Tag Archive: currencies

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

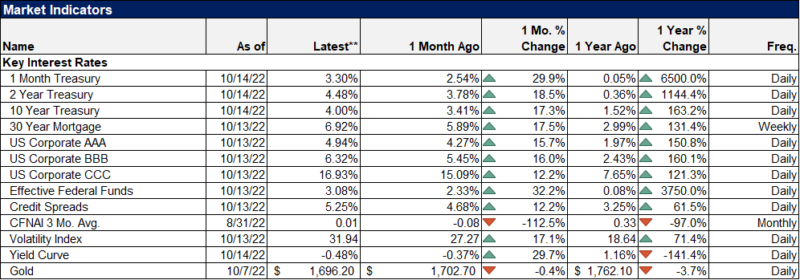

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market.

Read More »

Read More »

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

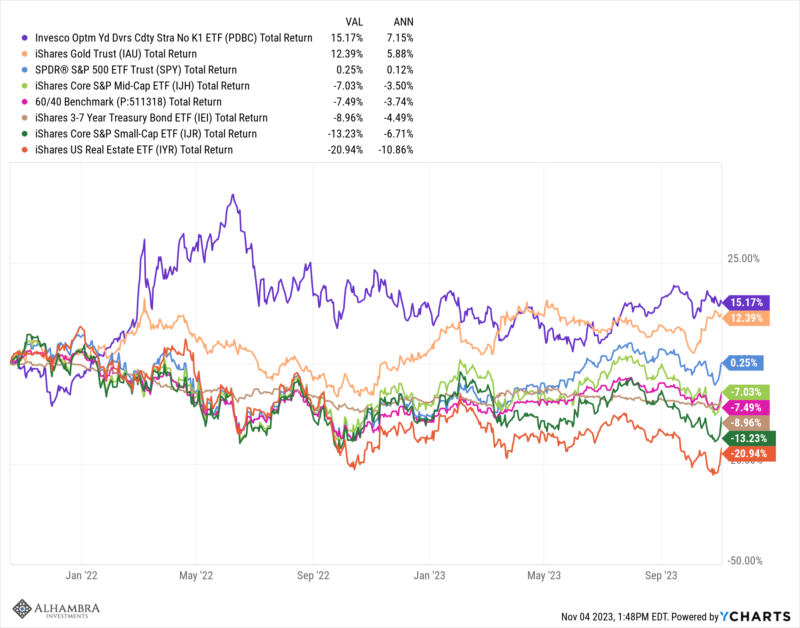

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »

Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air.

Read More »

Read More »

Weekly Market Pulse: Happy Days Are Here Again!

Your cares and troubles are gone

There’ll be no more from now on!

Happy days are here again!

The skies above are clear again

Let us sing a song of cheer again

Happy days are here again!

Lyrics: Jack Yellen, Music: Milton Ager

That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P...

Read More »

Read More »

Weekly Market Pulse: First, Kill All The Speculators

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome.

Read More »

Read More »

