Tag Archive: DXY

Collateral Shortage…From *A* Fed Perspective

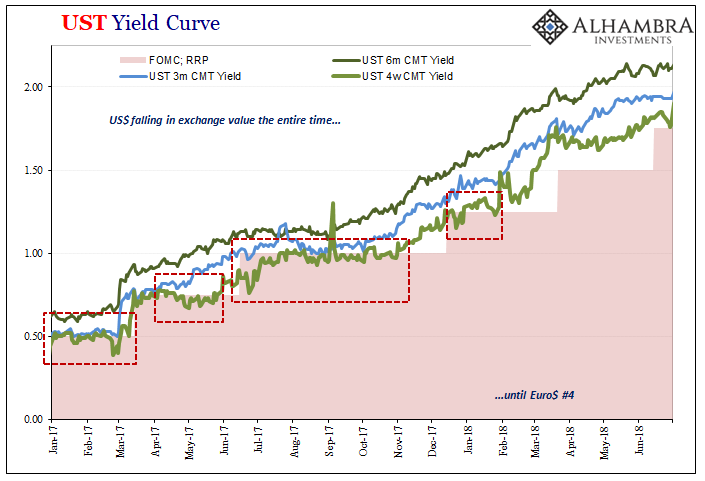

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods....

Read More »

Read More »

For The Dollar, Not How Much But How Long Therefore How Familiar

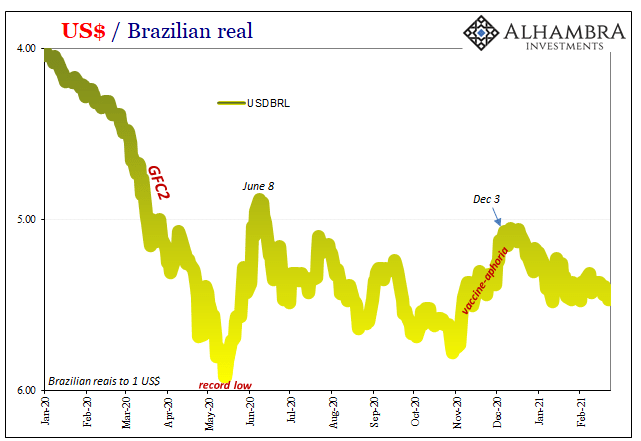

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal...

Read More »

Read More »

What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »

