Tag Archive: capital goods

With No Second Half Rebound, Confirming The Squeeze

It’s a palpable impatience. Having learned absolutely nothing from the most recent German example, there’s this pervasive belief that if the economy hasn’t fallen apart by now it must be going the other way. The right way. Those are the only two options for mainstream analysis (which means it isn’t analysis).

Read More »

Read More »

More Down In The Downturn

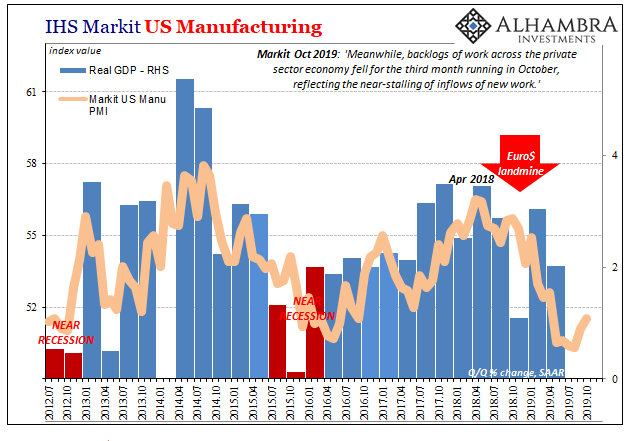

Flash PMI’s from IHS Markit for the US economy were split in October. According to the various sentiment indicators, there’s a little bit of a rebound on the manufacturing side as contrary to the ISM’s estimates for the same sector. Markit reports a sharp uptick in current manufacturing business volumes during this month.

Read More »

Read More »

Monthly Macro Chart Review: April 2019

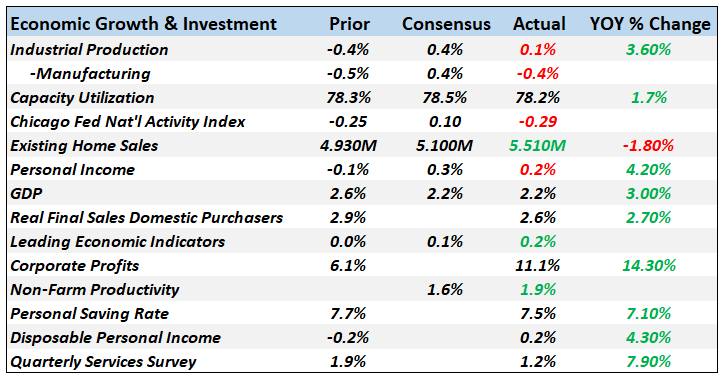

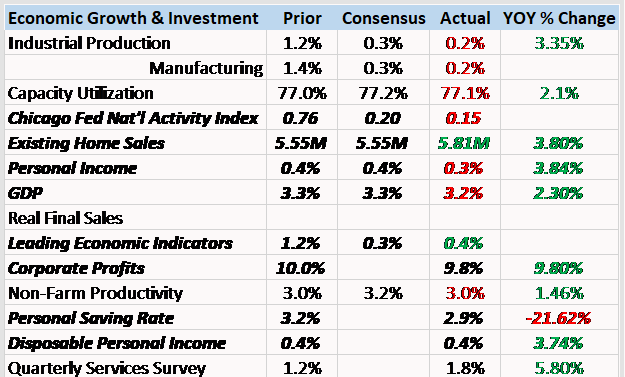

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed.

