Tag Archive: downturn

As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

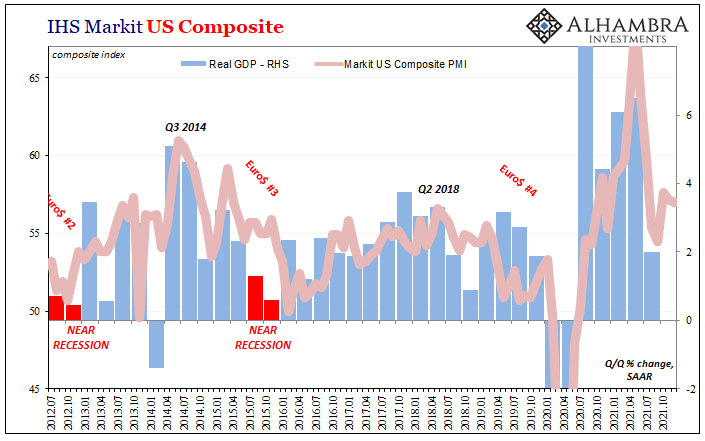

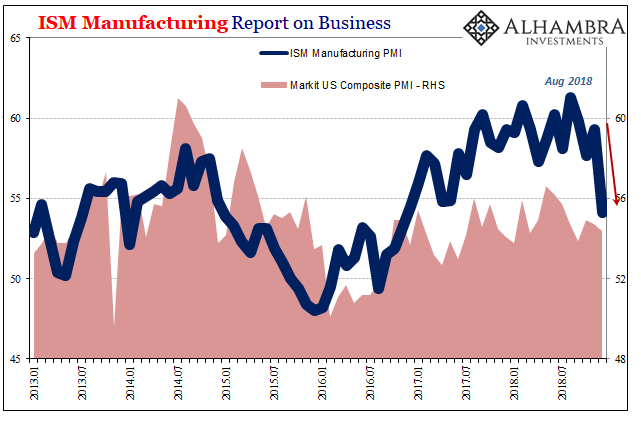

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

Read More »

Read More »

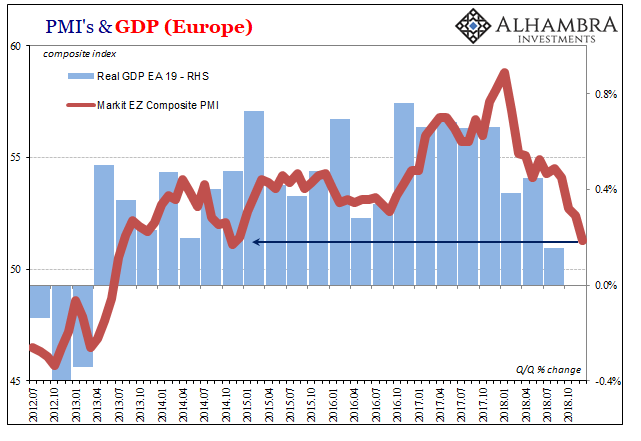

European Economy: A Time Recession

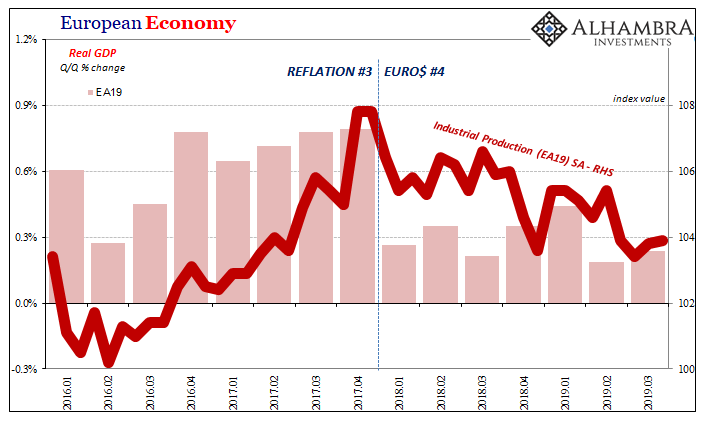

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before.

Read More »

Read More »

Definitely A Downturn, But What’s Its Rate of Change?

