Tag Archive: cfnai

Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

Read More »

Read More »

The Economy Improved In July

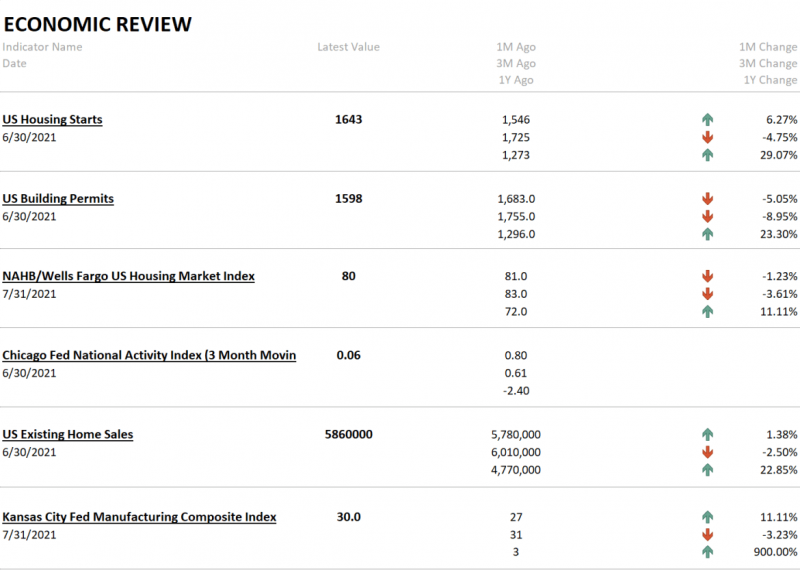

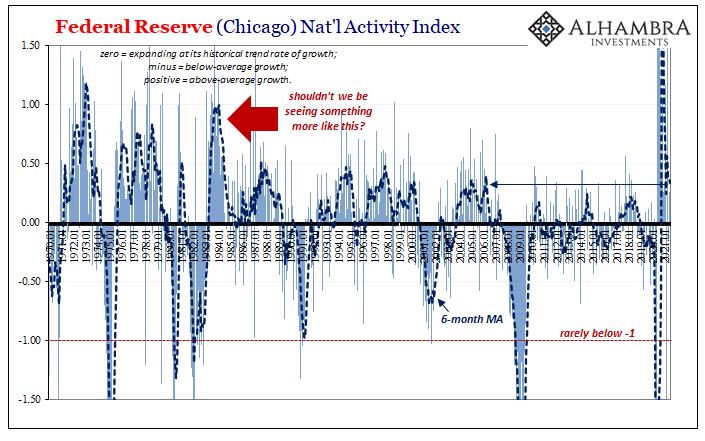

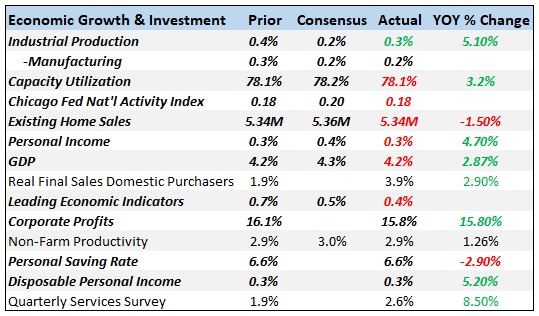

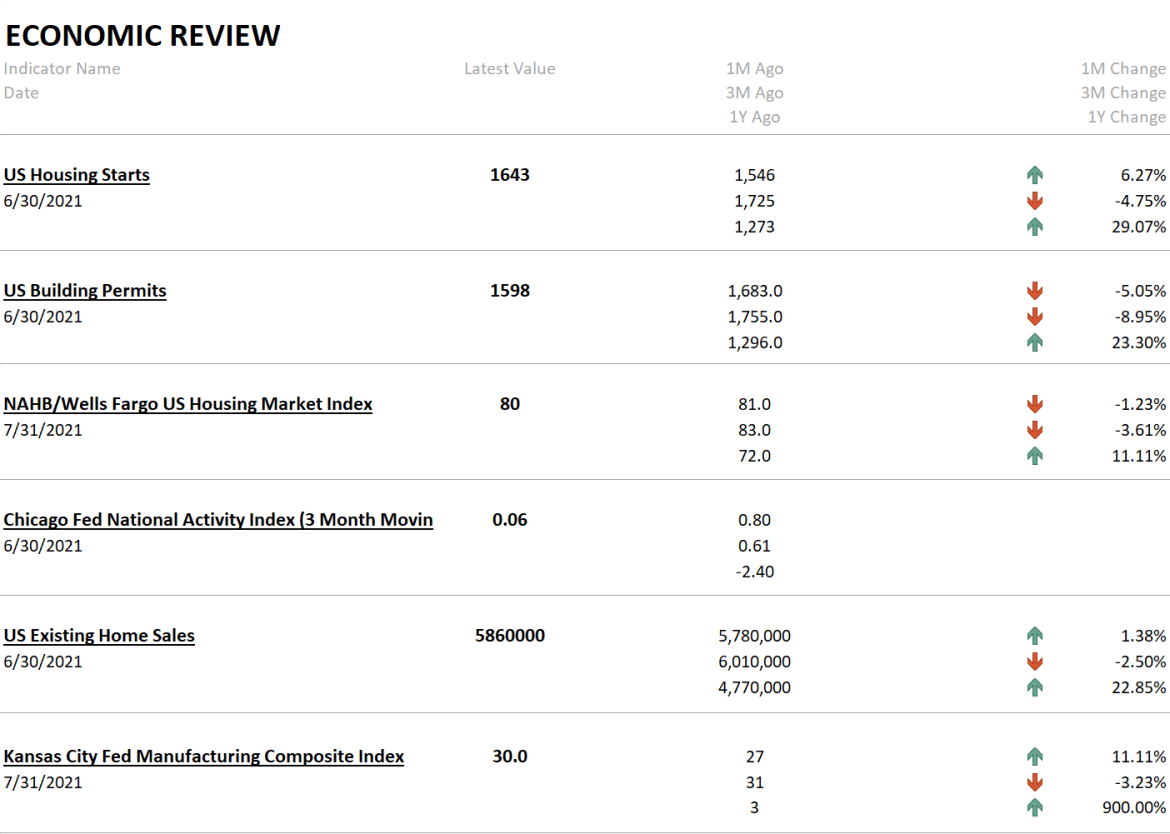