Weekly Market Pulse: A Fatal Conceit

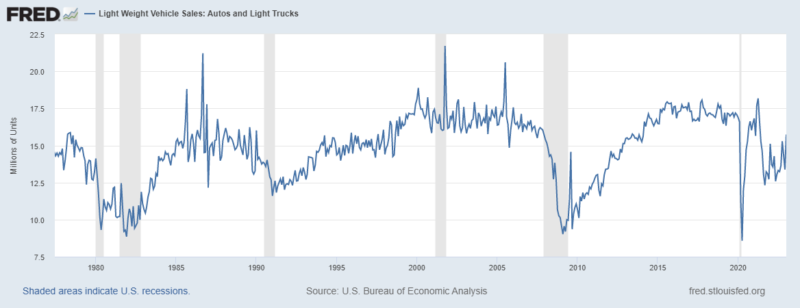

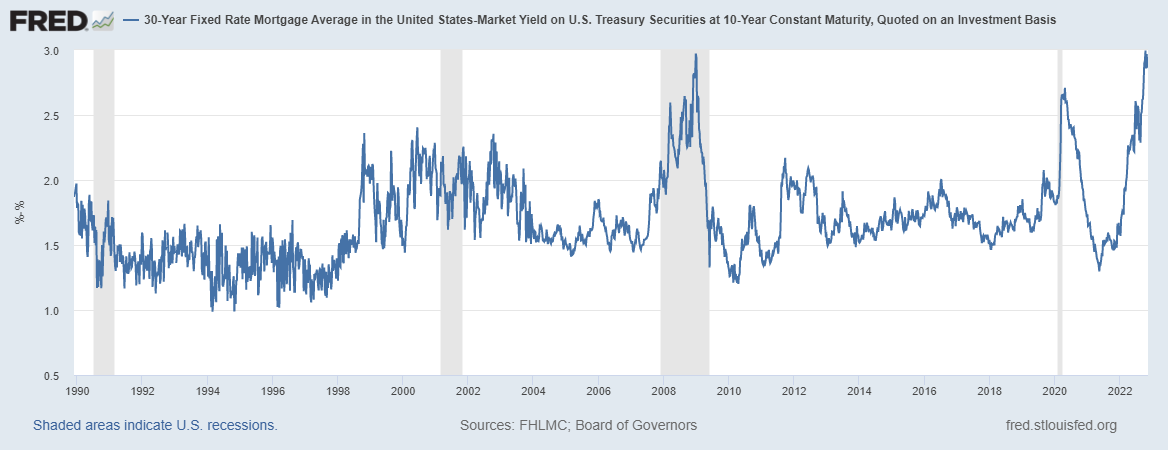

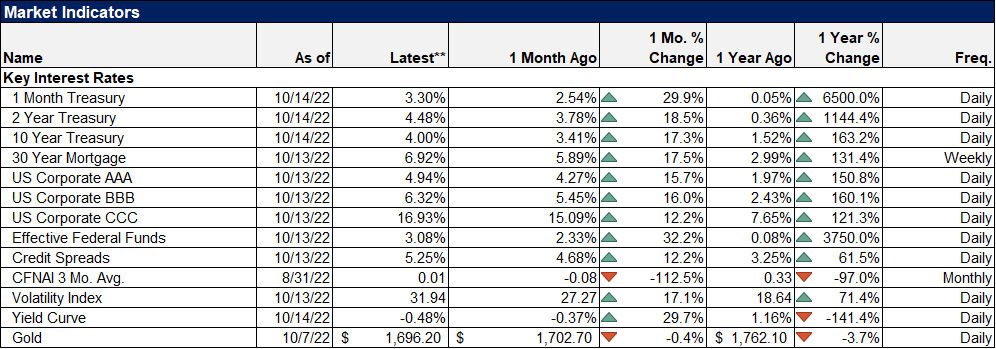

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business.

Read More »

Read More »

Weekly Market Pulse: Happy Holidays

We received a host of economics reports this past week; some good, others not so much. The week started with the Consumer Price Index report coming in better than expected at an increase of just 0.1% from the previous month (7.1% from a year ago), compared with respective estimates of 0.3% and 7.3%.

Read More »

Read More »

Weekly Market Pulse: Envy

Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated: “The world is not driven by greed.

Read More »

Read More »

Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately,...

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

The Cleanest Dirty Shirt

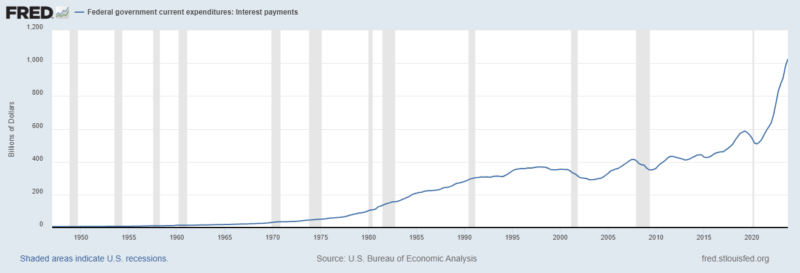

It’s easy to overestimate the problems the United States faces while underestimating its strengths. The challenges are certainly significant. Politics have seldom been so divisive. The government is running an annual deficit of over a trillion dollars, with a total debt many times that. Inflation has spiked. The Fed has been hiking interest rates at a pace that could imperil the economy.

Read More »

Read More »