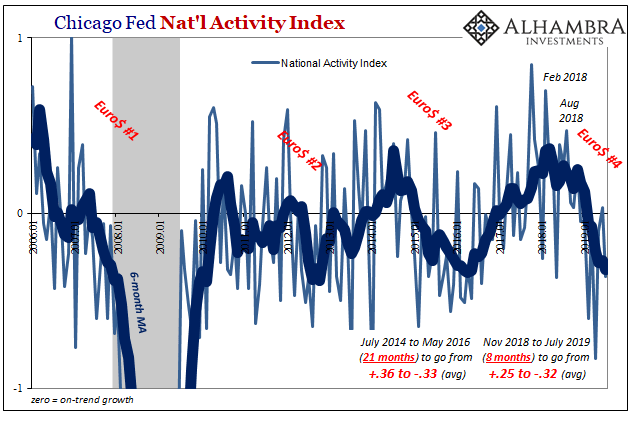

The Chicago Fed’s National Activity Index (NAI) fell to -0.36 in July. That’s down from a +0.10 in June. By itself, the change from positive to negative tells us very little, as does the absolute level below zero. What’s interesting to note about this one measure is the average but more so its rate of change.

Read More »

Read More »

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

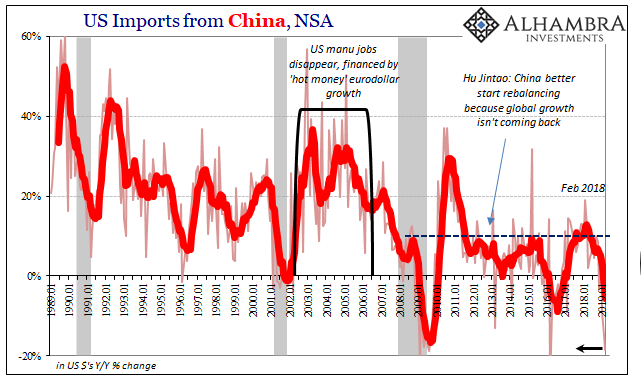

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

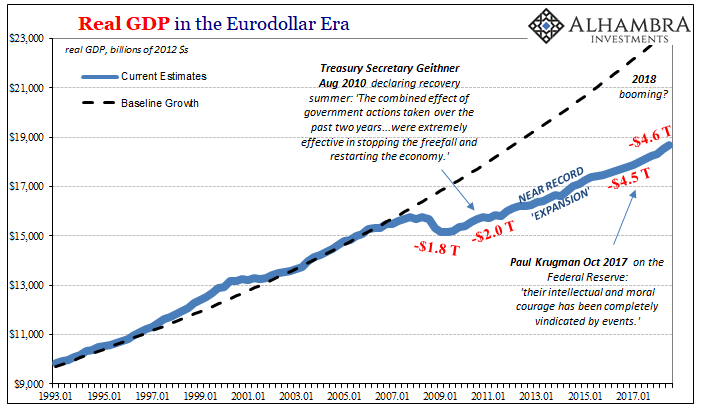

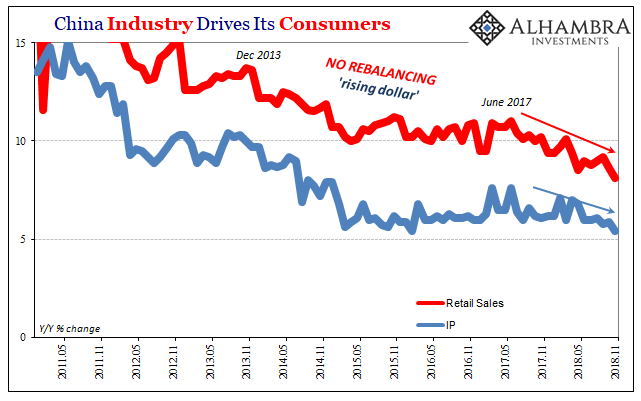

China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging.

Read More »

Read More »

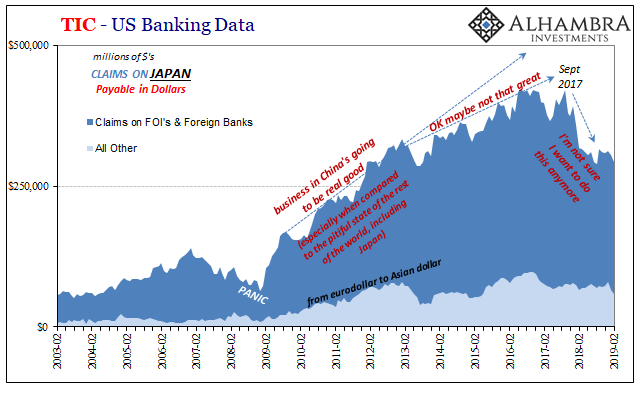

What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective.