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

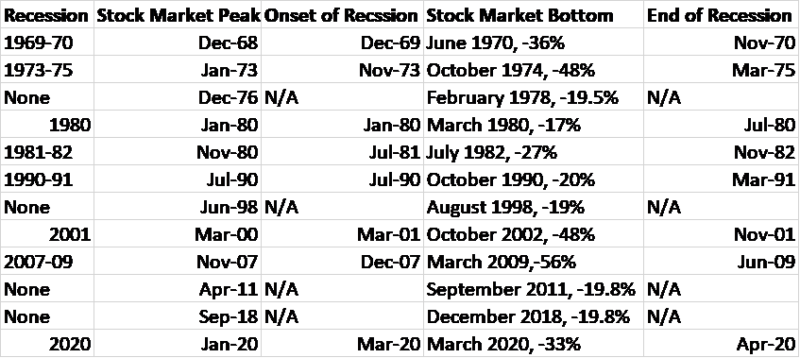

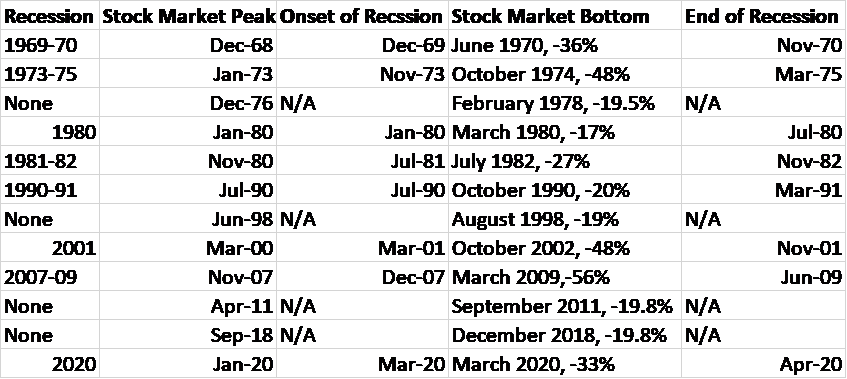

Weekly Market Pulse: Is The Bear Market Over?

Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days.

Read More »

Read More »

