Tag Archive: COVID-19

Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion.

Read More »

Read More »

Weekly Market Pulse: Not So Evergrande

US stocks sold off last Monday due to fears over the potential – likely – failure of China Evergrande, a real estate developer that has suddenly discovered the perils of leverage. Well that and the perils of being in an industry not currently favored by Xi Jinping. He has declared that houses are for living in not speculating on and ordered the state controlled banks to lend accordingly.

Read More »

Read More »

Weekly Market Pulse: Is It Time To Panic Yet?

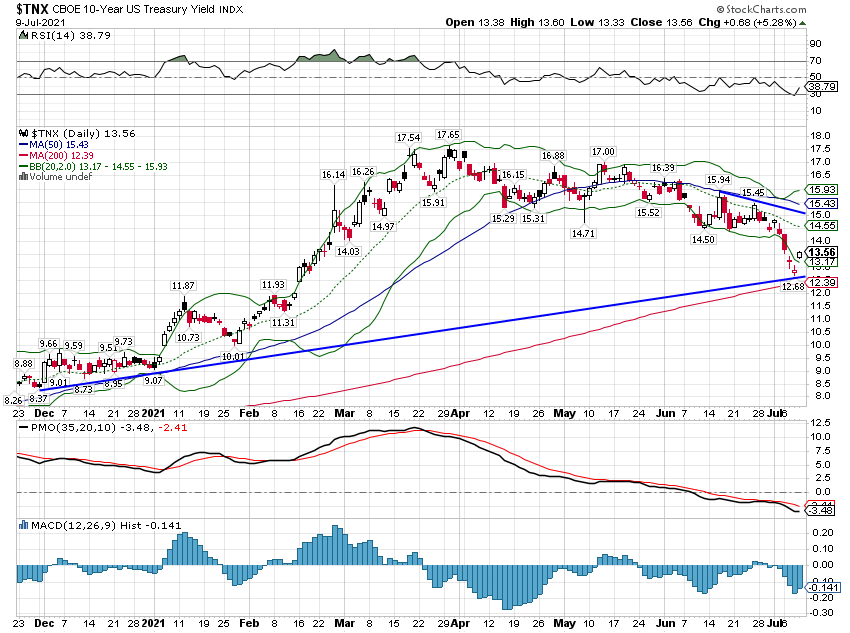

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »

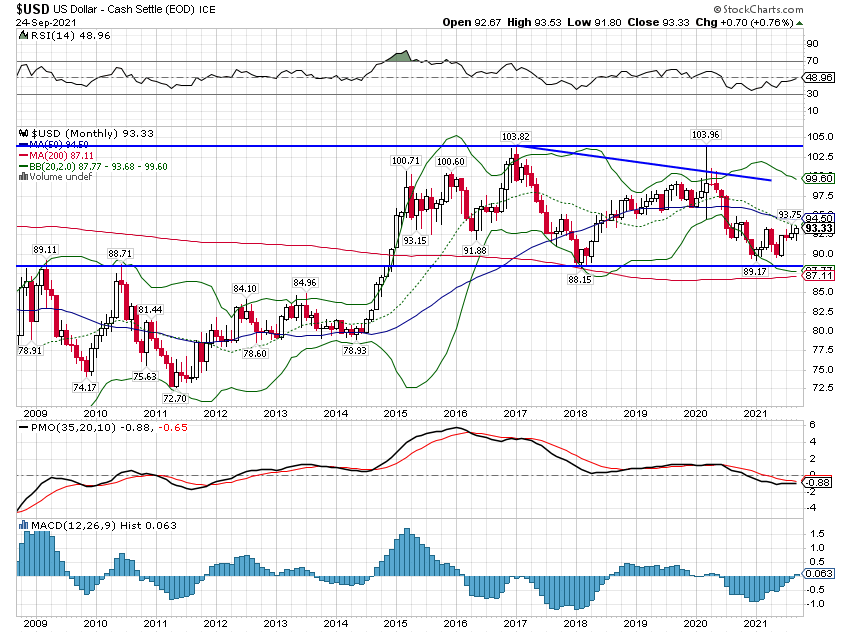

FX Daily, April 26: Big Week Begins Quietly, with the Greenback Still Under Pressure

Overview: What promises to be a notable week has begun off quietly: the US, EMU, and South Korea report Q1 GDP. The eurozone also provides its first estimate of April inflation. Corporate earnings feature tech and financial firms. Equities are mostly firmer in the Asia Pacific region and Europe.

Read More »

Read More »

FX Daily, April 20: Market has Second Thoughts about Timing of First Fed Hike

Overview: Even as US yields edge higher, the dollar struggles. With the 10-year Treasury yields now at 1.62%, nine basis points above last week's lows, the greenback has turned mixed against the major currencies. After briefly slipping below JPY108, the dollar has recovered to around JPY108.55.

Read More »

Read More »

Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag.

