Tag Archive: Currency Movements

FX Daily, July 26: Markets Consolidate as the Dollar Index Extends its Advance for the Sixth Consecutive Session

Investors are happy for the weekend. Between the ECB, Brexit, and next week's FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data point of the week, though it is unlikely to impact next week's Fed decision.

Read More »

Read More »

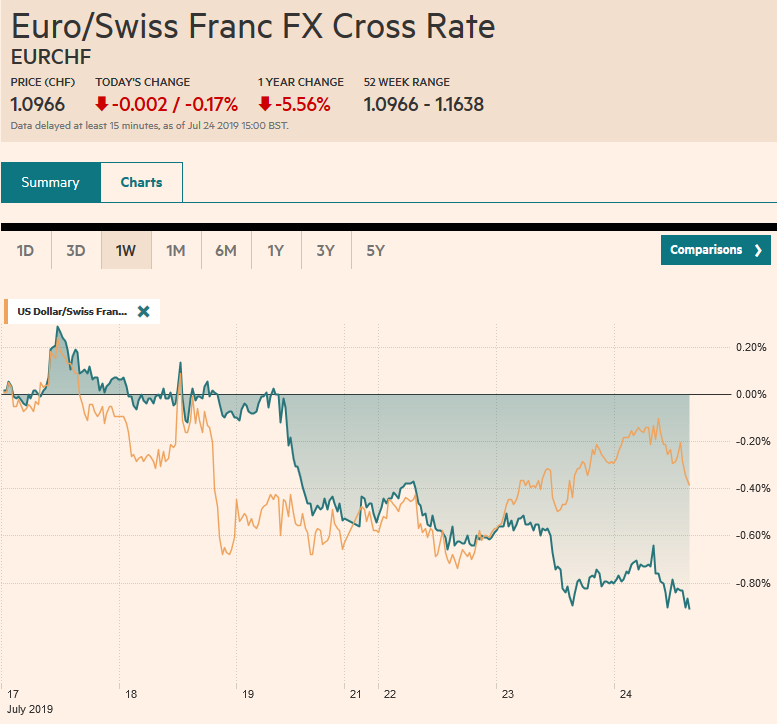

FX Daily, July 24: Poor PMI Weighs on Euro Ahead of ECB

Overview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow's ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and Spanish 10-year benchmark yields are off four-six basis points, while core bond yields are off two-three basis points.

Read More »

Read More »

FX Daily, July 23: Debt Deal Help Lifts the Dollar

The gains in US equities and the apparent US budget agreement has underpinned equities today and the US dollar. Asia Pacific equities recouped yesterday's losses, and Europe's Dow Jones Stoxx is posting gains for the third consecutive session, helped by some earning beats, to probe two-week highs. US shares are firmer. Benchmark 10-year yields are mixed with the Asia Pacific softer and European firmer.

Read More »

Read More »

FX Daily, July 22: Greenback is Mostly Firmer to Start New Week, while the Euro is Pinned near $1.12

What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new Prime Minister.

Read More »

Read More »

FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an Iranian drone in the Gulf helped spur gold to new six-year highs. There was some attempt to clarify the (NY Fed's) comments and the dollar has pared yesterday's losses.

Read More »

Read More »

FX Daily, July 18: Dollar on Back Foot as Equities Slide

Overview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second straight session and has now retraced half of the gains scored since early June. The Shanghai Composite is at its lowest level in a month.

Read More »

Read More »

FX Daily, July 16: Sterling Weakness Punctures Subdued Session

Overview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan, South Korea, and India. Europe's Dow Jones Stoxx 600 is flattish, struggling to extend its three-day rally.

Read More »

Read More »

FX Daily, July 15: Marking Time on Monday

Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed today, but equities were mostly firmer in the Asia Pacific regions, markets in China, Hong Kong, Taiwan, and India firmed.

Read More »

Read More »

Dollar’s Technical Tone Improves

It is not that the US dollar had a particularly good week. It was mixed. The best performers were sterling and the Canadian dollar. The pound led with a 1.6% gain, followed closely by the Canadian dollar.

The latest polls suggest that tho...

Read More »

Read More »