Weekly Market Pulse: Are We There Yet?

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness.

Read More »

Read More »

Weekly Market Pulse: Growth Scare?

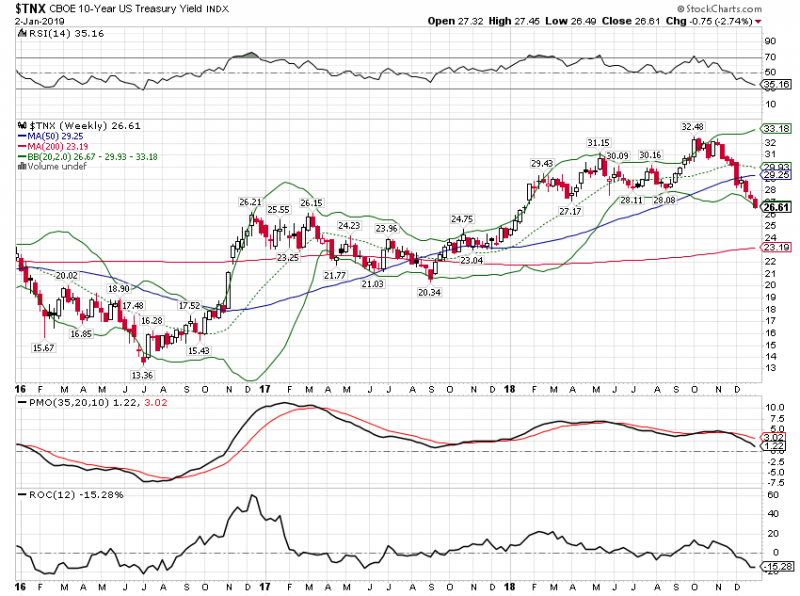

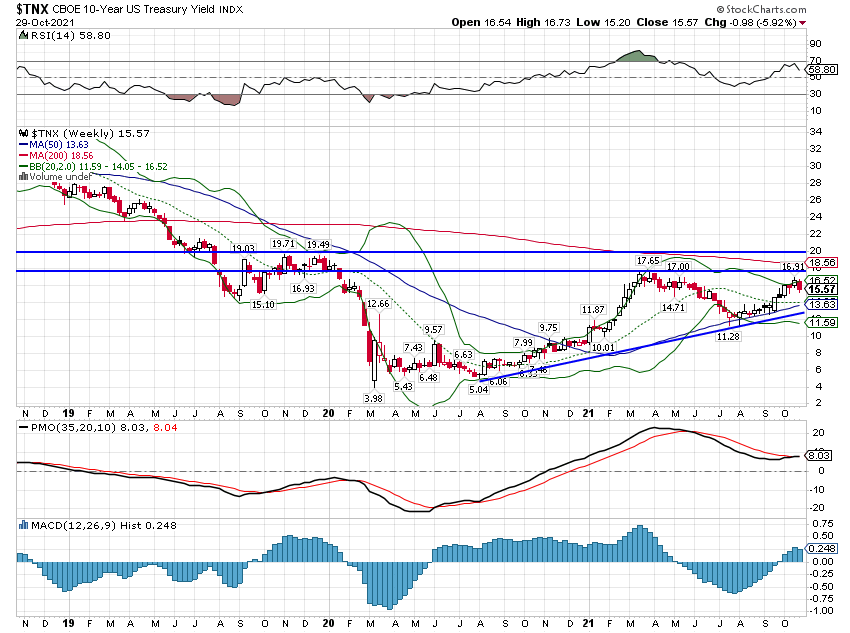

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved.