Read More »

Read More »

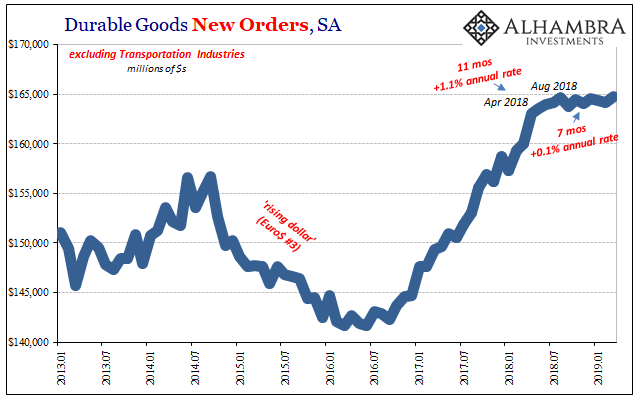

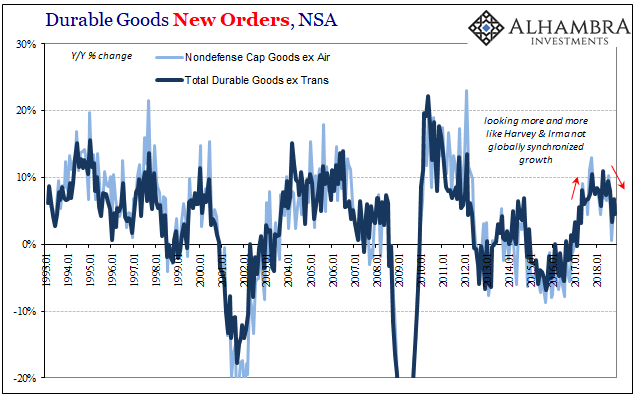

Durably Sideways

Next month, in the durable goods series, the Census Bureau will release the results of its annual benchmark changes. In May 2019, the agency will revise the seasonal adjustments going back to January 2002. Unadjusted data will not be, well, further adjusted.

Read More »

Read More »

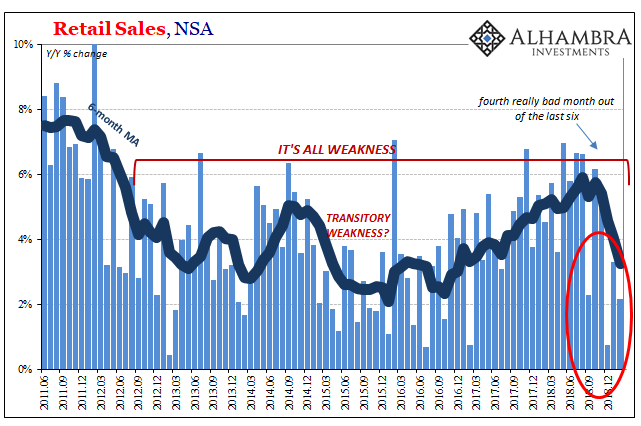

Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks.

Read More »

Read More »

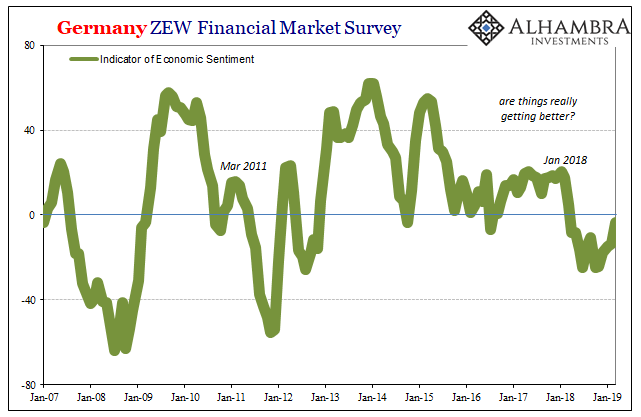

Slump, Downturn, Recession; All Add Up To Sideways

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6.

Read More »

Read More »

Downturn Rising, German Industry

You know things have really changed when Economists start revising their statements more than the data. What’s going on in the global economy has quickly reached a critical stage. This represents a big shift in expectations, a really big one, especially in the mainstream where the words “strong” and “boom” couldn’t have been used any more than they were.

Read More »

Read More »

US Manufacturing Questions

The US economic data begins to trickle in slowly. Today, the reopened Census Bureau reports on orders and shipments to and from US factories dating back to last November. New orders for durable goods rose just 4.5% year-over-year in that month, while shipments gained 4.7%. The 6-month average for new orders was in November pulled down to just 6.6%, the lowest since September 2017 (hurricanes).