Read More »

Read More »

Durable and Capital Goods, Distortions Big And Small

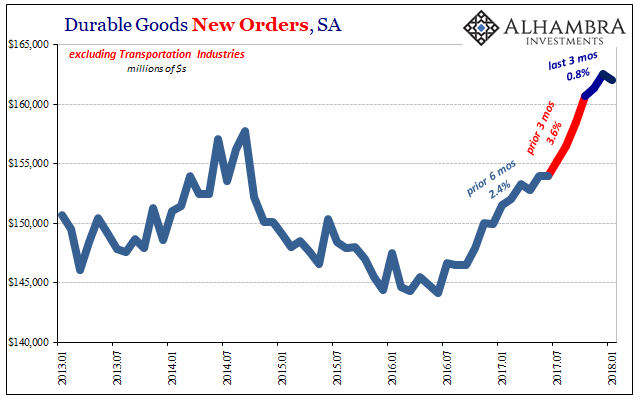

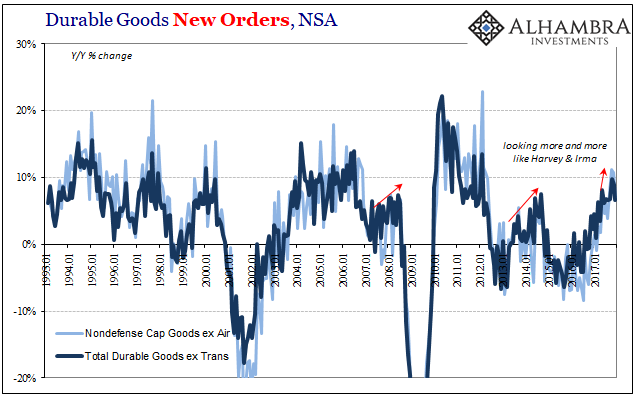

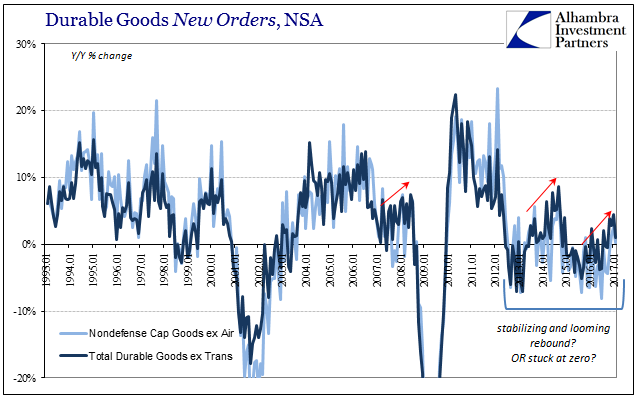

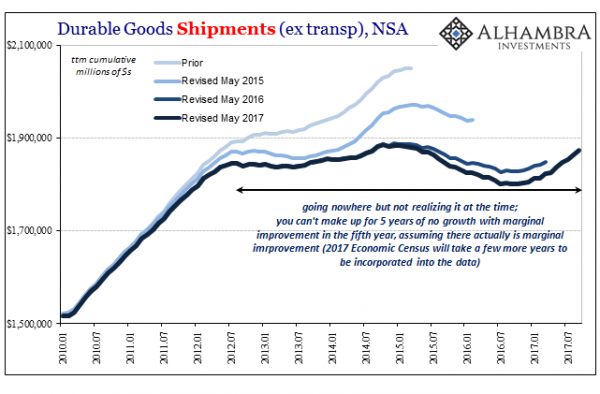

New orders for durable goods, excluding transportation industries, rose 9.1% year-over-year (NSA) in January 2018. Shipments of the same were up 8.8%. These rates are in line with the acceleration that began in October 2017 coincident to the aftermath of hurricanes Harvey and Irma. In that way, they are somewhat misleading.

Read More »

Read More »

December Durable Goods

Durable and capital goods orders and shipments all increased in December by growth rates consistent with those registered in the months leading up to the big storms Harvey and Irma. We continue to find evidence that accelerated growth in October and November was nothing more than the anticipated after-effects cleaning up after those hurricanes.

Read More »

Read More »

Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the economy.

