Tag Archive: GDP

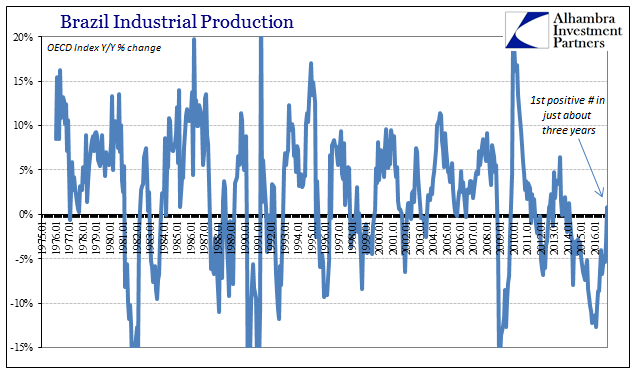

Brazil: Continuing Problems

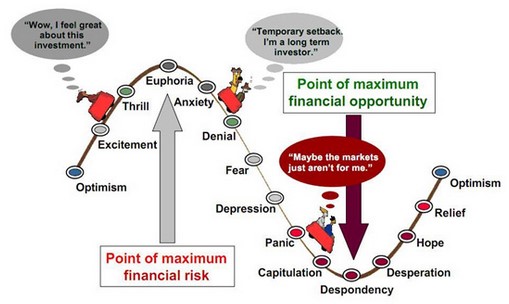

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it.

Read More »

Read More »

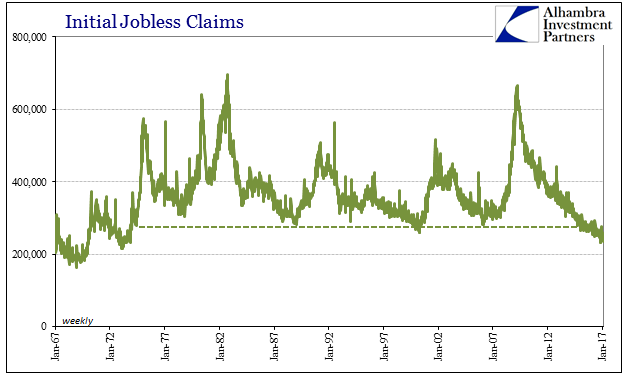

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »

Great Graphic: GDP Per Capita Selected Comparison

US population growth has been greater than other major centers that helps explain why GDP has risen faster. GDP per capita has also growth faster than other high income regions. The US recovery is weak relative to post-War recoveries but it has been faster than anticipated after a financial crisis and shows little evidence of secular stagnation.

Read More »

Read More »

Great Graphic: How the US Recovery Stacks Up

The US recovery may have surpassed the 2001 recovery in Q2. Though disappointing, the recovery has been faster than average from a balance sheet crisis. Although slow, it is hard to see the secular stagnation in the data.

Read More »

Read More »

