Tag Archive: EUR/USD

FX Daily, December 4: Hope Springs Eternal

Overview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite PMI, are snapping a four-day 2.75% slide.

Read More »

Read More »

Exports: Currency Devaluation Won’t Grow the Economy

A visible weakness in economic activity in major world economies raises concern among various commentators that world economies have difficulties recovering despite very aggressive loose monetary policies. The yearly growth rate of US industrial production stood at minus 1.1 % in October, against minus 0.1% in September, and 4.1% in October last year.

Read More »

Read More »

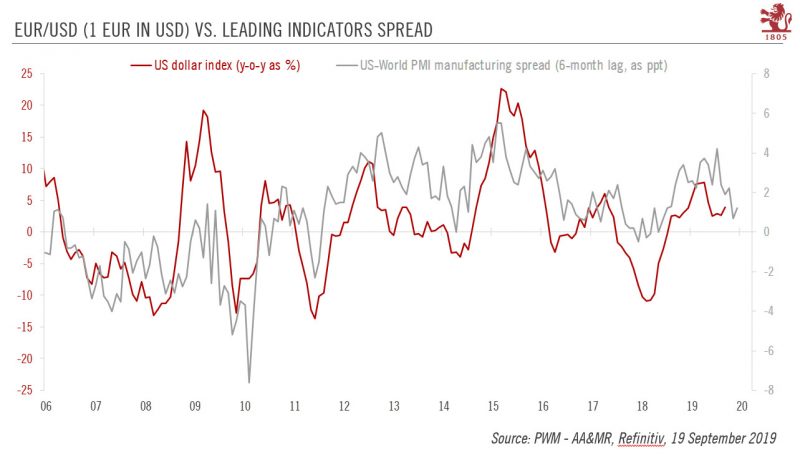

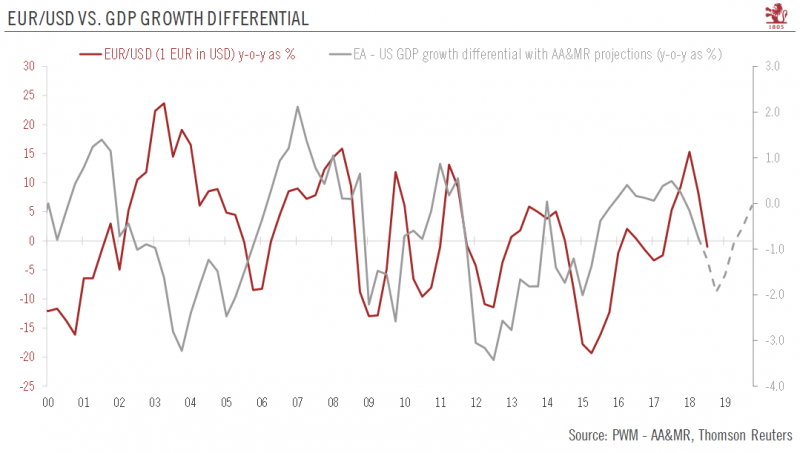

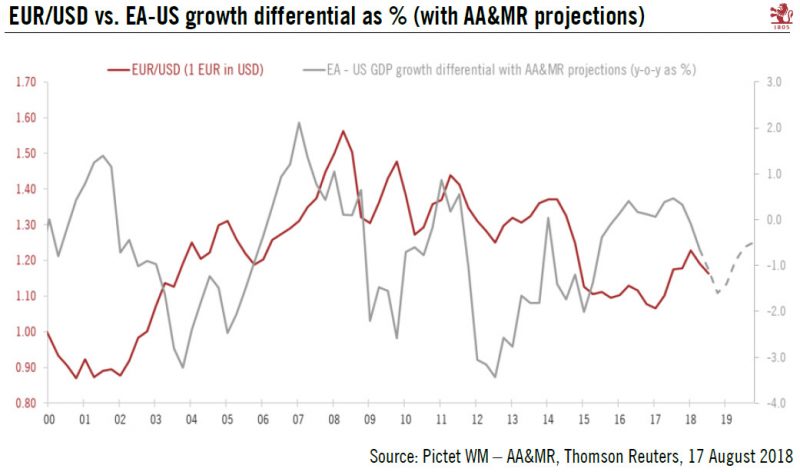

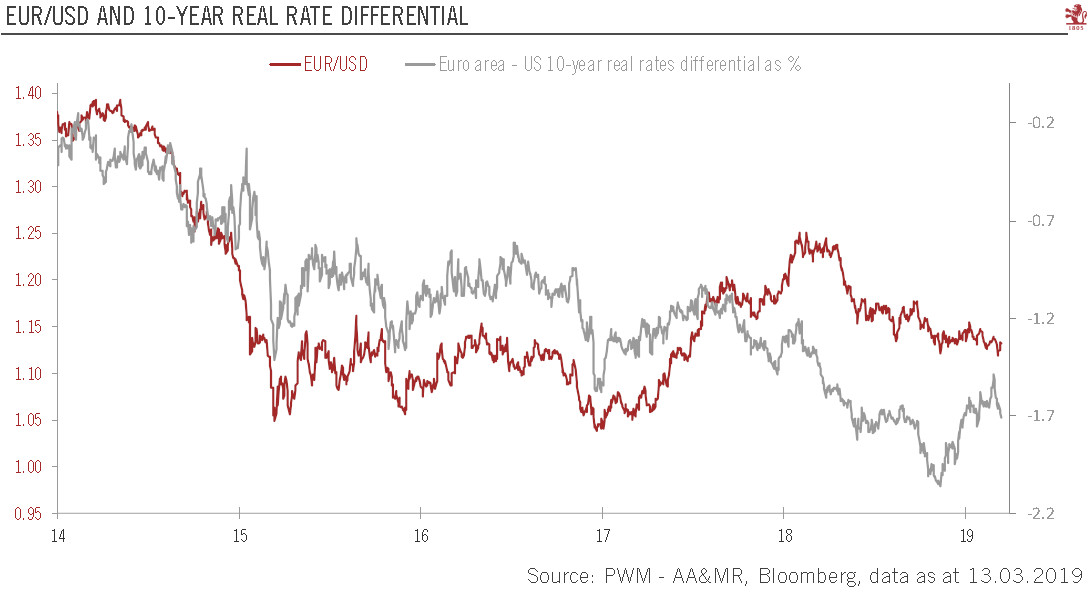

Euro/USD: things look pretty stable

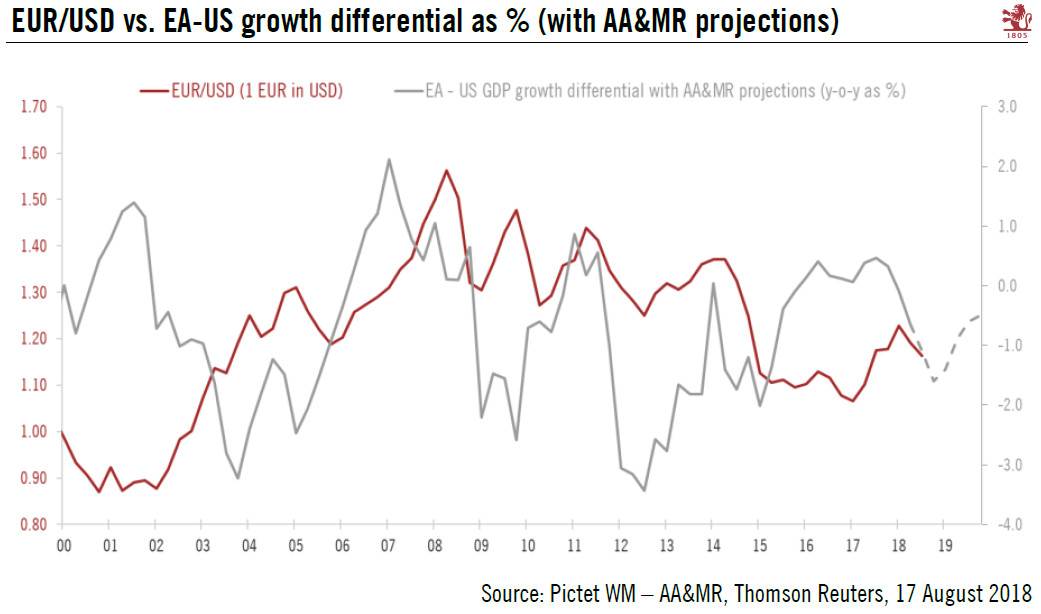

Competing forces mean the two currencies could remain in a holding pattern for a while.The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way.

