Tag Archive: federal-reserve

Market Hears a Dovish Fed and Sells the Greenback

Overview: The Federal Reserve triggered a dollar

sell-off yesterday and follow-through selling was seen in Asia before

profit-taking emerged. That created a new dollar selling opportunity in early European

turnover. The FOMC revised up this year's growth forecast, shaved the

unemployment projection, and while maintaining the PCE deflator forecast, and

the median dot remained for three cuts this year. The soft-landing scenario was

underscored and...

Read More »

Read More »

China Returns, the US is on Holiday, and the Dollar Consolidates

Overview: US markets are closed for President's Day,

while China's markets re-opened from the long Lunar New Year holiday. Mainland

stocks advanced, while the yuan slipped slightly. The US dollar is mostly

softer but in narrow ranges. The Antipodeans and yen lead, while the Swiss

franc the only G10 currency that is slightly softer. Most emerging market

currencies are lower, led by about a 0.5% loss of the South African rand. The

Mexican peso's and...

Read More »

Read More »

Sterling Buoyed by Labor Market Report Ahead of US CPI

Overview: The US dollar is enjoying a mostly firmer bias ahead

of today's CPI report. Sterling is the strongest among the G10 currencies after

a more resilient than expected labor market report. The dollar extended its

gains against the Japanese yen to a new high since last November, but the

market seems cautious as it approaches JPY150, where large options expire today.

On the other hand, emerging market currencies are mostly faring better. The...

Read More »

Read More »

Greenback Consolidates Two-Day Surge

Overview: The US dollar is consolidating its the

two-day surge since the jobs data at the end of last week. The Reserve Bank of

Australia did not rule out additional rate hikes, and although the derivatives

markets do not think it is likely, the Australian dollar is the best performer

in the G10 today with a small gain. An unexpectedly strong German factory

orders report failed to help the euro much and it languished near yesterday's

low. Sterling...

Read More »

Read More »

US Dollar Offered Ahead of Employment Data after US 10-year Yield Set New Low for the Year

Overview: The dollar is offered ahead of today's US

jobs report, even though expectations are for solid if not spectacular jobs

growth of around 185k. The Australian and New Zealand dollars are leading

today's move, while the euro approached $1.09, which it has not traded above

this week. Sterling neared the lower end of its $1.26-$1.28 trading range

yesterday and set a new high for the week today, slightly above $1.2770. Emerging

market currencies...

Read More »

Read More »

The Euro and Australian Dollar Take Out January Lows to Start the New Month

Overview: Federal Reserve Chair push against

speculation of a March rate cut as explicitly as could be imagined at

yesterday's press conference lifted the dollar, while weighing on stocks. US

regional banks sold off sharply yesterday, and challenges emanating from US

real estate adversely impacted a Japan's Aozora Bank and Deutsche Bank

quadrupled its loss provisions for such exposure. The greenback remains bid. The

euro and Australian dollar have...

Read More »

Read More »

Oil Retraces Initial Surge, Euro Slips to Marginal New Low, while Sterling Hugs $1.27

Overview: Key developments today include the Hong

Kong court ordered liquidation of China's Evergrande and the reversal of oil

prices after a sharp rally initially in Asia after separate attack in the

Middle East that killed US troops in Jordan and struck a Russian oil tank in

the Red Sea. March WTI, which settled near $78 ahead of the weekend, its best

level since the end of last November, rallied to about $79.30 before returning

to almost $77.50...

Read More »

Read More »

China Equity Slump Continues, while Dollar Extends Consolidation

Overview: The foreign exchange market is quiet to

start the new week. As the North American session is about to begin, the dollar

is mostly +/- 0.10% against most of the G10 currencies. The Swedish krona is

the notable exception, rising about 0.25% against the US dollar amid good

demand for its bonds today. Emerging market currencies are mostly lower. The

Taiwanese dollar is the strongest in the complex so far today, rising about

0.30% against the...

Read More »

Read More »

War is the health of the State

Part II of II by Claudio Grass, Hünenberg See, Switzerland

This is precisely what the State is doing. The idea of war, mayhem and destruction being economic boosters is exactly what has supported the thin facade that politicians like to place over their greed and their personal gain that they derive from the military industrial complex. “It’s good for the country”, is certainly easier to sell than “it’s good for me and my reelection...

Read More »

Read More »

US CPI Front and Center, but Can Congress Avert a Government Shutdown?

Overview: The dollar is somewhat better offered

today ahead of the October CPI report. The US House of Representatives may hold

a vote today on a continuing resolution to avoid a partial government shutdown

at the end of the week. Narrow ranges have prevailed. Most emerging market currencies

are firmer, though paradoxically, the South Korean won is the weakest, despite

a strong equity market rally (~1.2%), encouraged by the first in increase in...

Read More »

Read More »

US Treasury Yields Come Back Softer After Moody’s Cut Outlook, and the Dollar Rises to New Highs Against the Yen

Overview: The dollar is beginning the new week

narrowly mixed against the G10 currencies. Sterling seems largely unaffected by

the cabinet reshuffle that has seen former Prime Minister Camron return as the

foreign minister, replacing Cleverly who replaces Home Secretary Braverman. The

dollar rose to new highs for the year against the Japanese yen (~JPY151.85). The

market has shown little reaction to the pre-weekend news that Moody's cut the

outlook...