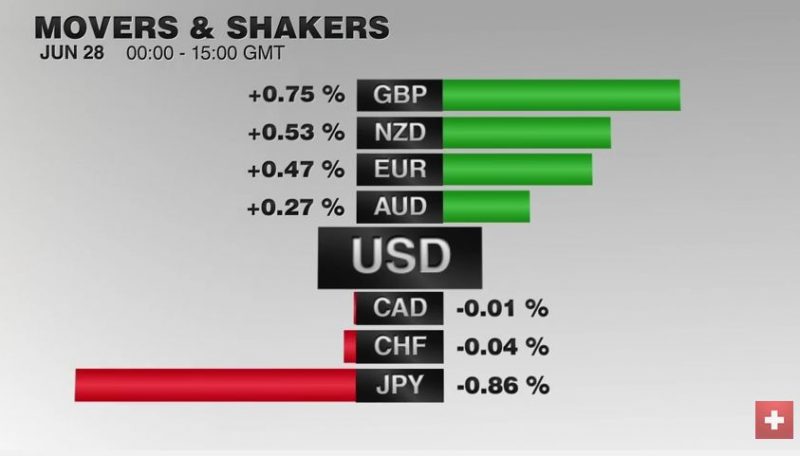

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

The Fed Doomsday Device

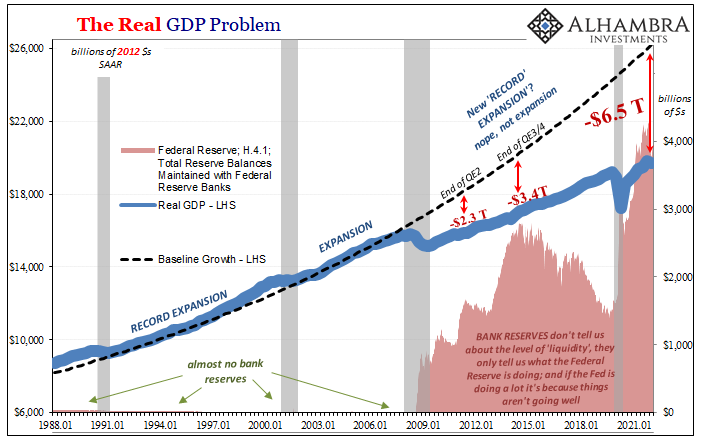

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply.

The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic.

Read More »

Read More »

The Power Elite: Bumbling Incompetents

Is there any smarter group of homo sapiens on the planet? Or in all of history? We’re talking about Fed economists, of course.

Not only did they avoid another Great Depression by bold absurdity…giving the economy more of the one thing of which it clearly had too much – debt. They also carefully monitored the economy’s progress so as to avoid any backsliding into normalcy.

Read More »

Read More »

Kuroda-San in the Mouth of Madness

Deluded Central Planners Zerohedge recently reported on an interview given by Lithuanian ECB council member Vitas Vasiliauskas, which demonstrates how utterly deluded the central planners in the so-called “capitalist” economies of the West have bec...

Read More »

Read More »

Retirement Torpedoes and Democracy

Bonner compares Total credit market debt, federal government debt and GDP – an economy running on debt, and now running on empty.

Read More »

Read More »

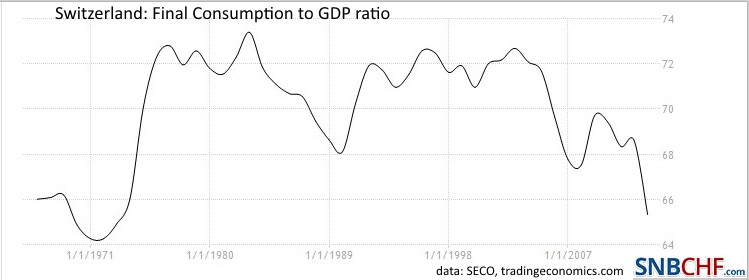

Swiss GDP 2014 +1.9%. Trade Surplus Contributed More than Half, Consumption Lagged

According to the figures of Swiss Statistics, the Swiss trade surplus rose by 10.4% in 2014. Therefore its contribution to the 2014 real GDP is higher than 50%. Private consumption lagged compared to the other components of Gross Domestic Product.

Read More »

Read More »

(12) FX Rates, Contrarian Investments and the Misleading Concept Called GDP

We extended our existing post to contrarian investing. It was published on Seeking Alpha and awarded the Editor's Pick.

Gross Domestic Product(ion) is (or has become) a measurement of activity and consumption, but not of capital accumulation and production.

In many cases, GDP growth is negatively correlated to saving. Higher savings (aka austerity) leads to lower GDP growth today, but to higher GDP in the future.

In its worst case, GDP growth...

Read More »

Read More »

Heterodox Economic Theories and GDP

Heterodox economic theories focus on the human desires to spend, to save, to obtain credit in order to anticipate spending and future earnings, to increase or to reduce debt or even to deplete existing savings, on human behaviour. Those theories neither think that humans are rational nor that markets are efficient.

Read More »

Read More »

The Misleading Concept Called GDP

GDP is (or has become) a measurement of activity and consumption but not of capital accumulation and production.

In many cases, GDP is negatively correlated to savings. Higher savings (aka austerity) lead to lower GDP today, but higher GDP in the future.

In its worst case, GDP growth could be completely based on credit, eliminating the capital basis of a country (example Greece).

Western countries saw rising housing investments based on more...

