American Operators a Better Selling Opportunity

Overview: The dollar's sell-off last week was

extreme and it recovered yesterday and through the European session today. The

Australian dollar has been hit the hardest. It is off more than 1% today after

the RBA lifted the cash rate by 25 bp (to 4.35%). Still, the US dollar's gains

have stretched intraday momentum indicators, suggesting the upside correction

may be nearly over. The greenback's moves appear to have been driven by

interest rate...

Read More »

Read More »

DZ BANK startet eigene Crypto Verwahrung

Deutschland’s DZ BANK hat eine neue Plattform für die Abwicklung und Verwahrung digitaler Finanzinstrumente in Betrieb genommen.

Damit gehört das genossenschaftliche Institut zu den ersten Kreditinstituten, die auf Basis der Blockchain-Technologie ein solches Angebot für institutionelle Kunden auf den Weg gebracht haben. Die DZ BANK ist mit einem Volumen von über 300 Mrd. EUR nach BNP Paribas und State Street die drittgrößte Verwahrstelle in...

Read More »

Read More »

Divergence Continues to Underpin the Greenback

Overview: The divergence reflected in the flash PMI

readings seen yesterday underpinned the dollar, which is firmer in mostly quiet

turnover. The initial Australian dollar gains scored in response to the

slightly less decline in Q3 CPI have been unwound. The greenback also remains

within striking distance of JPY150 where there are still some large options and

some apprehension over possible BOJ intervention. Hungary's larger than expected

rate cut...

Read More »

Read More »

Markets Remain on Edge

Overview: The markets remain on edge. The press

reports US President Biden is planning an imminent trip to Israel while Iran

warns of "multiple fronts" against Israel if the attacks on Gaza

continued. The dollar, which was offered yesterday, is better bid today. Still,

the capital markets are relatively quiet. Even the Swiss franc, which was the

strongest G10 currency last week (~0.9%) is slightly heavier today. Among

emerging market...

Read More »

Read More »

Bonds Extend Recovery

Overview: Broadly speaking, the dollar's

recent pullback was extended today but the momentum appears to be slowing,

perhaps ahead of tomorrow's US CPI report. The Dollar Index slipped to its

lowest level since September 25 before steadying. The greenback is mixed as the

North American market is set to open. The dollar bloc and Swedish krona are the

underperformers. The Swiss franc is the best, up about 0.2%, while the yen and euro are little...

Read More »

Read More »

War in Israel Spurs Flight to Dollars, Yen and Gold, While Driving up the Price of Oil

Overview: There are three main developments. First,

the market is digesting the implication of the US employment data, where the

optics were strong (336k increase in nonfarm payrolls compared with 170k median

forecast in Bloomberg and Dow Jones surveys) but some details were

disappointing (like the third consecutive decline in full-time posts,

seasonally adjusted). Second, Chinese mainland market re-opened after a six-day

holiday). Chinese stocks...

Read More »

Read More »

US Employment Data to Determine Whether the Greenback’s Rally since mid-July is Over…Maybe

Overview: One key issue for market participants is

if the dollar's pullback is the beginning of something important or is largely

position adjusting ahead of today's US jobs report. We suspect that the

dollar's rally that began in mid-July is over, though a strong employment

report that boosts the chances of a Fed hike before year-end could quickly

demonstrate the folly of making claims ahead of what is still one of the most

important reports in...

Read More »

Read More »

Looming US Government Shutdown Stems the Dollar’s Surge

Overview: The increasingly likely partial US federal

government shutdown has spurred a bout of liquidation of long dollar positions.

The psychologically important JPY150 level was approached, and the euro was

sold through $1.05 yesterday, and the greenback has come back better offered

today. It is lower against all the G10 currencies. It is mixed against the

emerging market currency complex, with central European currencies and South

African rand...

Read More »

Read More »

Funding Overview Blockchain Germany 2023

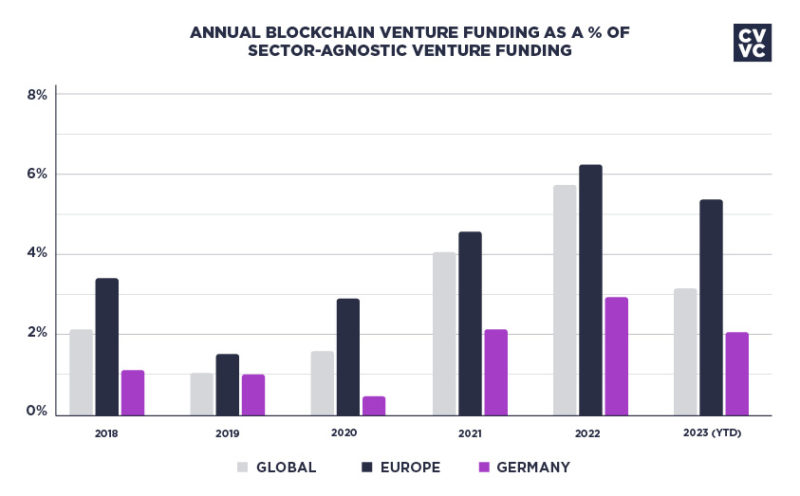

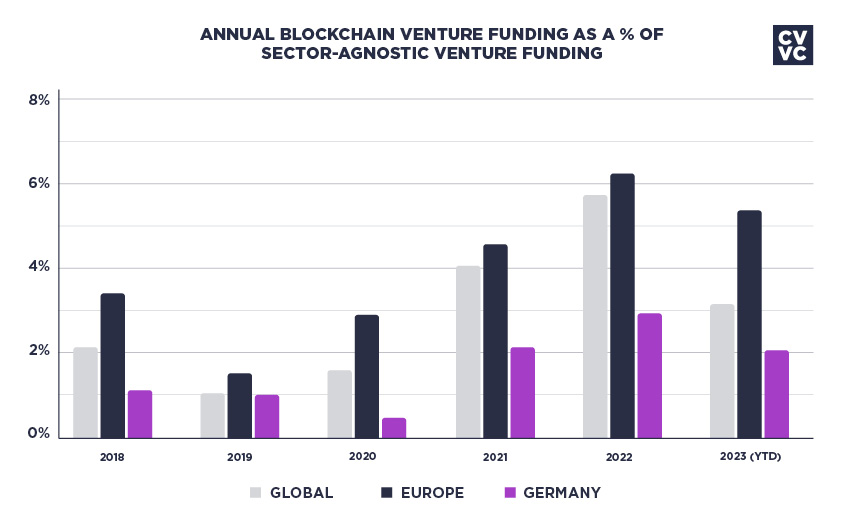

The CV VC German Blockchain Report 2023 highlights Germany’s remarkable achievements in the blockchain sector, unveiling a 3% increase in blockchain funding and an all-time high share of global funding.

Covering data from Q3 2022 to Q2 2023, the report reveals that the German blockchain sector experienced an impressive 3% year-over-year increase in funding, totaling $355 million across 34 deals. In contrast, all continents saw YoY funding declines,...

Read More »

Read More »