Tag Archive: Featured

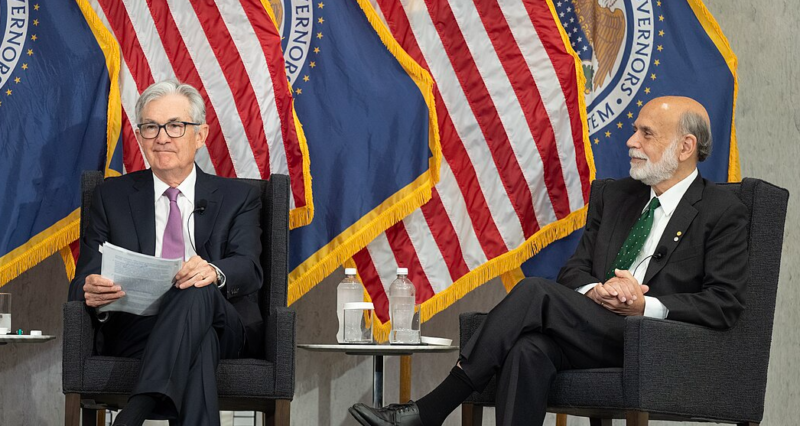

The Death of Easy Money Has Been Greatly Exaggerated

Reports on the death of the present cycle of politically motivated monetary easing, in the words of Mark Twain, grossly exaggerated. Contemporary market analyses are full of how the Fed and ECB are dialing back on previous hints of Spring 2024 rate cuts. In tune with this, commentators are lauding the central banks, especially the Fed, for a show of political independence as elections approach.

The bigger picture though suggests otherwise. In the...

Read More »

Read More »

Kein Stress mehr mit Unterlagen | Geld ganz einfach

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_cDlg5sX0iS4

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_cDlg5sX0iS4

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_cDlg5sX0iS4

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_cDlg5sX0iS4

Justtrade

Traders Place* ►...

Read More »

Read More »

Living Free in an Unfree World

The State knows no limits when it comes to intervening in the economy and our lives. From the value of our hard-earned income to the flow of water in our showerheads, nothing is out of reach for meddling bureaucrats.

Ludwig von Mises explained, "The ultimate basis of an all around bureaucratic system is violence." Yet we advocate and hope for a world of peaceful cooperation and flourishing markets.

It's doubtful that politics holds all...

Read More »

Read More »

AUDUSD trades between 200 bar MAs above & 100 bar MAs below. Traders wait for the shove.

The 200-bar MA on the 4-hour chart is up at 0.6577. The 100-bar MA on the 4-hour chart is at 0.6527.

Read More »

Read More »

USDCAD trades lower after key target resistance at the 50% stalls the rally.

The 50% of the move down from the October high to the December low stalled the rally at 1.3537 (high reached 1.3535). The seller take more control.

Read More »

Read More »

Marktausblick mit Stefan Breintner und Markus Koch Februar 2024

Marketing-Anzeige: #aktien #geldanlage #investieren

Bisher lieferte 2024 den meisten Anlegern Grund zur Freude. Die Wachstumsstory im KI-Bereich ist intakt, die US-Konjunktur erweist sich robuster als gedacht. Was heißt das für die nächsten Wochen?

Im Marktausblick diskutieren wie gewohnt Stefan Breintner, Research-Leiter der DJE Kapital AG und Wall-Street-Experte Markus Koch, diese und weitere Themen:

✅ Könnte die Inflation wieder...

Read More »

Read More »

Rette dein Vermögen aus den Bankbilanzen!

Dieses Video zeigt die Highlights aus unserem exklusiven Webinar zum Thema Bankenkrise. Florian Günther und Stephan Richter zeigen Dir, welche Risiken im Bankensystem lauern und wie Du Dein Vermögen vor einer möglichen Neuauflage der Bankenkrise schützen kannst.

Melde Dich hier für unseren Newsletter an, um in Zukunft keine Einladung mehr zu verpassen: https://investorenausbildung.de/webinar-anmeldung/

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare...

Read More »

Read More »

The USDCHF remains above the 100 day MA and 50% retracement. Key support at 0.8785.