Read More »

Read More »

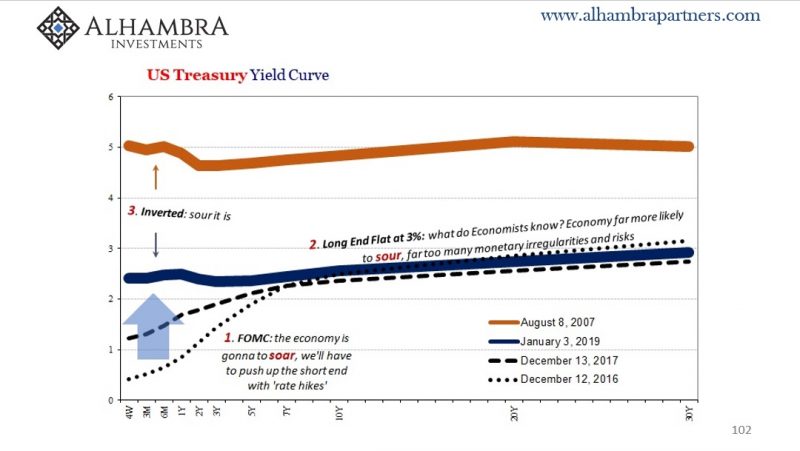

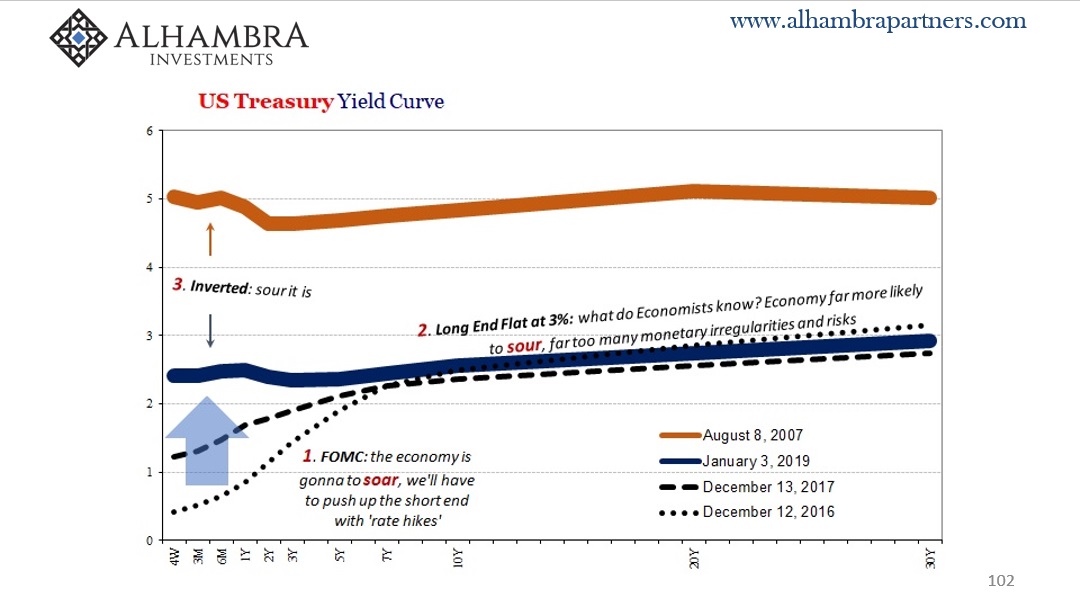

Bond Curves Right All Along, But It Won’t Matter (Yet)

Men have long dreamed of optimal outcomes. There has to be a better way, a person will say every generation. Freedom is far too messy and unpredictable. Everybody hates the fat tails, unless and until they realize it is outlier outcomes that actually mark progress. The idea was born in the eighties that Economics had become sufficiently advanced that the business cycle was no longer a valid assumption.

Read More »

Read More »

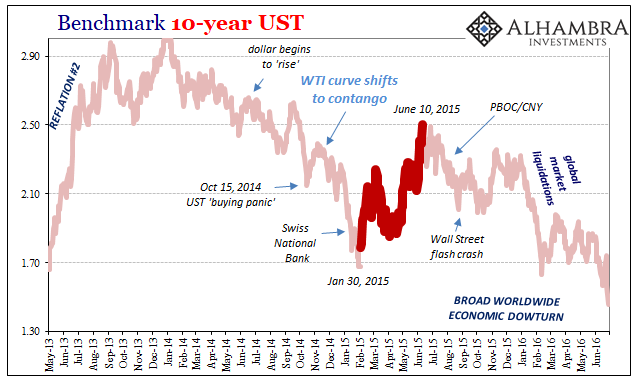

You Know It’s Coming

After a horrible December and a rough start to the year, as if manna from Heaven the clouds parted and everything seemed good again. Not 2019 this was early February 2015. If there was a birth date for Janet Yellen’s “transitory” canard it surely came within this window. It didn’t matter that currencies had crashed and oil, too, or that central banks had been drawn into the fray in very unexpected ways.