Read More »

Read More »

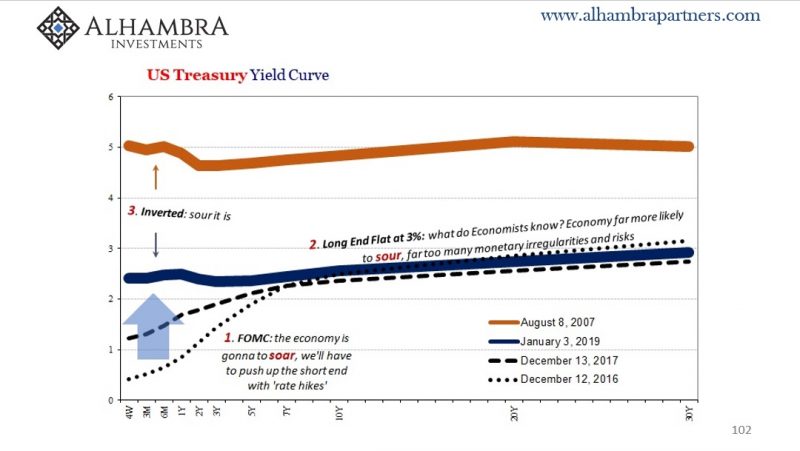

The Real End of the Bond Market

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke).

Read More »

Read More »

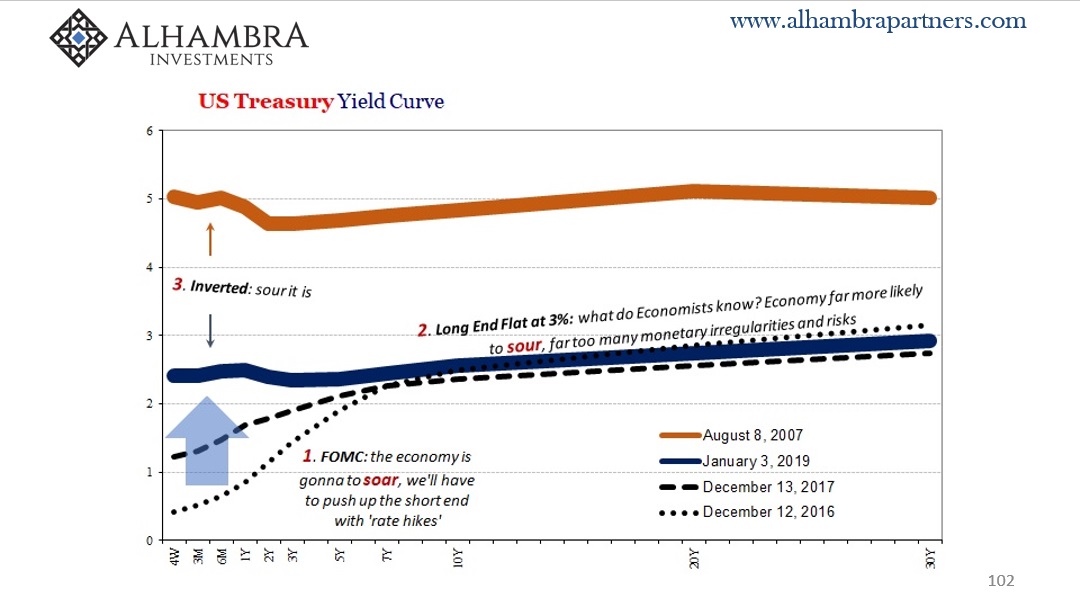

Chart(s) of the Week: Reviewing Curve Warnings

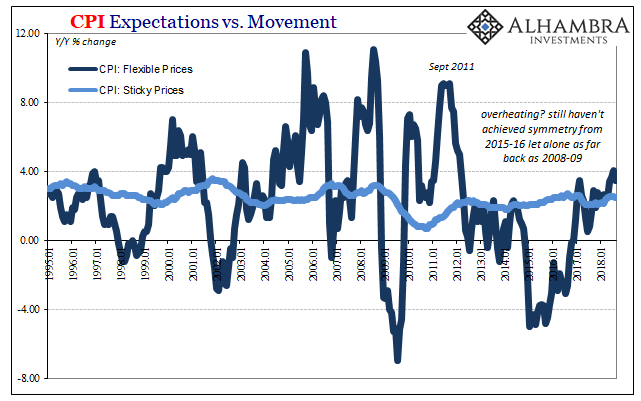

Quick review: stocks hit a bit of a rough patch right during the height of inflation hysteria. At the end of January 2018, just as the US unemployment rate had finally achieved the very center of attention, global markets were rocked by instability. Unexpectedly, of course.

