Tag Archive: Europe

JPY150 Pierced but Market is Not Done

Overview: News that Israel's ground assault

on Gaza is being delayed while hostage negotiations continue saw gold and oil ease,

but tensions continue to run high. Gold peaked near $1997 before the weekend

and pulled back to about $1964 today before steadying. December WTI peaked in

front of $90 a barrel at the end of last week, and fell to about $86.85 today,

but has also steadied. The dollar is firmer against the G10 currencies, with

the Scandis...

Read More »

Read More »

Dollar Stabilizes After Extending Gains

Overview: The dollar's gains were initially extended before a

consolidative tone emerged. The euro has been sold to $1.0460

and has returned to almost $1.05. Sterling fell to nearly $1.2060 and has

recovered though has stopped short of $1.2100. The dollar edged closed to

JPY150 but stalled near JPY149.95 and has held above JPY149.65. The Australian

dollar near $0.6300 and the greenback rose to CAD1.3725.

Benchmark 10-year yields are firm, though...

Read More »

Read More »

US Banking Crisis Swamps Other Considerations

Overview: The US banking crisis has overwhelmed other

market drivers. The strong measures announced as Asia Pacific trading got under

way was embraced by the market even though moral hazard issues and gaps in the

Dodd-Frank regulatory framework were exposed. The dollar is trading heavily. The

prospect of a 50 bp Fed hike next week has evaporated and some are doubting

that a 25 bp increase will be delivered. Rate hike expectations for the ECB

this...

Read More »

Read More »

Is it Too Easy to Think the Market Repeats its Reaction to a Soft US CPI?

The market expects a soft US CPI print today, which has recently been associated with risk-on moves. The US 10-year yield is holding slightly above 3.50%, the lowest end of the range since the middle of last month. The two-year yield is a little above 4.20%, also the lower end of its recent range. Most observers see the Federal Reserve slowing the pace of its hikes to a quarter point on February 1.

Read More »

Read More »

The State of the German Blockchain Ecosystem

Despite a global venture capital (VC) pullback, shrinking valuations and public market turmoil, Germany’s blockchain VC funding market remained stable this year, with companies in the space securing a total of US$218 million across 20 deals year-to-date (YTD), just US$37 million short of 2021’s US$255 million, a new report by CV VC, a Swiss VC and private equity firm specialized in cryptocurrency and blockchain solutions, shows.

Read More »

Read More »

Weekly Market Pulse: Currency Illusion

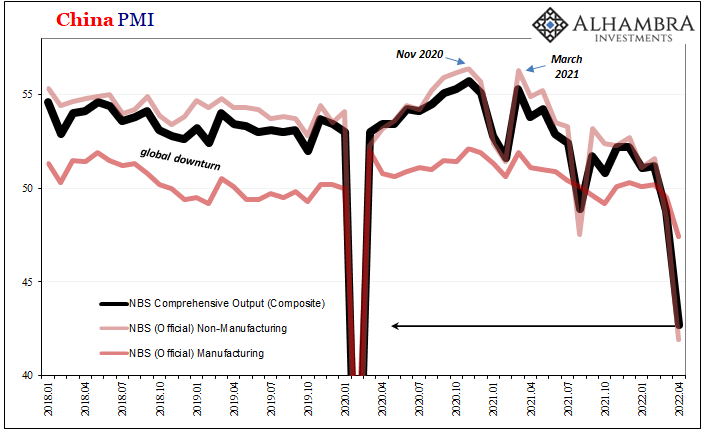

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately,...

Read More »

Read More »

Nasty Number Five, Not Hawk Hiking CBs

It’s not recession fears, those are in the past. For much if not most (vast majority) of mainstream pundits and newsmedia alike, unlike regular folks this is all news to them (the irony, huh?) Economists and central bankers everywhere had said last year was a boom, a true inflationary inferno raging worldwide.