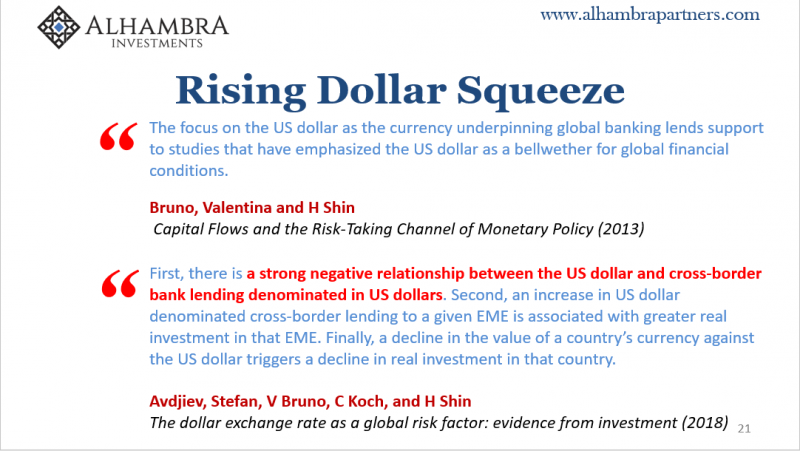

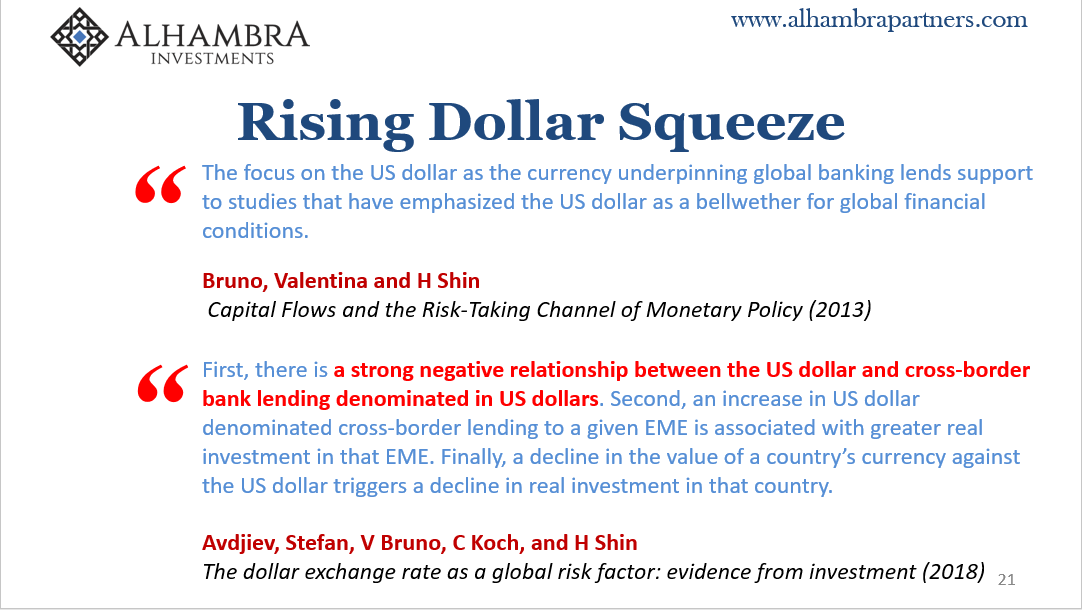

Wait A Minute, The Dollar And The Fed’s Bank Reserves Are Directly Not Inversely Related

One small silver lining to the current situation, while Jay Powell is busily trying to sell you his inflation fantasy, he’s actually undermining it at the very same time. No mere challenge to his own “money printing” fiction, either, the Fed’s Chairman is actively disproving the entire enterprise. While he says what he says, pay close attention instead to what he’s done.

Read More »

Read More »

Everything Comes Down To Which Way The Dollar Is Leaning

Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.”

Read More »

Read More »

Great Graphic: Did the CRB Bottom?

The CRB index has been trending lower since late May. It fell nearly 10% to retrace 50% of the rally come June 2017. This Great Graphic shows the 4 1/2 month trendline. It had been violated in late August but fell back under it at the end of last week.

Read More »

Read More »

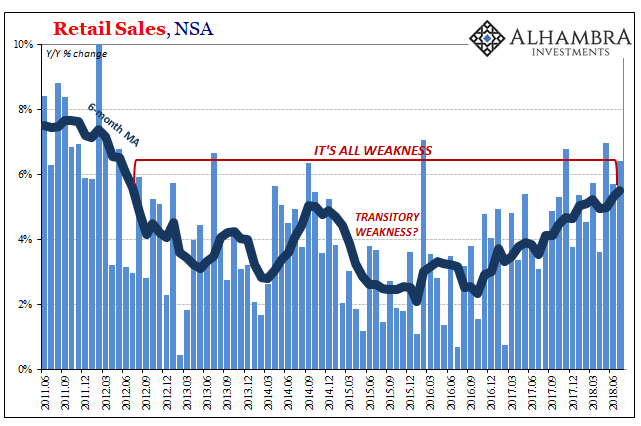

What’s Hot Isn’t Retail Sales Growth

Americans are spending more on filling up. A lot more. According the Census Bureau, retail sales at gasoline stations had increased by nearly 20% year-over-year (unadjusted) in both May and June 2018. In the latest figures for July, released today, gasoline station sales were up by more than 21%.

Read More »

Read More »

Great Graphic: Nearly Five-Month Uptrend in the Dollar Index Set to be Tested

DXY has been holding an uptrend since early May. It looks set to be tested near-term and technical indicators suggest it may not hold. Here are the two scenarios of penetration.

Read More »

Read More »

Dollar Bull Case Intact: It is All About the Perspective

Our bullish dollar outlook was based on divergence and we judge it to still be intact.The Dollar Index has been trading broadly sideways since March 2015, but never did more than a minimum retacement of its arlier rally. The Dollar index is at it highest level since March today.

Read More »

Read More »