Read More »

Read More »

FX Daily, November 10: Markets Remain Unsettled

Overview: Pfizer's vaccine announcement eclipsed the US election as the key market driver. It spurred the unwinding of Covid trades in terms of sectors and yields. Emerging market currencies and the majors that benefit from world growth outperformed the perceived safe-havens, like the yen and the Swiss franc.

Read More »

Read More »

FX Daily, November 3: Risk Appetites Return as the US Goes to the Polls

More than 95 mln Americans voted before today, and many observers warn of a cliffhanger that could be decided in the courts. The polls sand surveys show strong odds in favor of a Democratic sweep. Looking at the capital markets, nothing looks amiss.

Read More »

Read More »

FX Daily, October 28: Animal Spirits Called in Sick

Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions.

Read More »

Read More »

FX Daily, October 2: POTUS Infected: Is this the October Surprise?

Before a US election, there is often speculation of a last-minute game-changing development. News earlier today that the US President and his wife have tested positive for the Covid virus has injected a new unknown into not only the US election but the markets as well.

Read More »

Read More »

FX Daily, September 14: UK Presses Ahead, China Strikes Out at German Pork Producers, and Moody’s Weighs on Turkey

A flurry of deals, including the still-evolving Oracle-TikTok tie-up, helped lift equity markets in the Asia Pacific region. South Korea's Kospi, and Indonesia, which had been battered last week, led the advance. The MSCI Asia Pacific Index rose for the third consecutive sessions. European bourses are little changed while US stocks are firmer.

Read More »

Read More »

FX Daily, June 22: Dollar Begins Week on Back Foot

Overview: Investors begin the new week, perhaps slowed a bit by the weekend developments and the growth of new infections. Equities are mixed. The MSCI Asia Pacific Index snapped a four-day advance, though India bucked the regional trend and gained 1%. Europe's Dow Jones Stoxx 600 is recovering from an early dip to four-day lows. US shares are trading higher after the S&P 500 closed below 3100 ahead of the weekend after reaching 3155.

Read More »

Read More »

OECD forecasts drop in Swiss economic growth in 2020

Even though restrictions aimed at slowing the spread of Covid-19 were less strict than in other countries, Switzerland will still see its GDP fall by 7.7%, if the pandemic is contained by summer.

Read More »

Read More »

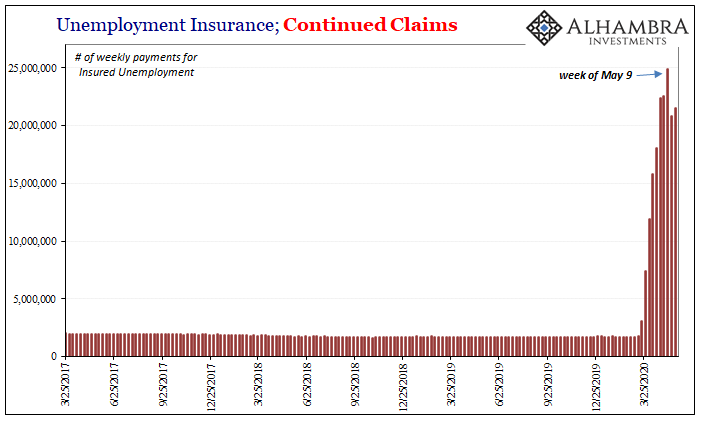

What Did Everyone Think Was Going To Happen?

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign.The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this...

Read More »

Read More »