Read More »

Read More »

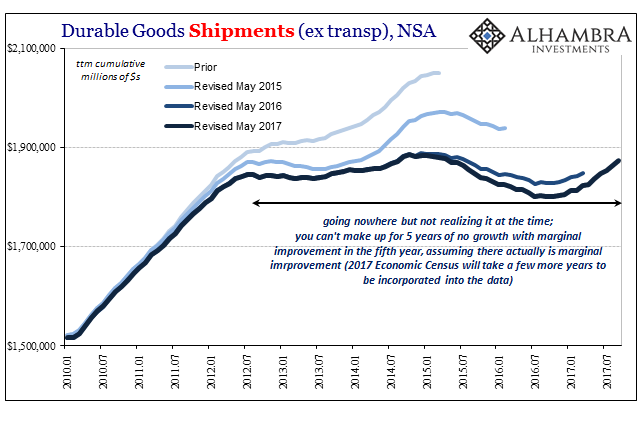

Durable Goods Only About Halfway To Real Reflation

Durable goods were boosted for a second month by the after-effects of Harvey and Irma. New orders excluding those from transportation industries rose 8.5% year-over-year in October 2017, a slight acceleration from the 6.5% average of the four previous months. Shipments of durable goods (ex transportation) also rose by 8% last month.

Read More »

Read More »

Subject To Gradation

Economic growth is subject to gradation. There is almost no purpose in making such a declaration, for anyone with common sense knows intuitively that there is a difference between robust growth and just positive numbers. Yet, the biggest mistake economists and policymakers made in 2014 was to forget that differences exist between even statistics all residing on the plus side.

Read More »

Read More »

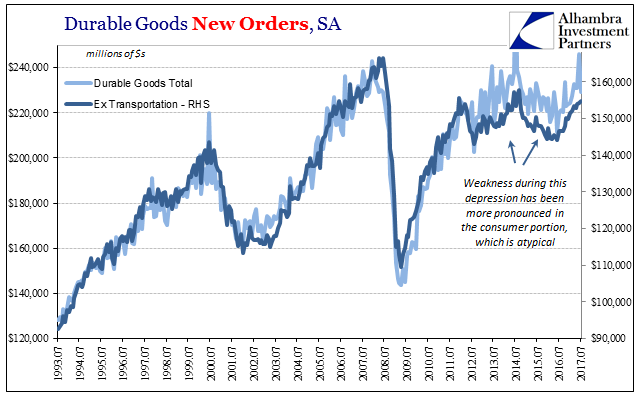

United States Durable Goods In July; Rinse, Repeat

The Census Bureau reported today updated estimates for Durable Goods in July 2017. Quite frankly, nothing has changed so minimal commentary is all that is required. The aircraft anomaly from last month faded, leaving total new orders of $229.2 billion (seasonally-adjusted). That is less than in May before the Boeing surge, and less even than estimated order volume in March 2017.

Read More »

Read More »

Durable Goods After Leap Year

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version.

Read More »

Read More »

Durable Goods Groundhog

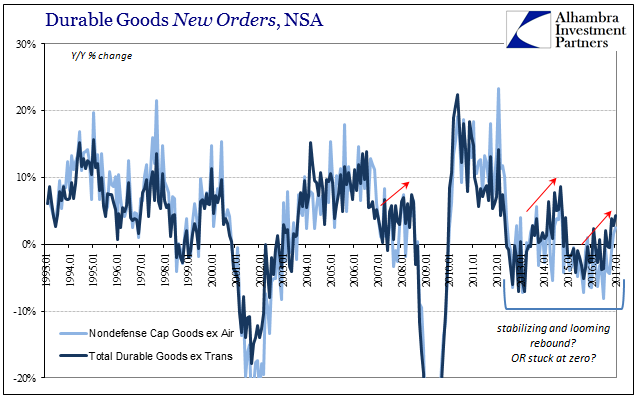

If the economy is repeating the after-effects of the latest “dollar” events, and it does seem more and more to be that case, then analysis starts with identifying a range for where it might be in the repetition. New orders for durable goods (ex transportation) rose 4.3% year-over-year in January 2017 (NSA, only 2.4% SA), the highest growth rate since September 2014 (though not meaningfully faster than the 3.9% rate in November 2016).

Read More »

Read More »