Read More »

Read More »

Who Changed: Powell or the Market?

Overview: A poor reception to the 30-year

Treasury sale and Federal Reserve Powell pledged to raise rates again, if

necessary, not exactly a new ground, but it spooked the doves--driving rates sharply higher and fueling a strong

dollar recovery. There was a large five basis point tail on the bond sale. The

eight-day rally in the S&P 500 and nine-day advance in the NASDAQ was

snapped like dry kindling. The S&P 500 comes into today down on...

Read More »

Read More »

The Dollar Remains Mostly Softer but Near-Term Consolidation is Likely

Overview: The US dollar, which was sold last week

after the FOMC and soft employment report, remains on the defensive today. The

Antipodean currencies and yen are struggling, but the other G10 currencies are

firm. The dollar is also lower against most emerging market currencies. Still,

given the magnitude of the dollar's pullback, we suspect some consolidation is

likely.Asia Pacific equities rallied,

helped by the sharp gains in the US before the...

Read More »

Read More »

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

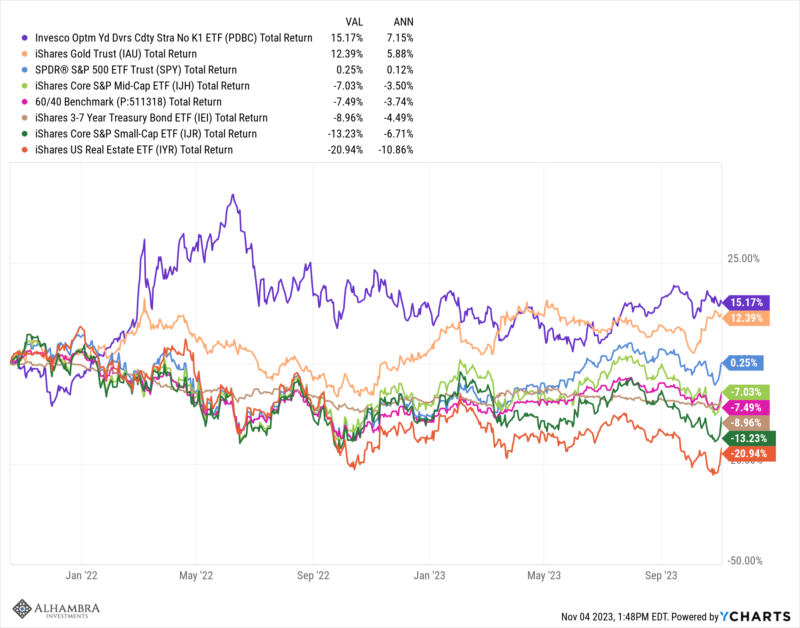

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »

Dollar Extends Losses Post-FOMC

Overview: We suspect that if Martians read the FOMC

statement, which was nearly identical to the September statement and listened

to Chair Powell, they would conclude there was nothing new. Yet, the market

habitually hears Powell as dovish and this has weighed on rates and the dollar,

while lifting risk appetites. Follow-through selling of the greenback has

dragged it lower against all the major currencies, with the Antipodean leading

the way, and...

Read More »

Read More »

Japanese Fireworks Continue as the Market Turns to the FOMC

Overview: The FOMC meeting is today's highlight but

the drama in Japan continues to rivet the market. The Ministry of Finance

warned of the risk of material intervention in the foreign exchange market, and

the BOJ bought bonds in an unscheduled operation a day after its downgraded the

1.0% cap to a reference rate, whatever that means. The yen is trading with a

slightly firmer bias. The Swiss franc is also trading a little firmer, but the

other G10...

Read More »

Read More »

The Dollar Continues to Press Against JPY150; Risk Off Ahead of the Weekend

Overview: True to the market's penchant, it heard a

dovish Fed Chair Powell yesterday. He seemed to suggest that the bar to another

hike was high. This helped cap the 10-year yield just in front of 5.00% and

allowed foreign currencies to recover against the dollar. The US two-year yield

reversed lower after rising above 5.25%. It is now around 5.15%. Still, Powell

appeared to cover similar ground as several other officials, including Fed

governors...

Read More »

Read More »

Greenback Consolidates Ahead of September CPI

Overview: The dollar is mixed against the G10

currencies. It is confined to narrow ranges ahead of today's CPI report. The

Russian ruble is the strongest of the emerging market currencies following the

imposition of new capital controls, forcing many exporters to repatriate their

foreign earnings. After posting a key upside reversal at the end of last week,

gold continues to recover. It nearly $1883 so far today, the best level in more

than two...

Read More »

Read More »

Dollar Edges to New High for the Year against the Japanese Yen, While Developer Woes Hit Chinese Stocks and Yuan

Overview: The US dollar begins the new week on a

firm note. It is trading at new highs for the year against the Japanese yen and

is bid against nearly all the G10 currencies, though the Swedish krona and

Canadian dollar are resisting the greenback's push. Most emerging market

currencies are heavier, with the Polish zloty and a few East Asian currencies

holding their own. Gold is trading with a heavier bias near $1922, but within

the ranges seen at...

Read More »

Read More »