Read More »

Read More »

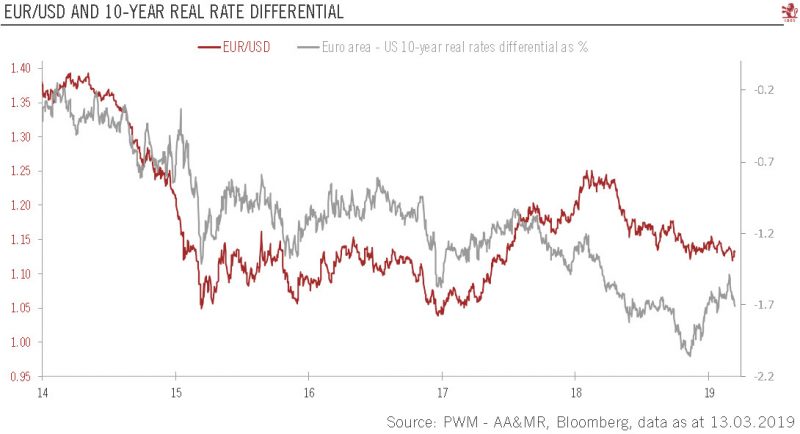

Euro slides against the dollar on ECB dovishness

The euro has declined further against the dollar but should strengthen over next 12 monthsThe euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months.

Read More »

Read More »

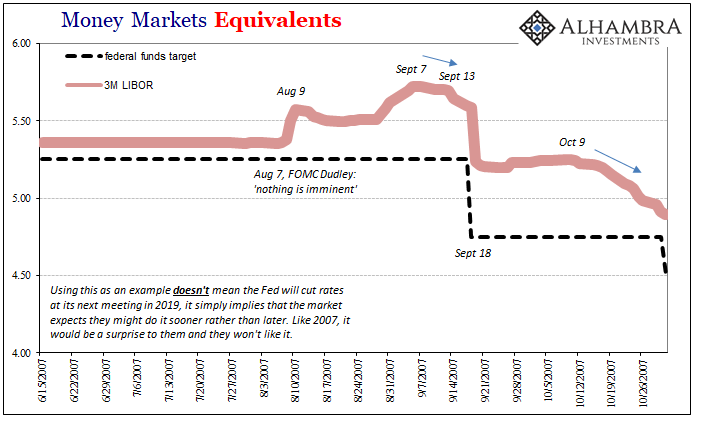

LIBOR Was Expected To Drop. It Dropped. What Might This Mean?

Everyone hates LIBOR, until it does something interesting. It used to be the most boring interest rate in the world. When it was that, it was also the most important. Though it followed along federal funds this was only because of the arb between onshore (NYC) and offshore (mainly London, sometimes Caymans) conducted by banks between themselves and their subs (whichever was located where).

Read More »

Read More »

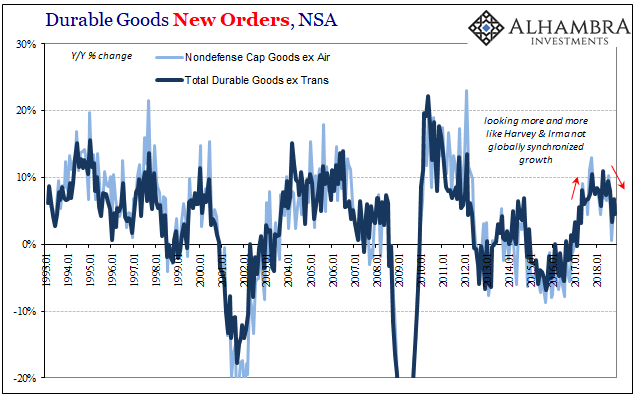

US Manufacturing Questions

The US economic data begins to trickle in slowly. Today, the reopened Census Bureau reports on orders and shipments to and from US factories dating back to last November. New orders for durable goods rose just 4.5% year-over-year in that month, while shipments gained 4.7%. The 6-month average for new orders was in November pulled down to just 6.6%, the lowest since September 2017 (hurricanes).