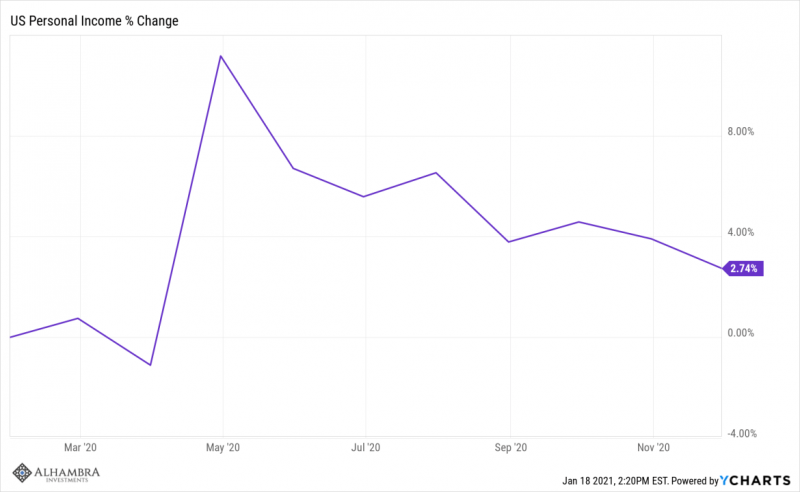

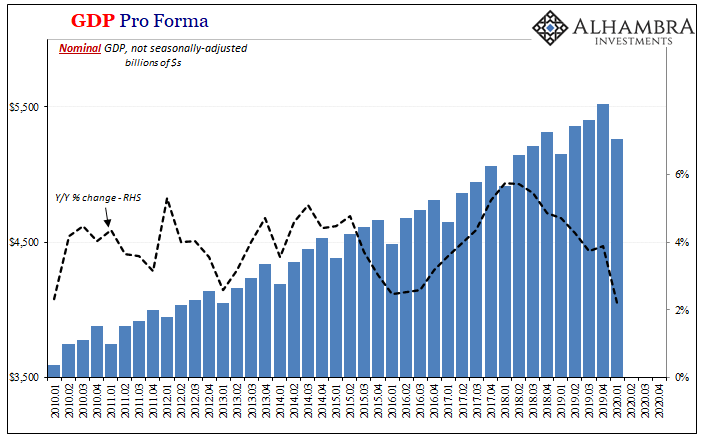

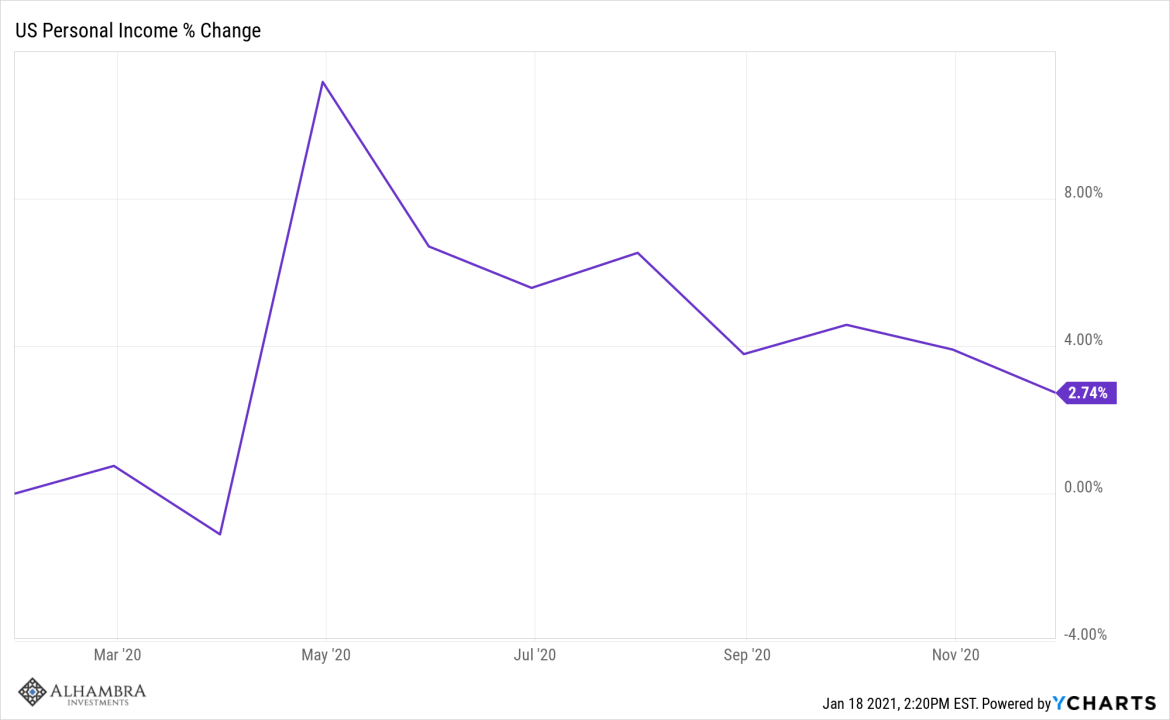

Getting A Sense of the Economy’s Current Hole and How the Government’s Measures To Fill It (Don’t) Add Up

The numbers just don’t add up. Even if you treat this stuff on the most charitable of terms, dollar for dollar, way too much of the hole almost certainly remains unfilled. That’s the thing about “stimulus” talk; for one thing, people seem to be viewing it as some kind of addition without thinking it all the way through first.You have to begin by sizing up the gross economic deficit it is being haphazardly poured into – with an additional emphasis...

Read More »

Read More »

FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday's loss.

Read More »

Read More »

FX Daily, April 14: Equities are Firm but New Developments Needed or Risk Appetites may Become Satiated

Overview: Risk appetites have returned today after taking yesterday off. The MSCI Asia Pacific Index advanced every day last week, slipped yesterday, and jumped back today. Most of the national benchmark advanced at least 1.5%, and the Nikkei led the way with a 3% rally to reach its best level since mid-March.

Read More »

Read More »

FX Daily, April 8: Flavor of the Day: Consolidation

Overview: Global equities are struggling after the S&P 500 staged a dramatic reversal yesterday. The early 3.5% gain was completely unwound and closed slightly lower. With few exceptions (e.g., Japan and the Philippines), most equity markets in the Asia Pacific region and Europe are lower.

Read More »

Read More »

FX Daily, April 6: Glimmer of Hope Lifts Markets

Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the number of states with infection rates above 20% is less than 10 from over 40 last week.

Read More »

Read More »