Tag Archive: Featured

Altria + Bayer = Dividendenfalle

Dividendentitel sind in der Welt der Aktionäre gern gesehen. Einige setzen sogar auf reine Dividendenportfolios. Warum das aus meiner Sicht ein Trugschluss zum passiven Einkommen ist, erkläre ich dir am Beispiel von zwei Aktien im heutigen Video.

Hier zum kostenlosen Webinar JETZT anmelden:

https://jensrabe.de/WebinarFeb24

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q1Termin24

Tägliche Updates ab sofort auf:...

Read More »

Read More »

Wer bekommt die meisten #Zinsen aufs #Tagesgeld ?

Wo haben eigentlich die Experten von #finanztip ihre Tagesgeldkonten und wie viele Zinsen bekommen sie darauf? Leo sucht den Finanztip-Tagesgeld-Champion. Am Ende erklärt Geldanlage-Experte Hendrik, wie Ihr immer aktuell die besten geprüften Tagesgeld-Angebote mit guten Zinsen findet.

Read More »

Read More »

The Homo Economicus Myth

Among the larger albatrosses burdening the economics profession is the idea of Homo economicus. To this day, most economics undergraduates hear about it in the context of neoclassical economics. Homo economicus, we are told, is the ideal economic man who always seeks to maximize profits and minimize costs. He only acts “rationally,” and rationalism is defined as, well, always seeking to maximize profits and minimize costs. Even worse, “profit” is...

Read More »

Read More »

The Failure of Conservatism

The Failure of American Conservatism and the Road Not TakenBy Claes G. RynRepublic Book Publishers, 2023; 468 pp.

Claes Ryn, a leading conservative intellectual who taught politics for many years at the Catholic University of America, is by no means a libertarian, but readers of The Misesian can learn much from this book. I’d like to discuss two topics: first, the criticism of Harry Jaffa and his mentor, Leo Strauss; and second, the full-scale...

Read More »

Read More »

Heftig: ZDF verdreht alle Fakten bei AfD Reportage!

Das ZDF verdreht die Fakten, wenn es sagt die AfD wäre aufgrund ihrer emotionalisierenden Botschaften etc. so erfolgreich auf Social-Media. Der eigentliche Grund ist nämlich das permanente Fitness-Programm, welches die AfD seit Jahren durchläuft!

https://link.aktienmitkopf.de/Depot*

📊 Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

📒 Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

🎧JETZT auch als Hörbuch...

Read More »

Read More »

Are The Magnificent Seven Stocks In A Bubble?

Has Nvidia become the world's most-valuable company? The S&P is aiming at more all-time highs, but can they hold? Fed minutes reveal no rush to cut rates. The disconnect with markets' expecting more cuts. Will the Fed reduce QT as money flows into markets? Meanwhile, markets continue to test rising trendline at 20-DMA, as consolidation continues. No reason to be bearish on markets...yet. What markets missed from Fed Minutes: the quantity of...

Read More »

Read More »

NEU: dieses Gesetz wird alles ändern… (bereite dich vor)

Kostenfreier Live-Trading-Workshop (01.-03. März 2024): 👉 https://oliverklemmtrading.com/workshop?utm_source=youtube1&utm_campaign=workshop

Jetzt anmelden! Plätze begrenzt...

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉 https://oliverklemmtrading.com/apply-now-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=2

►Folge Oliver auf Instagram:...

Read More »

Read More »

Buying Your First Stock: Stock Investing for Beginners – Andy Tanner

In this episode, Andy Tanner along with Noah Davidson and Corey Holiday discuss the process of buying your first stock. They focus on the importance of taking the leap and getting started and offer advice on how to choose which stock to invest in.

They emphasize doing something, getting educated, and being pragmatic about investing. They encourage buying something you are confident in spending money on and ultimately shifting from being a...

Read More »

Read More »

Risk On, Dollar Sold

Overview: The

post-close rally in US tech stocks after Nvidia's earnings has fueled risk-on

activity today. The Nikkei closed at record highs with a 2.2% rally. China's

CSI rose for the eighth consecutive session as official discourage sales at the

open and close, and short sales in general. Europe's Stoxx 600 is up more than

0.5% to recoup the small losses seen in the last two sessions. US indices are

poised to gap higher at the open. Benchmark...