Read More »

Read More »

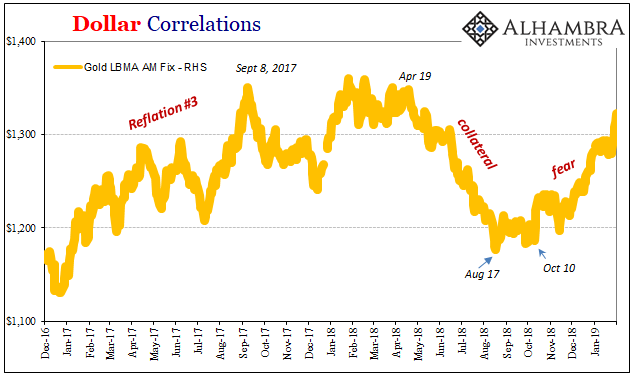

Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way.

Read More »

Read More »

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword.

Read More »

Read More »

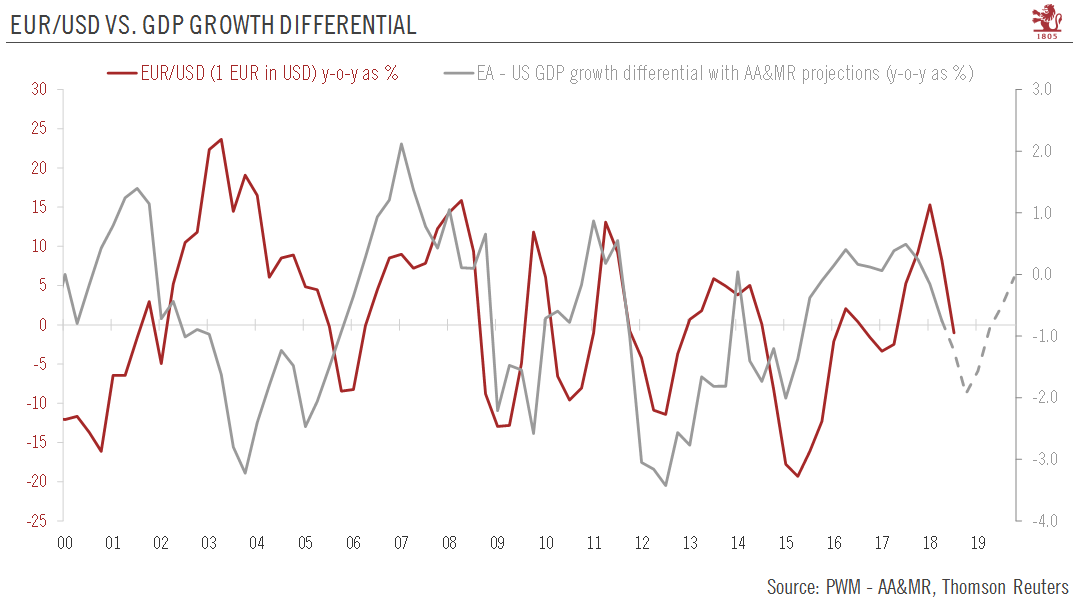

Further consolidation of EUR/USD rate likely

Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafterWe have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term.

Read More »

Read More »

