Tag Archive: Economics

Immigration And Its Impact On Employment

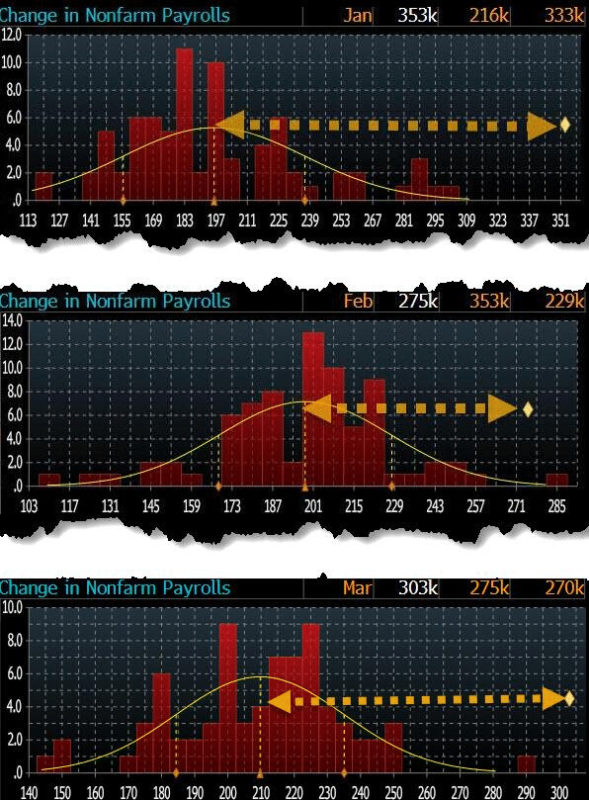

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Is gold too expensive to buy right now?

Share this article

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions...

Read More »

Read More »

Sound Individualism vs Toxic Collectivism

When it comes to the State, however, and all its ministries, branches and institutions, a very different set of rules seems to apply – a much more lenient, flexible and liberal one.

Read More »

Read More »

Private property rights under siege

People invest in gold for many different reasons. Many do so out of concern over economic, monetary or political uncertainty. Others seek a hedge against inflation, a way to protect and preserve the real purchasing power of their savings.

Read More »

Read More »

Europe’s Agrarian Uprisings: Brussels is reaping what it sowed

Share this article

Across the European landscape, a disquiet rumbles beneath the surface of rolling hills and fertile plains. It emanates from the very backbone of the continent – its farmers. From the tractor rallies of France and Germany to the demonstrations in Poland and the Netherlands, a wave of agrarian protests has erupted, driven by a potent cocktail of frustration, betrayal, and a yearning for stability.

Over the past few years,...

Read More »

Read More »

Corrupt Money = Corrupt Society

Share this article

Discussion with Sean from SGT Report about the corruption of our money which has led to the corruption of society.

to watch the video click on this link: https://rumble.com/v44t52f-corrupt-money-corrupt-world-claudio-grass.html

Read More »

Read More »

2024 outlook: Gold Shines Bright in the Gathering Storm

The year 2024 is poised to be a critical period for the global economy and it already appears to be fraught with economic and geopolitical challenges, casting a dark shadow over the global landscape. Signs of a looming economic downturn are becoming increasingly evident and the many challenges we faced over the past year will certainly remain with us for many months to come.

Economic and monetary landscape

Central bankers in most advanced...

Read More »

Read More »

2023: A year in review

After the catastrophic covid crisis of 2020 and 2021, the extremely impactful and consequential Russian invasion of Ukraine in 2022, many hoped that 2023 would break this terrible bad spell and finally present us all with some hope, economically, geopolitically, socially, technologically. Unfortunately, it only offered further reasons for serious concerns on all these fronts.

Economically, even though the official inflation rate followed a...

Read More »

Read More »

The awakening of the working class

Part II of II, by Claudio Grass, Switzerland

One of the maxims I tend to mention quite often in sociopolitical debates or in response to arguments about the flawlessness of the democratic process is “the smallest minority is the individual”. To some, it might sound trite or banal, and perhaps it is; but it does carry a meaning that I believe is an essential human value and a fundamental building block for any civilized, productive and...

Read More »

Read More »

The awakening of the working class

Part I of II, by Claudio Grass, Switzerland

It is a worn-out cliché that many (if not most) political zealots meet their downfall because of their arrogance. “Pride goes before destruction, a haughty spirit before a fall,” the proverb goes, and it does prove true more often than not. The specific kind of pride, or haughty spirit, or plain hubris in this case, has to do with the certainty that some people have (one can’t imagine how and why...

Read More »

Read More »

War is the health of the State

Part II of II by Claudio Grass, Hünenberg See, Switzerland

This is precisely what the State is doing. The idea of war, mayhem and destruction being economic boosters is exactly what has supported the thin facade that politicians like to place over their greed and their personal gain that they derive from the military industrial complex. “It’s good for the country”, is certainly easier to sell than “it’s good for me and my reelection...

Read More »

Read More »

War is the health of the State

Part I of II by Claudio Grass

For any reasonably well read adult, any amateur student of history or any responsible citizen for that matter, the idea that ”war is the health of the State” should be adjacent to a truism. After all, literally nobody benefits from violence and bloodshed apart from those at the heart of any State that is directly or indirectly involved and their cronies. In fact, the more horrific the violence and the more...

Read More »

Read More »

“Sound money must be anchored to and backed by real, tangible assets”

Dani Stüssi interview with Claudio Grass

Over the last few years, the financial woes and daily pressures that have been unleashed upon the average citizen, saver and taxpayer have put the spotlight on money itself. Countless ordinary people who have otherwise never seriously pondered these questions, began to question basic principles like: what makes their paycheck shrink from month to month, what or who actually responsible of it and what,...

Read More »

Read More »

Rethinking “safe” investments

Part II of II by Claudio Grass, Hünenberg See, Switzerland. For those of us who have studied history, these Ingenuous beliefs and expectations likely bring a smirk to our face. However, these are entirely reasonable assumptions for most citizens, as the majority of the population is blissfully unaware of the numerous real-life examples that clearly demonstrate just how capable and how eager the government is to do these things – to fail, or to lie,...

Read More »

Read More »

Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland

To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess...

Read More »

Read More »

Gold for the people

At the end of September, a very interesting story made the rounds in the media and caught my attention. Apparently, the US big box giant Costco added one rather surprising product to its range and it proved immensely popular. Next to humongous multipacks of cereal, buckets of peanut butter, mattresses and air fryers, customers were offered the opportunity to throw a gold bar in their carts as well.

Selling like hotcakes

According to a...

Read More »

Read More »

The slow, stealthy but steady spread of absolutism

Part II of II by Claudio Grass, Switzerland

Over the last couple of years, we saw countless examples of free speech suppression and of the steep price paid by those who chose to exercise that right. Divergent ideas and thoughts contradicting the government narrative were silenced and often punished in ways that would have been entirely unimaginable before the covid outbreak.

No matter what one thinks about the pandemic, about the policies...

Read More »

Read More »

Gold Hits New All Time Highs

2023-11-02

by Dave Russell

2023-11-02

Read More »