Read More »

Read More »

Weekly Market Pulse: Inflation Scare!

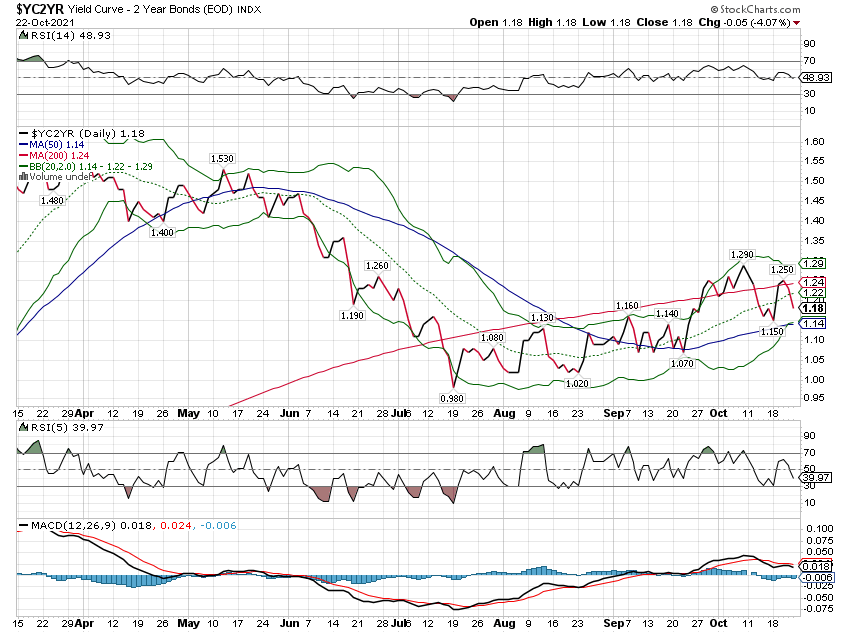

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »

Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time.

Read More »

Read More »

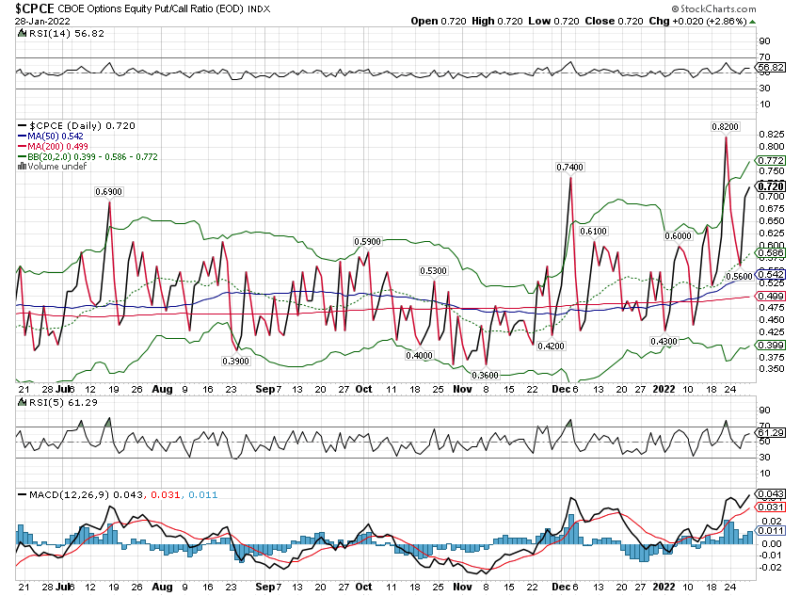

Weekly Market Pulse: Buy The Dip, If You Can

If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »

Read More »

Do Rising ‘Global’ Growth Concerns Include An Already *Slowing* US Economy?

