The Washington Post began this week by noting how the US economy seems to have lost its purported zip just when it needed that vitality the most. Never missing a chance to take a partisan swipe, of course, still there’s quite a lot of truth behind the charge. An actual economic boom produces cushion, enough of one that President Trump and his administration may have been counting on it when opting for full-blown shutdown.

Read More »

Tag Archive: China PMI

Meanwhile, Over In Asia

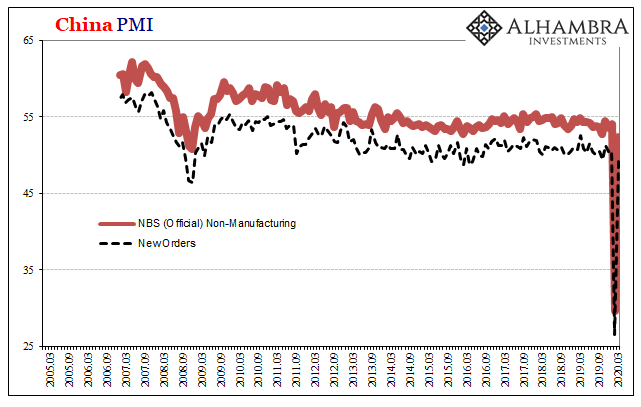

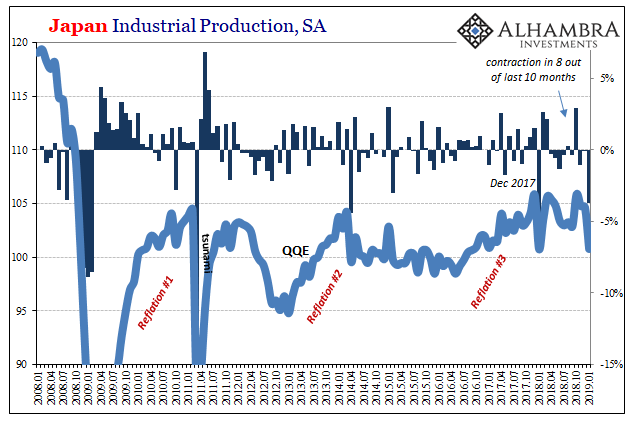

While Western markets breathed a sigh of relief that US GDP didn’t confirm the global slowdown, not yet, what was taking place over in Asia went in the other direction. There has been a sense, a wish perhaps, that if the global economy truly did hit a rough spot it would be limited to just the last three months of 2018. Hopefully Mario Draghi is on to something.

Read More »

Read More »

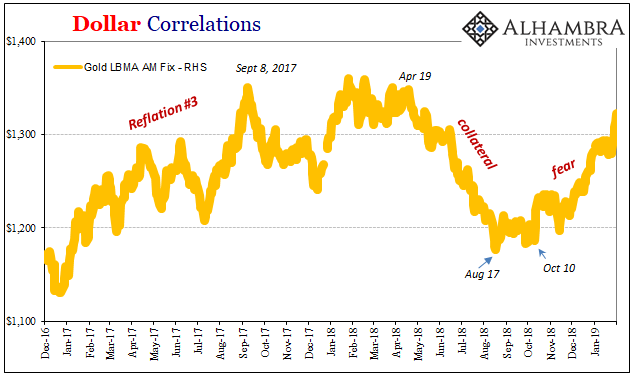

Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way.

Read More »

Read More »

