Tag Archive: Currency Movement

Consolidative Mood Grips Markets

Overview: The dollar is consolidating yesterday's advance and is confined to fairly narrow ranges in quiet turnover. Most of the major currencies are within 0.1% of yesterday's close near midday in Europe. The $1.1700-level held in the euro.

Read More »

Read More »

FX Daily, August 17: Antipodeans and Sterling Bear Brunt of Greenback’s Gains

Overview: Concern about the economic impact of the virus and new efforts by China to curb "unfair" competition among online companies has triggered a dramatic response by investors. A lockdown in New Zealand and the Reserve Bank of Australia signaling it will respond if the economic fallout increases sent the Antipodean currencies sharply lower.

Read More »

Read More »

Rising Rates Underpin the Greenback

Overview: The US dollar remains firm ahead of the July CPI release, and even though Chicago Fed Evans demurred from the hawkish talk, the market is getting more comfortable with the idea of a rate hike next year.

Read More »

Read More »

Gold’s Flash Crash and Limited Follow-Through Greenback Gains

Overview: A flash crash saw gold drop more than $70 an ounce in early Asia. Silver was dragged lower too. The precious metals have stabilized at lower levels, but it signals a rough adjustment to a higher interest rate environment as a hawkish BOE and strong US employment data suggest peak monetary stimulus is at hand.

Read More »

Read More »

US Employment Data is Important but for the Millionth Time, Don’t Exaggerate It

Overview: Record high closes yesterday for the S&P 500 and NASDAQ have done little to help global equities today. Most of the Asia Pacific region markets, but Japan and Australia slipped ahead of the weekend while still holding on to gains for the week.

Read More »

Read More »

Yesterday’s Dollar Recovery Stalls

Overview: US interest rates and the dollar turned higher following comments by the Fed's Vice Chairman Clarida, who appeared to throw his lot with the more hawkish members. The dollar recovered from weakness that had seen it fall to almost JPY108.70, its lowest level since late May, and lifted the euro to $1.19.

Read More »

Read More »

Greenback Softens amid Stronger Risk Appetites to Start August

Overview: Risk appetites snap back after easing in the waning hours last month. The MSCI Asia Pacific equities jumped back after dropping 1.8% last week for the second week in a row. Japan's Topix and China's CSI 300 rose by more than 2%, and Hong Kong, Taiwan, and Australia gained more than 1%.

Read More »

Read More »

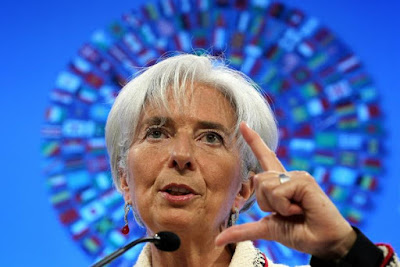

FX Daily, July 22: Enguard Lagarde

Overview: The rally in US shares yesterday, ostensibly fueled by strong earnings reports, is helping to encourage risk appetites today. The MSCI Asia Pacific Index is posting its biggest gain in around two weeks, though Japan's markets are closed today and tomorrow. The Dow Jones Stoxx 600 is building on yesterday's rally, and with today's ~0.8% gain, it is up on the week.

Read More »

Read More »

FX Daily, July 21: Did Japan Deliver a Fait Accompli to the US?

Overview: The biggest rally in US equities in four months has helped stabilize global shares today. In the Asia Pacific region, Japan, China, and Australian markets advanced. Led by information technology and consumer discretionary sectors, Europe's Dow Jones Stoxx 600 is up around 1.35% near the middle of the session.

Read More »

Read More »

FX Daily, July 20: Doom and Gloom Takes Toll

Overview: The capital markets have begun stabilizing after yesterday's dramatic moves. The MSCI Asia Pacific Index did, though, see follow-through selling, and the third consecutive loss saw the benchmark close below its 200-day moving average for the first time in a year. Europe's Dow Jones Stoxx 600 is posting small gains to snap a four-day drop.

Read More »

Read More »

FX Daily, July 16: BOJ Tweaks Forecasts

The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland's cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European bourses are edging higher, while US futures are oscillating around unchanged levels.

Read More »

Read More »

FX Daily, July 15: Strong Gains in US CPI and PPI Don’t Stop the Bond Market Rally

Strong inflation prints this week have not prevented the long-term US interest rates from tumbling. The 10-year yield is about 10 bp lower than where it closed on Tuesday after the lackluster 30-year auction. The 30-year yield itself is 11 bp lower.

Read More »

Read More »

FX Daily, July 14: RBNZ Moves Ahead of the Queue, Will the Bank of Canada Maintain its Place?

The Reserve Bank of New Zealand jumped to the front of the queue of central banks adjusting monetary policy by announcing the end of its long-term asset purchases. New Zealand's s 10-year benchmark yield jumped seven basis points, and the Kiwi is up almost 1%, to lead the move against the greenback today.

Read More »

Read More »

FX Daily, July 13: Headline US CPI may Decline for the First Time in a Year

New record highs in the US S&P 500 and NASDAQ coupled with China allowing Tencent to acquire a search engine helped lift Asia Pacific equities. It is the first back-to-back by MSCI's regional index for more than two weeks. Australia's market was a notable exception.

Read More »

Read More »

FX Daily, July 12: Markets Adrift ahead of Key Events

The new week has begun quietly. The dollar is drifting a little higher against most major currencies, with the Scandis and dollar-bloc currencies the heaviest. The yen and Swiss franc's resilience seen last week is carrying over.

Read More »

Read More »

FX Daily, July 09: PBOC Cuts Reserve Requirements after Inflation Measures Ease

The capital markets are winding down what has been a challenging week that has seen equity markets slide and the dollar and bonds rally. The MSCI Asia Pacific fell for the fourth consecutive session, but the more interesting story may be the intrasession recovery that could set the stage for a better performance next week.

Read More »

Read More »

FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

The dollar has steadied after surging yesterday and has so far retained the lion's share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming.

Read More »

Read More »

FX Daily, July 02: US Jobs and OPEC+ Day

The US jobs report and OPEC+ decision are awaited. The dollar remains bid. Only the yen and Canadian dollar are showing a hint of resilience, though, on the week, the Scandis and dollar-bloc currencies are off between around 1-2%. The greenback is also firmer against the emerging market currency complex, and the JP Morgan index is off for the sixth consecutive session.

Read More »

Read More »

FX Daily, July 01: The Greenback is Bid to Start the Second Half

Soft Asian manufacturing PMIs weighed on local shares after the S&P 500 set new record highs yesterday. European shares are recouping yesterday's month-end losses, while US futures indices are bid. The US 10-year yield is around 1.47%, and European yields are 1-2 bp higher.

Read More »

Read More »

FX Daily, June 30: The Greenback is Firm into Quarter-End

The dollar is finishing the quarter on firm footing, gaining against most of the major currencies today. The euro is straddling the $1.1900 area, having begun the month above $1.22. Sterling has tested the $1.38 area. It had traded at a three-year high near $1.4250 at the start of the month.

Read More »

Read More »