Global factors, meaning that the wave of significantly higher deflationary potential (therefore, diminishing inflationary chances which were never good to begin with) in global bond yields the past five months have seemingly focused on troubles brewing outside the US. Overseas turmoil, it was called back in 2015, leaving by default a picture of relative American strength and harmony.

Read More »

Read More »

Weekly Market Pulse: As Clear As Mud

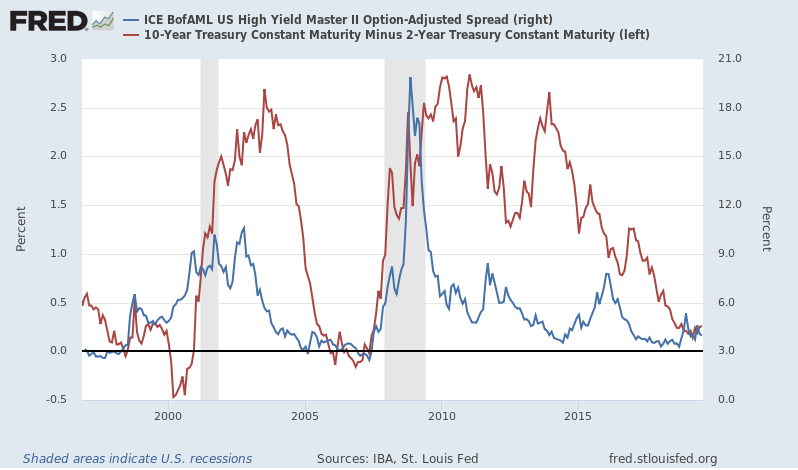

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs.

Read More »

Read More »

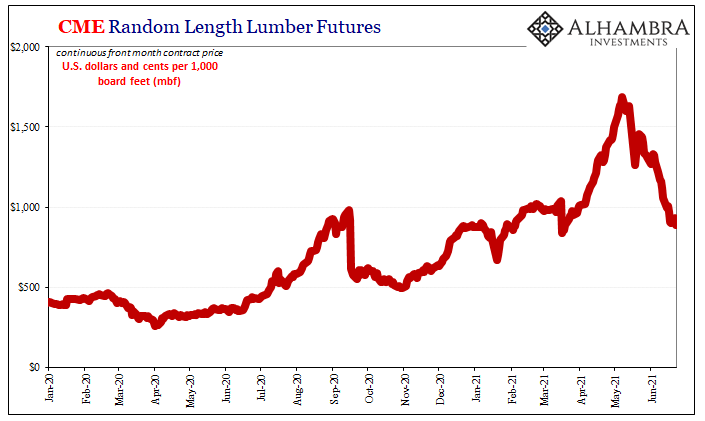

Sure Looks Like Supply Factors

If it walks like a duck and quacks like a duck, then it must be inflationary overheating. Or not? As more time passes and the situation further evolves, the more these recent price deviations conform to the supply shock scenario rather than a truly robust economy showing no signs of slowing down.