Read More »

Read More »

El Impacto de LA LEY Y EL ORDEN en EL SALVADOR

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Eklat: Professor zerpflückt grüne Journalistin!

Endlich gibt es für Ulrike Herrmann mal ein bisschen Gegenwind!

https://link.aktienmitkopf.de/Depot*

📊 Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

📒 Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

🎧JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

Haftungsausschluss: Anlagen in Wertpapieren und anderen Finanzinstrumenten bergen immer das Risiko des Verlustes Ihres Kapitals.

Prognosen und...

Read More »

Read More »

Bläst der Rückenwind plötzlich von vorn? – DJE-plusNews Februar 2024 mit Mario Künzel

Marketing-Anzeige #aktien #inflation #fonds

Insgesamt wird ein „Goldilocks“-Szenario eingepreist – eine weiter zurückgehende Inflation, positives Wachstum und eine lockerere Zentralbankpolitik im Jahr 2024. USA entwickeln sich besser als Europa und China.

Außerdem:

▶ USA entwickeln sich besser als Europa und China.

▶ Der Markt preist aktuell weiterhin fünf Zinssenkungen bis Jahresende in den USA ein.

▶ Wegen höherer Inflation in Verbindung mit...

Read More »

Read More »

Gold Technical Analysis

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:39 Technical Analysis with Optimal Entries.

1:55 Upcoming Economic Data....

Read More »

Read More »

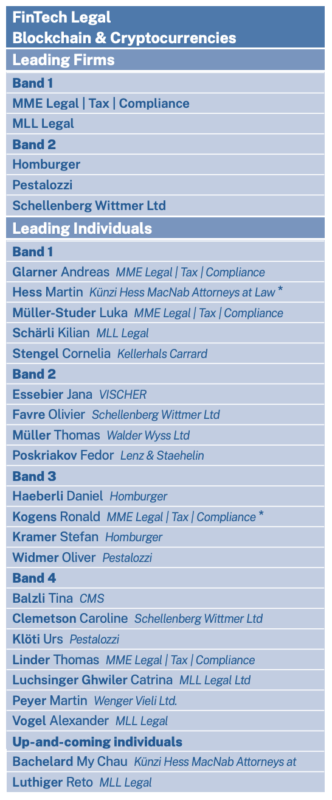

The Top Swiss Law Firms for Fintech and Blockchain Practice

Chambers and Partners, a legal research company, has released its Chambers Fintech 2024 guide, an annual report which recognizes the top fintech advisors and litigators worldwide.

In this year’s Swiss edition, Chambers and Partners ranked MME Legal | Tax | Compliance, MLL Legal, Baer and Karrer, and Lenz and Staehelin as the top Swiss law firms in the fintech legal category, recognizing them for their expertise, diligence and customer service.

MME...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #255

Kostenfreier Live-Trading-Workshop (01.-03. März 2024): 👉 https://oliverklemmtrading.com/workshop?utm_source=youtube1&utm_campaign=workshop

Jetzt anmelden! Plätze begrenzt...

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉 https://oliverklemmtrading.com/apply-now-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=2

►Folge Oliver auf Instagram:...

Read More »

Read More »

The Most Important Financial Lessons You Need Right Now – Robert Kiyosaki

In this episode, host Robert Kiyosaki talks with guest George Gammon. They discuss the current state of the world economy, as predicted by the International Monetary Fund (IMF), asserting it's about to encounter the biggest financial headwinds since WWII, and the most important financial lessons you need right now.

They dive into the widening gap between the rich and the poor, emphasizing the importance of financial education to help bridge this...

Read More »

Read More »

Bill Belichick & Ray Dalio on the Psychology of a Team

#BillBelichick and I on the #psychology of a #team. If you enjoy this, you can find our full conversation here: -TUGz4 #principles #success #professionalfootball #teamwork

Read More »

Read More »

The Last Conservative

Milton Friedman: The Last ConservativeBy Jennifer BurnsFarrar, Straus and Giroux, 2023; x + 587 pp.

Imagine that you come across this about the “education premium” on someone’s blog: “By going to college, you are more than tripling your chances for success in after life.” The statement is buttressed by a calculation of the extra lifetime earnings that a college degree will provide. Wouldn’t you think that the author is an economist? In fact, the...

Read More »

Read More »