Tag Archive: currency war

The Greenback Firms to Start the New Week, Stocks Slide

Overview: The busy week is off to a slow

start as Japan is on holiday and the UK and Canadian markets are closed to

honor Queen (Australia will commemorate with a holiday on Thursday). Nevertheless,

the sell-off in equities continues and the US dollar is firm. Most of the large

markets in Asia fell. India is a notable exception. Its benchmark rose for the

first time in four sessions, helped by bank shares and Infosys. Europe’s Stoxx

600 is off for...

Read More »

Read More »

No Rest for the Weary

Overview: Risk appetites are improving on the margin. Asia Pacific stocks still fell after the sharp losses on Wall Street on Monday. Still, China, Taiwan and Indian equities traded higher. Europe's Stoxx 600 is snapping a four-day 6.5%+ slide and is up around 1.2% in late European morning turnover.

Read More »

Read More »

FX Daily, January 29: Please Stay Seated, the Ride is not Over

Powerful corrective forces continue to grip the market. After a large rally to start the New Year, the correction is punishing. Most Asia Pacific equities markets were off again today to bring the week's loss to 2.5% to 5.5% throughout the region. Europe's Dow Jones Stoxx 600 is a little more than 1% lower on the day.

Read More »

Read More »

FX Daily, January 27: The Fed and Earnings on Tap

Overview: Risk appetites seem subdued even if GameStop's surge draws attention. Asia Pacific equities mostly slipped lower, and profit-taking was seen in Hong Kong and Seoul, which are off to an incredibly strong start to the year. Small gains were reported in Tokyo, Beijing, and Taipei.

Read More »

Read More »

FX Daily, December 17: Dollar Thumped

Overview: The prospects of a UK-EU deal and US stimulus continue to underwrite risk appetites and weigh on the dollar. Equity markets are moving higher. Led by Australia and China, the MSCI Asia Pacific Index rose to new record highs, while Dow Jones Stoxx 600 in Europe is at its best level since February.

Read More »

Read More »

Yes, the Dollar is Above CNY7.0, but No, the Sky is Not Falling

The world's two great powers are at loggerheads. Chinese nationalism meet your sister, US nationalism. Import substitution strategy of Made in China 2025 meet your cousin Make America Great Again. Paradoxically, or dialectically, the similarities are producing divergent interests that extend well beyond economics and trade policy.

Read More »

Read More »

Cool Video: The implication of CNY7.0+

President Trump's tweets last week announcing the end of the tariff truce signaled a new phase in the US-Chinese tensions. China responded as did investors. I was fortunate to have been invited to the Bloomberg set to discuss the issues of the day.

Read More »

Read More »

FX Daily, July 29: Prospects of a No-Deal Brexit Weigh on Sterling

Unrest in Hong Kong and disappointing earnings reports from South Korea weighed on local equity markets, and the MSCI Asia Pacific Index fell for the third consecutive session. European equities are edging higher in tentative trading. The Dow Jones Stoxx 600 is firmer for the sixth session of the past seven. US shares are little changed after record-high closes before the weekend.

Read More »

Read More »

THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck. Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert in the development of...

Read More »

Read More »

Initial Thoughts on Draghi

ECB President Draghi was unable to arrest the US dollar's slide and euro's surge. But he did not try particularly hard. While many investors are a bit stumped by the pace and magnitude of the dollar's slump, Draghi seemed to imply that it was perfectly understandable given the recovery of the eurozone economy.

Read More »

Read More »

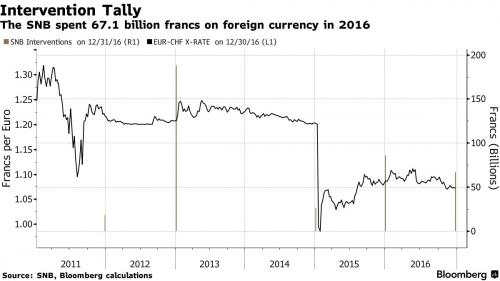

SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China.

Read More »

Read More »

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

Cool Video: Bearish Case for Euro and Prospect of Currency Wars

Still in London as this part of the business trip is winding down. I had the privilege of going over to the Bloomberg office today and spoke with Vonnie Quinn and Mark Burton about the euro's outlook and whether the US should have a strong or weak dollar.

Read More »

Read More »

Trump and the Dollar

US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk.

Read More »

Read More »

Talk of Secret Shanghai Agreement is a Distraction

(I have been sick with pneumonia but am just about back. I expect to resume my commentary tomorrow. Here is my overdue monthly column for a Chinese paper. Thanks to everyone for their support.)

Conspiracy theories have run amok. After sev...

Read More »

Read More »

(8) Currency Wars: How to Push and Talk Down Your Currency?

Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Read More »

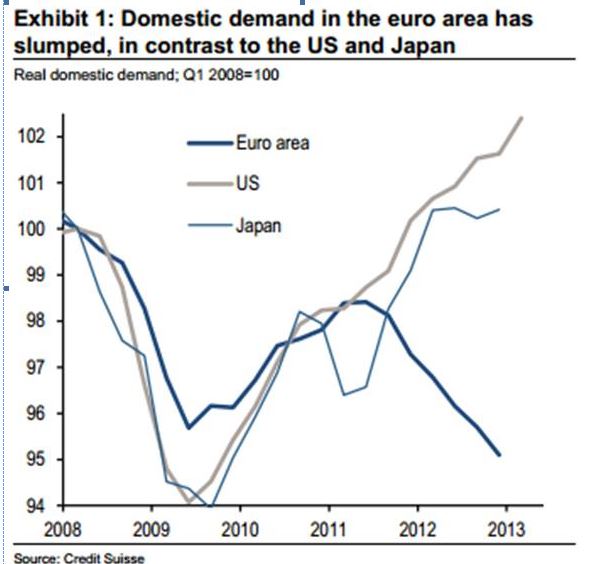

Balance of Payments Crisis: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

The Fed's excessive monetary easing QE2 caused an inflationary period, that created a balance of payments crisis during which the Eurozone members were obliged to introduce excessive austerity measures.

Read More »

Read More »

SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

Central Bank data show that the Swiss National Bank (SNB) remains the only central bank that strongly participated in currency wars with FX intervention, while the Japan was just verbal intervention.

Read More »

Read More »

Will Switzerland finally get hit by eurozone woes?

Switzerland and Japan are currently the leaders in currency manipulation, now even in front of the Fed and far ahead of the leader until 2009, China. Hear the interview with Guardian's Ambrose Evans-Pritchard on World Radio Switzerland.

Read More »

Read More »

New Russia/China Gold Backed Currency Imminent

2022-05-20

by Stephen Flood

2022-05-20

Read More »