Read More »

Read More »

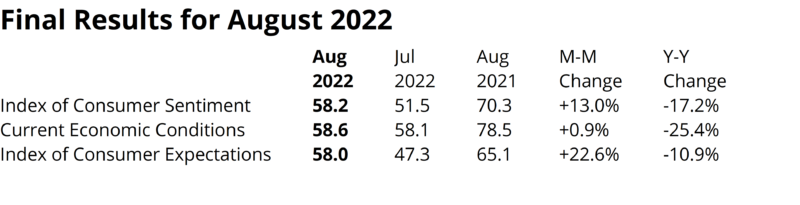

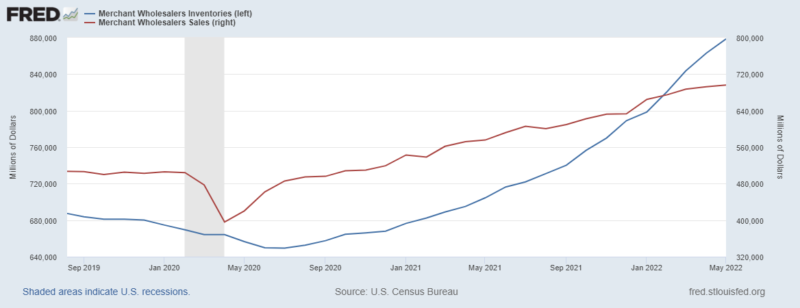

Monthly Macro Monitor: Doom & Gloom, Good Grief

When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time.

Read More »

Read More »

Monthly Macro Monitor: We’re Not There Yet

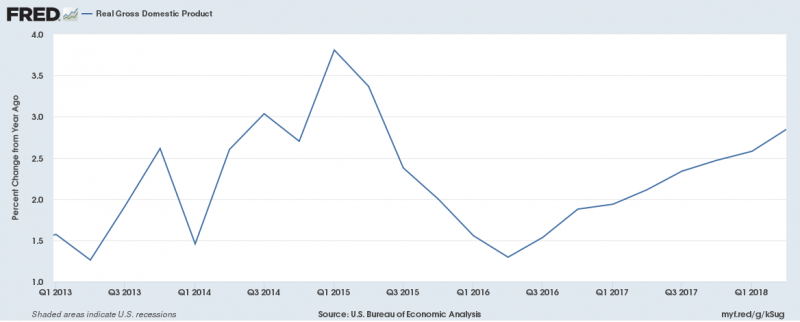

I first wrote about the current economic slowdown a year ago and Jeff Snider actually started seeing signs of slowdown in the Eurodollar market as early as May 2018. So, the slowdown we’re in now certainly isn’t a surprise here at Alhambra. I think though that we often forget how long these things take to develop.

Read More »

Read More »

Monthly Macro Monitor: Economic Reports

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction.

Read More »

Read More »

Monthly Macro Chart Review: April 2019

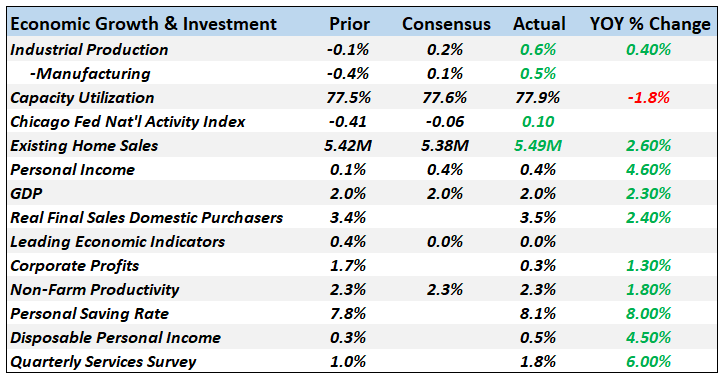

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed.

Read More »

Read More »

Living In The Present

It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable health care or Miami Dolphin playoff games? Will China’s economy succumb to the pressure of US tariffs and make a deal?