Read More »

Read More »

If You’ve Lost The ISM…

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow.

Read More »

Read More »

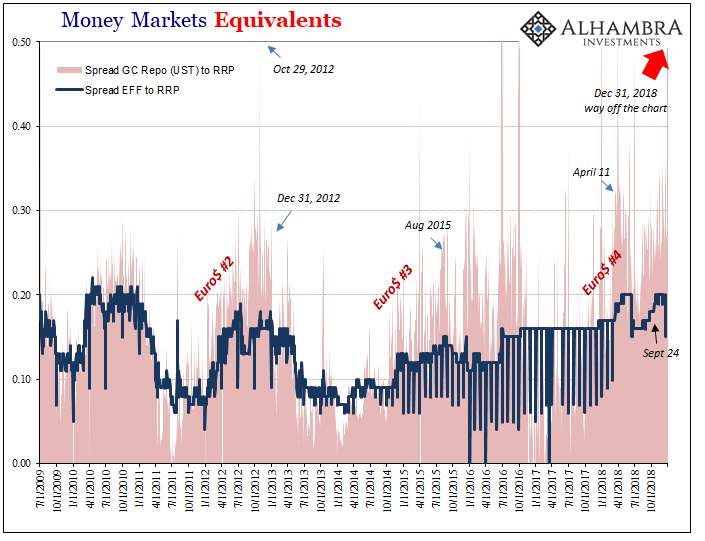

Insane Repo Reminds Us

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind the circumstances of that...

Read More »

Read More »

Just In Time For The Circus

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up the more “they” say it’s nothing just transitory roughness.

Read More »

Read More »

Xi Jinping’s Pretty Consistent Message

It seems many were disappointed by the speech delivered by Xi Jinping. China’s supreme leader spoke at the Great Hall of the People in Beijing today on the 40th anniversary of his country’s first embrace of economic reform. Commentators had been expecting Xi to use the occasion to recommit to liberalization, further opening China to free market forces.

Read More »

Read More »

‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts.

Read More »

Read More »

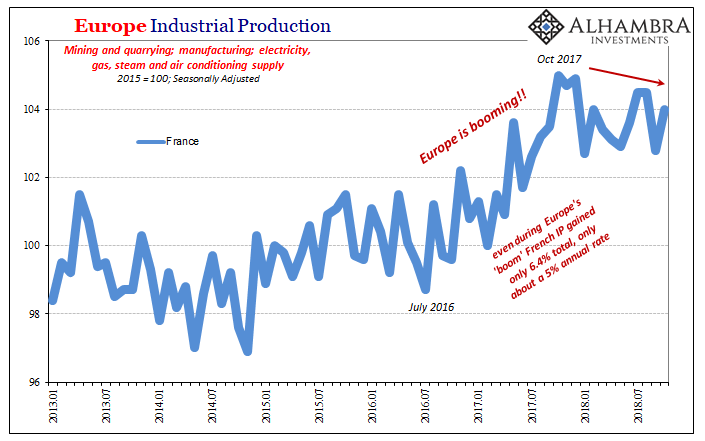

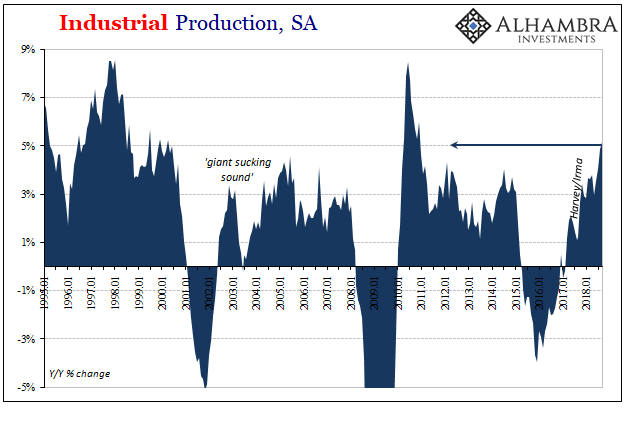

Just The One More Boom Month For IP

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010.

Read More »

Read More »

Europe Starting To Reckon Eurodollar Curve

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy.

Read More »

Read More »