Read More »

Read More »

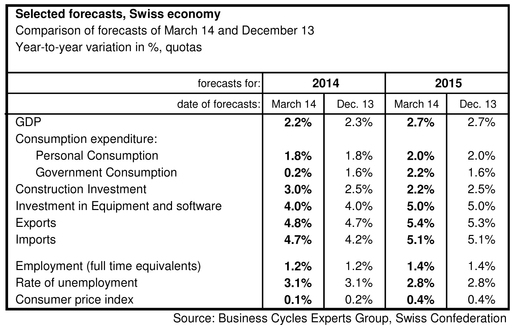

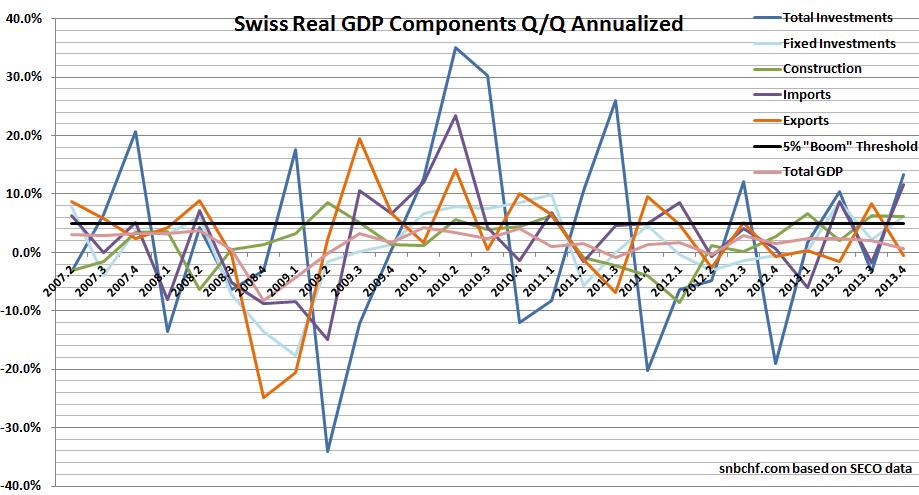

GDP: Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money

According to the latest data from the SECO,Swiss GDP rose by 0.2% in Q4/2013. Despite the relatively weak headline, the detailed data showed a couple of characteristics that speak for an upcoming boom. At the same time, the Swiss National Bank is printing money again: both the monetary base and money supply are increasing.

Read More »

Read More »

An Upcoming Italian Success Story?

Higher exports show that Italy's economy is trying to become a new German Companies seem to hide their competitiveness. A question remains: Will Italian companies really invest in Italy and create jobs?

Read More »

Read More »

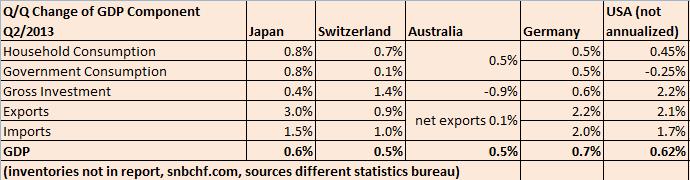

Swiss Q2 GDP Details Compared to Japan, Germany, Australia and U.S.

The Swiss GDP for Q2/2013 was in line with its peers in developed countries. The quarterly (not annualized) change was +0.5% compared to 0.6% for Japan and the United States, +0.7% for Germany and +0.5% for Australia. Swiss and Japanese growth was driven more by consumption, while the U.S. advances were based more on …

Read More »

Read More »

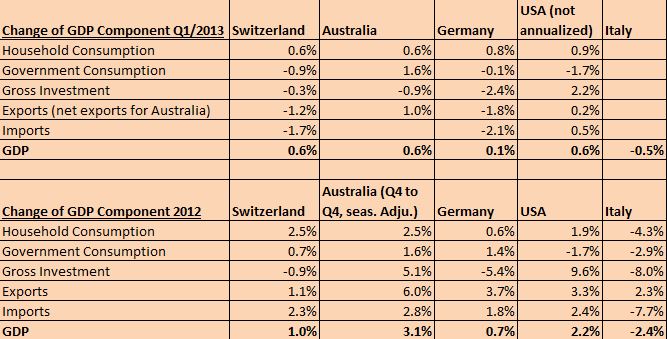

Q1 GDP: Japan +1.0%, AUS, Swiss +0.6%, US +0.45%, Germany +0.1%, Italy -0.5%

Update June 26: The Swiss economy has grown more quickly than the United States in Q1 2013. Japan is in the lead of the global comparison with 1.0% quarterly growth, Australia and Switzerland follow with 0.6%, the US has 0.45% QoQ (or 1.8% annualized), Germany 0.1% and Italy slowed by -0.5%. Weakest currency, strongest … Continue...

Read More »

Read More »

GDP Comparison BRICS Developed Markets

Beautiful charts by Goldman's Jim O'Neill that help to understand the former and future growth of different emerging, "growth markets", the BRICS. We criticise his partially over-optimistic views.

Read More »

Read More »