Read More »

Read More »

Monthly Macro Monitor – October 2018

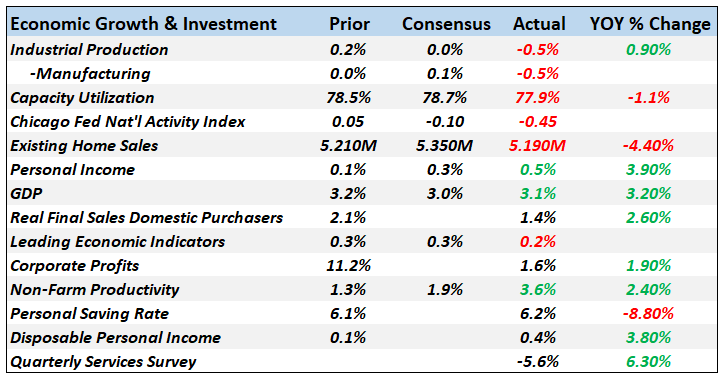

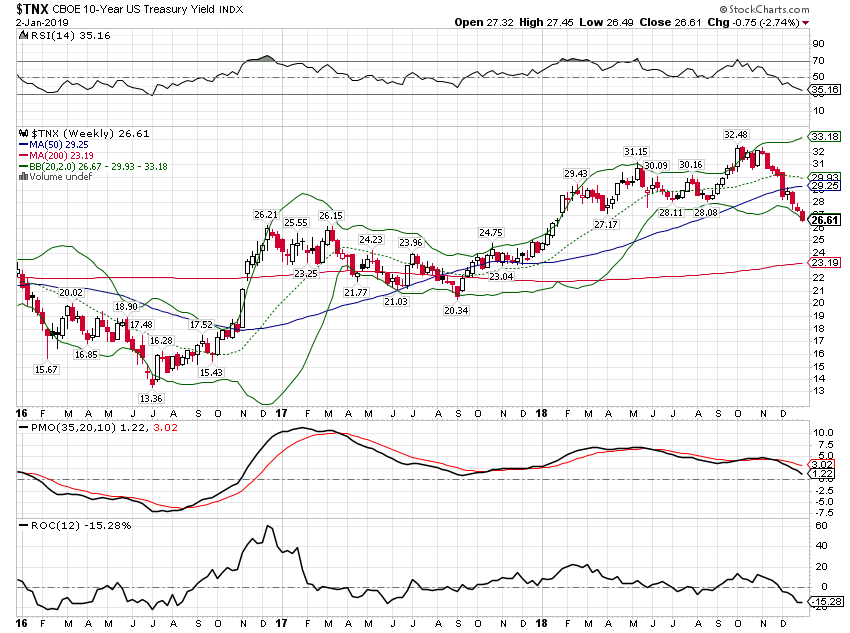

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly.

Read More »

Read More »

Monthly Macro Monitor – August 2018

The Q2 GDP report (+4.1% from the previous quarter, annualized) was heralded by the administration as a great achievement and certainly putting a 4 handle on quarter to quarter growth has been rare this cycle, if not unheard of (Q4 ’09, Q4 ’11, Q2 & Q3 ’14). But looking at the GDP change year over year shows a little different picture (2.8%).

Read More »

Read More »

Bi-Weekly Economic Review: As Good As It Gets?

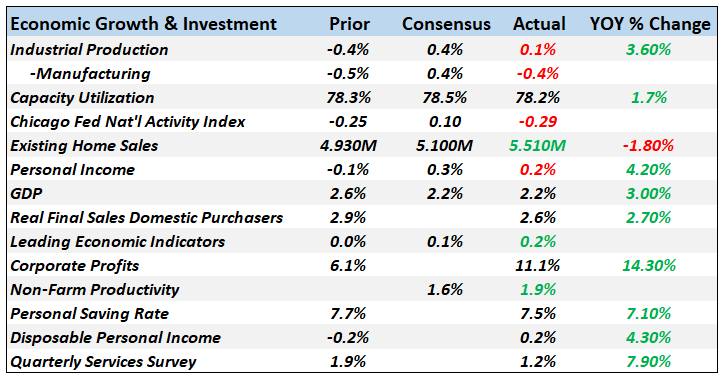

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not.

Read More »

Read More »