Tag Archive: equities

New Recession Worry Stalls Dollar Express but Doesn’t Derail It

A simply dreadful flash US PMI stopped the dollar's four-day rally in its tracks. It followed news that the eurozone, Japan, and Australia's composite PMIs are below the 50 boom/bust level. However, the dollar recovered, even if not fully as the market seemed unconvinced that the data could change Fed Chair Powell's message at Jackson Hole on Friday. A consolidative tone is evident today. Asia Pacific equities were mixed.

Read More »

Read More »

FX Daily, September 23: Trying to Find Solid Ground

A more stable tone is evident in the capital markets after the S&P 500, and NASDAQ rose more than one percent yesterday. Japan returned from a two-day holiday, and local shares slipped fractionally, while China, Hong Kong, South Korea, and Australian shares rallied. India and Taiwan fell.

Read More »

Read More »

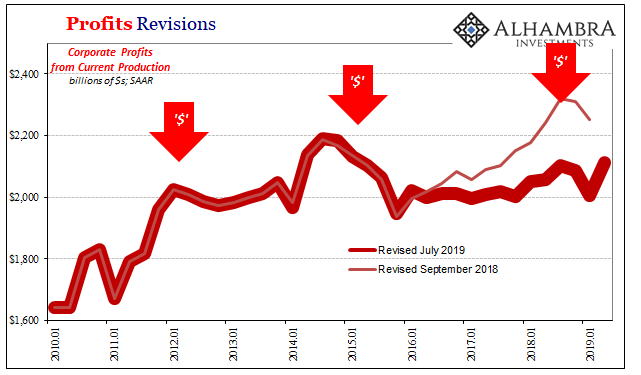

GDP Profits Hold The Answers To All Questions

Revisions to second quarter GDP were exceedingly small. The BEA reduced the estimate by a little less than $800 million out of nearly $20 trillion (seasonally-adjusted annual rate). The growth rate therefore declined from 2.03502% (continuously compounded annual rate) to 2.01824%.

Read More »

Read More »

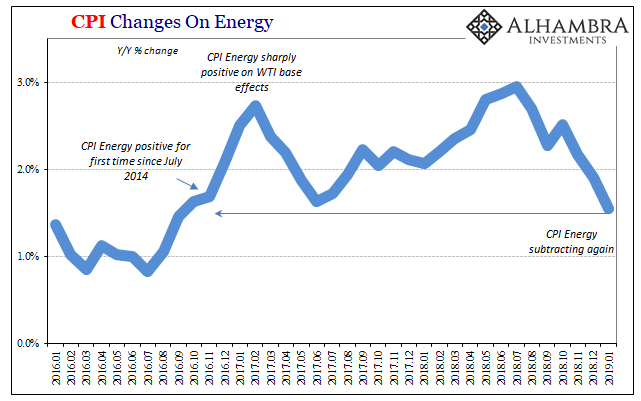

Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria.

Read More »

Read More »

FX Weekly Preview: DOTS in the Week Ahead: Divergence, Oil, Trade and Stocks

The Federal Reserve's confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would, in effect, allow the borrowers...

Read More »

Read More »

Great Graphic: What is Happening to Global Equities?

The decline in the global equity market is the most serious since the February and March spill. In this Great Graphic, the white line is the S&P 500. With the setback, it is up a little more than 8% for the year. It managed to recover fully from the sell-off earlier in the year.

Read More »

Read More »

Central Bank Investment Strategies

A survey of central banks and sovereign wealth funds by Invesco sheds light on their investment plans. The traditional separation of markets and the state may be helpful for ideological arguments, but the real situation is more complicated. Central banks and their investment vehicles (sovereign wealth funds) are market participants. In some activities, such as custodian, central banks compete with the private sector.

Read More »

Read More »

FX Daily, February 06: Recovering US Equities Puts Floor Under Europe after Asia Tanks

After the dramatic fall in US equities, Asian equities followed suit. The MSCI Asia Pacific Index fell 3.4% following Monday's slide of 1.7%. European bourses gapped lower and spent most of the morning moving higher, though large gaps remain. At its worst, the Dow Jones Stoxx 600 was off about 3.3%, and at the time of this writing, it is half as much. US equities initially extended yesterday's losses, but the S&P 500 has turned higher in the...

Read More »

Read More »

Great Graphic: European Equities Lead Move

European equities peaked earlier and have fallen the furthest. MSCI EM equities faring the best, and as of now, they are still up on the year. MSCI Asia Pacific fell 3.4% today and is now down 0.33% for the year.

Read More »

Read More »

FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past nine sessions. The notable exception in Asia was the Shanghai Composite. The 0.75% was led by the financial sector amid talk that a report later this week will show a strong jump in yuan lending from banks, which...

Read More »

Read More »

FX Weekly Preview: Changing Fortunes in the Capital Markets or Long Overdue Correction?

The chief development in the capital markets has been the sharp drop in equities after a significant rally since late last year and the rise in yields. The dollar had fallen alongside the exuberant appetite for risk assets. Anecdotal evidence supports the idea that the greenback was used as a funding currency to purchase those risk assets.

Read More »

Read More »

FX Daily, November 22: Global Equity Rally Resumes, while Dollar Slips

Global equities are on the march. US indices shrugged off their first back-to-back weekly decline in three months to set new record highs yesterday. The MSCI Asia-Pacific followed suit and recorded their highest close. The Dow Jones Stoxx 600 is struggling, as the CAC and DAX are nursing small losses.

Read More »

Read More »

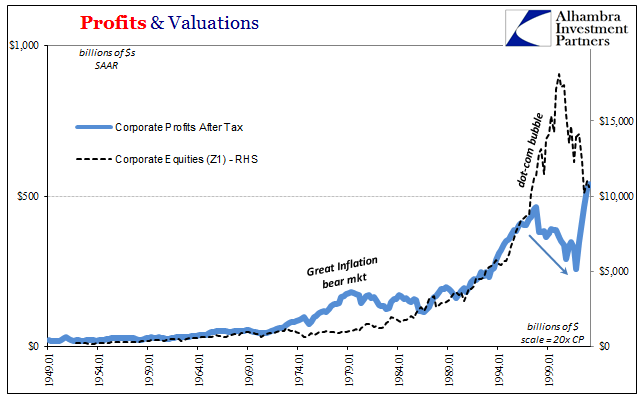

The Two Parts of Bubbles

What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really going on.

Read More »

Read More »

Great Graphic: Small Caps and the Trump Trade

The Russell 2000, which tracks the 2000 smallest companies in the Russell 3000, is threatening to turn positive for the year. It had turned negative in the second half of last week. Many pundits saw its decline and the penetration of the 200-day moving average for the first time in over a year as a sign of an impending down move in the broader equity market.

Read More »

Read More »

FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past the dramatic rhetoric.

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

Great Graphic: Surprise-S&P 500 Outperforming the Dow Jones Stoxx 600

Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax reform.

Read More »

Read More »

FX Daily, April 24: Dramatic Response to French Election

The results of the first round of the French election spurred a dramatic response in the capital markets. Our thesis that there is no populist-nationalist wave sweeping the world is supported by the previous results in Austria, the Netherlands, and now France.

Read More »

Read More »

Great Graphic: Emerging Market Stocks

MSCI Emerging Market Index is up 12.25% here in Q1. The index is approaching long-standing technical objectives. Look for profit-taking ahead of quarter-end as fund managers rebalance.

Read More »

Read More »

Here are three things you can learn from the Fed

2023-01-13

by Stephen Flood

2023-01-13

Read More »