It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.”

Read More »

Tag Archive: Eurodollar University

Eurodollar University’s Making Sense; Episode 89, Part 2: Let’s Crack China’s RRR Code

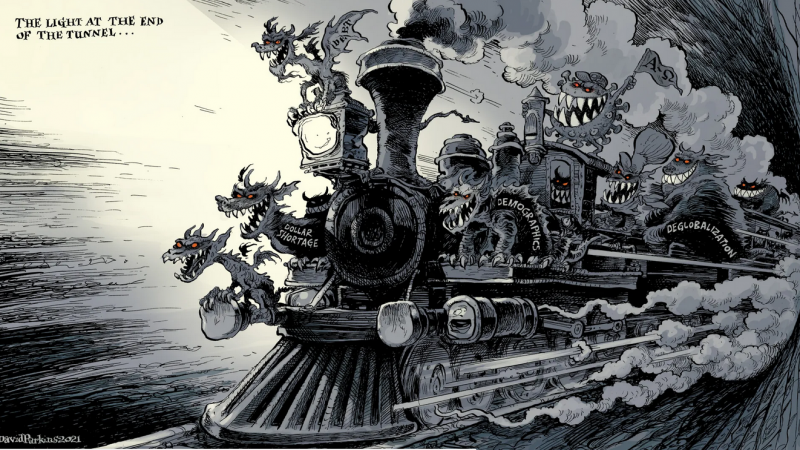

89.2 China Warns World of (Next?) Dollar Disorder. The People’s Bank of China lowers its bank Required Reserve Ratio to get money into a slowing economy. A lowered RRR means that there aren’t enough (euro)dollars flowing into China. Why? Because there aren’t enough (euro)dollars in the world. A lower RRR is a warning for the whole world.

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 46; Part 3: Bill’s Reading On Reflation, And Other Charted Potpourri

46.3 On the Economic Road to NothingGoodVilleRecent, low consumer price inflation readings combined with falling US Treasury Bill yields are cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac.

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 24, Part 2: Peering Behind The (Unemployment Rate) Curtain

———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Castbox: https://bit.ly/3fJR5xQ

Breaker: https://bit.ly/2CpHAFO

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

SoundCloud: https://bit.ly/3l0yFfK...

Read More »

Read More »

Currency Risk That Isn’t About Exchange Values (Eurodollar University)

This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year.

Read More »

Read More »