Overview: The dramatic shift in expectations for Fed

policy is a potent shock, with reverberations throughout the capital markets.

The business press was full of accounts putting the nearly 50 bp decline in the

US two-year note in an historical perspective. Yesterday, it fell by 61 bp as

the market continued to unwind Fed hikes and reprice the chances of a cut as

early as Q2. While the poorly received bill auctions suggests not significant

deposit...

Read More »

Tag Archive: Financial crisis

Quantitative Easing: A Boon or Curse?

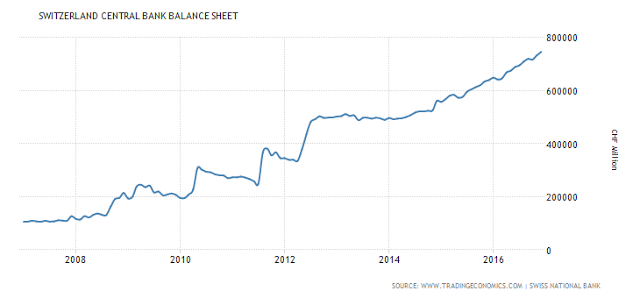

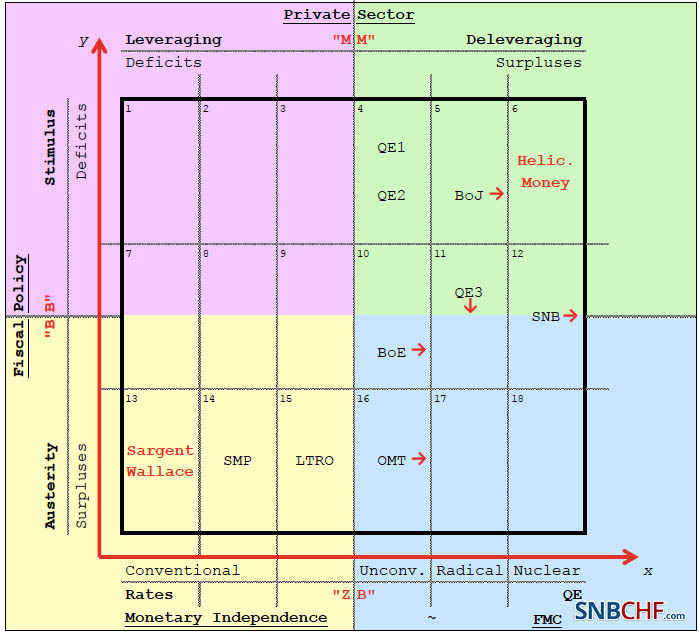

Central banks’ massive Quantitative Easing (QE) programs have come under scrutiny many times since the central banks fired up the printing press and began quantitative easing programs en masse after the 2008-09 Great Financial Crisis.

However, the increase in central bank assets due to quantitative easing programs during the crisis pale in comparison to the QE programs during the Covid pandemic.

As economies recovered after the...

Read More »

Read More »