Read More »

Read More »

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

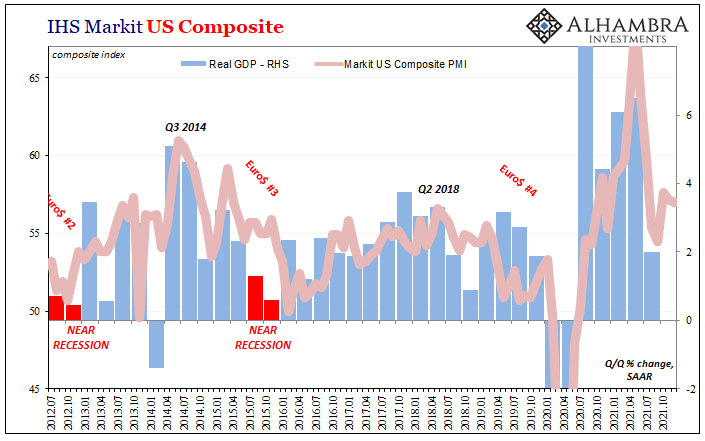

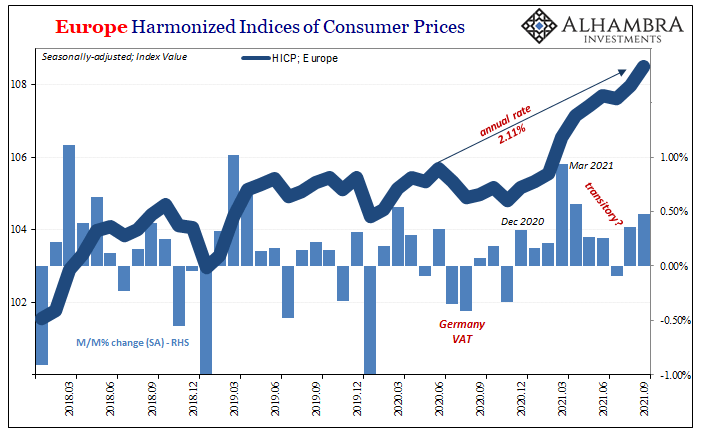

Another Month Closer To Global Recession

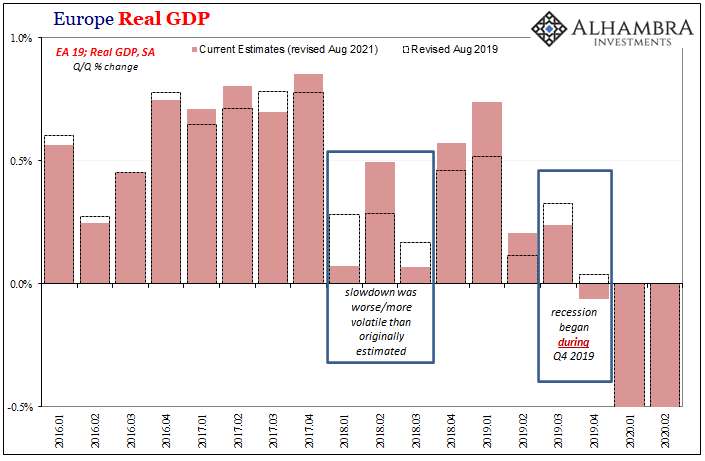

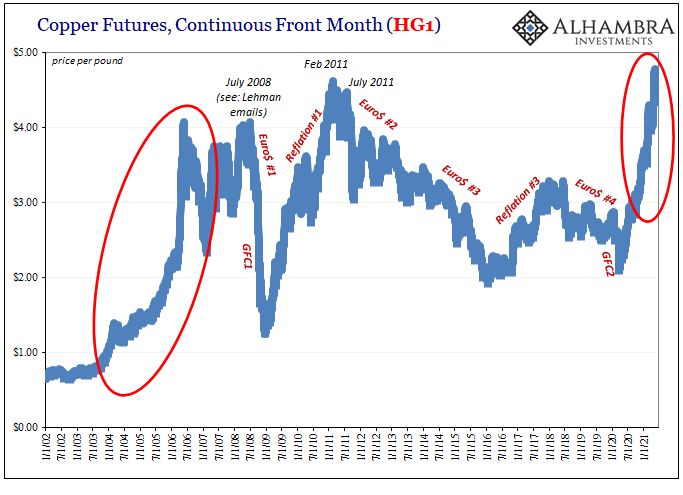

We always have to keep in mind that the major economic accounts perform poorly during inflections. Europe in early 2018, for example, was supposed to have been just booming only to have run right into the brick wall that was Euro$ #4.

