Tag Archive: Capital Markets

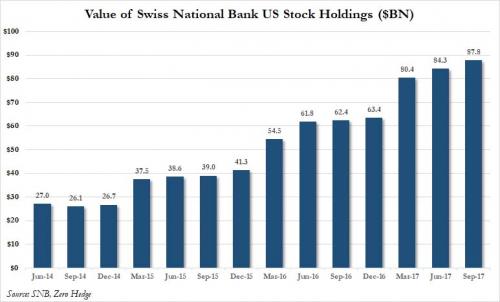

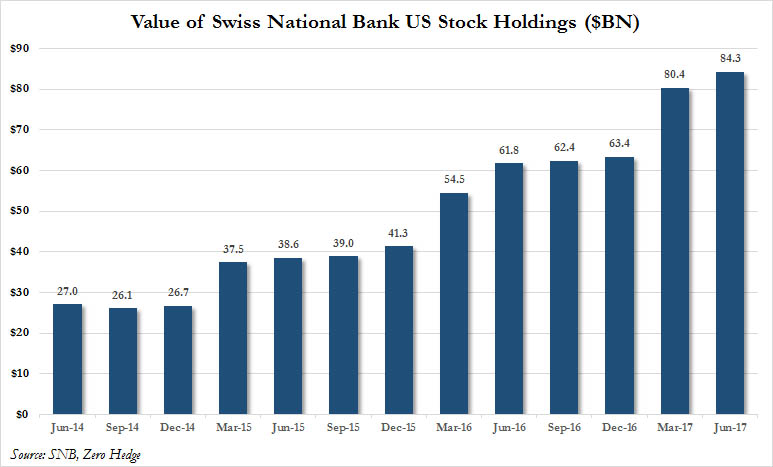

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks.

Read More »

Read More »

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

The Internet Helped Kill Inflation In America, Says Credit Suisse

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen - as he told CNBC two days ago - is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt.

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank's interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the "the BoJ comes in big, the...

Read More »

Read More »

100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world's largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump.

Read More »

Read More »

Largest Retail FX Broker FXCM Banned By CFTC, Fined $7 Million For Taking Positions Against Clients

The CFTC on Monday fined Forex Capital Markets, parent FXCM Holdings LLC and founding partners Dror Niv and William Ahdout to pay $7 million to settle charges it defrauded retail foreign exchange customers and engaging in false and misleading solicitations. As part of the settlement, FXCM agreed to withdraw its registration and never seek to register with the CFTC again, effectively banning it from operating in the US.

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

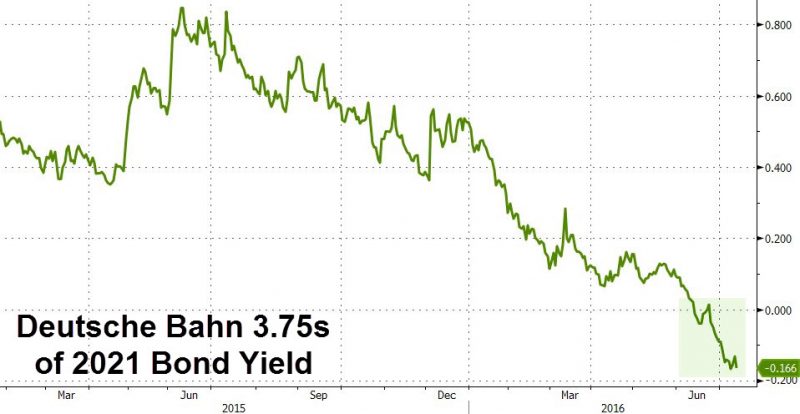

Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon.

Read More »

Read More »

Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into...

Read More »

Read More »

Nigerian Currency Collapses After Central Bank Halts Dollar Sales To Stall “Hyperinflation Monster”

Having told banks and investors "don't panic" in September, amid spiking interbank lending rates and surging default/devaluation risks, it appears the massive shortage of dollars that we warned about in December has washed tsunami-like ashore in oil-...

Read More »

Read More »