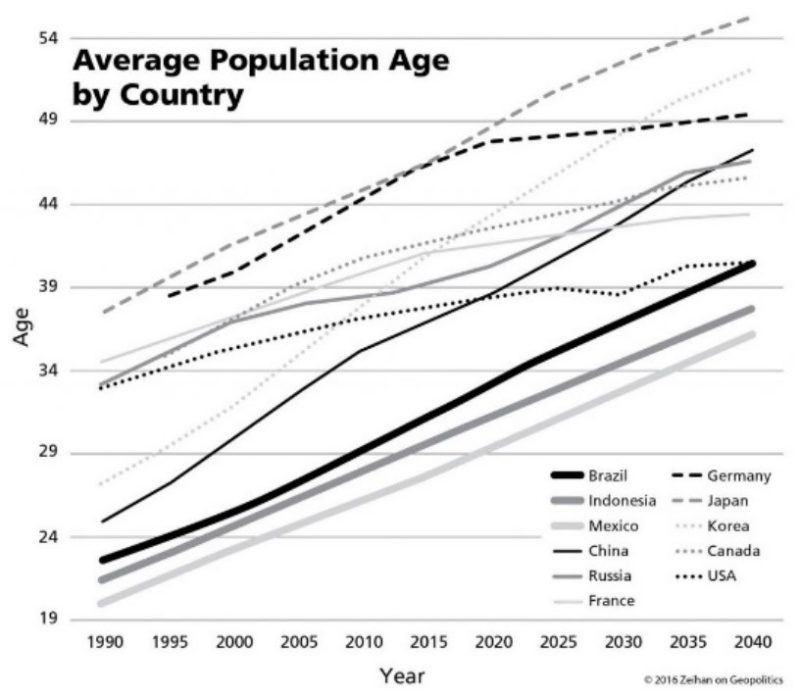

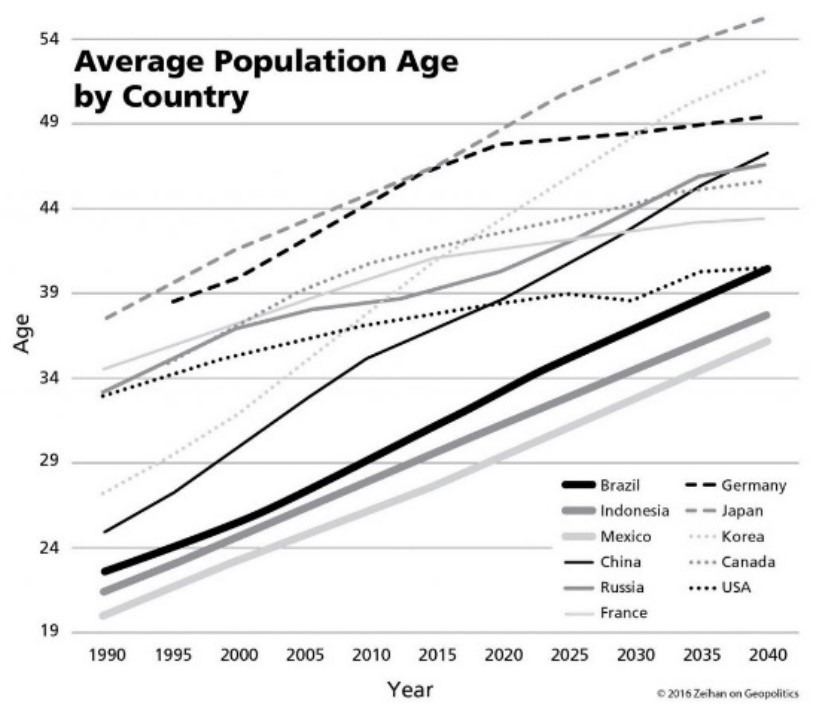

SPECIAL REPORT: Follow The Money Series – Dawn Of A New Era

With inflation recently hitting a high not seen since 1981, it is now apparent that the factors that drove the disinflation trend of the last four decades are coming to an end. Globalization and demographics, the two big factors that combined to hold down prices and wages for so long, are reversing, and so too is the downtrend in prices, wages, and interest rates.

Read More »

Read More »

Weekly Market Pulse: Did Powell Just Blink?

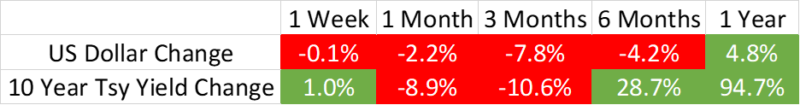

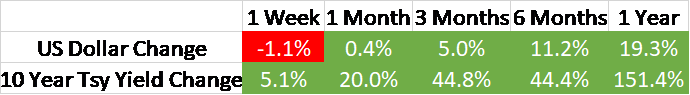

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close.

Read More »

Read More »

Market Currents: Fed Confusion

The Federal Reserve seems confused about its role in inflation and unemployment. Alhambra’s Steve Brennan and Joe Calhoun discuss it.

Read More »

Read More »

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

Market Currents: Don’t Listen to Buy and Hold Investing Advice

For decades a Buy and Hold strategy was a staple of financial advice. But should it be? Alhambra CEO separates myth and reality.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Are investors at the point of maximum pessimism? Alhambra CEO Joe Calhoun talks about a horrible 3rd quarter, sentiment, and where investors can look right now.

Read More »

Read More »

Here are three things you can learn from the Fed

2023-01-13

by Stephen Flood

2023-01-13

Read More »