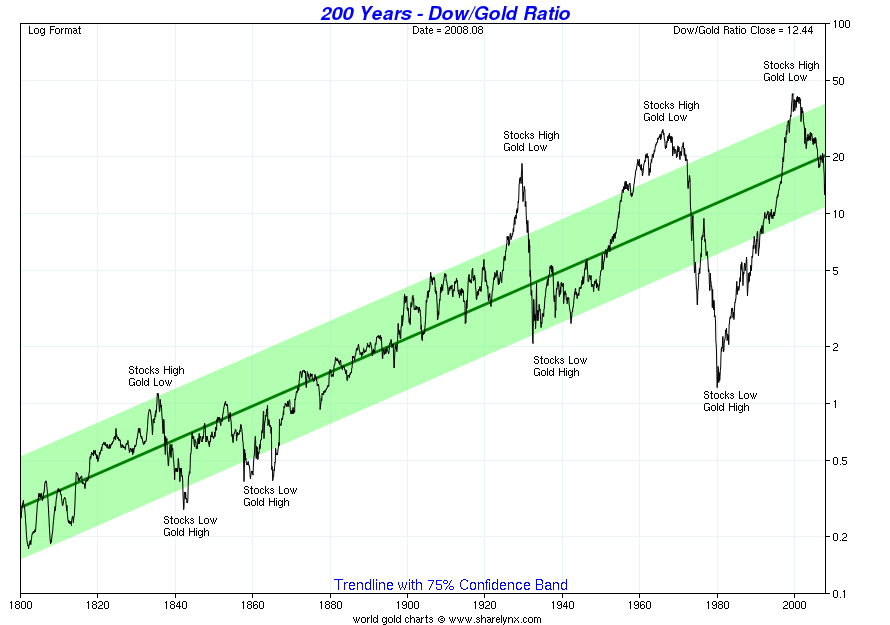

What lies ahead for gold in 2020

Over the last few months, gold’s performance has been remarkable. Many market observers and mainstream analysts have pointed to various geopolitical developments in their efforts to explain away the bullishness as a reaction to whatever happens to be in the headlines at the time.

Read More »

Read More »

The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies.

Read More »

Read More »

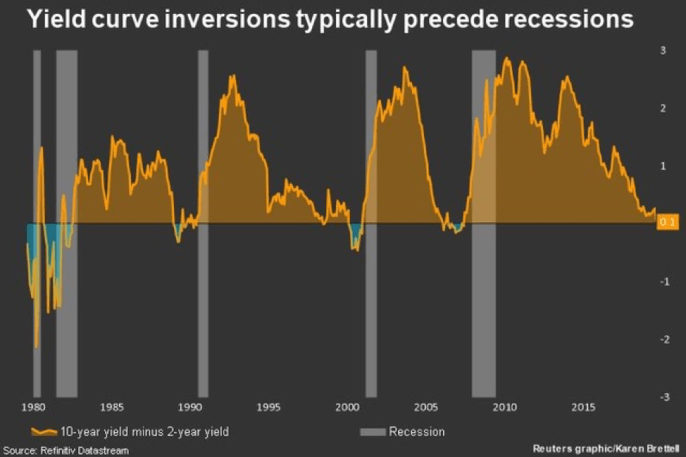

A turning point in the bond market?

We’ve recently seen a lot of coverage and even more “expert analyses” on the state of the bond market, to the extent that the average investor, or the average citizen for that matter, is likely to be overwhelmed and very confused about what it all means. Experts from the institutional side and defenders of the current monetary direction argue that it is all the result of policy choices, that’s it’s all under control and that we really shouldn’t...

Read More »

Read More »

The VIX Will Be Over 100 due to Central Bank Created Tail Risk

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

Read More »

Read More »

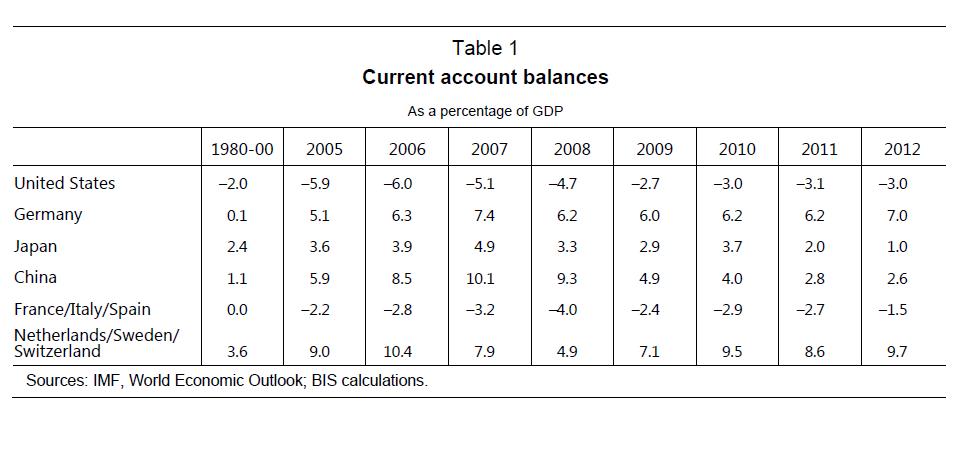

Overlending and Global Imbalances in Current Accounts

Some extracts from BIS Working Papers No 419 Caveat creditor: The Bank for International Settlement stresses the importance of getting "overlending" under control.

Read More »

Read More »

Italy: A Sustained US Recovery Will Make a Eurozone Split Up Possible

We reckon that a sustained US recovery will make it possible that the eurozone splits up. Today's Italian elections are maybe the start of an upcoming Italian euro exit.

Read More »

Read More »

Gold, Stocks & Commodities- A Complicated Correlation

2021-08-07

by Stephen Flood

2021-08-07

Read More »