Tag Archive: Currency

Marriage of Gold and Cryptocurrencies: A New Future?

The debate between relatively new digital cryptocurrencies versus ‘tried and true’ gold has dominated most precious metals related websites. But what if gold and cryptocurrencies were combined? According to a Bloomberg article a NYC Real Estate Mogul, after learning about cryptocurrencies from his son, is putting this concept to work by securing a minimum of $6 billion in gold reserves to back his new cryptocurrency.

Read More »

Read More »

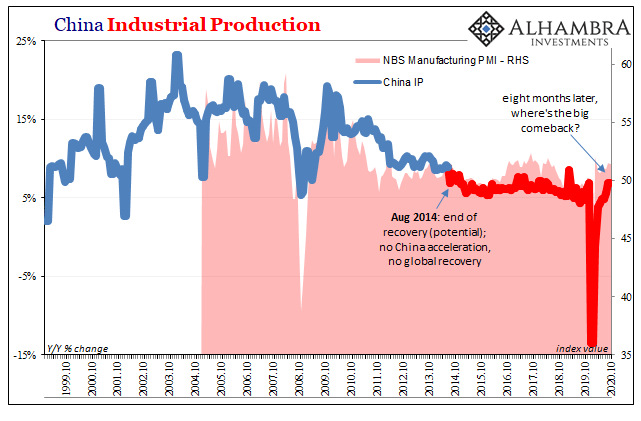

Six Point Nine Times Two Equals What It Had In Twenty Fourteen

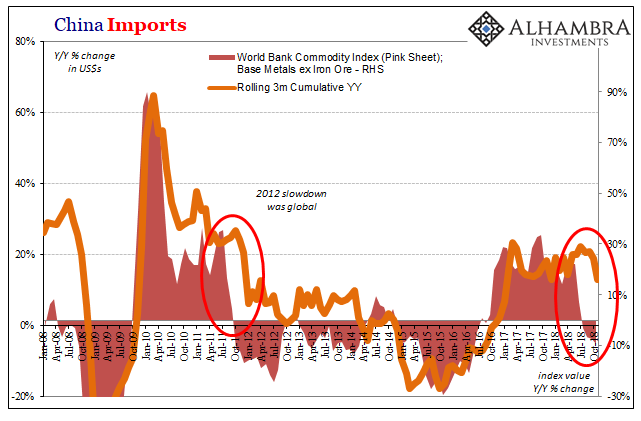

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.”

Read More »

Read More »

China’s Financial Stability: A Squeeze and a Strangle

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled.

Read More »

Read More »

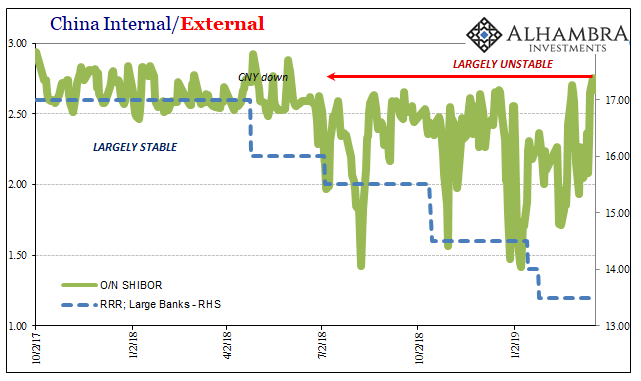

February 2019 PBOC/RMB Update

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions.

Read More »

Read More »

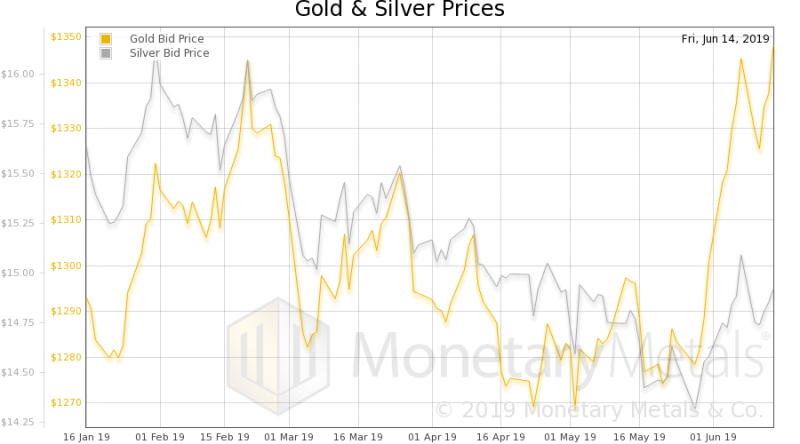

More Unmixed Signals

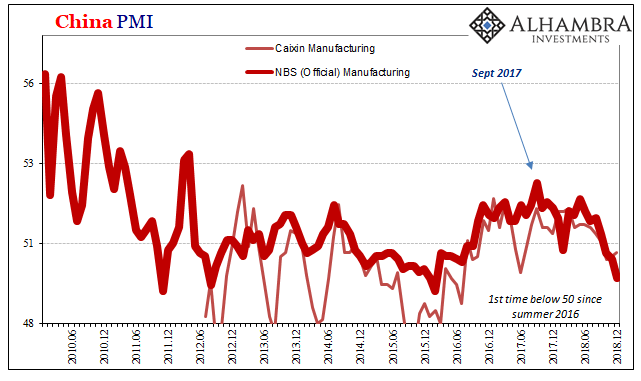

China’s National Bureau of Statistics (NBS) reports that the country’s official manufacturing PMI in December 2018 dropped below 50 for the first time since the summer of 2016. Many if not most associate a number in the 40’s with contraction. While that may or not be the case, what’s more important is the quite well-established direction.

Read More »

Read More »

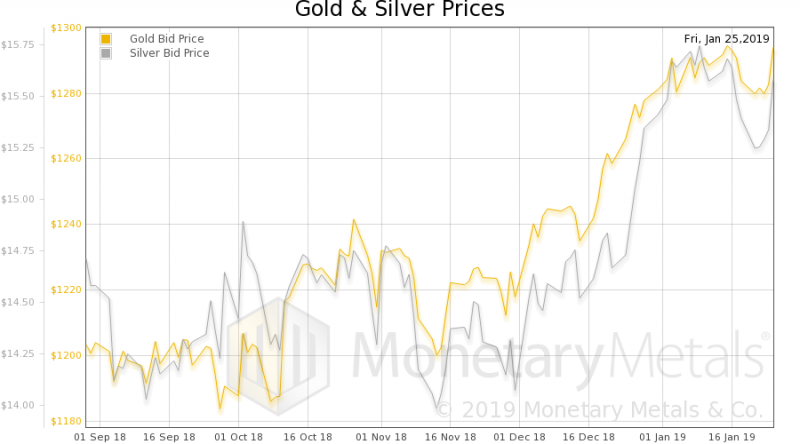

Sometimes Bad News Is Just Right

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019).

Read More »

Read More »

If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange.

Read More »

Read More »

A Gold Guy’s View Of Crypto, Bitcoin, And Blockchain

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well, everything.

Read More »

Read More »

The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the...

Read More »

Read More »

History Of Money and Evolution Suggests a Crash is Coming

2022-08-27

by Stephen Flood

2022-08-27

Read More »