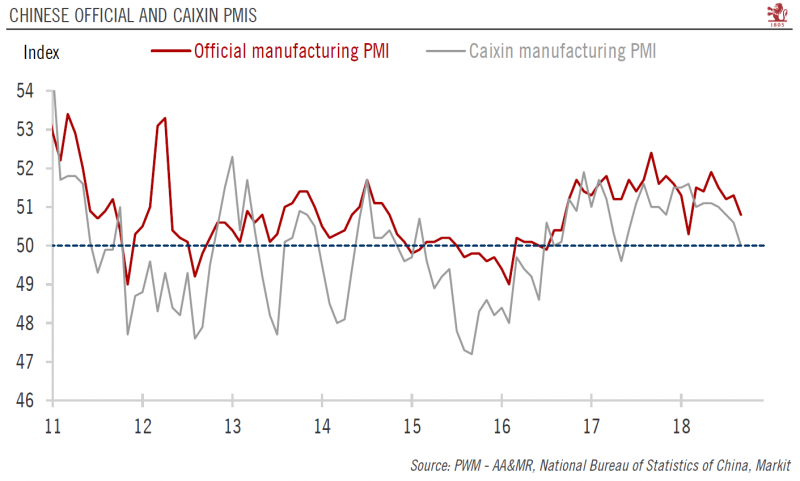

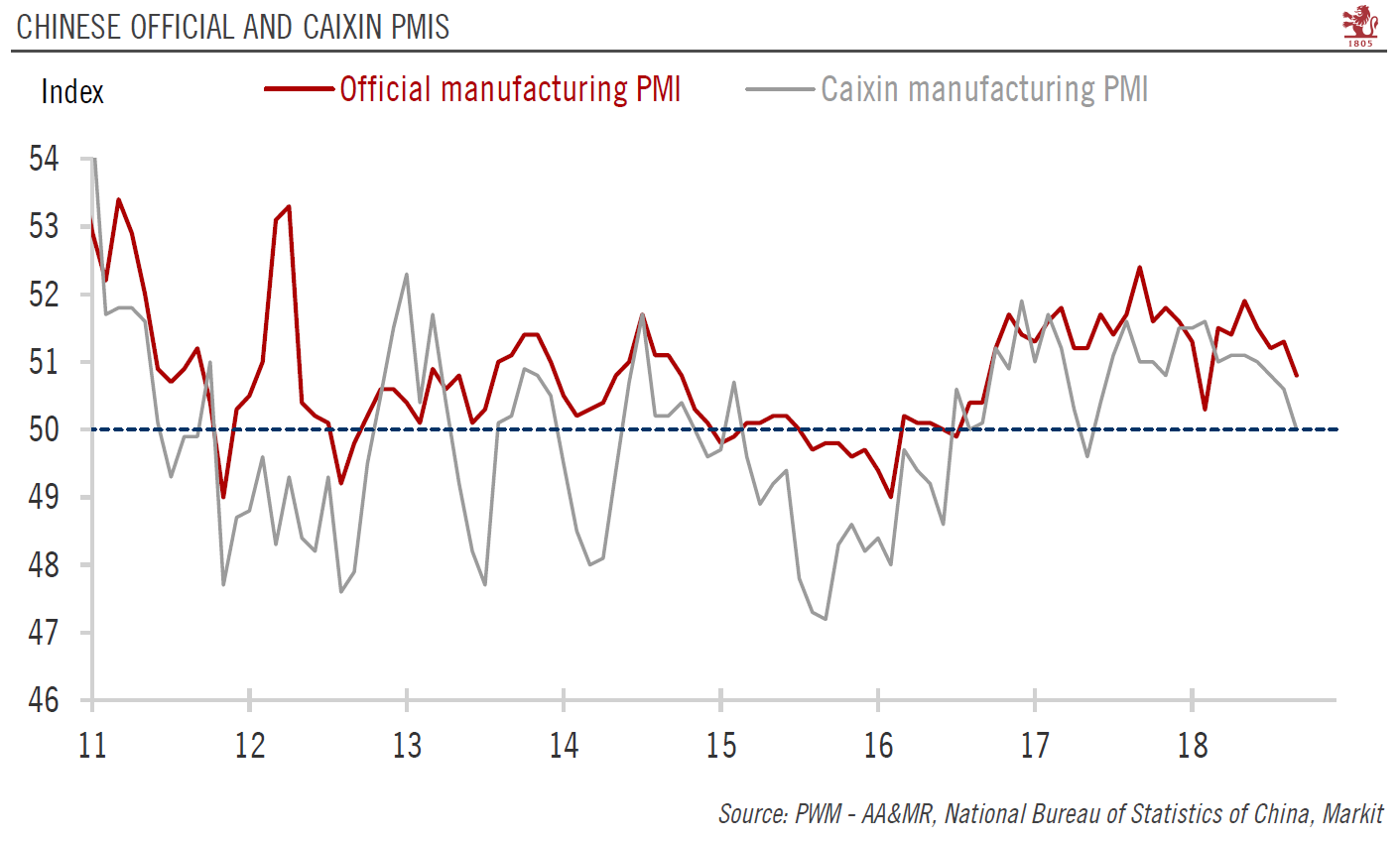

Chinese PMI data points to further growth moderation

More policy support is expected, and may lead to slight rebound in Q4.China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely continued to moderate in Q3 and that the weakness may extend into Q4.In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has turned to policy easing since June.

Read More »

Read More »