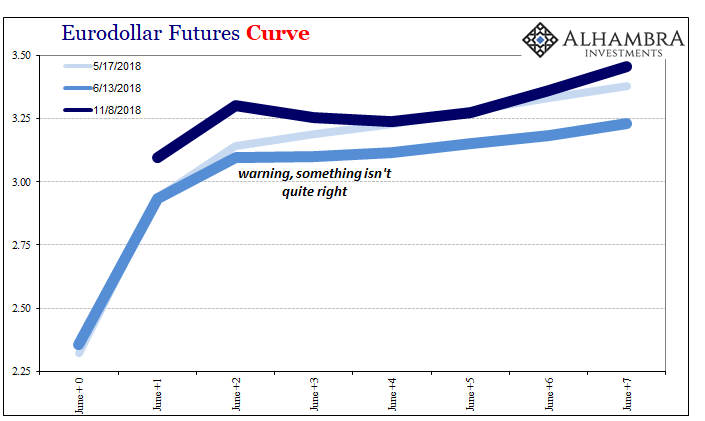

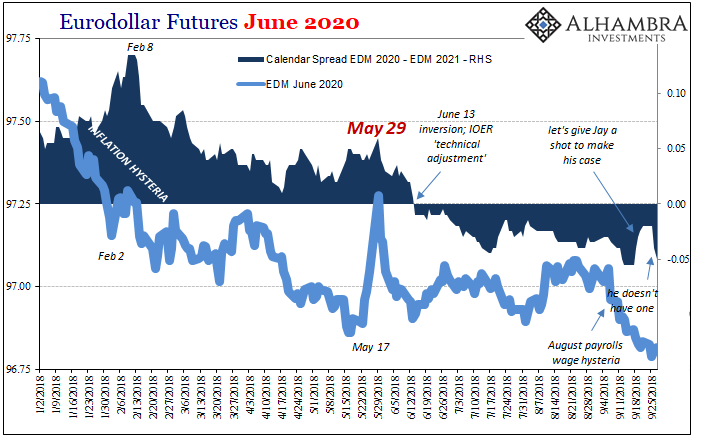

Make Your Case, Jay

June 13 sticks out for both eurodollar futures as well as IOER. On the surface, there should be no bearing on the former from the latter. They are technically unrelated; IOER being a current rate applied as an intended money alternative. Eurodollar futures are, as the term implies, about where all those money rates might fall in the future. Still, the eurodollar curve inverted conspicuously starting June 13. That was the day of the prior “rate...

Read More »

Read More »

Downslope CPI

Cushing, OK, delivered what it could for the CPI. The contribution to the inflation rate from oil prices was again substantial in August 2018. The energy component of the index gained 10.3% year-over-year, compared to 11.9% in July. It was the fourth straight month of double digit gains.

Read More »

Read More »

Europe Starting To Reckon Eurodollar Curve

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy.

Read More »

Read More »

A trying time for euro

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months.The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the...

Read More »

Read More »

Euro, Yen, and Equities: Reviewed

US equities and the dollar appear to be moving higher together. The greenback is near its best level this year against most of the major and emerging market currencies. The Chinese yuan is not an exception to this generalization. At the same time, the S&P 500 is at its best levels since the downdraft February, and the NASDAQ set a new record high earlier in the week.

Read More »

Read More »

Greenback Corrects Lower

The consensus narrative is that with rising inflation it is understandable that next week's meeting is live and that the confirmation of such has lifted the euro to ten-day highs, dragging the dollar broadly. However, to accept this is to accept the debasement of language. Until now, we dubbed central bank meeting that could result in action as "live." For example, given that the Fed has not changed interest rates since the hiking cycle began in...

Read More »

Read More »

Weekly Technical Analysis: 04/06/2018 – USD/CHF, EUR/JPY, GBP/USD, AUD/USD, WTI

The USDCHF pair managed to break 0.9850 level and closed the daily candlestick below it, which supports the continuation of our bearish overview efficiently in the upcoming period, paving the way to head towards 0.9723 level as a next station, noting that the EMA50 supports the expected decline, which will remain valid for today conditioned by the price stability below 0.9870.

Read More »

Read More »

What Happened Monday?

Italian politics dominated Monday's activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections.

Read More »

Read More »

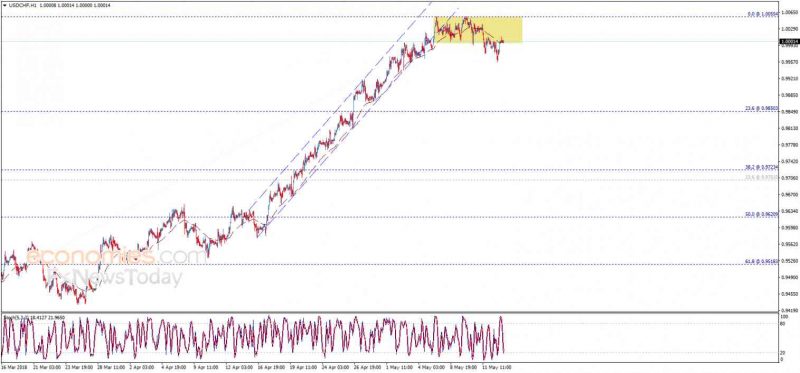

Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally upwards to breach 1.0055 level and...

Read More »

Read More »