The USDCHF is modestly lower on the day but remains above the key 50% midpoint of the move down from October and the 100 day MA near 0.8785.

Read More »

Read More »

Russland Sanktionen scheitern krachend! So viel zahlt Deutschland drauf!

Die Sanktionen gegen Russland wirken sich immer negativer für die Deutsche Wirtschaft und die Bevölkerung aus! Ich bin gespannt, wie lange die Bundesregierung diesen Kurs noch halten kann.

https://link.aktienmitkopf.de/Depot*

📊 Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By Olaf Kosinsky - Own work, CC BY-SA 3.0 de, https://commons.wikimedia.org/w/index.php?curid=82138073

📒 Mein Buch! Der Rationale...

Read More »

Read More »

Kickstart the forex day with a technical review of the EURUSD, USDJPY and GBPUSD

What levels are in play for the 3 major currencies and why? A technical look at the EURUSD, USDJPY and GBPUSD.

Read More »

Read More »

Will Nvidia Break the Market?

It's Nvidia earnings reporting day, and as tech companies have driven markets of late, the results, and the company's forward guidance, could have a huge effect. Earnings expectations are extremely high; risk of disappointment is high. The S&P is testing a rising trendline at the 20-DMA, against a negative divergence in relative strength. The dichotomy is unsustainable. The Conference Board releases latest survey of leading economic indicators,...

Read More »

Read More »

The Outrageous Persecution of Julian Assange

Today marks the second and final day in what could very well be Julian Assange’s last extradition trial in front of the British High Court. For almost five years now, the United States government has been working to get the Wikileaks founder extradited to the US to face charges that he violated the Espionage Act.

Inspired by Daniel Ellsberg’s release of the Pentagon Papers back in 1971, Julian Assange founded Wikileaks in 2006. Assange’s vision was...

Read More »

Read More »

The Right Is Wrong to Pursue Term Limits

Americans across the board have routinely spoken for term limits. Recently, however, this has been most common among Republican politicians. On January 29, Ron DeSantis announced his legislative priorities over social media as he found himself no longer focused on a presidential campaign, and his very first item on the list was enforcing term limits. Additionally, perhaps the most right-wing politician in America, Anthony Sabatini, routinely calls...

Read More »

Read More »

Pictet – How fixed income might evolve in 2024

Why we see merit in being ready to move from cash to fixed-income bonds to capture the returns we expect them to offer this year.

Read More »

Read More »

China’s CSI 300 Rises for Seventh Consecutive Session and Offshore Yuan Strengthens for the Sixth Session

Overview: The dollar is trading quietly

after being sold yesterday. It is still soft against the dollar bloc and the

Swiss franc but is firmer against the other G10 currencies. Narrow ranges have

dominated. Emerging market currencies are mixed, with central European

currencies and the Taiwan dollar trading softer. The offshore Chinese yuan is

firmer for the sixth consecutive session. The highlights of today's North

American session features minutes...

Read More »

Read More »

Schwellenländer und ihre Aktienmärkte können auch ohne China leuchten

Die einfache und schöne Kinderzeit Chinas ist vorbei. Das Land ist geopolitisch und wirtschaftlich in der Pubertät angekommen, wo viele Dinge - Eltern wissen das - schwieriger werden. Und wirksame Gegenmaßnahmen zu ergreifen, fällt der KP in Peking offensichtlich schwer. Tatsächlich schätzt die (Finanz-)Welt China auf allen Ebenen kritischer ein. Das kommt anderen Schwellenländern zugute wie Robert Halver analysiert.

Read More »

Read More »

WTI Crude Oil Technical Analysis

#crudeoil #futures #technicalanalysis

In this video you will learn about the latest fundamental developments for WTI Crude Oil. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:49 Technical Analysis with Optimal Entries.

2:09 Upcoming Economic Data....

Read More »

Read More »

SPD Politiker überrascht Faeser und Paus!

Der SPD Politiker und Journalist Mathias Brodkorb hat ein flammendes Plädoyer für Rechtsstaat und Grundrechte aufgeschrieben, welches ich unterschreiben kann! Es wird Zeit, dass sich die SPD reformiert und diesen anti-demokratischen Kurs aufgibt.

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

📊 Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By...

Read More »

Read More »