Read More »

Read More »

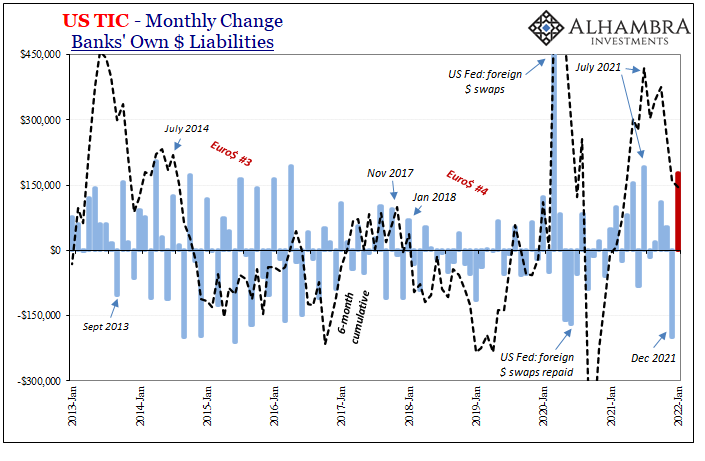

Looking Back At Chaotic March Through TIC

March ended up being a pretty wild ride. Lost amidst the furor over Russia’s invasion of Ukraine, the month began with a couple clear “collateral days. T-bill rates along with repo fails echoed that same shortfall before the yield curve then joined the eurodollar futures curve being inverted.

Read More »

Read More »

Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

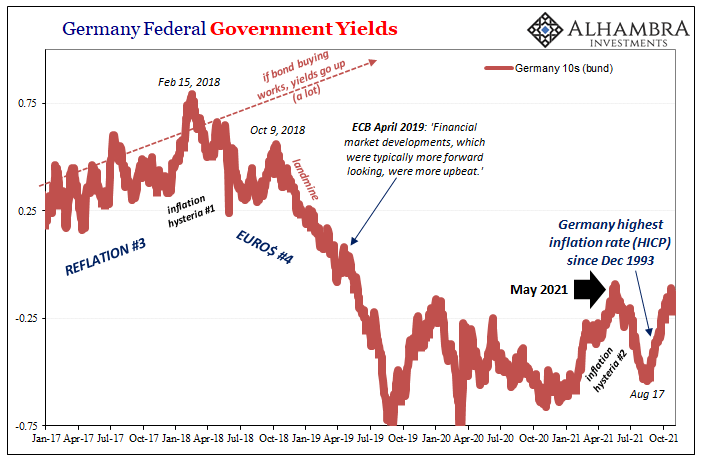

China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious.

Read More »

Read More »

Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two.Running red-hot to the point of near-horror, that’s “our” Federal...

Read More »

Read More »

It Wouldn’t Be TIC Without So Much Other

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention.

Read More »

Read More »

As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

Read More »

Read More »

The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup?

Read More »

Read More »

Tapering Or Calibrating, The Lady’s Not Inflating

We’ve got one central bank over here in America which appears as if its members can’t wait to “taper”, bringing up both the topic and using that particular word as much as possible. Jay Powell’s Federal Reserve obviously intends to buoy confidence by projecting as much when it does cut back on the pace of its (irrelevant) QE6.

Read More »

Read More »

Freedom Is Not Free You Have To Fight For It, The People Will Demand Decentralization

Claudio begins his discussion with him taking a trip from Switzerland to Spain. On his travels he realized that the borders are open for cars and people were not asked for proof of vaccination. The people will begin to come together when they cannot function in everyday life because of inflation. People will look for decentralization because the globalist system does not work for the people. Freedom is not free you have to fight for it.

Read More »

Read More »

Copper Corroding PPI

Yesterday, lumber. Today, copper. The “doctor” has been in reverse for better than two months now, with trading in the current session pounding the commodity to a new multi-month low. Down almost $0.19 for the day, an unusual and eye-opening loss, this brings the cumulative decline to 9.2% since the peak way back on May 11.

Read More »

Read More »

Pandemic diplomacy in the Western Balkans

The business of fighting Covid-19 is now estimated at around $150 billion. As of March 2021, 354 million vaccine doses have been delivered – 90 percent of them to countries that are home to only 10 percent of the world’s population. If 65 to 85 percent of people have to be vaccinated to reach global immunity, then it is unlikely to happen this year.

Read More »

Read More »